Waaree Renewable Technologies posted a stellar 205% year-on-year jump in net profit this quarter. But behind the ₹86.39 crore PAT and ₹603 crore topline, the company’s expenses soared 146%—a figure markets didn’t overlook, sending the stock into a mild post-result dip.

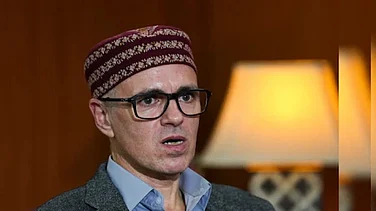

In an interview with Outlook Business following the results, CFO Manmohan Sharma struck a confident tone. But as the company races to deliver a 3.2GW engineering, procurement and construction (EPC) pipeline—with ambitions to tap a further 25GW—questions around execution discipline, margin protection, and capital structure linger.

To unpack what’s driving the numbers—and what’s not—we asked him what investors really want to know: Is Waaree overstretched? Is the order pipeline priced for profit or for volume? And how resilient is the capital structure if market tailwinds shift.

Edited excerpts from the exclusive interview

Q: The company reported ₹673 crore in revenue and ₹86.39 crore in profit. But expenses have more than doubled year-on-year. What explains this sharp rise—and is it sustainable?

A: The growth in expenses is linked to the scale and pace of our EPC execution. Based on our current order book, we are looking at execution timelines of 12–15 months, and we expect this operational intensity to continue.

Q: Your EPC order book is now at 3.2 GW, with 40 MWh in battery storage. But what is the current spend per kW, and are margins holding up in a price-competitive market?

A: We’re not seeing margin pressure in new tenders. Government solar tenders and utility-scale projects continue to show strong traction. Our current pipeline includes 3.15 GW under execution and a broader funnel of around 25 GW in active prospects. We assess margin viability project by project and won’t pursue orders that dilute returns.

Q: That sounds prudent, but is it realistic? Are you turning down low-margin or loss-leading contracts—even when they offer market share gains?

A: Yes. We do not take loss-making orders just to stay busy or show top-line growth. Every order undergoes a rigorous risk-reward analysis. If the project economics don’t hold up, we walk away. We are not chasing volume for optics.

Q: You say governance and risk management are embedded in operations. But are there formal stress-testing protocols? How often is the board reviewing risk exposure in this volatile sector?

A: Risk evaluation is part of every vendor and project decision. Governance and risk matters are reviewed quarterly at the board level, as required. It’s an active and ongoing process.

Q. You describe your capital structure as “lean”—with ₹20 crore in paid-up capital and minimal debt. That seems thin for a company chasing multi-gigawatt projects. Is it sustainable?

A: We are capital-light by design. Apart from a small term loan of ₹26–27 crore for IPP assets and some working capital facilities, we carry no debt. The EPC model doesn’t require heavy capex. For the IPP vertical, we deploy surplus funds as needed, but we’re cautious and selective about asset creation.

Q: What are your capex plans for the next two years? And will those be funded internally or through external equity?

A: There is no significant capex planned for EPC. It’s a manpower-intensive model, not capital-intensive. For the IPP segment, any capex will be backed by surplus accruals. We’re not planning any equity dilution or long-term debt raises at this point.

Q: Finally, what kind of returns are solar investors expecting in India today? Are the assumptions behind your bids aligned with these expectations?

A: Return expectations vary. Captive versus utility-scale, project size, end-use, and funding mix all influence IRR. There’s no one-size-fits-all. That said, we do not commit unless returns meet our internal thresholds.