The march by thousands of farmers from Punjab towards the National Capital last month threw up a déjà vu moment for the Narendra Modi government. Their protests brought back memories of 2021 when farmers from Punjab, Haryana and Uttar Pradesh locked horns with the government over three farm laws that it had sought to introduce for reforming the country’s agriculture sector. Their anger, fuelled by the fear of collapse of the minimum support price (MSP) programme and threat to their financial security net, forced the government to withdraw the three laws.

This time, the farmers want legal guarantee for MSP as per the formula of C2+50% suggested by M.S. Swaminathan, the father of the Green Revolution in India. Under this formula, farmers will get 50% margin on comprehensive cost of production which includes the input cost of capital and the rent of the land. However, heeding to this demand might not be as easy as repealing a law. The biggest consideration will be the burden their demand, if accepted, will put on the exchequer. But other, not often talked about, factor should be the reach of benefits being demanded.

Currently, 23 crops are covered under the government’s MSP programme. According to the report by the Shanta Kumar Commission—tasked with giving suggestions on restructuring of the Food Corporation of India for better efficiency—in 2015, only 6% of the farmers in the country benefitted from the MSP programme. That the scope of MSP as a pro-farmer initiative is limited is further reflected in the fact that the crops for which it is provided account for just 28% of the total agricultural production in the country. Also, within the MSP ambit, the biggest gainers are growers of wheat and paddy—procured by the government in huge quantities to feed its food subsidy programme—in a few states. The figures from the Ministry of Consumer Affairs, Food and Distribution corroborate this finding. Of the 252 lakh metric tonnes of wheat procured up to May 9, 2023, for the rabi marketing season of 2023–24, Punjab accounted for 118.68, Haryana 62.18 and Madhya Pradesh 66.5 lakh metric tonnes.

But as the farmers argue, they need assurance for their income. Their demand points to a much deeper problem of missing income growth in the hinterlands of India. Even before the Covid-19 pandemic, rural areas had negligible wage growth in many quarters. A 50% guaranteed profit on produce no matter what the market dynamic suggests at the time seems like an ideal solution.

The story, however, is not so simple.

The State’s Hand

Food has a weight of 45.9% in the consumer price index but its contribution to overall inflation has increased from 48% in April 2022 to 67% in November 2023, write RBI deputy governor Michael Patra, Joice John and Asish George in a paper titled Are Food Prices the ‘True’ Core of India’s Inflation?, published in the RBI bulletin in January 2024.

“With its large share in the consumption basket, food inflation has the potential to affect headline inflation and it can also affect non-food inflation in the event of large and repeated food price shocks,” it reads.

For the marketing season of 2023–24, the Central government had announced an increase in MSP for all kharif crops in the range of 5% to 10%, and for all rabi crops in the range of 5% to 9%. While increasing the MSP, the government argued that it was trying to improve the nutritional health of Indians by focusing on diversifying diets and improving income levels. However, a 2016 paper by economists Prachi Mishra and Devesh Roy, published by the International Monetary Fund (IMF), argues that the government might be enabling high food inflation. The authors note, “Domestic interventions such as minimum support prices, which are aimed at increasing production, might themselves be contributing to food inflation.”

Data and expert research also point to the same conclusion. A note by NITI Aayog in 2018 had cautioned about the effect of food inflation on MSP. It said that if the effect of increase in farm-level prices due to government decisions on MSP was transmitted to wholesale and retail level, it would have implications for inflation. The think tank had vouched for competitive and efficient markets.

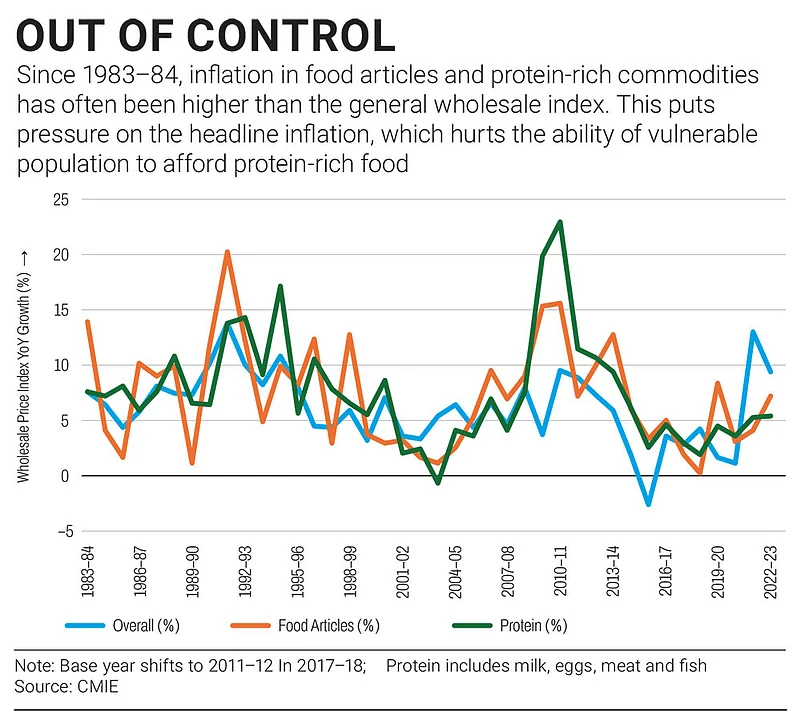

Data for the financial years between 2013 and 2023 points to a worrying picture of food inflation. As per the information from the Ministry of Commerce and the Ministry of Statistics and Programme Implementation, in seven out of the last 11 financial years, annual food inflation remained higher than the headline inflation figure. Within the food index, the combined inflation of egg, meat, fish, milk and other dairy products—important for proteins in the diet—has remained higher than retail inflation in eight out of 11 financial years.

The magnitude of the problem becomes clearer, looking at the wholesale price index (WPI) data. From 1983–84, since the data for the WPI print is available, food inflation has been higher than the overall print in 25 out of 40 years. The inflation in protein-rich commodities was higher in 26 out of 40 years than the general inflation number, showing the connection between restrictive farm policies and malnutrition.

Shoba Suri, senior fellow–Health Initiative at Observer Research Foundation, says, “Food price inflation affects both availability and access, and it can significantly affect the nutritional well-being of the population. It impacts the affordability of nutrient-rich foods, leading to shift in dietary patterns towards cheaper, less nutritious options, further exacerbating nutritional deficiencies. Low availability of protein-rich foods can further exacerbate malnutrition, impacting child development.”

Nutrition Crunch

Although the food security measures of the government through the public distribution system (PDS) across the country take care of demand for cereal consumption, they are not enough for protein-rich foods. Mishra and Roy, in their paper, observe that the higher MSP for cereals leads to higher market price, but alongside, it also hinders the reallocation of resources like land and labour to crops in short supply, such as pulses and oilseeds. In 2022–23, paddy and wheat together constituted nearly 75% of the total foodgrain production, according to the final estimates of production of major crops released by the Ministry of Agriculture and Farmers Welfare in October 2023. The Food and Agriculture Organisation (FAO) of the United Nations notes in the State of Food Security and Nutrition in the World (SOFI) 2023 report that 74% of the population in India cannot afford a healthy diet.

One of the ways to avoid widespread inflation in highly nutritious commodities is to change the cropping pattern away from the dominant wheat and paddy cultivation in the country. But the incentive structure, as has been argued by many, is aligned towards the crops which were targeted during the Green Revolution. It is pertinent to note that these two are central to the farmers’ ongoing protests.

Noting that the food management system in the country had not been able to deliver on its objectives efficiently, the Shanta Kumar Committee report observed that the benefits of procurement had not gone to a larger number of farmers beyond a few states. It recommended that the FCI hand over procurement of wheat and paddy to states that have gained sufficient experience and infrastructure and move on to help the ones where farmers have to resort to distress selling at prices lower than the MSP, particularly the ones dominated by small land holdings, like eastern Uttar Pradesh, Bihar, West Bengal and Assam, among others.

Pressure on the Economy

Consistently high inflation and the low ability to afford nutritional food have resulted in the country’s low rank in the global hunger index. India ranks 111 out of 125 countries in the index which measures the level of malnutrition in an economy.

The effect of this is not only felt by the poor but the entirety of the Indian economy. At the 59th SEACEN governance conference, Reserve Bank of India governor Shaktikanta Das said that recurring food price shocks make tackling inflation hard. “We firmly recognise that stable and low inflation will provide the necessary bedrock for sustainable economic growth,” Das said. The RBI has been able to keep inflation below its targeted level of 4% in just two out of past 11 financial years. High inflation due to increase in food prices forces it to raise interest rate across the economy. But there is little the central bank can do to control the agri sector problems as the ball is mostly in the government’s court.

Keeping interest rates in check by not having to frequently control high inflation can be a major boost to India’s ambition of increasing its manufacturing share in the GDP to 25% from the current 17%. A UN Industrial Development Organisation report notes that successive increases in interest rates to combat inflation dampen the pace of growth in the manufacturing sector. In the 21st century, the RBI’s repo rate has moved in the range of 4% to 8%, with the current rate at 6.5%, to combat episodes of high inflation.

A sustainable check on inflation for the long term will allow the RBI to focus on growth. As calculations show, this will not be fiscally possible with the Swaminathan formula for MSP on crops. Experts argue that instead of looking to keep the trade protectionist, the country must open the agriculture sector for any meaningful reform. Between 2018–19 and 2023–24, the MSP for paddy would have been higher by 34% on an average had the Swaminathan formula been used. For wheat, it would have been 8%. Not only would it have pushed the government’s cost of procurement from farmers, the impact on inflation would also have been visible as food inflation already surpassed headline inflation for many years.

Is MSP on all crops fiscally feasible? In a 2021 article in The Indian Express, ICRIER professor Ashok Gulati and Arcus Policy Research’s founder and CEO Shweta Saini cited back-of-the-envelope calculations, observing that even if only 10% of the production of the rest of the 21 MSP crops—excluding sugarcane—is procured, it would cost the government about Rs 5.4 lakh crore annually.

Talking to Outlook Business, Saini explains that while the government can improve procurement in paddy and wheat, it would be unfair to expect it to be able to repeat the similar procurement pattern in all crops. “We have been tracking the PDS for decades now and what we have seen is that the leakage in the system has come down to 36% in some states. It has reduced to as low as 10% as well in some states. However, the leakage still continues. So, if we have not been able to fully plug the gaps in a system in place since 1942 for primarily two crops, then how can we expect it for the remaining 21 crops?” she asks. According to government data, the Centre spent Rs 18.39 lakh crore between 2014 and 2023 on procuring rice, wheat, pulses and oilseeds. Within this, wheat and rice accounted for expenditure worth Rs 17.19 lakh crore.

Import Solution

Mishra and Roy suggest imports as an option to moderate inflation. They note in their study that the liberalised trade policy in edible oils resulted in muted inflation. A similar story was observed for pulses where more imports had moderated inflation to an extent during price spikes. “Both raise the question of whether the patterns of inflation we observe in most commodities would have been different were trade more liberalised to begin with,” they write, referring to the examples of pulses and edible oil.

Estimates suggest that only 15% of the domestic pulse consumption is currently met through imports. An International Food Policy Research Institute study found that a 1% increase in imports of arhar was associated with lowering prices by around 3% between 2002 and 2012.

Evidence from China suggests that imports could be an option to stabilise inflation in the long run. The country has been a net importer of food since 2004, some of its major imports being soybean, wheat, rice and dairy products, among others. While India struggled to keep food inflation under check despite being a net exporter of food, our neighbour was able to keep it below 5% in most of the years in the past decade. Thus, importing is an important economic consideration if RBI is to keep the cost of borrowing low to boost growth.

In 2023, the government considered importing major dairy products due to stagnant milk production owing to the breakout of lumpy disease among cattle. However, imports of dairy products have remained a contentious subject as the dairy producers’ lobbies in India want protection against foreign low-priced dairy products. FAO data shows that India’s cow milk yield is 47% lesser than the global average. Between 2022 and 2023, dairy inflation followed a different trajectory than the headline inflation. While retail inflation declined from over 7% in May 2022 to 4.25% in the same month in 2023, dairy inflation surged from 5.78% in July 2022 to 8.34% in the same month in 2023.

Need for Reforms

Prerna Sharma Singh, head of agriculture, food and retail practice at Indonomics Consulting, believes that opening up trade in protein-rich products will help contain food inflation. “Moreover, a crop-neutral income support will be better than extension of MSP to all crops and/or legal guarantee to MSP. More market-driven reforms will be good for lndia’s farm sector,” she argues.

Speaking about the need to lift trade barriers from agriculture, NITI Aayog member Arvind Virmani says that protectionism has acted as a constraint on growth. “I have no doubt that reforms in the agricultural sector will result in wages rising. We need to lift protectionism, and we have to increase our competitiveness,” he says.

Data from the World Bank suggests that by the end of 2021, the global average of people employed in agriculture was 26% of the labour workforce. In India, around 45% of the workforce is in the agriculture sector, though the share of agriculture in India’s GDP has declined to a mere 15%. “It is a desired goal [to move people into more manufacturing jobs] and should be achieved as early as possible. Any economy that has a dream of [becoming] a developed economy must transform from predominantly agricultural to manufacturing one,” says Lakhwinder Singh, visiting professor of economics at the Institute for Human Development (IHD), Delhi.

Liberalisation of the farm sector could change its face, but it is a big ask in a country where protectionism has long dominated the agricultural landscape.

—Inputs from Abdul Haleem Sherif