Fertiliser industry body FAI has requested reducing GST on raw materials like ammonia and sulphuric acid from 18% to 5%.

FAI also sought a refund of accumulated input tax credit (ITC) to fertiliser manufacturers and traders.

A delegation met Finance Minister Nirmala Sitharaman on August 26 and submitted a representation on the issue.

FAI Seeks Cut in GST Rates for Fertiliser Raw Materials, Refund of Accumulated Input Tax Credit

A delegation of the Fertiliser Association of India (FAI) met Finance Minister Nirmala Sitharaman on this issue on August 26 and also gave a representation

Fertilisers industry body FAI has demanded lowering of GST rates on raw materials like ammonia and sulphuric acid to 5% as well as a refund of accumulated input tax credit to the manufacturers.

A delegation of the Fertiliser Association of India (FAI) met Finance Minister Nirmala Sitharaman on this issue on August 26 and also gave a representation.

The government has announced that it would reform the GST before the Diwali festival to bring down the prices and make this law simpler.

In a statement on Thursday, the industry body said that during the meeting it requested the finance minister to "reduce the GST rates on fertiliser raw materials (ammonia and sulphuric acid) from 18% to 5% and allow refund of accumulated ITC (input tax credit) in fertiliser manufacturing and trading where accumulation is due to the non-taxable subsidy portion." The FAI pointed out that the industry has been facing vital problem related to GST.

The finance minister assured the delegation about examining the issues and taking necessary actions in the matter, the statement said.

Explaining the problems, the association said that P&K (phosphatic and potassic) fertilisers attract GST rate of 5% but the GST rates on inputs for manufacturing P&K fertilisers such as ammonia and sulphuric acid attract a GST rate of 18%.

Apart from that, the FAI said that the fertiliser subsidy has been excluded from the value of supply under the GST regime.

"As a result of lower rate of output GST than the rates of GST on some inputs, the output GST payable is much lower than the input GST credit, mainly due to subsidy. On account of subsidy being excluded from the taxable supply, fertiliser industry has huge amount of accumulated input tax credit," FAI said in a statement.

This unutilised ITC is seriously impairing the working capital, the industry said, and hoped that the ITC issue would be suitably addressed by the Government.

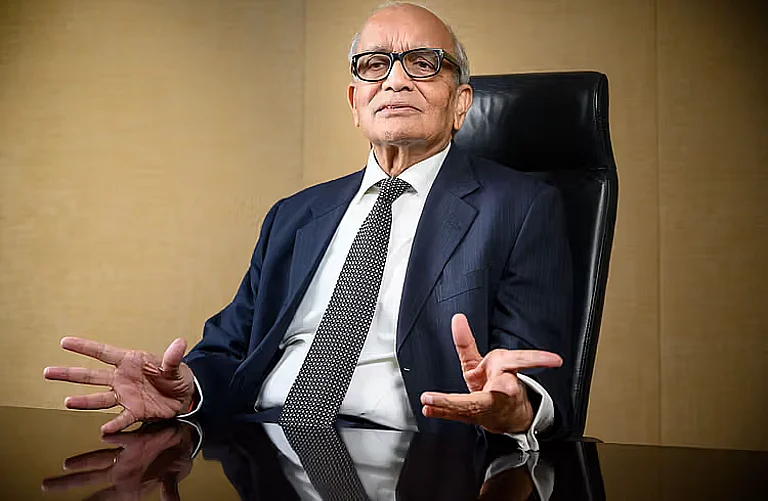

The FAI delegation comprised Dr P S Gahlaut, Managing Director of Indian Potash Ltd; Dr Suresh Kumar Chaudhari, Director General of The Fertiliser Association of India; and S Sankarasubramanian, Co-Chairman of FAI, and Managing Director & CEO, Coromandel International Ltd.