As protectionism, climate imperatives and geopolitical rivalries reshape global trade annually, India stands at a critical inflection point. The ruling by a US federal court nullifying Trump-era tariffs may have momentarily softened trade tensions but it has not revived the old consensus of open globalisation. Instead, the world is entering a new era of fragmented supply chains, regional alliances and strategic economic nationalism.

In this shifting terrain, India is not a passive observer rather it is emerging as a pivotal player. With US imports from China falling to 13.4% in 2024, according to US statistics, American firms are actively seeking alternative supply partners. India’s bilateral trade with the US touched $131.84bn in financial year 2024-25, but what makes India distinctive is its relatively low merchandise export dependency on the US, just 18%, compared to Vietnam’s 87% or Thailand’s 65%. This cushion grants India a rare negotiating latitude.

This series’ earlier focus on India’s strengths in IT services and pharmaceuticals, its protective stance on agriculture and MSMEs and its ambition to push bilateral trade to $500bn by 2030 laid the foundation. Now, the spotlight shifts to how India can leverage its geopolitical heft and align its trade strategy with emerging global values, particularly sustainability.

At the 2024 G20 New Delhi Summit, India positioned itself not merely as a beneficiary but a shaper of global trade rules advocating for environmentally aligned trade practices. The May 2025 United Nations Conference on Trade and Development (UNCTAD) report on the circular bioeconomy reinforces this trajectory.

India’s capacity to transform agricultural byproducts, maize husks, coconut shells, fish waste into exportable goods such as biodegradable textiles, plant-based chemicals and biofertilizers presents a clear path to green industrial growth.

Global investors are increasingly driven not just by low-cost destinations anymore but by resilience, environmental, social and governance (ESG) compliance and regulatory predictability. India's ambitious plan calls for spending $1.723trn (approximately ₹143trn) on infrastructure between financial year 2024 and financial year 2030 with a particular emphasis on power, roads and developing industries like renewable energy and electric vehicles.

Yet hurdles continue to persist. The American non-tariff barriers, especially around digital trade norms and sanitary standards can be restrictive. Domestically this challenge lies in balancing ambition with protection: shielding the 700mn agricultural livelihoods and $12bn in (micro, small and medium enterprises) MSME exports from premature liberalisation.

The way is in strategic convergence by merging competitiveness with equity, scale with sustainability and growth with resilience. This pivotal moment demands that India embed a circular bioeconomy principle into its trade strategy not just to keep pace with a changing world.

But how can India position itself in a shifting global trade landscape?

Sustainability, Strategy and the Future of Global Commerce

For India to thrive in a global trade ecosystem increasingly shaped by environmental imperatives and supply chain realignments, it must pivot from traditional export models to a future-oriented strategy that integrates circular bioeconomy principles with deeper participation in global value chains (GVCs).

This dual approach, anchored in sustainability and competitiveness, offers a roadmap not only for achieving India’s $500bn bilateral trade ambition with the United States by 2030 but also for embedding resilience and equity into the fabric of trade itself.

The UNCTAD, in its May 2025 report, underscores the circular bioeconomy as a transformative opportunity for the Global South. For India, the implications are profound.

The report cites how agricultural by-products ranging from pineapple leaves and coconut husks to sugarcane bagasse can be repurposed into export-grade goods such as bioplastics, plant-based chemicals, and natural textiles. These products command higher margins, diversify India’s $89.81bn merchandise export basket (financial year 2024–25) and open new pathways for green industrialisation.

India’s regional leadership in this space is already visible. UNCTAD’s South Asia Sustainable Manufacturing and Environmental Pollution (SMEP) initiative, for example, helped scale banana-fibre-based textiles, while generating thousands of rural jobs annually and conserving biodiversity.

Building on such models, India can push for tariff-free access for circular bio-based goods in its bilateral trade negotiations with the US. Such a move would allow India to offer high-value sustainable exports without prematurely opening up vulnerable sectors like agriculture and MSMEs to competitive pressures. It would also reinforce India’s positioning as a partner aligned with the evolving ESG priorities of western markets.

Simultaneously, India’s capacity to climb higher up the GVC ladder especially in electronics, clean technology and textiles requires infrastructural readiness and regulatory coherence. With $143trn earmarked for infrastructure by 2025 including for 5G connectivity and smart ports, India is better positioned than ever to become a hub for value-added manufacturing. UNCTAD’s 2024 Trade and Development Report notes that US-bound Indian exports in electronics alone have crossed $15bn, while apparel shipments stand at over $10bn.

However, structural challenges remain.

Indian bio-based exports were rejected in 2024 due to issues surfacing from non-tariff barriers like unclear environmental certification norms. Qualitative standards sometimes inhibit the potential for bio-based exports which require the Union government’s attention. India’s experience with the Indo-Pacific Economic Framework (IPEF), which facilitated a $1.5bn surge in clean energy exports last year, offers a useful template through targeted mutual recognition agreements and streamlined sustainability standards, India can unlock constrained market access.

Furthermore, as the Indian government has committed approximately $10bn (₹76,000 crore) under the semiconductor production-linked incentive (PLI) scheme to bolster domestic chip manufacturing. The India Economic Survey 2024 highlights significant growth in India's electronics sector, driven by initiatives like the PLI scheme and increased manufacturing activities by global companies

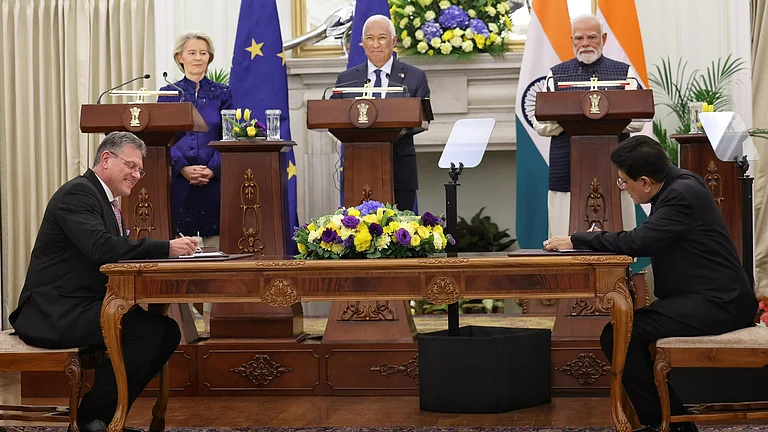

Yet the trade calculus must remain cautious. A lack of regulatory convergence could lead to significant losses in rejected exports, warns Niti Aayog. The success of the EU-India Free Trade Agreement (FTA), which boosted sustainable goods trade through standard harmonisation, highlights the importance of such alignment.

In this context, India’s evolving trade posture is rooted in circular bioeconomy innovation and strategic GVC integration and it must now be matched by policies that deliver long-term, broad-based benefits. As the next step, the challenge lies in ensuring that this transformation is not only green and growth-oriented, but also socially inclusive, locally embedded and globally responsible.

Fostering Sustainable and Inclusive Trade Growth

Building on the foundation of a circular bioeconomy and deeper GVC integration, India’s next imperative is to align its trade strategy with inclusive and sustainable development goals. In this evolving trade architecture, growth must not only be green, it must be equitable, participatory and rooted in resilience.

In financial year 2024–25, MSMEs contributed nearly 45% of India’s total exports and employed over 110mn people, according to the Ministry of MSME. Yet, their integration into GVCs remains shallow. India must proactively link marginalised producers, smallholder farmers, rural cooperatives and informal manufacturers, into export ecosystems through targeted infrastructure and policy support.

Establishing bioeconomy clusters in agrarian states like Odisha where still over 70% of the population depends on agriculture, can transform regionally available biomass (eg, rice husks, sugarcane bagasse) into high-value export products like bioplastics, sustainable packaging and natural fibres. Human capital, too, must evolve. India’s green jobs sector is projected to grow by 35mn jobs by 2047 (NITI Aayog), driven largely by sectors like bioenergy, sustainable textiles and clean technology.

Yet only 5% of youth in India receiving formal vocational training. To capture value from bio-based trade, India must invest in vocational training aligned with sustainability goals, especially in Tier-II and Tier-III cities, through public-private skilling initiatives. To capture value from bio-based trade, India must invest in vocational training aligned with sustainability goals, particularly in Tier-II and Tier-III cities, through strengthened public-private skilling initiatives.

The Green Skill Development Programme (GSDP), launched by the Ministry of Environment, Forest and Climate Change, has trained more than 60,000 people across 27 states and Union territories as of 2023. Scaling such programmes nationally will be crucial to building a workforce equipped for the emerging green economy.

Digitally inclusive trade is another frontier. Internet users in India increased by 19mn (+2.6 %) between January 2023 and January 2024, yet over 35% of rural areas still lack reliable connectivity. Expanding rural broadband under BharatNet and creating digital business-to-business (B2B) platforms for cooperatives and MSMEs could empower grassroots exporters to tap global demand, especially in sustainable consumer goods which is projected to cross billions of dollars globally by 2026.

Policy architecture must be equally inclusive. Institutionalising Sustainability Impact Assessments (SIAs), already adopted by the European Union (EU), would help India evaluate trade agreements not just on revenue but on employment, ecological impact and gender equity.

For instance, the recently announced India-EU FTA could be assessed on how it affects women-led micro-enterprises, which account for 20% of India’s informal trade. Finally, the idea of regenerative trade must be central. India loses over $13bn annually in post-harvest waste (FAO), much of which could be repurposed into exportable bioproducts. Exporting sustainability, not just goods, positions India not merely as a rule-taker but a rule-shaper in the emerging global trade order.

This is India’s trade moment and economic possibility to not only to thrive and assert its economic weight and strategic advantage in a fragmented, climate-restriction based world, but also to lead by example in creating a circular bioeconomy.

By mainstreaming circularity, inclusion and innovation into trade policy, India can recast commerce as a driver of shared prosperity. In doing so, it won’t just keep pace with the future, it will help design it.