Grim faces and stoic silence—that is what the boardroom of a Bengaluru-headquartered IT firm held on a balmy morning in late February 2023. The deepest frown lines were etched on the CEO’s forehead as everyone’s eyes fixated on the massive screen.

It showed a report by JP Morgan that predicted that generative artificial intelligence (GenAI) models, like OpenAI’s ChatGPT, could slow down market revenue growth of Indian IT companies, which dominate the country’s $245 billion tech market. It also forecasted that it could deflate their pricing in the short term and consulting companies, like Accenture and Deloitte, could snatch market share from these firms.

With alarm bells ringing loudly in the background, the thought uppermost in every individual’s mind in the boardroom was, “Can GenAI truly disrupt India’s IT sector, or is this just another doomsday prediction that will never come to pass just like Y2K?”

“Does this mean that these consulting firms will steal our lunch? Especially when we are dealing with slowing customer spending in our key markets, like the US and the UK that is compounded by a recessionary trend and ongoing Ukraine-Russia and Israel-Hamas war?” thundered the CEO. “Do we have a game plan to tackle this additional challenge? How are we making our offerings more competitive and our staff more competent to deal with this changed reality?” asked the CEO.

These questions kept emerging during the brainstorming session and are being constantly asked across the Indian IT sector. However, in subsequent months, it seems, the Indian IT sector has deciphered the GenAI challenge to a large extent and is devising ways to turn it into an advantage.

A New World Rises

“We already had AI capabilities around that for a few years, which has become better with GenAI. The quality has improved, and so has the efficiency. We are trying to promote this efficiency gain across industries,” says Sudarshan Seshadri, senior vice president, data and AI business unit, at Coforge, while discussing document processing.

GenAI, of course, is not a novel concept for IT companies, but it acquired a dominant currency in tech-related business conversation after the release of ChatGPT in November 2022. An advanced language model developed by OpenAI, ChatGPT has played a significant role in the sudden spurt of interest in GenAI. The popularity of ChatGPT lies in its ability to understand and generate human-like text that helps users in different professions accelerate their creative and analytical output. As its popularity with common users grows, the role of applications based on large language models (LLM), which is the model behind ChatGPT, has come to the forefront in the IT sector as well.

Over the years, Indian IT companies have built a robust client base around the world with digital transformation as the tallest pole in their tent. This meant digitising clunky monolithic applications or even offline models and taking them to the cloud for global access. Now, GenAI can disturb this model of doing business, as the world has woken up to its potential of its ability to automate processes—from customer services to software development and data analytics to production—and bring greater efficiency and productivity for amplified business outcomes.

However, how Indian IT companies deal with this emerging situation in GenAI will decide what happens to their existing client base. Rahul Bhattacharya, technology consulting and AI leader at the global delivery services division of EY, argues that GenAI presents a distinctive opportunity to change IT organisations through efficient software engineering processes. He says, “Swift adaptation to these new paradigms holds the potential to expedite its integration into offerings and service delivery significantly. This adaptability emerges as a key determinant in the timeline for harnessing the transformative power of GenAI.”

Globally, GenAI is sprinting on two parallel tracks. On the one hand, Big Tech, newbies like OpenAI and start-ups are exploring ChatGPT-like consumer applications, and, on the other, the IT services industry is fighting against time to integrate GenAI into its existing suites in enterprise and governance tech. In June last year, Bloomberg Intelligence claimed in a report that the global GenAI market was valued at $40 billion in 2022 and anticipated to soar to $1.3 trillion in the next decade. It reckons that GenAI-focussed IT and business services are likely to grow at a compound annual growth rate (CAGR) of 100% and 97% respectively between 2022 and 2032. However, it expects the highest CAGR in GenAI-focussed ad spending.

In June last year, McKinsey and Company published a report, The Economic Potential of Generative AI, in which it claimed, “Our latest research estimates that generative AI could add the equivalent of $2.6 trillion to $4.4 trillion annually across the 63 use cases we analyzed.” It claimed that 75% of all GenAI-focussed value could fall into just four areas—customer operations, software and engineering, marketing and sales and R&D. The first two are clearly the areas that Indian IT companies operate in, while it has sizeable presence as enablers in the other two.

Unlearning and Relearning for IT Companies

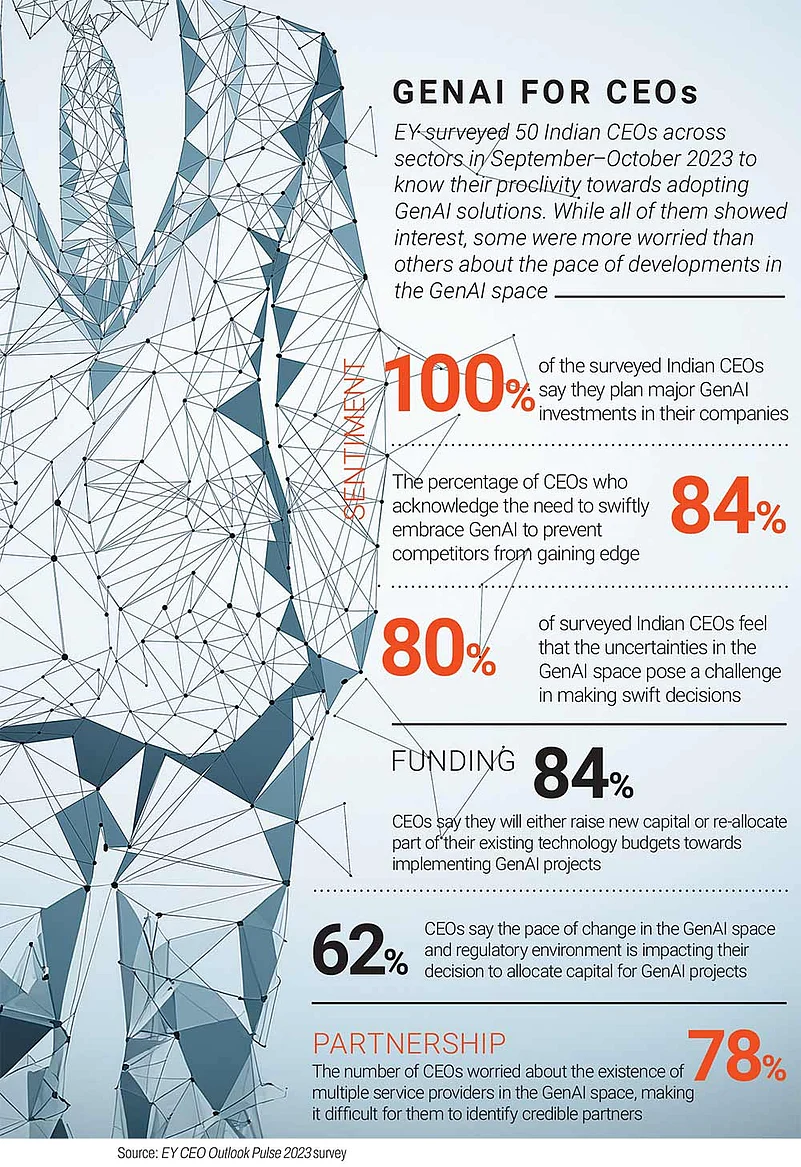

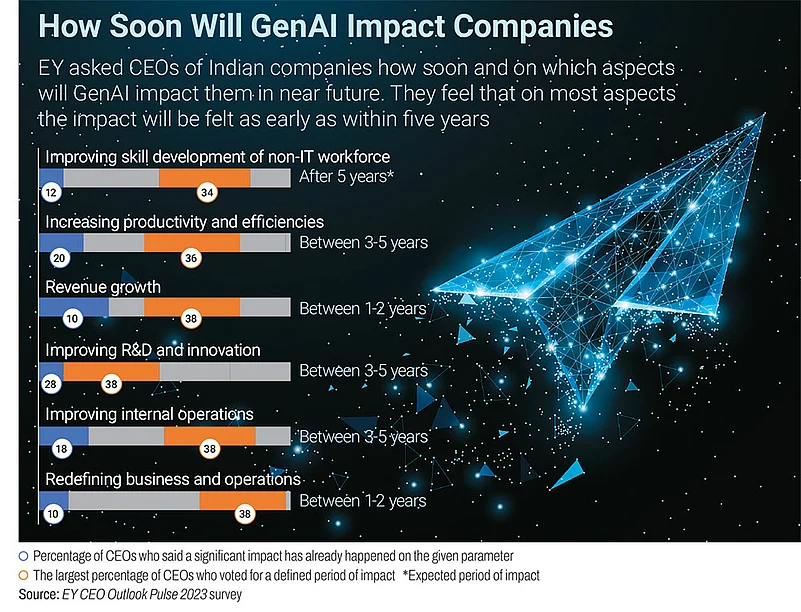

An EY C-suite survey, EY CEO Outlook Pulse Survey, published in October 2023 claimed that 62% of the global CEOs were concerned about competitors getting an edge and thus showed urgency to integrate GenAI into their business processes. At the same time, 61% of the CEOs felt uncertainties around formulation and execution of GenAI strategies. The survey found that the companies that had multiple AI initiatives expected them to turn around their business completely in three to five years.

In this conundrum and timeframe lies both the opportunity and challenge for Indian IT companies in advancing on the GenAI route. Just as the rapid increase in the pace of GenAI conversations around the world has taken business leaders by surprise, IT companies are also moving fast to create a workforce that convert these conversations into business deals and deals into execution pathways.

The EY survey, which also covered 50 Indian CEOs, confirms that GenAI conversations are much more vigorous in Indian companies than in other parts of the world. EY India says that “... [84% of Indian CEOs recognise] the imperative for their organizations to act promptly on GenAI to prevent competitors from gaining a strategic edge”. These CEOs—80% of them—made a startling admission that GenAI will force them to cause disruption in their own business model lest competitors score over them. Most interestingly, all the surveyed CEOs conceded that they cannot ignore GenAI and are devising ways to integrate it into their processes.

But before Indian businesses can integrate GenAI into their workflow, IT firms need to set their house in order. Realising this, the upper echelons of Indian IT firms are driving the march rather rapidly to stake their claim in the GenAI battlefield. Their top management is rolling up its sleeves to better understand the technology at work before mapping out the strategies to harness it for extra revenue.

Technology and business process services company Hexaware, which crossed the $1 billion revenue milestone in 2022, made all its management council members, comprising those reporting to CEO R. Srikrishna and a level below, undergo mandatory courses in deep learning. Those who did not complete this training were not invited to the company’s annual planning session in Chennai in December 2023!

Recently, digital business transformation firm Publicis Sapient curated a GenAI learning path for everyone in the company, including the leadership unit. Once the team moved past the initial curiosity of using it for tasks like summarising emails, it started evaluating how it could add value to their customer offerings, quickly realising that it had unleashed a helpful genie from its bottle.

Reskilling for the Future

While the leadership teams at IT companies acquire GenAI skills to understand its business potential, a transformation centred around the new technology hinges on staff retraining, involving thousands of engineers who have long ceased to be students. Tiger Tyagarajan, president and outgoing CEO of Genpact, though, does not see GenAI-related reskilling within IT companies as a big challenge. “The IT services industry in India, at a broad industry level, is one of the leading engines of reskilling in the world,” he says, adding that the IT industry has been reskilling its workforce for years now. “When a new technology gets launched, the client comes to us and says, ‘Do you have SAP S/4HANA skills?’ We do not go and hire people with SAP S/4HANA skills, because the requirement for that only came six months back. We trained people on it. Our business is reskilling,” he explains.

That GenAI has fully exploded in the job market in India can be gauged from the data released by e-learning company Coursera. It claimed in December last year that a student enrolled in a GenAI-related course every three minutes in 2023 in India, the total number being 1,96,000, for its 35-odd courses launched by global universities and industry educators.

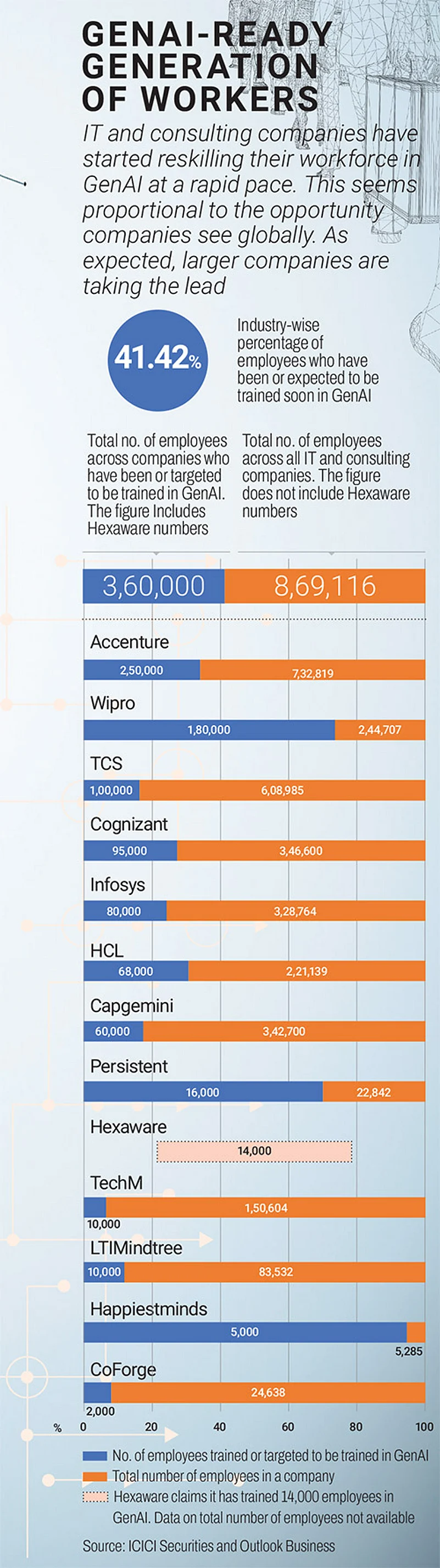

This interest has already become visible in the employee roll call of IT companies. Tata Consultancy Services (TCS), India’s largest IT company by profit, has the largest number of GenAI-trained professions. Its COO and executive director N. Ganapathy Subramaniam said at the time of the Q2 FY24 earnings call, “We continue to make investments in our people and new technologies. We now have a 1,00,000-strong pool of GenAI-ready consultants and prompt-engineers who are engaged in hundreds of GenAI projects for our clients across segments.”

Its rival Wipro has made an even bigger announcements on upskilling its workforce for AI. While announcing an investment of $1 billion in harnessing and innovating AI capabilities in July last year, the company announced that it would train all of its 2,50,000 employees in AI fundamentals within one year. A significant part of this investment and training is likely to revolve around GenAI, given the momentum building around it lately.

Mukesh Chaudhary, managing director and lead for data and AI, Accenture’s Advanced Technology Centres in India, notes that organisations will need to ramp up their talent investments to both create and use AI. This means developing technical competencies like AI engineering and training people across the organisation to work effectively with AI-supported processes. Incidentally, Accenture is one of the very few IT sector companies that declare their revenue earned through GenAI projects.

Chaudhary’s suggestions are already at play at Tech Mahindra, which has 60 pre-built use cases in its GenAI studio. It has crafted a well-defined AI proficiency framework to upskill employees on AI capabilities, which consists of four levels—AI developer, AI engineer, AI expert and AI champion.

Arun Ramchandran, president and global head of consulting and GenAI practice, Hexaware, says that 14,000 of the company’s 30,000 employees have received certified training on a 25-hour foundational level GenAI course. “Three thousand of them have taken the intermediate course, and 1,000 have done the advanced one,” he says, adding that cross-skilling and upskilling for delivery leaders also takes place side by side. Similarly, LTIMindtree has also trained 21,000 people already on its GenAI pathways.

Intent without Investment

In the opportunity-versus-challenge debate on GenAI, Tyagarajan is candid about who the winners and losers are likely to be. “It is technology. Embrace it. Use it for the betterment of humanity, business, clients, everyone. Those who do not do it because of fear that it will replace everything will actually get replaced,” he says.

His statement seems to second the findings of the JPMorgan report, even when the statement makes no distinction between Indian IT companies and consultancy firms. Big tech and consultancy firms like Accenture are early adopters of GenAI, and its results are already visible. Accenture seems to have taken a lead in this space globally, so much so that it declared a revenue of $300 million from selling its GenAI products in fiscal 2023 and claimed that it already had sales commitments for $450 million in the first quarter of fiscal 2024. Its global CEO Julie Sweet famously called 2023 as “a year of generative AI experimentation” for the company’s clients. “We are now focusing on helping our clients in 2024 realise value at scale,” she said.

Globally Accenture has more than 300 active GenAI projects across 19 industries. Explaining how his company has built a lead in GenAI, he says, “Accenture has launched AI Navigator for Enterprise, a GenAI-based platform to help clients define business cases, make decisions, navigate AI journeys, choose architectures and understand algorithms and models to drive value responsibly.” He says that his company has recently launched a proprietary GenAI model Switchboard that allows users to choose models based on the factors of cost and accuracy.

Indian IT companies are still far away from making such claims. Currently, discussions within these companies largely revolve around internal experimentation, elucidating the modest investments in GenAI announced thus far and the limited visibility of recording revenue for this service category as a distinct entity. Furthermore, like in the case of Wipro, these IT enterprises continue to offer general statements concerning investments and deal worth in AI, as opposed to specific emphasis on GenAI.

Hexaware is a modest exception in this trend. Ramchandran says that Hexaware will invest around $15 million in the next two years in various aspects of GenAI, including training, building proofs of concepts (PoCs), GenAI lab, centres of excellence and partnerships. Importantly, he adds, the company will leverage its alliances with Microsoft, Google and Nvidia for experimentation at its GenAI Consulting and Practice Unit. “We will relook at this investment in the next few months to determine additional magnitude and numbers required,” he says.

While IT companies can count GenAI investments over a period of time, not everyone feels that it should declare revenue the way Accenture does and become a vertical. Balkrishan Kalra, the CEO designate of Genpact, feels that GenAI will be all pervasive but will not become a standalone vertical. “At Genpact, our mission is to be AI first, to bring all branches of AI, including GenAI, into all spheres of life that Genpact engages internally or at house interfaces with clients. But is it going to be a separate vertical? No,” he says.

The Productivity Conundrum

A crucial driver of the success of Indian IT companies is labour arbitrage that it offers to global companies while striking outsourcing deals. Industry insiders believe that this factor will come under scrutiny as GenAI capabilities are built both into business processes and the software development, since clients are now aware how GenAI reduces dependence on human labour in coding and other processes.

With GenAI copilots, software engineers employed by IT companies can reduce the time taken to build client-specific apps drastically, thus improving their productivity. Sachin Arora, head of KPMG Lighthouse India, says, “Using GenAI to do this will see radical improvement in productivity, which means the company requires a lesser number of people to do the same job.”

But does higher productivity of engineers protect the revenue of IT companies? Arora feels that GenAI-driven improvement in productivity opens two roads for an IT company. Firstly, it can increase the deal flow with the same workforce with better earning margins. Or it can continue doing the same work it did previously but with the help of a highly productive tool, though its staffers would then sit idle for three-fourths of their time.

Hexaware has analysed the raging question of an increase in productivity having an impact on the company’s revenue. Ramchandran concedes that there is no straightforward answer to it. While logic dictates that if one puts fewer coders or developers on a project by adding GenAI as the intermediate layer, the project cost should come down.

However, different engineer profiles will be required to handle these new requirements and interrogate the GenAI engine to ensure the right code is executed. In such a scenario, the average billing rate for some of these resources can be significantly higher. Ramchandran adds that this will allow IT companies to charge more for their services. Drawing an analogy with an auditing company, he says that one cannot put 100 auditors in a room and charge for this work, when 15 auditors can do the same work if the data ingestion is done automatically. “However, since this firm has invested in platforms for capturing financial reports, it can charge for the technology, not just for people. It does not have to reduce its overall billing, because it provides better output,” he elaborates, adding that this is the path that IT services companies can tread.

Facing uncertainty about how much the client will pay for a lesser headcount, the increase in GenAI conversations has made IT companies review their revenue mix. Rather than looking at what percentage of their revenue is GenAI-enabled, the companies evaluate what percentage of their deal has a GenAI element. Cresting this curve is akin to the same value migration the IT industry saw over the last 25 years, which started with offshoring and was later fortified with digital transformation.

Mphasis CEO Nitin Rakesh points out that since the IT industry is a reasonably mature one and if a company achieves this kind of scale, it will anyway drop its price to cater to a more extensive customer set. “The competitive intensity and the maturity of the buyer organisation will also keep margins fairly reasonable,” he reasons. “So, is there an opportunity to go from 18% EBITDA to 20% EBITDA because of GenAI? Absolutely. But can you double from 18% to 30%? I doubt it,” he cautions.

About 70% of Mphasis’ revenue is application-centric today. Rakesh expects that almost every service line that the company delivers will soon have some element of AI or machine learning embedded within.

With increasing integration of GenAI in IT projects, moving away from the time-and-material model into a more outcome-and-usage-based one will ensure that revenue discussions are not solely dependent on headcount. It will now depend on the level of tech enablement of a solution an IT company offers to its clientele and IT company’s ability to scale it up.

For instance, Tech Mahindra’s chief digital services officer Kunal Purohit holds discussions with clients which have a focus on leveraging efficiency improvements for specific use cases rather than traditional full-time-equivalent (FTE) savings. The impact is anticipated to be more quantitative, causing a shift in FTE requirements.

“While immediate, outsize gains may not be universally experienced, AI’s impact extends beyond productivity. Its implementation will enhance operational efficiency, streamline workflows and augment decision-making processes. It will create opportunities for new business models and innovation, leading to sustainable long-term growth,” he says.

LTIMindtree, a subsidiary of Larsen & Toubro, with over $4 billion in revenue and a presence across 35 countries, is one of the few IT companies in India that declare that integration of GenAI in its business deal swings moment in its favour. “We remain invested in the integration of GenAI into our solutions. In last quarter alone, we have engaged in over 100 conversations and have more than 20 active engagements with our clients,” says Sudhir Chaturvedi, president and executive board member of LTIMindtree. “This has been reflected in our quarter’s order intake. It is on the back of essentially multi-year deal wins that we have had, large deal wins that we have had, and continuing momentum that we are seeing in the market as well as our ongoing commitment to invest in emerging technologies, be it GenAI or quantum,” he adds.

All Is Well. Or, Is It?

On record, most IT company representatives show enthusiasm about the use and business cases of GenAI for their global clients. However, as one digs deeper, they tend to betray a sense of unease at its potential to impact their revenue and Big Tech and start-ups encroaching upon their territory.

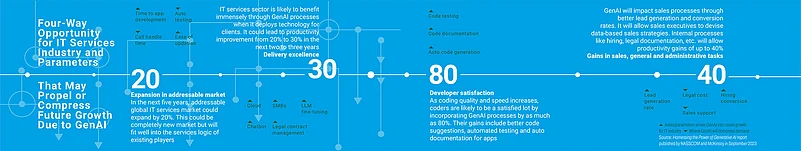

Industry bodies have gathered some evidence that justifies this fear. In a report on the impact of GenAI on IT services industry in India, ICICI Securities claimed in December last year that the productivity advantage provided by the use of GenAI would have a deflationary impact on the size of future deals, since clients would expect this advantage to be passed on to them. It reads a NASSCOM industry report and project-level examples provided by IT companies to calculate that the deflationary impact of GenAI on deals could be in the range of 20% to 30% in the short run. But, on a brighter note, the report cites conversations with industry leaders to claim that implementing GenAI at an enterprise scale in real-life scenarios may offer productivity benefits by approximately 5% initially “due to challenges related to data quality and efforts required around compliance”.

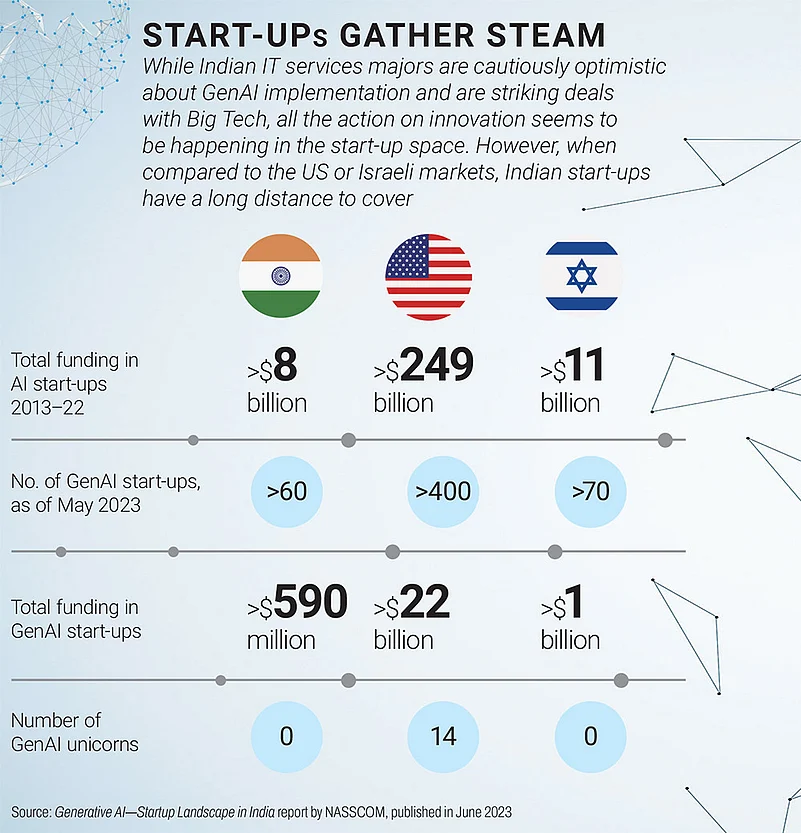

Big Tech has made huge investments in GenAI and, along with start-ups, has created an ecosystem where no client of IT companies can ignore Big Tech’s offerings. Big Tech innovator and hyperscaler and cloud providers as enabling hosts have become two indestructible pillars of the GenAI enterprise model. Indian IT companies have already struck alliances with these two sets of players to retain their existing clientele.

However, this relationship has fluid dynamics. The ICICI Securities report finds that there could be sizeable scope compression in the deals of IT companies because of overlapping services among the three arms of the ecosystem. It calculates a scope compression of 3% to 4% due to substitution by cloud service providers, revenue erosion of 2% to 5% due to insourcing by enterprise clients of IT companies and a negative impact on existing revenue by between 2% and 3% due to automation of workflows.

Given the rapid technological advancement, there is a good chance that GenAI will disintermediate some of the work that Indian IT companies are doing as service providers. However, industry stakeholders claim that this trend will not become permanent because they have their time-tested aces. They know that even if new players, or their existing clients, use new tools to build software, they will continue to require quality processes, DevOps and profiles of people that only Indian majors can provide on a sustained basis. Moreover, with the plethora of new GenAI tools and platforms coming in, these clients lack clarity about the right models or architecture to use, how to get the right data or ensure it is curated to deliver appropriate results.

Chaturvedi finds it unlikely that GenAI-exclusive companies, like OpenAI, will rise as competition to Indian IT companies. He believes that they are more focused on developing the models, and, besides, “they need people like us to deploy their models”. He smilingly quips, “Also, OpenAI has only 730 employees, while you need thousands of workers to deploy GenAI at scale, which is what we bring to the table.”

GENAI IS AN inflexion point for enterprise tech, turning AI into a megatrend by dramatically bending the innovation curve and pace of technological change. It is clearly showing the potential to drive growth and efficiency across industries. It most certainly is forcing Indian IT companies to reorient their service offerings and, in the process, reimagine their DNA. FY23 and CY23 were years of subdued revenue growth and poor revenue projection for Indian IT companies. They were also the years when these companies reduced their headcount substantially.

The silver lining for the sector, however, is the immense market opportunity a GenAI-centric economy is predicted to create and the role Indian IT companies will play in it. When ICICI Securities predicts their new revenue opportunities by 15% to 25% and 40% positive impact on margins due to differentiated capabilities and NASSCOM expects 75% of new GenAI market to comprise four core areas that these companies service product and R&D, and sales and marketing—industry leaders know that their pain has a short-term character.