Sensex, Nifty crash: No relief for D-street investors. Last week's market rally now seems like a temporary optimism wave as benchmark indices took a sharp dive on Monday.

Sensex, Nifty Fall Over 1.5% Amid ITC De-merger & 1st HMPV Case; Check Out What's Behind the Drop

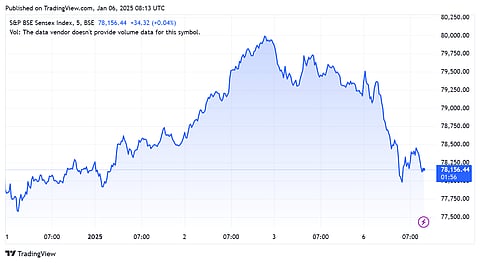

Markets today: Both Sensex and Nifty took a sharp plunge during the week start as investor sentiment across the D-street took a major hit

Both BSE Sensex and NSE Nifty dropped sharply during the week's start as multiple factors weighed heavily on the sentiment of Dalal Street. Nifty PSU index emerged as the worst performing sector as the index dropped by nearly 3.07 per cent. Almost all major large-cap companies were trading in the red territory, except IT giants and Titan, ICICI Bank and Bajaj Finance.

From the Sensex pack, Tata Steel, Kotak Mahindra Bank, Asian Paints, Powergrid and NTPC were among the worst-performing stocks.

At 01:30 pm, the 50 company index, NSE Nifty, was trading at 23,663.45 level, down by 1.42 per cent per cent. As for Sensex, the index was trading around 78,135.14, down by 1.37 per cent.

Here's what pulling the markets down:

1. FII Outflow: As per data from bourses, FPIs (Foreign portfolio investors) have continued their selling spree in the Indian market. Since the advent of this month, foreign investors have sold around Rs 4,285 crore. Uncertain global macro sphere alongside the much awaited quarterly season are adding to the selling sentiment.

2. HMPV Virus: India recorded its first suspected HMPV case which eventually sent shockwaves across the Dalal Street. While the reason was not the only factor that pushed the markets on a downtrend, it weighed heavily on investor sentiment owing to both health and economic concerns.

3. Triggers in major blue-chip stocks: Some blue-chip companies experienced a drawdown in investor mood. For instance, ITC's shares plummeted by nearly 2 per cent on the NSE as the stocks turned ex-date ahead of its demerger from its hotel segment. Kotak Mahindra Bank also experienced a decline of over 3 per cent as Milind Nagnur, COO and CTO of the banking firm, resigned. This marked the 6th C-suit departure from the company in the last 15 months.

4. Strong Dollar: The greenback continued with its upward trajectory, adding pressure on emerging market currencies. The value of Rupee has already surpassed Rs 85 against the US dollar largely owing to subdued investor sentiment. While the Reserve Bank of India (RBI) continues to take action in order to support the domestic currency, declining forex reserves and rising trade deficit are together adding additional pressure on Rupee.

"FIIs are likely to continue to sell going forward, so long as the dollar continues to rally and the U.S. bonds yield attractive returns. The dollar index at around 109 and the 10-year bond yield above 4.5 per cent are strong headwinds for FII flows," said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.