After many false starts, cryptocurrency has arrived in India. With two short mentions in her budget speech delivered on February 1, Union finance minister Nirmala Sitharaman announced the launch of a central bank digital currency (CBDC)—to be called digital rupee—and tax on gains made from the trading of “virtual digital assets” at the rate of 30%. These announcements have set the fast-expanding crypto sector abuzz with speculations about the impending bill and how it should respond. Sitharaman’s two short mentions are the first categorical policy statements from the government on the crypto sector, though she had told Parliament on November 30 about a bill and even listed the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, for introduction in the Lok Sabha in the winter session of Parliament. The bill has not been tabled yet, but Sitharaman’s related announcements in Parliament have put a finality to the government’s intent to regulate and tax the sector.

India Has A Crypto Dilemma

As India emulates China in launching digital fiat currency, will the government’s attempts at controlling the crypto sector lead to stakeholder interests being caught in policy tangles?

Sitharaman faces two types of challenges in dealing with the crypto sector in India: one concerns policy, where she will have to accommodate the caution sounded by the Reserve Bank of India (RBI) on cryptocurrencies posing monetary challenges and balance it with the interests of crypto investors, and the other is how the world views this sector conceptually and in legal terms. Rumour has it that the government decided not to table the bill in the Lok Sabha because bureaucrats wanted to watch the fluid global situation on cryptocurrencies for longer.

Cryptocurrency, an Indian Love Story

Tejas Bhatt, a senior executive working with a multinational insurance company, started investing in the crypto sector around five years back. His decision to diversify his investment portfolio to include cryptocurrencies was driven by emerging opportunities in this sector. Typically, he invests about 10% to 15% of his investible income through crypto exchanges in India and abroad. “The global, transnational nature of this sector gives it a stability that reduces risks and offers assurance to investors.” He is concerned that the government has announced a high tax on gains made from crypto trading, but sees no panic selling in the sector due to the announcement. “No one believes that the government will ban crypto trading in India, as it will simply push trading to international platforms, and the government will not gain anything out of it. Moreover, the investor community interprets the government proposal to tax crypto gains as a given, so panic selling brings no advantage to them,” he says.

With the crypto sector expected to reach $241 million in size by 2030 in India—as per a 2021 NASSCOM report and India being ranked second after Vietnam in the 2021 Global Crypto Adoption Index by market research firm Chainalysis—it is difficult to ignore the sector anymore. According to Chainalysis, India’s crypto market grew 641% from July 2020 to June 2021. In terms of investments, too, the segment has been abuzz. Crypto-selling platforms—also called cryptocurrency exchanges—attracted a large part of capital infusion in the start-up space in 2021, resulting in two of them turning unicorns. CoinSwitch Kuber raised $260 million from Andreessen Horowitz and Coinbase Ventures in October, while CoinDCX raised $90 million in August to hit unicorn status. Some of the world’s leading venture capitalists, including Andreessen Horowitz, Sequoia Capital and Tiger Global have pumped in more than $500 million to back crypto start-ups and innovation in India.

In fact, according to the Blockchain and Crypto Assets Council (BACC), which is a part of the Internet and Mobile Association of India, the country has about 15 to 20 million retail investors who hold about Rs 6 lakh crore in crypto assets. Kantar, a data insights company, has claimed in a survey that 16% urban Indians trade in cryptocurrencies, with 75% of them preferring to own Bitcoin. Of all such surveys and studies, broker discovery platform BrokerChooser puts the most definitive number to crypto owners in India. It claimed in October that India has 10.07 crore crypto owners, which is the highest number for any country. It puts the US at the distant second spot with 2.74 crore owners and Russia at the third spot with 1.74 crore.

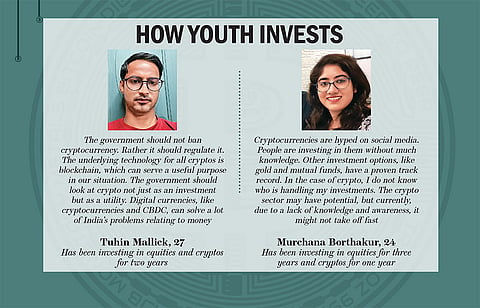

Experts believe that the sudden surge in the crypto sector in India has taken place due to the saturation reached in the US and other developed markets. The Indian market, with its young demography, relatively high savings rate and urban tech-savvy populace, presents itself as an ideal ground for the new cryptocurrency trading business. The demography of the crypto investors in India covers mostly 18-25-year-olds.

At the same time, India is making significant contributing to new developments in the blockchain technology. A Damodaran, a professor at the Indian Institute of Management, Bangalore, says, “India has contributed to a formidable pool of blockchain specialists, some of whom have developed amazing, globally reputed blockchain platforms—Polygon, for instance. In recent years, many state governments, like Telangana, Kerala and Tamil Nadu, have initiated blockchain-related skilling programmes for enhancing India’s talent pool.”

The Indian crypto and blockchain community wants to look beyond merely being an investors’ market and explore global competition. “Blockchains have cryptos, just like public companies have shares. Cryptos incentivise talent to maintain and develop on top of the blockchain. The Indian blockchain ecosystem has the potential to become as big as the IT services industry or the e-commerce sector someday: it can attract foreign direct investment and create more jobs,” says Ashish Singhal, founder and CEO of CoinSwitch Kuber.

Crypto, Crime, Criminals

Like the alliteration, the connection between cryptocurrencies and crime is real and palpable. And this brings us back to what’s causing Sitharaman’s unease with cryptos.

A report by Chainalysis shows how the last year recorded an all-time high usage of cryptocurrencies in illicit transactions, while the notable point is that the volume of illegality is a small percentage of the overall crypto adoption in 2021.

“Across all cryptocurrencies tracked by Chainalysis, total transaction volume grew to $15.8 trillion in 2021, up 567% from 2020’s totals. ... It’s no surprise that more cybercriminals are using cryptocurrency. But the fact that the increase in illicit transaction volume was just 79%,” reads the report.

However, this logic is not cutting ice with authorities in India. From whispers of D-company using crypto for money laundering to evidence of its increasing use in the narcotics trade, India is alarmed.

In mid-February, the Narcotics Control Bureau (NCB) cracked down on a drug cartel involving 22 young, tech-savvy people who used a nationwide darknet and cryptocurrencies to deliver narcotics to their clients.

Though India has many laws to deal with financial and narcotics-related crimes, law-enforcement agencies have a new challenge in the form of cryptocurrencies, as its private and privacy-centric foundations discourage tracing ill-gotten money. Sources in the Enforcement Directorate say that while there is evidence of rising use of cryptocurrency for money laundering, they cannot easily track real beneficiaries. In 2021, it unearthed Rs 4,000 crore in laundered money using cryptocurrencies. “But crypto exchanges are an issue. They provide complete anonymity to their users and provide [blockchain-based] services of crypto conversion to Indian currency and person-to-person transactions, which are not available for any audit,” says an official in the Enforcement Directorate.

The RBI’s aversion to crypto also stems from rising evidence of the use of virtual currencies in crime. “There are internal intelligence reports to highlight the threat that cryptos present in cross-border crimes. RBI’s opposition to it has roots in these reports,” says a senior officer in the finance ministry.

But RBI’s bigger concern is crypto’s impact on financial stability. “The class of crypto products is fundamentally designed to bypass the established financial system, and, on a larger scale, government itself. Some enthusiasts even claim that cryptocurrencies can usher in a separation of money and State, like separation of Church and State. Some refer to it as ‘freedom’ money,” says T. Rabi Sankar, RBI deputy governor.

Global Fear and Opportunity

Over 50 countries have banned cryptocurrencies so far, fearing a crash of their fiat currencies, unsustainable usage of electricity or its potential to encourage financial crimes. But, a larger number of countries seem to be happy regulating the new technology that promises to change the way humankind transacts. This is reflected in the rising presence of crypto-related companies.

However, just as India, the world is caught between the classification of cryptocurrency in the nature of a fiat currency and treating it as a digital asset. While El Salvador has taken the former route, Nigeria, The Bahamas and China have chosen to take the CBDC way. Nigeria has launched eNaira as its digital fiat, The Bahamas, which was the first country to launch a CBDC in October 2020, has the sand dollar and China has e-Renminbi. Interestingly, Nigeria and China have banned cryptocurrencies while they are making an aggressive push with their digital fiats.

China has a curious case. It cannot seem to decide whether to love the crypto sector or spurn it. Bhatt says that “China has already banned cryptocurrencies seven to eight times”, the last being in September. These bans occupy a curious place in China’s crypto history given the fact that it is accused of trying to create state-sponsored mining groups which can adversely affect the distributed nature of blockchains.

The world has at least two other templates to deal with the crypto sector. One of them is a strong reaction to an El Salvador type of acceptance of Bitcoin either from central bank managers or from international bodies. In January, the International Monetary Fund (IMF) asked El Salvador to dissolve the $150 million trust fund it had created to facilitate the smooth acceptance of Bitcoin as legal tender.

In contrast to China stands a very watchful USA, which is the second global template to deal with cryptocurrencies. It seems to be purposefully delaying declaring a clear crypto policy. Reports emerging from Washington, DC, in January indicated that President Joe Biden was preparing to ask federal agencies to assess risks and opportunities in the crypto industry, while many policy observers believe that the Biden administration is mulling a high tax on gains from crypto trading.

As the US administration is beginning to address all aspects of cryptocurrencies slowly, it seems to be taking the lead in managing stablecoins. This category of cryptocurrencies has emerged in response to the criticism of volatility against cryptocurrencies. Bitcoin, the most valued cryptocurrency, rose from $10,764 in September 2020 to an all-time high of $61,374 in October 2021 and traded at around $44,560 in February. Conceptually, the price of stablecoin is pegged to fiat money, another cryptocurrency, or precious or industrial metals, which allows greater stability in their value. US policymakers are aggressively considering regulating this sector, as many stablecoins are pegged to the US dollar.

India’s Place in the World

Just like the US, India has also started taking tiny steps towards regulating the crypto sector. It faces the same issues that other countries do, especially in the West, where the governments are interested in mopping revenue from crypto trading but fear the compromises they may have to make with their fiats.

In January, while addressing a virtual summit of the World Economic Forum’s Davos Agenda 2022, Prime Minister Narendra Modi asked world leaders to create a policy framework for collective and synchronised global action on digital currencies based on the blockchain technology. Talking about cryptocurrency, he said, “The way technology is related to it, any decision taken by a particular country will not be adequate to resolve the challenges it poses. We need to keep a uniform thought process on it.” This statement was made after the government’s decision to table the cryptocurrency bill in the Lok Sabha was not followed through, indicating that the it is waiting for global cues.

The government has been visibly sceptical of the sector for a while now. In November 2017, it had formed an inter-ministerial committee to study virtual currencies and suggest ways to deal with them. The report was submitted to the government in February 2019 and made public in July that year. It made a pitch for an official digital currency.

Sitharaman did show an open mind about it in the budget speech in February, and, going by what other countries are doing, it can be called an early start. “India has been one of the first large economies to announce the roll-out of a CBDC by 2023. While a CBDC is legal tender and, in that sense, will operate in a completely different space from private cryptocurrencies, the framework for India’s CBDC is likely to become a benchmark for many other jurisdictions,” says Shilpa Mankar Ahluwalia, partner and head, fintech, Shardul Amarchand Mangaldas & Co.

One of the biggest challenges the finance minister faces while developing a framework for the Indian CBDC is to balance the interests of crypto investors in the country. According to government sources, crypto investors are being taxed on their gains from trading under different heads for different categories of people. Some of them pay long-term capital gains tax, while others pay windfall gain tax or treat it as business income. The proposed 30% tax on crypto incomes clears that ambiguity to a large extent.

However, experts see some grey areas. “The question really is what happens to profits of the past years. The gains from crypto trading have always been considered income and were taxable. In the absence of specific provisions, it was left to taxpayers to decide under which head of income and at what rate the tax was to be paid,” Rohinton Sidhwa, partner at Deloitte India, says. He is of the opinion that even though these provisions are not retrospective, taxpayers may seek to apply them retroactively to pay tax for the past years. “The tax will be applicable to all Indian taxpayers even if the income arises from a cross-border transaction,” Sidhwa adds.

Caught with the urge to maximise revenue while waiting for developed economies to offer policy clarity, India is caught in a web of cynicism, which emanates partly from RBI’s outright rejection of the concept of cryptocurrencies. Former RBI chief Raghuram Rajan has been vocal about his reservations against the crypto sector right from his governorship days. He told a TV channel in November that most cryptocurrencies lacked permanent value and only one or two out of the many cryptocurrencies would eventually survive.

The current RBI leadership does not think too differently. In December, it was reported that the RBI told its central board that it favoured a complete ban on the trading of cryptocurrencies. More recently, after the February monetary policy meeting, current governor Shaktikanta Das cautioned investors against putting money in crypto trading, saying, “Private cryptocurrencies, or whatever name you call … [them with], are a threat to our macroeconomic ... and financial stability. They will undermine the RBI’s ability to deal with issues of financial ... and macroeconomic stability.” He famously compared cryptocurrencies to the 17th century speculative phenomenon of tulip mania, saying that such assets did not have any underlying value, “not even a tulip”. On an earlier occasion, he even disagreed with industry reports about the sector getting massively popular with the Indian youth, claiming that such figures were exaggerated.

Another challenge that the government faces in regulating the crypto sector is that of classification. In a post-budget interaction with Outlook Business, finance secretary T.V. Somanathan said, “Should cryptocurrency be banned, regulated or remain unregulated and not banned—all possibilities are open. It can be banned; it can be regulated; or, it can be left neither regulated nor banned but taxed. That is a separate discussion and [its outcome is] yet to be decided.” He added that various stakeholders within the government were working to resolve these issues.

Neo-Converts to Neo-Currency

Love it or hate it, but you cannot ignore cryptocurrencies. Monetary historians point out that Nobel laureate economist Milton Friedman had foreseen the emergence of cryptocurrencies when, in 1999, he said, “The one thing that is missing but will soon be developed is a reliable e-cash, a method whereby on the internet you can transfer funds from A to B without them knowing each other.”

Globally, the interest in the future of cryptocurrencies, which are built on the Web3 technology or blockchains, has risen tremendously. Clearly, there are two schools of thought that fiercely defend their antagonistic positions on cryptocurrency. On the one side, there are tech theorists and companies which conceptualised it and want to replace fiat currencies with it. “Cryptos were designed to be unalloyed global commons. They were premised on the maxim of distributive justice. The first generation of blockchains had serious monetary ambitions.

They focused on creating a currency with a strong deflationary touch,” says Damodaran about the ideals with which cryptocurrencies were developed. On the other side, these idealists were pitted against central banks which see cryptocurrency posing challenge to their sovereign rights over money supply in the economy.

The origin of Bitcoin is attributed to a white paper written by “Satoshi Nakamoto” in 2008. This simple statement hides two curious facts which have made naysayers suspicious about the whole concept. First, no one knows who Satoshi Nakamoto is. It could be an individual or a group of smart people who proposed a financial idea that has caught the imagination of, first, young techies and, then, young investors. Second, the white paper was written at a time when the existing global financial system seemed to have crashed. Many people believe that the two events are connected and the idea of replacing fiat money with a seemingly open-source model emerged more out of the need to try out a new financial model rather than some do-gooder anarcho-capitalists taking on inflation-driven central bankers.

Whatever the reason of its rise, the reality now is that with each passing year, huge amount of money is being poured by venture capitalists in the crypto sector, so much so that even traditional investors who were initially averse to the sector have had a change of heart. The Oracle of Omaha Warren Buffett, who once called crypto “a rat poison” recently bought $1 billion worth of stocks in a crypto-centred digital bank. Buffett’s company Berkshire Hathaway made its crypto investment public with a regulatory filing with the US Securities and Exchange Commission, revealing a stock purchase of $1 billion in Nubank, a digital bank based in Brazil. If the global crypto sector needed one big endorsement for legitimacy, this is it.

Buffett’s change of stance on cryptocurrencies is symptomatic of the change in the economy that has been introduced by Web3, which is threatening the old-world order. From being accepted by companies to pay salaries in different parts of the world to countries like El Salvador that have made Bitcoin one of its many legal tenders, cryptocurrencies have come a long way and are here to stay for a long time.

Though estimates vary, there seem to be around 6,700 cryptocurrencies in the world, with a total market capitalisation of around $2.5 trillion. With different characteristics and use cases, every cryptocurrency has the potential to grow in its multiples over the next day. The risks associated with the development of cryptocurrency use cases are equally high.

Emergence of an Undefined Asset Class

The Indian government’s slow movement on a clear crypto policy has made the industry uncomfortable, especially when the government does not want to let go of the revenue from taxes on crypto trading, treating it a digital asset. “There has been much discussion around the crypto use cases that will be permitted. The government has, on several occasions, indicated that it is not headed towards a complete ban, but it will be permitted to be traded as an asset,” Shilpa Mankar Ahluwalia says.

While the government may like to allow continuation of crypto trading in some form, given the large user base in India, it may not have enough legal teeth to control the sector in a refined way till Parliament enacts a comprehensive law on the issue. “It seems more likely that a legal framework will seek to regulate the crypto economy, tax gains on crypto trading—which has already been announced—and the ecosystem via licensed intermediaries. The challenge will be to ban certain use cases, such as crypto as a medium of exchange, while allowing others, such as crypto as an asset, given that technology may potentially blur the lines between the two,” Mankar Ahluwalia says.

Sitharaman has already declared that as of now, the government treats cryptocurrencies as assets. But, an asset needs to have a reference point to wealth, which is missing in this case and throwing up a challenge of classification to the government stakeholders. “We are still not sure how to call something an asset that has no underlying value. That is primarily why a regulation is taking so long. This sector is completely new to us, and it will take us more time to understand this sector,” a senior government official said on the condition of anonymity.

Given that cryptocurrency is a digital asset, whose transactions are concluded digitally and its ownership is established via a private digital key, data security and protection of transactions are important aspects of creating a safe crypto ecosystem. Industry stakeholders believe that the proposed legislation was expected to highlight a baseline data security architecture which would have become mandatory for intermediaries in the crypto economy to follow. The new legislation is also expected to include a framework for licensing intermediaries that operate in the crypto economy, such as crypto exchanges and wallet providers. “The regulatory framework will also include requirements in respect of KYC onboarding procedures and reporting of transactions by licensed intermediaries,” Mankar Ahluwalia believes.

The challenges in front of policymakers are many: How to define cryptocurrency and which regulator to appoint to oversee the sector. Indian investors, in the meantime, are cautiously enjoying the stardom that the explosion of the crypto sector has created for them. Bhatt’s family and friends seek him for advice and he gingerly tells them: “Do not invest anything that you cannot afford to lose.”

Neelanjit Das, Sneha Kanchan, Kamalika Ghosh, Pallavi Chakravorty, Neeraj Thakur and Suchetana Ray contributed to this story