The voluntary carbon market (VCM) is a largely unregulated mechanism through which companies buy or sell carbon credits. A carbon credit represents one tonne of carbon dioxide (CO2) equivalent reduced or removed from the atmosphere. Typically, carbon credits are sold by companies with low-carbon emissions to entities with a high carbon footprint. This trade-off provides a mechanism to incentivise reduction of emissions and investments in green initiatives on the part of the companies.

The carbon market consists of several stakeholders including:

a.) Carbon credit registries which issue credits and manage information

b.) Developers who invest in greenhouse gas (GHG) reduction projects

c.) Organisations or individuals purchasing carbon credits to offset their emissions on a voluntary basis

d.) Third-party verifiers who assess the legitimacy and accuracy of emission reductions claimed by projects

e.) Carbon trading brokers who act as intermediaries between project developers and buyers

f.) Financial institutions to finance projects that generate carbon credits

Carbon Markets in India

Carbon credits can be issued for a host of mitigation activities, including renewable energy with storage, solar thermal power, compressed bio gas, sustainable aviation fuel and high-end technologies for energy efficiency.

Between 2010 and 2022, India issued a total of 278 million credits in the voluntary carbon market, accounting for 17 per cent of the global supply, stated a 2023 special report on GHG emissions by S&P Global.

Voluntary market transactions in India have grown from $520 million in 2020 to $2 billion in 2021, according to the estimates of Ecosystem Marketplace, a US-based research organisation.

In 2023, India took measures to develop its domestic carbon market under the provisions of the Energy Conservation Act 2001. This legislation established a national framework for the Indian carbon market, with the aim of reducing, removing or avoiding GHG emissions from the Indian economy. Thereafter, the Energy Conservation (Amendment) Act of 2022 provided a statutory mandate for such a Carbon Credit Trading Scheme (CCTS), reported The Hindu. The larger aim was to align India's climate commitments under the 2015 Paris Agreement with larger economic goals, stated the report.

The Indian carbon market framework hinges on two key mechanisms:

1. Compliance which aims to address emissions from energy use and industrial sectors, and

2. Offset mechanism to incentivise the voluntary actions from entities (not covered under compliance) for GHG reduction.

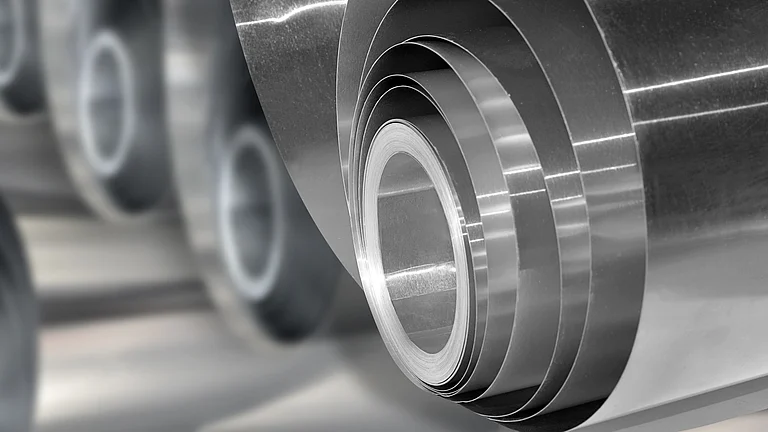

The compliance market, regulated by the government, is a market which operates under a cap-and-trade system where the government sets the limit on the the amount of GHGs companies can emit. This segment of the scheme is scheduled to commence in FY26, with 11 sectors expected to be covered gradually, including petroleum refineries, cement, steel, aluminum, thermal power plants and fertilizers. There is no set timeline for the launch of the voluntary carbon market.

The CCTS will also enable non-obligated entities to participate in the carbon credit market, allowing them to register projects and obtain tradable carbon credit certificates. The purpose of the regulation is to price emissions through carbon credit certificate trading and expand the voluntary carbon market.

Challenges Facing Carbon Markets in India

Lack of transparency is a major issue in India's voluntary carbon market. Currently, there are uncertainties regarding the actual and measurable benefits accruing from the current market. Moreover, due to high transaction costs, community-led renewable energy initiatives with limited capacity to scale projects are unable to participate in the market.

Despite these challenges, experts have repeatedly emphasised on the merits of establishing and nurturing a domestic carbon market, citing India's commitments under the Pari Agreement as well as its economic interests.

The World Bank's annual State and Trends of Carbon Pricing 2024 report, for instance, notes that as of August 2023 there were 74 carbon pricing mechanisms globally, either in the form of emissions trading schemes or carbon taxes. Carbon pricing revenues have reached a record $104 billion in 2023, it added. Considering the immense potential of the carbon trading market, experts have dubbed India's efforts under the CCTS as a step in the right direction.