In 2023, Joyatika Ghosh, a 30-year-old marketing professional, travelled to the United Arab Emirates (UAE) hoping to use the Unified Payments Interface (UPI)—a year after it was officially launched there. Despite the rollout, her experience on the ground was underwhelming, as UPI was still not widely accepted.

“Before travelling, I heard that UPI had been officially launched in the UAE. But neither at the airport nor in any local store did I see an option to use it,” she said.

A similar experience played out for Madhab Sharma, a 31-year-old IT professional, at Mauritius’ Sir Seewoosagur Ramgoolam International Airport in April 2025.

“Nobody was accepting UPI at the airport even though many Indians travel to Mauritius. Also, when I did a transaction using UPI in Mauritius previously, there was a 3% bank charge. Honestly, not many merchants are willing to accept UPI there,” he said.

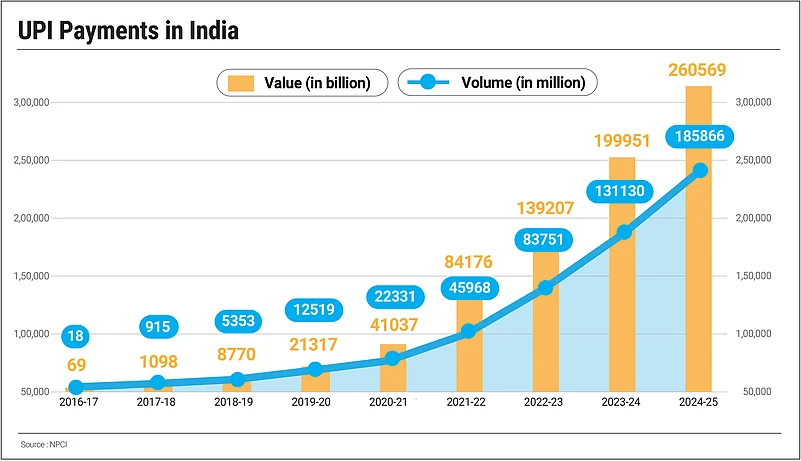

Launched in 2016 by National Payments Corporation of India (NPCI), UPI saw slow initial growth until demonetisation and apps like Google Pay and PhonePe boosted adoption. Between the financial year 2016-2017 and 2024-2025, transactions volume surged 10000-fold and over 3700 times in value. With rising smartphone use, low fees and supportive regulation, UPI transformed India’s digital payments, growing from millions to billions of transactions monthly. Usage spiked fivefold after the Covid-19 outbreak.

India’s attempt to globalise UPI began after its breakout success at home following its 2016 launch. The first international foray came in Bhutan in 2021, followed by launches in Nepal, Singapore, France, Mauritius, Sri Lanka and the UAE. In March 2025, NPCI International (NIPL) partnered with Singapore-based HitPay, enabling UPI across 12,000 merchants in the city-state. While NPCI doesn’t disclose international transaction volumes, insiders say UPI is gaining more traction in India’s neighbouring countries than elsewhere.

Behind the Geoeconomics Play

At the G20 summit, India spotlighted its UPI. Countries including Japan, the UK, the US, Saudi Arabia and Thailand have since expressed interest in adopting similar systems. India’s ambition to globalise UPI received a further boost when the World Bank lauded the country’s digital public infrastructure (DPI)—particularly Aadhaar and UPI—as a transformative force for financial inclusion. An International Monetary Fund (IMF) paper echoed this sentiment, highlighting UPI as a model for nations aiming to shift from cash to digital payments, provided they also build complementary infrastructure in digital ID, banking access and mobile connectivity.

The global payments ecosystem today is dominated by US-based networks like Visa, Mastercard and Western Union, while China’s Alipay and WeChat Pay are steadily expanding their reach across Europe and Africa.

As per the latest data, the Visa network processed an average of 639mn transactions every day in 2024 across the globe. UPI topped this figure and processed 644mn transactions on June 1 this year. While Visa and Mastercard remain global heavyweights, UPI’s explosive growth has significantly altered market dynamics at home and positioned it as a potential global contender.

As UPI overtakes Visa and Mastercard in domestic transaction volumes, India's ambition to internationalise its homegrown payment rail has taken on a larger strategic dimension—one that goes beyond mere convenience or fintech pride.

UPI’s global acceptance, experts argue, is central to building a parallel financial architecture that reduces dependency on the US dollar, and help bolster the rupee's acceptance internationally. “Once you are able to establish corridors where UPI acceptance is there, it will also help the rupee acceptability outside of India. Over time this can move to rupee to rupee transactions in a cross border setting. This can contribute towards better capital account convertibility.” said Vivek Mandhata, managing director & partner at Boston Consulting Group (BCG).

As most global payments today are routed through US-based networks, UPI offers a rare chance to chip away at that control. “If we have to get out of the hegemony of the West and them calling the shots and setting the standards—rather than following the Western standards—this is critical,” said G Padmanabhan, former executive director of RBI and advisor to the Payments Council of India (PCI).

In essence, globalising UPI is not merely a financial innovation—it's a geopolitical project aimed at reshaping the power dynamics of cross-border payments.

Challenges of Driving Global Use

In the financial year 2024, UPI recorded 1,331.1bn transactions—far surpassing Visa’s 303bn and Mastercard’s 160bn (annualised). UPI also outpaced Mastercard in Q1 2025, logging 51.4bn transactions compared to Mastercard’s 40.1bn. Yet, Visa and Mastercard continue to dominate globally, accepted across nearly every country. Despite UPI’s success in India, Mastercard has flagged concerns over its commercial viability. Mastercard’s chief financial officer Sachin Mehra called it “fantastic but incredibly painful”, as banks often lose money on UPI transactions—raising questions about its long-term sustainability.

UPI’s limited global presence is also hindered by regulatory complexities, lack of merchant acceptance and absence of a robust credit framework. While NPCI has pursued bilateral agreements to expand UPI abroad, experts argue this is slow and inefficient. Data localisation laws and geopolitical tensions, such as concerns over US access to transaction data, further complicate expansion. Analysts believe integrating credit functionality—similar to RuPay’s domestic credit card link—could boost global adoption and revenue potential, positioning UPI as a true international contender.

But beyond structural and geopolitical challenges, even individual users hesitate to use UPI abroad due to low acceptance and trust issues.

No matter how comfortable the users feel while using UPI in India, they were somehow compelled to take a step back while trying to do a transaction using UPI abroad. As Ghosh recalled, she would have been a little hesitant too, in terms of doing a transaction abroad using UPI, as she has a sense of security in terms of using credit cards.

“For any transactions abroad, I prefer using a credit card as I know even if there is any issue, I can claim the money back in the credit card. Thus, the chance of getting scammed is comparatively less,” added Ghosh. Alongside, the Indian travellers are also hesitant in terms of the transaction fees to be levied by the bank while using UPI abroad.

Although UPI transactions are typically free for users within India, cross-border payments often come with hidden costs. When used internationally, banks may impose a foreign exchange conversion fee—commonly referred to as a markup—to cover currency conversion expense. The fee structure varies by institution and destination, adding complexity to UPI’s global appeal. Alongside, acceptance of UPI has been persistently hard to drive among merchants abroad.

“Currently, we are fine with international credit card usage freely. Also, knowing your customers' process of tourists coming to a country remains a challenge. What we need the most is the cooperation between the central banks of the respective countries to promote better UPI adoption and we need to address certain tech issues,” said Padmanabhan.

At the same time, dollar dominance continues to be a hurdle in making UPI a global mode of transaction. India had earlier made moves to promote de-dollarisation by encouraging trade settlements in rupees with countries like Russia, Sri Lanka and the UAE. However, with Donald Trump’s return to the global stage, New Delhi appears to have paused its momentum, wary of geopolitical repercussions and the dollar’s enduring dominance in global finance.

As highlighted by Padmanabhan, it has become particularly challenging to keep the transactions completely a political firewalled from ‘sanctions’ risk particularly during the unpredicted Trump era. “Dollar dominance is also one of the factors—you have to convert rupee to dollar and then dollar to that local currency. So, there will be some additional charges or some cross-currency charges that can be levied, will increase the cost of the transaction for the customer,” said Mihir Gandhi, partner at PwC, payment and fintech.

Another challenge is the presence of prominent payment systems in respective countries or a lack of fast payment infra in some countries. Be it Singapore or the UAE, either most of the countries has an existing fast payment network or the residents are comfortable in their existing payment system like use of debit card or credit card.

“To not be dependent on global networks, they (NPCI) chose to create bilateral arrangements with similar real time payment networks in other countries, like Singapore or UAE. However, bilateral tieups to achieve global acceptance is difficult, time-consuming and inefficient. Thus UPI, like most other domestic payment networks, have found limited success in acceptance beyond their own borders,” said Ranadurjay Talukdar, partner & payments sector leader, EY India.

Several UPI players also dealt with certain other challenges as they tried to expand their market abroad. Ritesh Pai, CEO International Payments at PhonePe told Outlook Business that adoption on ground presents a few practical challenges—including integration with international QR standards, ensuring merchant readiness and training and building awareness at the point of sale. Regulatory alignment is important but often the real complexity lies in operational enablement and last-mile execution.

From Vision to Execution

Despite limited global uptake, UPI’s competitiveness could improve with targeted policy interventions. If RBI and NPCI can focus a little more on regulatory alignment, forex integration and bilateral partnerships to challenge entrenched global payment networks, UPI can gain global prominence.

As highlighted by both advisors of PCI and fintech experts, NPCI needs to focus largely on interoperability. UPI can only be used in countries where there are real-time payment networks. India needs to identify those countries and identify banks that could help do the payment settlement after currency conversion.

“The local real-time payment network will allow you to pay using UPI. Money will go to the merchant in that country and will be debited from your India account. And NPCI will choose a settlement bank which will convert the currency. Due to multiple bilateral arrangements and country level nuances, this has also been a challenge. The way forward is clearly participating in global cross currency initiatives like Project Nexus, where centralised entities will connect domestic payment networks,” added Talukdar.

As confirmed by NIPL, to enhance UPI’s global presence, NIPL is primarily focusing on two aspects- interoperability and expanding digital infrastructure. NIPL is collaborating with countries like Peru, Trinidad & Tobago to help them build digital infrastructure that can accommodate UPI-like payment systems. For countries like Singapore and the UAE, the prime focus is interoperability. That’s why NIPL is partnering with various payment solution providers in the respective countries so that more merchants can onboard UPI.

Mandhata explains that if India is able to capture the peer-to-peer kind of cross-border flows using UPI, that could be a huge revenue pool as well.

While UPI can only be explored by Indians travelling abroad or non-resident Indians having a bank account in India currently, UPI service providers are hopeful that soon NPCI will figure out ways to tap residents of the partner countries too. “I am sure in future, NPCI will expand UPI’s role globally as an alternative to card networks for digital infrastructure. Every country is different; some don’t have instant bank rails. The challenge is figuring out how to stay compliant with local rules, including data protection and financial regulations, while still keeping UPI as fast and easy as it is here," said Shashvat Nakrani, founder, BharatPe.