Sensex Rally: Domestic benchmark indices defied the movement of global markets and rallied nearly 2% on Friday, as Trump's 90-day pause on tariffs provided the much-needed breathing room. India’s fear gauge, Nifty VIX, eased over 6%, signalling a drop in market anxiety.

Sensex, Nifty Defy Global Stock Market Blues, Auto & Pharma Stocks Lead Gains

Sensex, Nifty Today: Bullish sentiment returned on D-street as Trump's 90-day pause on the imposition of tariffs provided a sigh of relief to investors

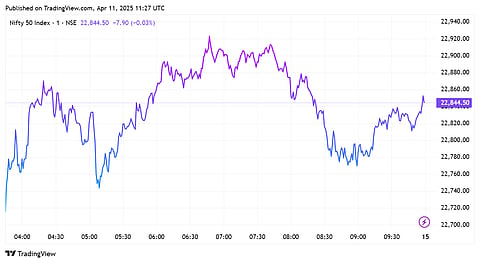

BSE Sensex concluded the trading session at 75,157 level, marking a surge of over 1,300 points or 1.77%. Meanwhile, NSE Nifty50 was up by nearly 2% or over 400 points and ended the trading session at 22,828 level. Sectorally, pharma and auto were among the top-performing industry indices.

The rally came despite a sharp fall in US markets. The S&P 500 index crashed over 3.46%. The tech-heavy index, Nasdaq also plummeted over 4.3% or more than 700 points. The Dow Jones Industrial Average experienced a 1,000-point decline, as well.

Asian markets followed suit, with Japan's Nikkei declining over 1,000 points.

Nearly all stocks from the Sensex pack ended in the green, excluding TCS and Asian Paints. Meanwhile, Tata Steel, PowerGrid, NTPC, Kotak Mahindra Bank, Reliance and Adani Ports were among the top gainers.

Broader market indices mirrored the benchmark's positive momentum. The Nifty Midcap 100 and Smallcap 100 indices also experienced strong gains of 1.90% and 2.80% respectively, indicating widespread buying interest, as per analysts. "The breadth of the market was strongly positive, with advancing shares significantly outnumbering declining ones. The advance-decline ratio on the BSE stood at a strong 3.68, marking its highest level since last month," said Nandish Shah, senior derivative and technical research analyst at HDFC Securities.

IT sector remains under stress

The tariff spat between China and the US has already increased the risk of prospective trade wars. With both countries continuously hiking import duties, investor sentiment has turned cautious. This could lead to lower discretionary spending by US companies, which might, in turn, hurt the earnings of Indian IT firms.

TCS’s recent Q4 results have further contributed to the subdued outlook.

"An unexpected pause on reciprocal tariffs by the US provided relief in the midst of the uncertainty. Though the IT major’s result missed the street estimates, it opines optimism in the latter half of FY26 owing to growth in the order book. Any development in the bilateral trade negotiations can alter the near-term outlook on the export-driven sectors," said Vinod Nair, Head of Research, Geojit Investments.