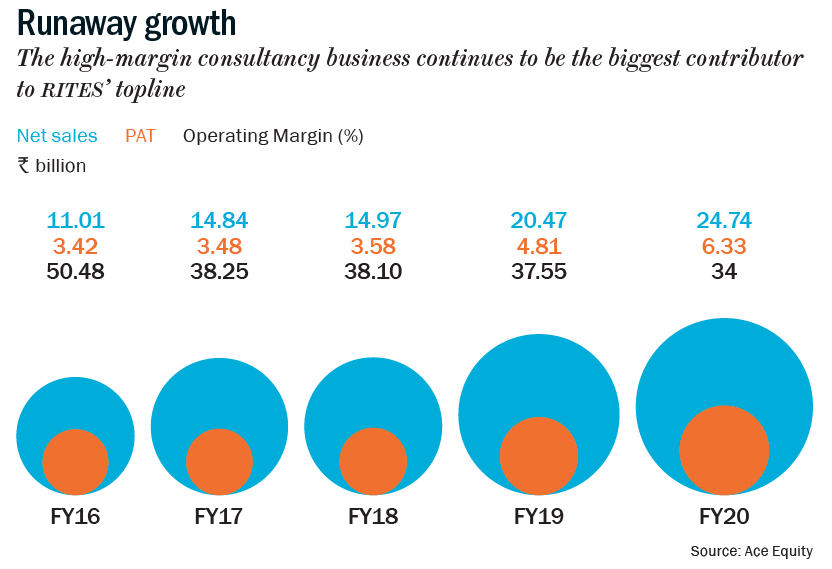

Heads, A wins, tails, B loses. It must be nice to be A. Whatever happens, it wins. Whether there’s a pandemic or an economic slowdown or the fact that the government has just opened railway construction bids to private players. There’s one company that has been winning — RITES or ‘Rail India Technical and Economic Service’. Although the infrastructure and consultancy PSU saw its revenue decline 44% in Q2FY21, compared to Q2FY20, it has a lot going for itself. The company has largely managed to sustain its growth momentum even while dealing with delays in execution and payments from certain projects and clients. Between FY15 and FY20, its revenue grew 19% CAGR while net profit grew 14% CAGR (See: Runaway growth).

One of the key factors for RITES’ growth momentum is its well-diversified business. With four engines of growth — consultancy, leasing, exports and turnkey — the company is hedged against risks that come with any infrastructure business. Its core business, consultancy, got more than 40% of FY20 revenue, under which the company examines feasibility of projects, for various sectors including railways, roads and highways, ports, inland waterways, airports and more.

One of the key factors for RITES’ growth momentum is its well-diversified business. With four engines of growth — consultancy, leasing, exports and turnkey — the company is hedged against risks that come with any infrastructure business. Its core business, consultancy, got more than 40% of FY20 revenue, under which the company examines feasibility of projects, for various sectors including railways, roads and highways, ports, inland waterways, airports and more.

This segment is its biggest strength since, besides human capital, the company does not need heavy investment. “Consultancy is an asset-light yet high-margin business. And since RITES is a government-owned company, it is in pole position as far as winning orders is concerned,” says Pankaj Bobade, head-fundamental research, Axis Securities.

An extension of the consultancy business is the turnkey vertical, contributing more than 25% to total revenue. Here, RITES not only provides the blueprint, but also helps with the execution. While it undertakes consultancy projects for several sectors, turnkey projects are only undertaken for railways. These include EPC projects for railway lines, track doubling and railway electrification.

Hedged right

Besides the domestic market, RITES also exports or leases locomotives and rolling stock (coaches, wagons and spare parts). This segment contributes about 20% to its overall revenue, but mostly depends on political relations with other nations and the line of credit extended by the government. Given India’s low-cost manufacturing advantage, exports is seen as a key alternative revenue source.

RITES also leases locomotives to companies such as NTPC, Coal India, Tata Steel and JSW to move their raw material to the nearest plant. Thus, leasing contributes about 4% to total revenue. “The growth in leasing segment has been led by continuous gain in market share, increase in client base and additional local requirements by existing clients,” says Viral Shah, analyst, Prabhudas Lilladher. In FY20, the company added six more locomotives to its leasing fleet, taking the total count to 62. Moreover, it is the only player that provides high horsepower locomotives in the wet leasing space (train engines with drivers and maintenance).

The last revenue contributor for the company comes through its joint ventures with Indian Railways and SAIL — REMC and SAIL-RITES Bengal Wagon Industry. These ventures are involved in trading, manufacturing and repairing of railway wagons and locomotives. “Over the years, RITES has been reporting growth in all segments — from consultancy to leasing and export and turnkey,” says Bobade. Going forward, analysts believe exports and turnkey will also drive growth. “Consultancy and leasing will grow steadily in the range of 10-15% each year,” writes Elara Capital’s Harshit Kapadia in his report.

External bonanza

What is also working in favour of the company is the huge infrastructure push that the government has promised. The government is aggressively rolling out the metro rail network in Tier-I and Tier-II cities with about 13 operational, 14 under construction and seven projects in the planning stage. “In the longer term, railways have given strong guidance and RITES is likely to be a big beneficiary of this. There may be a slight delay in execution, but no decline,” says a fund manager, who does not want to be named. The government has also identified 109 busy routes across India to run 151 private trains. This will mean more consulting business for RITES even though competition could increase. Currently, projects are allotted to the company directly by the government and the fund manager asserts that RITES will continue to have an edge. “Their IP levels have scaled so much that they should be able to withstand any competition without big reduction in margins. It is a long-term threat but cannot hamper growth. The opportunity is pretty large,” notes the fund manager.

The government has also identified 109 busy routes across India to run 151 private trains. This will mean more consulting business for RITES even though competition could increase. Currently, projects are allotted to the company directly by the government and the fund manager asserts that RITES will continue to have an edge. “Their IP levels have scaled so much that they should be able to withstand any competition without big reduction in margins. It is a long-term threat but cannot hamper growth. The opportunity is pretty large,” notes the fund manager.

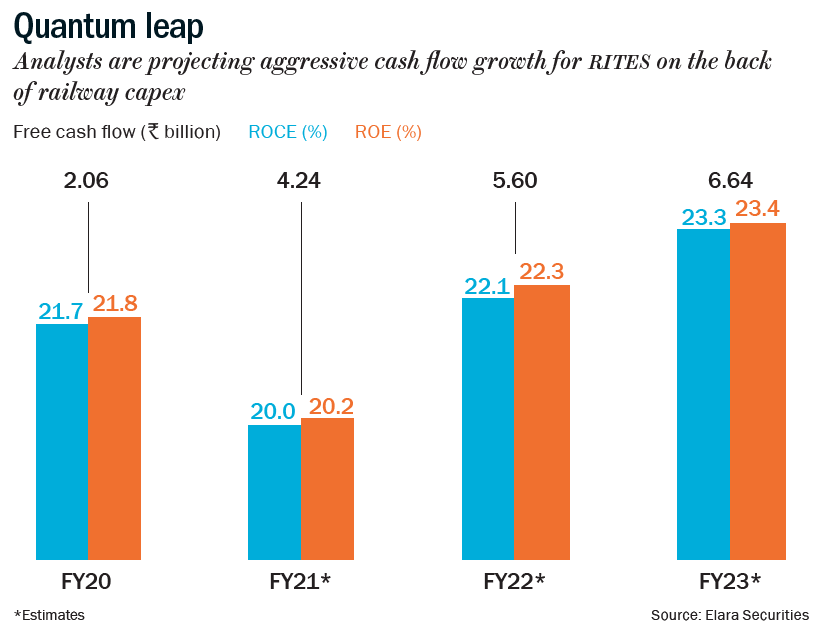

In fact, for FY21, railways capex is pegged at Rs.1.61 trillion (See: Quantum leap), 3% higher than the previous year. “The railways ministry is also planning to build three new dedicated freight corridor (DFC) networks, high-speed and semi high-speed trains, and upgrade the suburban rail network in Mumbai and Bengaluru,” says Kapadia.

As of March 2020, the company had an order book of Rs.62 billion. More than 70% of this comes from the government and other PSU projects. Analysts state that the order book provides visibility for the next two-three years. “Management is optimistic about turnkey construction orders of Rs.15 billion-20 billion from Ministry of Railways for electrification and doubling of lines likely to be awarded in FY21. The estimated book-to-bill of 2.5x FY21 sales gives strong revenue visibility,” notes the Elara report.

RITES’ business model has also kept the company debt-free. “RITES does not need to invest on assets like other infrastructure companies and hence has zero debt. Since they require low capex, they are cash-rich,” says Bobade. This is expected to remain unchanged going forward. Projected free cash flow of the company is seen rising from Rs.2.07 billion in FY20 to Rs.6.62 billion in FY23, notes Kapadia.

Even though there is fear that the government may reduce margins on projects awarded directly or divest its stake further, analysts are not too worried. The government has undertaken two offers for sale — 10% divestment in November 2019 (raised Rs.7.29 billion) and 5% in February 2020 (raised Rs.4 billion). Even as the government continues to hold 72%, Shah says, “The overhang of the divestment has been removed and there is time for the next divestment to occur.”

Winding track

However, the overall net margin could be at risk since the share of low-margin business is on the rise. While consultancy, exports and leasing provide margins of 45%, 22% and 38%, respectively, turnkey has margin of just 3.4% since it includes overheads as well as staff-related cost to supervise the projects. But Bobade believes it is just a forward integration of their consultancy business. “This is an unwarranted fear because consultancy continues to occupy a huge pie of the order book,” he says.

Also, unlike the consultancy business, RITES gets payment in advance in turnkey, exports and locomotive leasing business, which helps in sustaining cash flows. “If you see the return on capital, it shows that turnkey is not value destroying. I won’t worry too much about the business going up or down because the core business doesn’t require capital. So, if they add an additional layer of profit, it is okay,” adds the fund manager. Moreover, although it is an easy extension of its consultancy business, RITES has assured that it would cap the share of turnkey vertical to 30-35% of total business.

That said, RITES will be spending a lot of capital in the coming quarters. For instance, REMC secured its largest mandate from Indian Railways to manage the tendering, installation supervision and power supply of 3 GW solar power plants, which will be set up on vacant Indian Railways land. The Rs.18 billion project is divided into three phases. RITES will only consult during the first and the third phase but will be a developer in the second. For this, it will shell out an investment of Rs.1.5 billion-1.8 billion for the 400MW solar power plant through internal accruals.

The company will also add about 15 locomotives, which will require capex of Rs.800 million, construct office buildings in Kolkata and Lucknow for Rs.400 million and improve digitisation, which will cost Rs.400 million in FY21.

Despite the projected cash outflow via investments and share buyback, analysts are of the view that the upcoming quarters will see better performance. The fund manager adds that they do not sweat over near-term challenges like potential reduced spending by the government. “The valuation is not dependent on what happens this year, which is anyway a washout. The long-term earnings visibility is clear,” he adds.

After a muted listing in mid-2018, at a premium of just 3% against the issue price of Rs.185, RITES’ stock price hit an all-time high of Rs.331 in January this year. Since then, even after a buyback announcement at Rs.265, its current price of Rs.260 values it at 11x FY22 estimated earnings. “Higher return on capital coupled with high growth and lower business risk make for a potent combination. Thus, we continue to classify it as a value stock,” says the earlier unnamed fund manager who has bought in, along with other domestic mutual funds (See: Consensus favourite).

The company is expected to compound earnings at 8% over FY20-23 with return on equity and return on capital employed of 22%, each. Currently, the stock is trading lower than its historical valuation of 14-16x. “The business will improve with the economy, and the market will realise the stock is undervalued,” says Bobade.