A sprawling office with impeccable interiors meets my eye as I reach the 10th floor of Mfar Building in Manyata Tech Park, Bengaluru. The lounge area is cozy and informal with bright coloured chairs and is followed by a large, open-format seating. A few meters away is a 6 ft tall white wooden unit, which houses a coffee machine in the centre and well-stocked jars of quick bites such as peanuts, chips and biscuits in the adjoining shelves. A dark brown wooden deck doubles up as the balcony and runs around the entire exterior of the well-lit room, giving it the look and feel of a spacious home, not an office. And why not? After all, this office houses the world’s largest furniture retailer that has been specialising in home furnishing for over seven decades — Ikea.

The Swedish company, founded in 1943 by Ingvar Kamprad, is present in 49 countries with 403 stores globally. Ikea’s classic blue and yellow signage is among the most recognised logos in the world. Through its big-box retail stores located on the outskirts of a town, the company specialises in providing affordable home furnishing options to its customers. These large-format stores are supplemented by smaller format ‘Hej Homes’ located within the city. The company has also been focusing on strengthening its e-commerce presence for a generation that chooses convenience over experience. Across its retail formats, Ikea reported revenue of €38.3 billion last year (September 2016-August 2017). From beds and sofas to cutlery and showpieces, Ikea stocks almost everything that a home might need in terms of furnishing.

Not surprisingly then, there is growing enthusiasm as the furniture major gears up to launch their first store in India. “India is an exciting country and an emerging market with a lot of spending power, growth potential and good GDP. Plus it is a young country. Our vision is to contribute to make life better for our customers. We want to serve everybody to have a beautiful, sustainable, cozy and affordable home,” says Peter Betzel, CEO, Ikea India.

In India, the company is falling back on its tried-and-tested model of launching out-of-town large-format stores. The Hyderabad store, for instance, is being opened at Hitec City in the suburbs. “We were looking to focus on large cities where a lot of families reside and have problems to which Ikea could provide solutions. We received great support from all cities to start operations but Hyderabad happened to be the fastest,” smiles Betzel. This would be followed by the launch of stores in Navi Mumbai, Bengaluru and Delhi NCR. Ikea has already brought its Hej Home concept to Hyderabad in November last year, and plans to open similar stores in other cities. The vision is to have 25 stores — large and small format — in India by 2025 across nine cities, with an investment upwards of Rs.105 billion.

Ikea’s bullishness is not misplaced. Saloni Nangia, president of retail advisory firm Technopak states that a young population with increasing international exposure and evolving lifestyle provides a lucrative growth opportunity for Ikea in India. “There are limited home experience stores in India and at the same time there is also high brand salience of Ikea in the target customer segments. Plus, entry into the brand is also affordable for a wide consumer base as one can own a product from Ikea without spending a lot,” she adds. All this, she believes, will work in Ikea’s favour as they gear up for their foray in the Indian market.

Harish Bijoor, founder, Harish Bijoor Consults, concurs, and adds, “India is a sitting duck for ready-made furniture of high quality. No two Indian homes have the same needs or, for that matter, even sizes. Ikea, with its range, is going to be a welcome addition to the choice-spoiled generation of today.”

Glocal approach

Interestingly, while their first store is being launched in 2018, Ikea’s association with India began about 30 years ago as a sourcing centre for textiles, mattresses and bamboo products, which were sold in other markets. The company had also tried to set up shop in India in 2007 but couldn’t as 100% FDI in retail wasn’t allowed at the time. Eventually, in 2013, the FDI rules were eased and that marked the beginning of a new journey for Ikea in India.

The company began its operation in India from Gurugram (which already had a purchase office to handle their sourcing operations) before shifting to the current one in Bengaluru in 2017. The Swedish retailer knew early-on that a one-size-fits-all approach would not work in India, primarily because of varying weather conditions and unique market needs. Accordingly, Ikea had sent Marie Lundström, a top design executive with the company, to study furnishing trends in India. “We conducted over 1,000 home visits to understand the culture and the demands of consumers, and ensure affordability,” says Ulf Smedberg, country marketing manager, Ikea India, who has spent the past four years in the country.

The research helped them understand a couple of things — the Indian market would need a lot more colour options, they would have to take into account humidity and dust, and that while in Sweden the bedroom is where people just sleep and store some clothes, in India, the bedroom has many more uses such as eating and watching television.

Nangia points out another key difference, “In India, Ikea would have to invest in a service model that makes the concept IDIY (I do it for you) vis-à-vis DIY (Do it yourself).” Globally, Ikea manages to keep costs low by encouraging customers to assemble furniture themselves. In India, however, the DIY concept is restricted to a few hobbyists. Ikea has therefore hired 150 carpenters to help customers with assembly and installation at a nominal cost. They have also tied up with service provider UrbanClap to provide the service and trained 60 carpenters on the platform. “But we haven’t taken the DIY component away completely as it is cheaper than having the assembly service. We also ensure that the process of assembly is extremely simple,” adds Betzel, hoping to slowly popularise the DIY concept in India.

The research also prompted Ikea to stock India-specific products such as cooking range, tawa, idli maker, masala boxes, kitchen cutlery and bedsheets. “Another interesting example of localisation is that Indians like firm mattresses, so we will develop a mattress with a coconut layer because it is cooler for the summer,” notes Betzel.

Vibrant colours and India-inspired designs would be a key component of their product range retailed here. Modifications to their existing product ranges included adding mini legs for furniture and small structural changes to their chest of drawers. Similarly, for children, the company usually sells packs of spoons, knives and forks. However, in India, they would be selling only four spoons, priced at Rs.15 and produced locally.

At the same time, Ikea has ensured a balance of local and international products. “We haven’t changed our entire product line as we believe that more than 90% of our range is our identity,” says Betzel. In all, Ikea has about 2,000 India-inspired products and over 1,000 products manufactured in the country.

Sowmya Adiraju, research analyst, home and tech, Euromonitor International, believes that with Ikea sourcing a substantial amount of their products locally, it would give a big boost to domestic manufacturers. Local products will comprise 20% of their total offering in India, which would be sourced through 60 suppliers. The plan is to expand local sourcing to 50% across newer categories such as ceramics, glassware, wood and natural fibres. The company follows a strong filtering process before signing on any supplier. “We ensure long-lasting relationships with our suppliers and ensure that the product is beautifully designed, is functional, sustainable, affordable and of high quality,” stresses Betzel. Also, Ikea plans on introducing flat-packing, a popular method of manufacturing globally, to the Indian market.

Bed and bun

After localising and modifying the product offerings, the next task at hand was visualising these in the store and creating room settings. The 400,000 sq ft Hyderabad store, built on 13 acres of land, has been designed like a ‘theme park’ for furniture with 800 people employed to guide the customers, says Smedberg. The store has life-size rooms, resembling typical room sizes in Hyderabad, designed with Ikea products. The company expects a footfall of 7 million customers annually at this store.

A visit to the store will not just give the customer ideas on home furnishing but also provide easy parking, inspirational shopping experience, play facilities, restaurant and a café, making it a fun day out with family. “All in all, it’s a big place, big store, with a big range, big volume, and low prices. And the best part is you get to take your purchases back home the same day! Instant gratification as customers can pick up their purchase from our warehouse,” says Betzel.

Worldwide, Ikea is known as much for its furniture as it is known for its signature meatballs. And the same would be brought to India as well, albeit with slight modifications. “My team and I are responsible for introducing Swedish food in the Indian market while incorporating a mix of local Indian traditions and Swedish food experience, thereby creating a ‘Swe-desi cuisine’. It will have the famous meatballs but they will be made with chicken, not beef or pork. We will also have veggie balls,” says Henrik Österström, country food manager, Ikea India. The local menu will include samosa, dal makhani and biryani as well as Swedish delicacies such as chicken meatballs with lingonberry, grilled and smoked salmon, and a variety of desserts including their famous cinnamon bun.

Explaining the focus on food, Betzel says, “In any shopping complex, even if the rest of the mall is empty, the food court is always buzzing. We expect our food business to also do very well. Almost 10% of our revenue is expected to come in through food.” This is more than the global average of 5% for Ikea. Smedberg adds that the love for homes and love for food are the two things that are common between India and Sweden. “We think that food will be the first purchase from Ikea for most people,” he adds.

Local headwind

Eventually, Betzel says, the goal is to make Ikea the most preferred multi-channel retail brand when it comes to furniture. The ambitious target, however, is likely to face a number of challenges. Unlike other developed markets, the Indian furniture segment is largely unorganised, with traditional mom-and-pop stores and local carpenters dominating the space. Adiraju says that affordability, customisation and ease of access are the primary reasons for the popularity of unorganised players. Of the $20-billion furniture retail market in India, the unorganised segment still constitutes close to 90%.

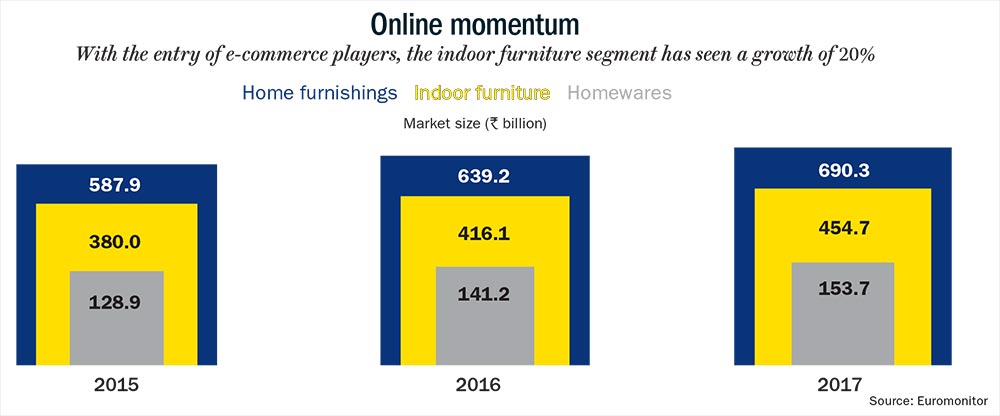

There are also a handful of e-commerce players, some of whom have forayed offline and established a strong brand presence in this category (see: Online momentum). They sell furniture at much lower prices compared to the offline or store-based retailers without compromising on quality or design. Take for instance Pepperfry, which already has a network of 30 stores and is taking it up to 70 in the next one year. Urban Ladder, too, is expanding its retail footprint to 20 by 2019. This is in addition to a well-established online channel that drove FY17 sales of Rs.1.28 billion and Rs.945 million for Pepperfry and Urban Ladder respectively. Walmart-owned Flipkart, too, has begun focusing on the furniture retail space. All three, though smaller in comparison to Ikea, benefit from having a well-established supply chain in place.

In contrast, Ikea is still building its supply chain across India. At present, it has invested Rs.200 million for a 270,000 sq ft distribution centre (DC) in Pune on leased land, which is run in partnership with IndoSpace, a logistics and industrial park. The plan is to expand this DC to 370,000 sq ft by next year. To manage home deliveries and reverse logistics for orders across Telangana, Ikea has tied up with express logistics company Gati-KWE. Shoppers can also arrange their own transportation. Once the Navi Mumbai store is up and running, Ikea plans to offer in-house logistics and extend it to other cities.

An advantage that Ikea enjoys is brand perception. “Ikea has already created quite a buzz in India and consumers are eagerly looking forward to the Ikea experience. The success of Ikea in India largely depends on building brand loyalty and trust among Indian consumers,” says Adiraju, adding that Ikea will play a significant role in catalysing the transition to a more organised sector.

Pricing it right

To make inroads into the Indian market, it is crucial for Ikea to maintain its ‘affordable’ pricing promise, for which it is known globally. The task would be a tad difficult as currently, almost 80% of its products are imported and subject to high duty. Compare this to existing players who almost have their entire product range manufactured locally, and the challenge is obvious.

Reportedly, of the 7,500 products that would be stocked at the Hyderabad store, close to 800 would be priced under Rs.200. Betzel doesn’t give a percentage, but says that the Indian pricing is on the “lower side” of the global average. However, the expenditure of acquiring and building the store in India ($150 million) is higher than the average in other markets ($80 million-100 million). Additional investment in providing services of assembly and installation make it tough to rein in prices. Meanwhile, competitors have the advantage of being fairly asset-light. Their offline stores are about 800-4,000 sq ft and require considerably less investment.

US-based Warren Shoulberg, an industry consultant and veteran business journalist specialising in the home industry, states that Ikea needs to maintain a delicate balance as it penetrates the Indian market. “On the one hand, it can’t forget what has made the retailer so successful and distinctive. Its product mix, design, in-store experience and, of course, pricing have been the cornerstones of why it has become one of the few retailers to succeed on an international basis. But it must also understand the limited purchasing power of its new customers in India, which is unlike anything it has faced elsewhere in the world. If it ‘dumbs down’ its products too much, it will lose the Ikea touch but it must look at lower cost merchandise specifically developed for the Indian market,” says Shoulberg.

His thoughts are echoed by Adiraju, who says that while the ‘furniture for all’ motto enables consumers from all segments to possess their very own branded furniture, Indians are also quite aspirational and deeply care about their reputation and social status. It, thus, becomes important for Ikea to get the product pricing as well as brand image quite right to succeed in India, she says.

But operating in 49 countries means that Ikea has the experience of working around a plethora of challenges. In China, for example, it faced competition from cheap replicas of its designs. Even in the US, Ikea struggled to find a strong footing when it entered in 1985. From competing with Walmart, Target and Home Depot to their low pricing being equated to ‘low-quality’, Ikea has faced it all. However, Shoulberg observes that Ikea was very patient in developing the US market, at first not really encountering a customer base that embraced it. That changed and that same patience will pay off in India.

Betzel explains that for Ikea, the approach is simple — to maintain affordability and gradually expand local sourcing based on the insights they receive from their Hyderabad store. “The home furnishing market is set to grow in India. I love that there is a lot of competition because the more we talk about home furnishing, the more the interest will increase and everybody will benefit from it, even the local carpenters. Also, while we want to be profitable as soon as possible, the focus is on maintaining affordability,” he reiterates.

Shopping patterns

Like most companies, Ikea, too, has been facing the challenge of an evolving consumer base and their shopping habits. Consider that while global footfall for Ikea stores stood at 936 million, their website saw 2.3 billion visits in the past year. “Ikea has been a traditional brick-and-mortar retailer, with large out-of-town locations. With convenience becoming key for consumers, Ikea would also need to adapt to their requirements. Both going ‘multi-channel’ and adapting to the millennial and Gen Z consumer requirements would be important for Ikea worldwide,” says Nangia. Experts also opine that in India, Ikea would need to look into locations that are well-serviced by public transport and not depend on their traditional ‘out-of-town’ model.

In line with convenience becoming key for shoppers, Ikea has been focused on firming up its e-commerce channel. In India, the company would be launching their app around the launch of the Hyderabad store and a website by 2019. “We still believe that nothing can compensate for the touch, look and feel aspect, but we also offer the option of shopping online as it provides a convenience factor for customers,” says Betzel.

The company also strongly believes in the Hej Homes format, where customers can not only see Ikea’s product range, but also sign up for workshops on designing and cooking. Citing the example of the Hyderabad Hej Home, Smedberg says that the brand recall and perception of Ikea has gone up from zero to 73%, largely due to the opening of the store.

“It is expected that Ikea will expand its retail consumer reach, deviating from its big-box retail format by introducing small-format stores across India,” says Adiraju. Globally too, Jesper Brodin, CEO, Ikea Group, has been quoted that the focus would be on aggressive growth by opening more small-format stores and strengthening of the e-commerce channel.

In the run-up to its India launch, the company is investing heavily in advertising and marketing. One of its ad films is about large families staying together and making each day special with the help of Ikea while the other talks about gender equality. Shoulberg believes that “whatever it does, the retailer brings a Western perspective to a country that is increasingly aspirational and should respond well to the Ikea model.”

It is evident that the entry of Ikea in the Indian market has brought in renewed vigour and has put the furniture space in the limelight. As Ikea goes about building its business in India, the challenges are almost as many as the opportunities. But armed with its years of expertise and a contemporary approach, the company is confident of carving its niche in the Indian market. And when it comes to Ikea, a niche usually translates to big ‘box’ market share.

Just one email a week

Just one email a week