In the din surrounding the initial public offering (IPO) of the Life Insurance Corporation (LIC), investors are sifting through figures, facts and fine print, trying to find the music of opportunity. There is already a rush to open demat accounts, but as shareholders become the new owners, one question pops up—will policyholders be shortchanged?

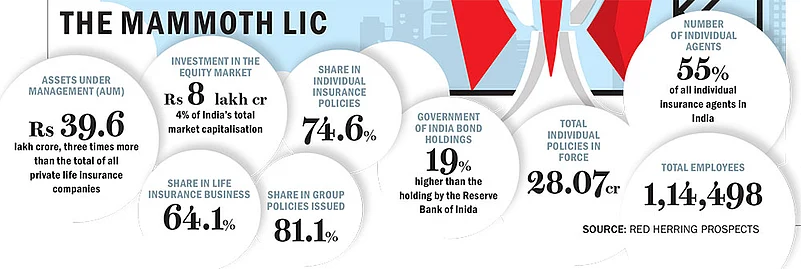

Established by merging and nationalising 245 private insurance companies in 1956 with an initial capital of just Rs 5 crore, the corporation has spearheaded the campaign for the saving and insurance culture in India. Other than almost two-thirds of the market share in the life insurance business in the country, the LIC takes more than 10% of the total household savings flow, according to UBS, the Swiss multinational financial services firm. It means that the LIC gets more flow of savings than the State Bank of India, the country’s largest bank, does, adds UBS.

But how did the LIC get such a huge resource mobilisation power? The answer is simple. With insurance protection, its policies also guarantee money-back, interest, bonuses and assured returns. The profit (or surplus, as used in insurance jargon) was largely distributed back to policyholders as bonus, money-back guarantees and incentives. However, it may change.

Now, some extra money from the surplus of policyholders will also be given to shareholders as they will be the owners. Additionally, a division in the surplus has been created and that will be entirely distributed to owners.

Until now, the entire surplus generated by the LIC was kept in a single fund, named Life Fund. With the government planning the disinvestment of the insurance major and with new investors (shareholders) coming on board, various sections of the Life Insurance Corporation Act have been amended. One such amendment mandated LIC to segregate the Life Fund into two parts, viz. a participating policyholders’ fund and a non-participating policyholders’ fund, effective September 30, 2021.

Before the amendment, the entire surplus was distributed in the ratio of 95:5, i.e. 95% going to policyholders and 5% to the shareholder, or the government, as it was the 100% owner of the corporation. However, after the amendment, around 31% of the Life Fund has been moved to the non-participatory fund. Any surplus from it will be distributed 100% to shareholders with the policyholder getting their share from the remaining 69% of the erstwhile Life Fund. “As on September 30, 2021, the participating policyholders’ fund aggregated to Rs 24,57, 995 crore and the non-participating policyholders’ fund aggregated to Rs 11,36,966 crore,” the LIC stated in the red herring prospectus.

Moreover, there is going to be an increased share transferred to shareholders from the financial year 2021-22 from the participating policyholders’ funds. Till now, only 5% was distributed to shareholders, but the share will go up to 10% by March 2025. “So far, 95% of the LIC’s profits used to come back to policyholders and funded the phenomenal growth of the corporation. The latest amendments to the LIC Act have reduced the policyholders’ minimum share in the corporation’s profits from 95% to 90%, an indicator of the way the policyholders are going to be treated in the coming years,” People’s Commission on Public Sector and Public Services, the lone voice of opposition against LIC’s disinvestment, said in a note published in January.

The LIC knows that the move can backfire. “Increasing the shareholders’ share of the surplus in ... participating fund may reduce the attractiveness of our participating products, which could have an adverse effect on our business, financial condition, results of operations and cash flows,” the prospectus mentions.

The LIC management, however, is quick to allay all fears. “A huge portion of the Life Fund has been now transferred to shareholders’ funds reflecting an increase in embedded value (EV). There is no shortchanging. Policyholders’ interest will be taken care of,” says M.R. Kumar, chairperson, LIC. “Private players in the industry were already doing it. It is now that we have realigned ourselves to the industry by transferring the fund. The ratio of policyholders’ share ... coming down in coming years does not mean they are going to get less,” he adds.

Equity investors, eager to grab a slice of one of the biggest financial institutions, also argue that it is time to shift focus to sustained earning expansion. “Given the increased investor and analyst scrutiny and vulnerability of value to public market discretion, the insurer will have to moderate returns to policyholders and shift focus onto sustained earnings expansion,” argues Rakesh Singh, CEO, Fisdom Stock Broking.

Retail Share

For the first time, the retail category of investors—those who invest up to Rs 2 lakh—is going to get almost 44% of the total 31.62 crore shares on offer from the LIC. This is the highest ever proportion by an Indian company. With this size, it is not only going to change the dynamics of household savings on the economic and banking front but also the flavour in the stock market.