Telecom giants Reliance Jio and Bharti Airtel have invested thousands of crores over the past years to expand network coverage in rural India. A new report now suggests that users in these areas are emerging as structural drivers of growth in average revenue per user (ARPU).

Telcos Bank on Rural India to Drive Growth, but Tariff Hikes Slow User Addition

According to a report by ratings agency Crisil, rural subscribers could contribute to a 10–12% increase in telecom companies’ ARPU in the financial year 2025–26 (FY26). However, being a price-sensitive market, data plan affordability will remain critical for continued growth in rural areas

According to a report by ratings agency Crisil, rural subscribers could contribute to a 10–12% increase in telecom companies’ ARPU in the financial year 2025–26 (FY26).

However, being a price-sensitive market, data plan affordability will remain critical for continued growth in rural areas, the report dated May 12 noted. This sensitivity already appears to be impacting subscriber addition after the huge tariff hike telecom giants implemented in Mid-2024.

Rural Subscriber Growth Slows

According to the Telecom Regulatory Authority of India (TRAI)'s March subscriber data published on May 7, the total rural and urban user bases stood at 534.69 million and 666.11 million, respectively. An analysis of TRAI’s reports from the last three years, by The Economic Times, reveals a significant slowdown in rural subscriber growth.

Between March 2023 and March 2024, rural telecom subscribers rose by 15.3 million—from 518.6 million to 533.9 million. But from March 2024 to March 2025, the growth slowed dramatically, with just 800,000 new users added, bringing the total to 534.7 million.

This trend is mirrored in rural teledensity, which increased from 57.7% in 2023 to 59.2% in 2024, before slightly declining to 59.1% in 2025. Teledensity represents the number of telecom users per 100 people in a geographic area.

Urban user growth also slowed. From March 2023 to March 2024, urban subscribers increased by 11.7 million, from 653.7 million to 665.4 million. But in the following year, only 700,000 users were added, pushing the total to 666.1 million. More significantly, urban teledensity fell from 133.8% in 2023 to 133.7% in 2024, and then dropped further to 131.5% in 2025.

Tariff Hikes Add Pressure

In June 2024, the top three telecom operators—Reliance Jio, Bharti Airtel, and Vodafone Idea—announced their first tariff hikes in three years, aimed at recouping heavy investments in 5G infrastructure. Airtel raised tariffs by 10% to 21%, while Jio’s hikes ranged from 13% to 27%. Vodafone Idea, burdened with high debt, announced hikes of 10% to 23% across 17 prepaid and postpaid plans, effective from July 4.

These hikes have prompted many rural users to consolidate their SIM usage. “Many rural households cut down on multi-SIMs and new connections. We expect a correction in rural net adds as both Airtel and Jio continue expanding rural rollouts in the coming quarters,” said Balaji Subramanian of IIFL Securities, as quoted in The Economic Times.

Internet Usage Surges in Rural India

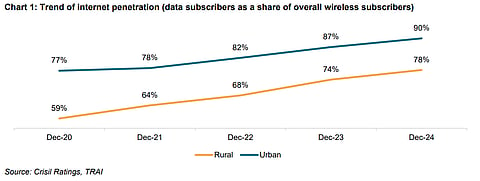

Despite this slowdown, Crisil noted a strong increase in internet penetration in rural India—from 59% to 78% between 2020 and 2024—outpacing growth in urban areas, which rose from 77% to 90%. Penetration in rural regions is expected to rise by another 4–5% by the end of FY26, driven by wider use of online communication, digital payments, content streaming, social media, and e-commerce.

According to Crisil Ratings Director Anand Kulkarni, ARPU is expected to rise by Rs 20–25 to reach Rs 225–230 by the end of this fiscal, assuming tariffs remain stable. “Around 55–60% of the incremental ARPU is expected to come from rural subscribers. Lower internet penetration in rural regions will fuel migration to data plans. Additionally, plan upgrades due to higher data consumption will further support ARPU growth,” he said.

Aggressive Rural Expansion by Telcos

Airtel and Jio have made massive investments in acquiring 5G spectrum and expanding tower networks in rural India. As per a Financial Express report from March, Airtel spent Rs 33,400 crore and Jio Rs 48,900 crore in FY24. Similar spending levels are expected in the current fiscal year.

Jio’s higher capex stems from its fully standalone 5G network built entirely on 5G technology. In contrast, Airtel initially deployed a non-standalone (NSA) 5G network based on its existing 4G core, though it has begun transitioning to standalone 5G—a process expected to take three to four years.

"In the auction held in June 2024, telcos acquired most of the spectrum in B and C circles. A substantial portion of the planned Rs 8,000–9,000 crore capex by independent telecom tower companies in FY26 will also be directed toward rural areas," said Crisil Ratings.

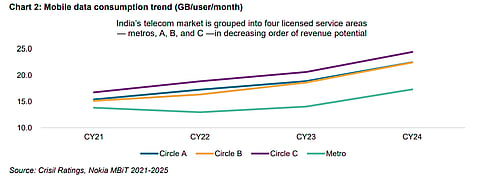

These investments are driving a surge in per-user data usage in rural areas. “Telcos are aligning their offerings with a variety of data-centric plans and investing in spectrum acquisition and tower densification in rural areas,” the report said. Much of this activity is concentrated in circles B and C, which account for nearly 70% of India’s rural subscriber base.

Data consumption in circles B and C has grown at a compound annual rate of 19–22% over the past four years—surpassing the 17–19% growth in metro areas—reflecting increasing mobile data adoption and steady demand.

“The targeted network and spectrum investments in rural areas, along with ARPU growth, will help increase telcos’ return on capital employed to approximately 12% in FY26 from about 10% in FY25. With around 75% of costs being fixed, even a modest ARPU increase can significantly boost earnings,” said Mohini Chatterjee, Team Leader, Crisil Ratings.