It was in 1996 that Kanhaiya Lal Agarwal, a chartered accountant by profession, became an entrepreneur. He took over an ailing aluminium products unit and renamed it Palco Metals. While he has been through quite a few business cycles in the ensuing years, the one this time is throwing up new challenges.

The Ahmedabad-based SME just took a hit on its receivables, after the LN Mittal-owned ArcelorMittal bought the Ruias-promoted Essar Steel for Rs.420 billion. Agarwal, who supplied aluminium coils to Essar Steel, now finds himself among the 150 small and medium enterprises (SMEs) who have not been paid their dues by the steel major after it went under the hammer through the Insolvency and Bankruptcy Code (IBC) 2016.

Around 1,750 SMEs have run up receivables of around Rs.9.8 billion. Following the settlement, 1,600 SME suppliers whose dues were less than Rs.10 million got their payment in full, but those such as Agarwal, who had arrears of Rs.25 million, just got 20%. “Banks have got 90% of their dues, while it’s the other way round for us,” says Agarwal, who is also heading a forum of aggrieved SME suppliers to Essar Steel. “Though we are planning to move court with a special writ petition, we are not too hopeful,” he says.

Since the past three years, SMEs across the country have faced one headwind after the other. To begin with, the construct of the IBC favours financial creditors such as banks and investors, not operational creditors that include SME suppliers. Therefore, small companies are waiting for a pile of dues to be cleared. Second, tax refunds under the Goods and Services Tax (GST) are getting delayed by painful paperwork, and lastly, credit has become hard to get as bankers turn wary.

Agarwal points to the peculiar injustice of the IBC proceedings. Suppliers like him keep companies like Essar Steel running by extending operational credit, but they have little to no representation on the Committee of Creditors (CoC) once the insolvency resolution process begins. They get a voice on the panel only if their dues exceed 10% of the total debt or if there aren’t any financial creditors. “Not even a single member from operational creditors was given a place on the committee,” he says. While the National Company Law Tribunal (NCLT) had ruled that Essar Steel’s then profit of Rs.34 billion be distributed among financial and operational creditors, the CoC had kept aside only 2.5% of the total for suppliers. “Mittal got a profitable entity because as suppliers we ensured that the company was operational. Now, when we are seeking intervention of the new management, they are yet to hear us out,” he laments.

The insolvency process still has a long way to go, in delivering dues to all creditors. As per credit rating agency Crisil, IBC has resulted in a recovery of Rs.700 billion in FY19 from 94 cases, but that’s just 43% of the total amount due. Of the over 19,771 cases pending before the tribunal, close to 11,000 cases are still being heard. The forum Agarwal heads has claimed that besides having to let employees go, the member suppliers won’t be able to repay Rs.10 billion lent to them by the banks. The narrative has further turned ugly with slowdown blues permeating across the economy.

Tax trap

With growth plummeting to a decade low of 4.5%, and demand taking a hit, SMEs feel an efficient taxation system would have been welcome. Under the GST, there is a promise of that, through input tax credit, which allows a company to deduct tax paid on inputs from its tax due on sales. That is, if an ice-cream company has paid taxes on its purchase of milk and vanilla extract, it can deduct these taxes from the tax it pays on ice cream revenue. Smooth, except this tax credit is slow in coming from all the paperwork.

Apurva Shah is at the receiving end. At 38, and three years down in his entrepreneurial venture, Shah is grappling with an existential crisis. Having worked for several years with MNCs, Shah took the plunge to set up a security solutions services firm, Shreeji Solutions & Services. What was a Rs.120 million venture is now down to Rs.40 million. “While the slowdown in the realty sector has hurt us, the obligation under GST is just making things worse,” says Shah, who has cut down his workforce from 30 to less than 10.

The company can claim input tax credit only if the supplier uploads the necessary invoice, which records the company’s payment of tax on purchase of raw material. Therefore, the tax relief a company gets is dependent on the diligence of its supplier with paperwork. Shreeji’s supplier has not been very attentive. “I can just avail of 10% input credit instead of 100%,” says Shah. “Clients are now taking more than three months for dues to be cleared. That means, to keep growing the business, I need to put in my own capital and also ensure that I don’t fall foul of the law,” he adds. Recently, the GST Council raised the provisional tax credit that buyers can claim to 20%. That is, if the supplier is slow with the paperwork, the company can claim credit up to 20% of the tax that has been paid through the supplier. But that has not helped much.

The new indirect tax regime has increased compliance cost. In the pre-GST era, the tax (value added tax or VAT), service tax, and central excise) authorities would match the data submitted by a taxpayer with the billing and purchase information. But under the new regime, the onus is now on the taxpayer to upload the invoice and make sure the input credit claim is reconciled or he would end up paying a penalty.

Unlike in the previous VAT regime, where the dues could be paid with an interest penalty, under GST there is no leeway. The government has cracked the whip on revenue collectors to meet the direct tax target of Rs.13.4 trillion ($187 billion) for FY20 as collections in the eight months to November has grown a dismal 5% against an expected 17%. Further, with the Supreme Court giving a free hand to GST officials to arrest a defaulter even without having an FIR registered, is giving small companies the chill. It is estimated around 10 million GST-registered entities are not filing their returns in time. Besides, in FY19, 1,620 cases of fake invoices involving fraudulent input tax credit claim of Rs.112 billion, resulted in the arrest of over 150 persons. According to authorities, tax evasion of Rs.900 billion a year could be taking place through circular trading, that involves selling and buying of goods through fake invoices without actual movement of goods, resulting in an inflated turnover and pocketing of higher input tax credit.

The Federation of Indian Export Organisations (FIEO) has urged the government not to paint all traders by the same brush, because of a few who might have abused the facility. “I have given up on fresh deals. My reputation has also been hurt as no new business will come to me until I clear some dues,” reveals Shah of Shreeji. In the current system, if a company hasn’t paid GST dues in time and a potential client punches in the company’s GST number, a red tick would indicate the company is a defaulter. “That causes a reputational damage, which is not necessarily of my making,” laments Shah.

Credit, please!

When cash flow is thinning out, easy availability of credit would have helped. But loans extended to micro and small enterprises have contracted by over 4% in the current fiscal, from Rs.3.75 trillion in March 2019 to Rs.3.58 trillion as of October. This is because of a series of defaults in the non-banking financial company (NBFC) space and increasing risk aversion among banks.

There is the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), which was launched in 2000 for MSMEs. Under this, businesses are to be given collateral-free loans and the trust guarantees repayment up to a certain limit to creditors. But banks are still pushing for collateral. “Banks are coaxing borrowers to sign an affidavit that they don’t want to pay the guarantee fee (which is essential to get a collateral-free loan under the scheme) and, hence, the loans would be considered with collateral,” says Badish Jindal, who runs a steel re-rolling unit in Ludhiana. He is also the president of Federation of Punjab Small Industries Association (FOPSIA). Interest rate, too, is not what is promised under the scheme. “Banks are charging MSMEs interest from 10.5% to 13%; besides levying 1-1.5% guarantee fee for availing loans under the scheme, in addition to 1% renewal fee. Hence, a Rs.1 million loan costs more than 15%,” he says.

“For all the big talk, of the country’s 65 million MSMEs, less than 0.001% (around 100,000 units) are getting direct benefit of all the MSME schemes,” Jindal says, adding that 30% of more than 200,000 MSME units in Punjab have already turned sick. The association has closely looked into the working of the CGTMSE and found that the number of beneficiaries reported is exaggerated. As of 2010, the total loans sanctioned under the scheme was Rs.48 billion and, in the same year, the RBI allowed banks to bring all collateral-free loans under the credit guarantee scheme, resulting in the outstanding surging to Rs.1.28 trillion over the next seven years. Further, FOPSIA points out that banks are also taking into account all the commercial vehicle loans given to MSMEs to gloss the numbers.

Banks seem to be implementing the scheme half-heartedly, but this attitude may be coming from conflicting instructions they are receiving from the central bank. Though they are being nudged by the RBI and the finance ministry to disburse credit, they have also been cautioned to go easy on small-ticket loans. The latter has come from concern over the quality of Mudra loans. At a recent industry event, RBI deputy governor MK Jain told bankers, “While such a massive push [Mudra loans] would have lifted many beneficiaries out of poverty, there has been some concern at the growing level of non-performing assets among these borrowers. Banks need to focus on repayment capacity at the appraisal stage and monitor the loans through the lifecycle much more closely.” According to reports, bad loans under Narendra Modi’s flagship scheme, Pradhan Mantri Mudra Yojana, has doubled to Rs.164.81 billion in FY19 from Rs.72.77 billion in FY18.

K Rama Devi, president of the Association of Lady Entrepreneurs of India, which represents the interest of 10,000 women-owned small enterprises across the country, says banking is no longer an easy relationship. Earlier, managers were empowered to deal with entrepreneurs at the branch level, but with centralised decision making, even if an SME unit has receivables, his credit can still get impacted if there is a delay in repayment. “Earlier, the bank manager could take a call since he had a better understanding of the entrepreneur and the business. But that’s no longer the case now,” she points out. Besides, she believes blindly embracing Basel norms for NPA recognition is also the culprit. “I don’t think our SME ecosystem has evolved to a stage where a one-rule-fits-all for NPAs should be applied,” reasons Rama Devi, who was also a part of the UPA-constituted high-level taskforce formed to look into the issues facing the sector.

Though the taskforce had submitted its report in 2010, nothing much has changed on the ground, except that yet another panel headed by UK Sinha was tasked later to look into the issues of the MSME sector! The panel submitted its report in June 2019.

Where’s my money?

What irks Rajiv Chawla is that even sound businesses like his have to face discrimination. Besides being an auto component-maker from Faridabad, he is also the chairman of IamSMEofIndia, the biggest industry body in the North with more than 15,000 SME units under its ambit. “My CC [cash credit] limit has been stuck at Rs.35 million for the past two years as the bankers are seeking more collateral. With that limit, how can I manage a business of Rs.550 million?” he questions. “RBI norms clearly state that the working capital limit should be 20% of the turnover, and that means I am eligible for Rs.110 million,” adds Chawla.

With 28% GST on auto components, the problem of liquidity is only getting exacerbated. For example, if an auto component SME clocks sales of Rs.10 million a month, at the current rate, they have to deposit Rs.2.8 million every month. “Now, if payments are coming three months later, I have to set aside Rs.8.4 million just for tax obligations. So, even if I have the capacity to grow, I am constrained,” says Chawla.

The problem of receivables is indeed a big pain point. On paper, there are laws to protect smaller players, but their implementation is weak. For example, under the MSME Act 2006, small suppliers’ dues have to be settled within 45 days, else interest is levied on the outstanding. Similarly, the ministry of corporate affairs has mandated dues to MSMEs to be identified separately by companies in their balance sheet. But with slowing economic growth, even companies are finding it tough to stick to the provisions. In fact, in October last year, the finance minister had to step in and urge PSUs to clear Rs.400 billion of SME outstanding that had piled up. State-owned BHEL saw its dues to suppliers surge to Rs.7.02 billion from Rs.4.79 billion in FY18.

It’s not just PSUs, even blue-chip companies have seen their MSME outstandings pile-up. L&T’s dues to small suppliers, as of March 2019, doubled to Rs.1.33 billion from the previous year. RIL’s rose from Rs.1.83 billion to Rs.2.29 billion, while Sun Pharma saw the biggest jump from Rs.1.05 billion to Rs.6.59 billion. Though the RBI had launched a digital platform, TReDS, where small businesses can raise capital by auctioning their trade receivables, only a handful of companies are utilising and reaping the benefits of this system.

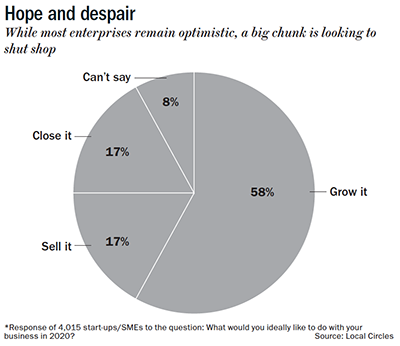

It comes as no surprise that the sentiment within the MSME universe is one of despair. Recently, Local Circles, an independent online social engagement platform conducted one of the largest national surveys covering close to 35,000 MSMEs and start-ups across the country. According to the findings, close to 17% of enterprises are planning to shut down operations, while around 17% are looking to sell out, even as 58% see a ray of hope (See: Hope and despair). But the government wouldn’t be too worried on that count given that the FY20 Economic Survey has made a case for only viable small businesses to survive. The architect of the survey, chief economic advisor Krishnamurthy Subramanian, had told Outlook Business in an earlier interaction that in the short-term, steroids [sops] can give comfort but the need of hour is to focus on long-term competitiveness. “Our policies have created a lot of dwarfs, and we cannot achieve the $5 trillion goal merely on palliatives. There’s a saying in Hindi: Honhaar birwaan ke hoth chikne paat (How can the gardener know that a sapling will become a large tree just by looking at the leaves?). As a good gardener, we have to identify those infants that can grow into giants over time.” While there is merit in the observation, if the nurturing process itself is flawed, the outcome cannot be any better.

Just one email a week

Just one email a week