India and the United Kingdom on July 24 signed a landmark free trade agreement, leaving out the Carbon Border Adjustment Mechanism (CBAM) —also known as the carbon tax—at this stage, but both sides said that it will be taken up for discussions later.

Hervé Delphin, EU Ambassador to India, told The Indian Express in June 2025 that the EU’s CBAM is not part of negotiations. “CBAM is not a trade measure. It is not part of trade and the FTA. It’s about compliance with our climate agenda to accelerate decarbonisation,” Delphin told the newspaper.

What is Carbon Tax?

As a measure of tightening its carbon market, the EU is making it more expensive for foreign companies exporting to the EU to emit greenhouse gases by planning to introduce the Carbon Border Adjustment Mechanism (CBAM) or carbon tax by January 1, 2027.

According to the Organisation for Economic Co-operation and Development (OECD), the CBAM requires EU importers to purchase “CBAM certificates” reflecting the carbon embedded. Initially, CBAM covers a list of 303 energy-intensive products (iron and steel, cement, fertilisers, aluminium, electricity, and hydrogen). Together, these products account for about 3% of EU imports.

India's Pushback on CBAM

The India-UK Free Trade Agreement (FTA) does not mention a resolution on the contentious Carbon Border Adjustment Mechanism (CBAM).

"If India secures an exemption from the UK’s Carbon Border Adjustment Mechanism under the FTA, it could significantly boost exports from affected sectors," an official told , indicating that the two sides were still engaged on the issue.

India has been vocal about CBAM being a trade barrier in the name of environmental concern and has asked for a transition period before fully following these rules, reported NDTV Profit.

Reports also suggest that India has resorted to measures such as green-certifying products locally and imposing a local tax to fund sustainability efforts and avoid the EU’s carbon tax on imports.

On May 6, Commerce and Industry Minister said that India will retaliate if the EU and the UK impose a carbon tax. “Trade talks are going well but if they (EU, UK) put a carbon tax, we’ll retaliate. I think it will be very silly, particularly to put a tax on friendly countries like India,” Goyal said during the Columbia India Energy Dialogue 2025 in New Delhi.

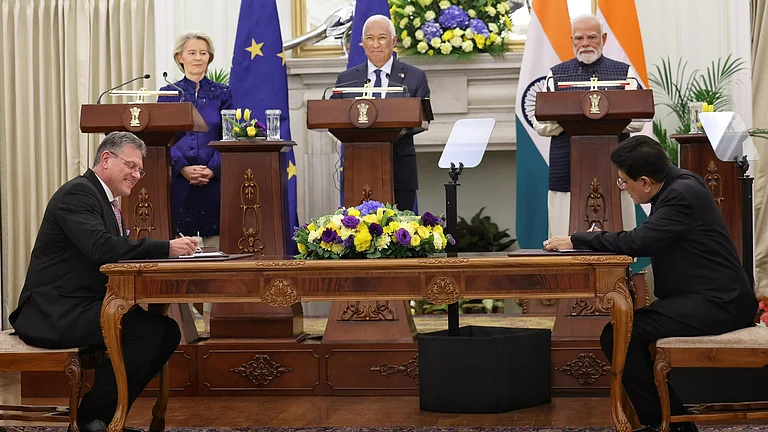

The recently signed deal is set to give a major push to bilateral trade and investment, offering greater market access across key sectors.