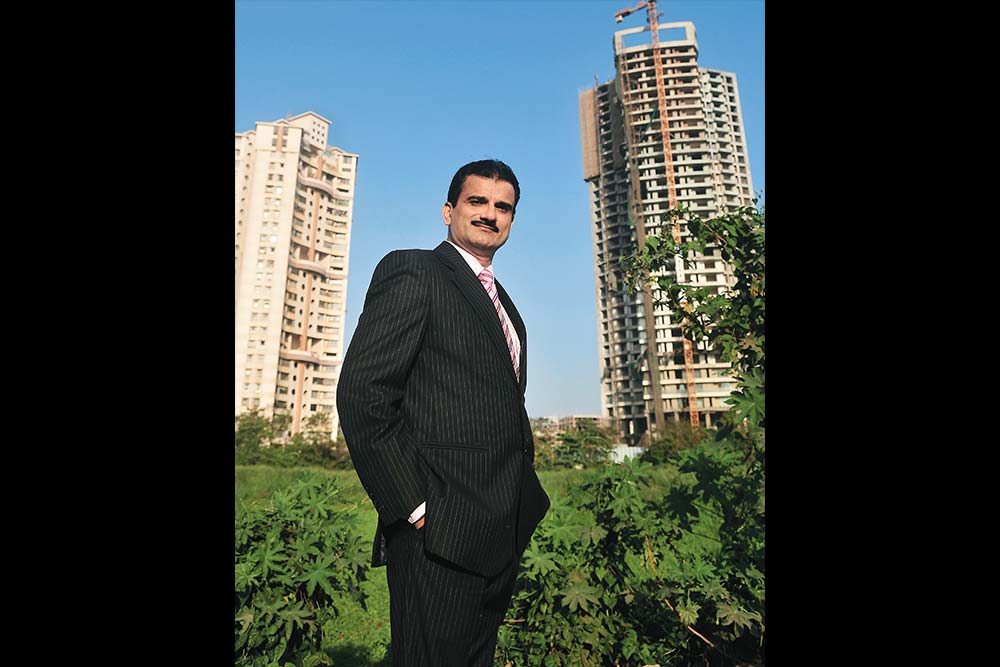

Sooryakanthi is a much sought-after four-floor apartment complex in Hubli, Karnataka. It comes equipped with frills like intercom phones connecting all the flats, modular kitchens and round-the-clock security. Back in Mumbai, VP Lobo, CMD of T3 Urban Developers, has every reason to smile. Sooryakanthi, the first apartment complex in Hubli, was his company’s maiden project and he was able to sell as many as 75 of the 150 flats (two-bedroom apartments for ₹15 lakh) within the first month of launch. “We created a tier 1 city project in a tier 3 town at its price,” he says. “It sold like hot cakes.”

Lobo is convinced that tier 2 and 3 cities are where he wants to be. After Hubli, the company launched five more projects in Shimoga and Mangalore, all of which have sold out, Lobo claims. Next up are Igatpuri and Nanded. What attracts Lobo (his last assignment was as CEO of Mumbai-based Evershine Builders) to smaller markets? The most obvious reason is the cost of land. The Hubli project, for instance, was built over a 30,000 sq ft stretch of land that cost Lobo around ₹1,200 per sq ft. “The cost of a plot of that size even on the outskirts of Mumbai, like Vasai, will be nothing less than ₹3,000 per square foot,” he explains. Then, getting approvals is faster in small towns — about a month compared with three to four years in a metro. Labour, too, is cheaper. “Most importantly, we have the first-mover advantage in all these markets. It is after our success in these markets that big builders have begun to look at them,” he says.

Started with an investment of ₹1 crore in 2008 by Lobo and his partners Frederick Fernandes and Kamal Rajput, T3 made a profit of ₹48.3 lakh on a turnover of ₹6.6 crore in FY11 and has closed FY12 with a profit of ₹55 lakh on a topline of ₹10.4 crore. The company is now readying to launch an IPO later this year and Lobo hopes to have as many as 50 projects across India three years from now, with a revenue turnover of ₹500 crore.

Lobo calls T3 a “recession-proof” company. He says he doesn’t embark on his next venture until he sells a minimum 50% of an ongoing project. “This is the only reason why I am profitable within four years of launch,” he says. “We are a cash-rich company with almost zero debt.” Most real estate companies have a land bank and set up as many projects as possible. “As a result, they find it difficult to sell their projects when the market is not bullish, and end up making losses,” points out Sujata Rao, director, T3 Developers. “We are never caught in a no-sale situation.”

The industry, however, still believes that a majority of house sales come from the top 10 cities because of superior infrastructure, higher earning opportunities and the migration of people from smaller markets. “Unless there is a meaningful reversal in one or all these factors, smaller markets will find it difficult to offer return on investment comparable to big cities,” says Aditya Verma, COO, Makaan, a property listing website. “Investment in smaller markets is a popular theme among people who are unable to muster the finances required for a big city. Moreover, smaller markets have less volatile property prices and so are considered much safer.”

But Lobo believes that small-town India has the capability to invest but doesn’t have enough opportunities to do so. He cites the example of a place like Vijayawada, the third largest city in Andhra Pradesh. “Most of the real estate investments in Hyderabad come from Vijayawada because there are no builders in Vijayawada,” he says. “We see Vijayawada as an opportunity to invest.” And Lobo insists he will continue looking for other Vijayawadas across the country.