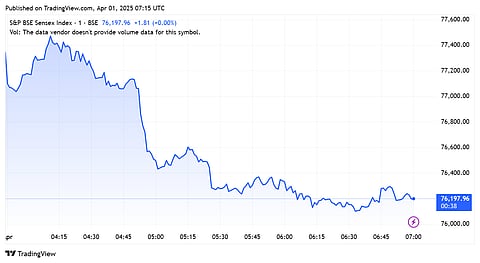

Sensex crash: After an optimistic recovery in March, the Indian stock market witnessed a sharp sell-off on April 1 as uncertainty owing to Trump's trade tariffs took the better of investor sentiment. Domestic benchmark indices— Sensex and Nifty— witnessed a sharp drop of around 1.5%. All sectors were trading in red with Nifty IT as the worst-performing index, dropping by over 896 points or 2.4% on Tuesday.

Sensex Crashes Over 1,000 Points: Here's Why Markets are Facing Sharp Sell-Off

Sensex, Nifty: Indian stock market witnessed a sharp sell-off on Tuesday as uncertainty owing to Trump's tariff stance took the better of investor sentiment, leading to a sharp sell-off

At 12:10 pm, BSE Sensex was trading at 76,130 level, down by around 1,284 points. Whereas, NSE Nifty50 also dropped by nearly 1.4% or 324 points and was trading at the 23,195 level.

D-street panic also pushed India's volatility index, Nifty Vix, up by nearly 9% in just one single day. While Trump's April 2 deadline for the imposition of tariffs is finalised, exactly how these tariffs will be implemented remains a blurry doubt.

From the Sensex 30 pack, almost all stocks were trading in red excluding IndusInd Bank and Zomato. Bajaj Finserv, HDFC Bank, Bajaj Finance Infosys and HCL Tech were among the top losers.

Nifty IT bears the brunt

"US government’s policy changes pertaining to tariffs have manifested in uncertainty over the last three weeks of the quarter. This may impact client decision-making and dampen recovery in discretionary spends," ICICI Securities said in a report.

So far this year, the Nifty IT index has remained the worst-performing sectoral index, declining by over 16%. Nifty50, on the other hand, was able to ease-of some downtrend, during the same period.

Analysts believe that global markets are currently focused on the details of Trump’s reciprocal tariffs to be announced tomorrow, which is in-turn heightening uncertainty among investors.

Why markets are falling?

Besides Indian markets, even the US equity market witnessed a dampening investor mood on Monday. The S&P 500 index and the tech-heavy index, Nasdaq plunged to a 6-month-low earlier this week. Last month, foreign institutional investors (FIIs) turned buyers in the Indian stock market, which contributed to the March rally. Analysts believe that the upcoming market trajectory will depend on the level of tariffs and their impact.

"If the tariffs are lower-than-feared there can be a rally in the market which will be led by externally linked sectors like pharmaceuticals and IT. On the other hand if the tariffs are severe there can be another round of downturn in the market. Investors can wait and watch and respond after the details are known," said VK Vijayakumar, chief investment strategist, Geojit Investments.