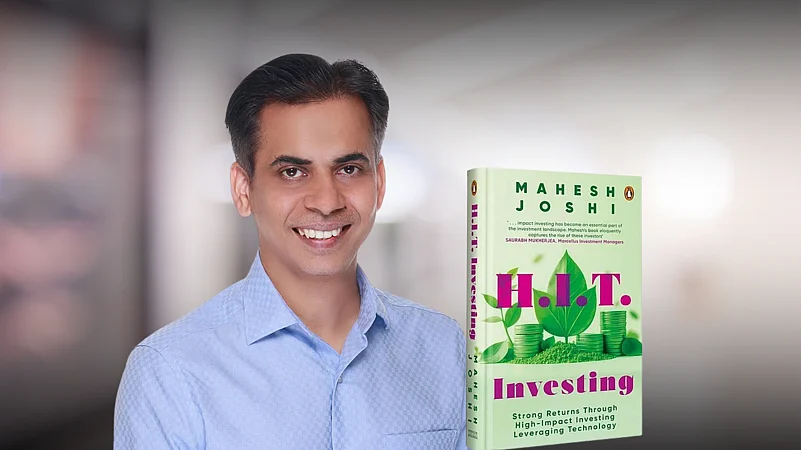

Mahesh Joshi, head of Asia private equity investment, BlueOrchard recently published his book H.I.T. Investing: Strong Returns Through High-Impact Investing Leveraging Technology.

In an exclusive interview with Outlook Business, Joshi talks about the inspiration for his book on impact investing and why it can generate strong returns, citing excellent examples from around the world. Despite being a fragmented market, India offers immense opportunities for investors in this space, he believes.

What inspired you to write the book on impact investing and its opportunities?

There are various parts to it that come together. It is my reflection of how I viewed impact investing from outside the industry and how my thought process changed once I was in it. Therefore, I felt that it is essential to communicate about impact investing properly to the outside world.

The idea of writing the book emerged out of a discussion with an old colleague from Leapfrog, Pritesh. We started together, but he could not continue due to other commitments.

Initially, when I started my journey in investing, I read a lot of books, some of which were simple Q&As with investors, like Value Investing with Investors and Market Masters by Kirk Kazanjian and Super Analysts by Andrew Leeming. I took a lot of value from them. I thought if I could do the same thing for impact investing, it could be helpful for people who want to learn about it.

In your book, you say that investors can expect high returns from impact investing. Can you explain this?

Impact investing, essentially, is supporting something important to you. It could be financial inclusion, improving access and affordability of health care or education or climate-related challenges. It could also be about solving for the farmers.

Impact investing helps you sharpen the focus on real value, which enables you to build meaningful businesses. This means in the long term, they will do well and generate returns.

Without it, you can easily end up chasing the latest buzzwords in the industry.

Microfinance space is an excellent example. Impact investors initially supported it. Today, most of the investors in this space are not impact investors. The industry is now worth more than 3 lakh crores. Over more than two decades, it has consistently grown at more than 30% CAGR [compound annual growth rate]. No industry, to my knowledge, has grown like that, and such growth is not possible unless people are investing for returns. The reason it works is straightforward: because a small loan given to the person helps them unlock value.

Climate-related investments don't necessarily have to sacrifice returns because there are many outstanding businesses which are doing well while also generating strong returns. As impact investors, our job is to find such companies and help them come up the curve.

When I joined Impact Investing, I used to focus on affordable and accessible healthcare services, especially for low- and middle-income people. I initially saw it as a challenge because it limited the types of businesses I could invest in. However, once I started focusing on that consistently, I began to see opportunities others were missing as I concentrated on the real value.

It also helps investors in monitoring the investment because, as an impact investor, I focus on whether the company is truly delivering value to its customers. This approach helps identify potential challenges early and supports building stronger, more sustainable businesses. That’s been my experience, and it aligns with what other investors told me while I was writing the book.

Can you talk about the investors you cited in your book? How did they manage to invest in these kinds of projects, and how did they earn returns?

A good example is Lok Capital in India. They started with a focus on just microfinance. They are probably among the best-performing funds in India. Their second fund generated 22% USD IRR [internal rate of returns] and is ranked in the top decile. They invest only in lending businesses that serve low- and middle-income people.

Capria Ventures (formerly Unitus Ventures) invested in India a lot, focusing on anything outside of financial services. They invested in a company called Betterplace, which is trying to solve the problems of all the low-income workers, like security guards, by getting them social security coverage, insurance or credit so that people have more confidence in hiring them. It's a brilliant business and has attracted a lot of investment, and they have started expanding globally.

Similarly, they invested in a company called Eduvanz, which provides loans for education where they are not available. In India, education loans are given to people who go abroad to study. It's very hard to get a loan for any vocational course. Eduvanz is also still generating good returns. Peak XV [formerly Sequoia Capital] invested in them.

Outside India, a fund called SDCL or Sustainable Development Capital focuses on energy efficiency. They are generating good returns; they got their funds listed and have $2bn under management.

Similarly, Quona Capital focuses only on fintech companies catering to the needs of low- and middle-income people across sectors. They have an excellent record in returns. Likewise, Apis partners have focused on payments to drive inclusion globally.

In Indonesia, there is a fund called AC Ventures. It has invested in a company called Julo, which provides credit card facilities to people who are almost unbanked or under-banked. It is one of the largest success stories in the country.

There is another fund called Verdane in Europe. They are huge, with each of their fund being about a billion Euros. They are doing phenomenal work on sustainability. They invested in a business called NORNORM, which provides refurbished furniture, increasing its shelf life and making it cheaper for customers. IKEA initially backed it.

All these eight investors cited in the book are doing brilliant work across sectors.

Can you talk about some success stories in India that have attracted impact investment?

IndiaMart is a listed company and one of the few tech firms in India that has performed well post-IPO. It plays a significant role in supporting SMEs [small and medium enterprises] across the country. Backed by Quona Capital in 2016–17, IndiaMart later went public and has generated substantial returns for its investors.

Five of the eight small finance banks granted licenses were backed by Lok Capital. These companies, including well-known names like Ujjivan and Equitas, have since become key players in the financial sector.

Another investee of Lok Capital—Veritas (a South India-based company), is helping bridge the gap in SME financing. Traditional banks often offer SME loans starting at ₹1 crore or more, leaving a huge underserved segment of small businesses that need loans in the ₹10–20 lakh range. Veritas is stepping in to address this critical financing need.

Akshayakalpa is another Lok Capital-backed business focused on organic dairy. They work closely with dairy farmers, helping them adopt sustainable practices and significantly boost their incomes by 3 to 4 times while delivering high-quality products to premium consumers.

What kind of investments does BlueOrchard make, and what are the geographies it operates in?

BlueOrchard is an impact investor focused on two key themes—financial inclusion and climate.

On the equity side, which is where I work, we manage a fund called the InsuResilience Investment Fund. The name combines ‘insurance’ and ‘climate resilience’. We’re trying to build climate resilience by using insurance as a tool.

The thesis is that no matter what we do on climate mitigation, we are heading toward a 1.5–2°C temperature increase. Low- and middle-income individuals in emerging markets will be the most impacted. For example, if a flood wipes out a farmer’s crop, he often doesn’t have the money to buy seeds and plant again. Or if a kirana store is flooded and loses inventory, it’s very hard to restart. That’s where insurance comes in. We invest in insurance and insurtech companies and also in businesses that support these goals. For example, we invested in a Noida-based company called FinAGG last year. They provide loans to kirana stores and micro-enterprises. We worked with them to embed business insurance into those loans. So, if there’s a burglary, fire, or natural disaster, the borrower is compensated, and their business can continue.

Similarly, we’ve invested in Probus, which is probably the only profitable insurtech in India right now. BlueOrchard currently manages about $5bn in assets.

How do you identify scalable, investable businesses in a fragmented market like India with so much regulatory ambiguity?

We cover emerging markets such as India, Vietnam, Indonesia, Philippines and Cambodia. India offers tremendous opportunity and is a great market in which to invest. India gets huge benefits from being such a large market with 1.5bn people.

India has one of the best ecosystems for the public markets as well. IPO is a proper exit opportunity for a lot of investors in India, which is why there is so much interest in India in general. So, despite being fragmented, there are a lot of opportunities for investors.

It is also one of the best places for impact investing because when you solve for low- and middle-income people, you offer affordable production services, which means you will work on lower margins. The country provides the advantage of significant volumes. Impact investing as a concept, thus, becomes much more sustainable and valuable.

Emerging economies like India receive disproportionately low climate finance for adaptation, mitigation and resilience compared to Western nations. What systemic factors drive this disparity, and what steps can ensure equitable funding flows to address the climate vulnerabilities of developing economies in the coming decades?

The amount of investment required on the climate side is massive. I also mention this in the book. We have to look at both the supply and the demand side in any kind of problem. At least, climate mitigation and renewable energy attracts a lot of capital in India. All the global funds have also set up their offices in India because they want to invest in these opportunities.

However, there are other initiatives around climate-tech or energy efficiency that present a challenge on both sides. Probably, there are not enough scaled opportunities for people to invest.

Also, some early-stage capital may be needed to get such businesses to scale to a certain level. It is a vicious circle because start-ups are not scaling up due to the lack of enough capital, and investors are not investing as there are not enough start-ups.

That will also depend on how much people are able to raise globally. Ultimately, it has to start from the investors somewhere, and they need to allocate more towards capital. But with what is happening in the US, those taps are now being turned down a little bit.

Over time, I believe that climate-related businesses will attract a lot of capital, which will also increase supply. We need success stories, after which everybody will start chasing climate tech.