Consumer-focused companies have, for far too long, enjoyed the perks of rich valuations, fuelled more by promise than performance. But the patience of investors seems to be wearing thin. After a steady stream of underwhelming results, the goodwill may finally be running out, and this time, the market appears less forgiving.

Discontent is brewing over the sky-high valuations of consumer-centric stocks, particularly as actual growth continues to trail far behind the storylines. This growing disconnect seems to have finally tipped the iceberg.

The contrast is hard to ignore. While the benchmark Nifty 50 has managed to chalk up a resilient 8% gain this year even while navigating its fair share of turbulence, the Nifty FMCG index is stuck in reverse, down nearly 4%.

Even more disappointing is the fact that consumer stocks underwhelmed with their performance even with the odds working in their favour. From tax cuts in the Union Budget aimed at boosting consumption, to easing inflation and the liquidity push from the RBI via rate cuts, the conditions were hardly stacked against them. Yet, instead of capitalising on these tailwinds, the sector appears to have taken a back seat, leaving investors wondering what more it actually needs to deliver.

Consumer-Centric Stocks: Valued on Hype, Not Growth

Once the darlings of defensive buying, India’s consumer-centric stocks now find themselves on the wrong side of market mood. Despite favourable tailwinds and high investor hopes, performance has stalled, while sky-high valuations no longer pass the litmus test for sustained buying

Premium Pricing, Discounted Results

While market experts had long warned of the raging valuations commanded by consumer stocks, the bull market run seen last year did little to care. But times change, and when it did, it turned the tide against consumer stocks, with lofty valuations being the iceberg that sunk this Titanic.

Analysts at Kotak Institutional Equities highlighted that valuations of most consumer-facing companies failed all major valuation tests, coming in as expensive in absolute terms, relative to history, and even in comparison to global peers.

“The first two are quite obvious, but the third is a major surprise. The market has continued to pay high multiples for stocks for a while, hoping for a turnaround, but hope alone cannot sustain valuations forever,” said Sanjeev Prasad, Co-Head of Institutional Equities at KIE.

Prasad further noted that valuations in the consumer sector are increasingly out of step with the underlying fundamentals.

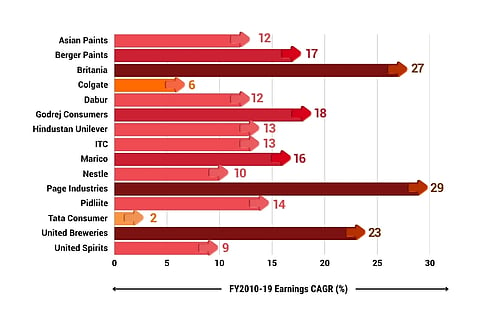

Despite a visible slowdown in earnings momentum, stock multiples stuck at elevated levels, often matching or topping pre-pandemic levels. Given that the outlook for absolute earnings growth appears modest at best, with both near- and medium-term projections falling well short of the high-growth trajectory seen during the 2010s, Prasad sees these high valuations making little sense.

What’s more, even with similar earnings growth expectations in the near term, these companies continue to trade at a significant premium to their global peers, raising eyebrows about how long such lofty valuations can be sustained.

The current valuations suggest far-reaching optimism over a strong recovery in earnings growth over the medium term; however, experts see little hope in that narrative.

“The ongoing dilution of brand and distribution moats does not provide much ground for such optimism. It is obvious that multiples should be far lower in the context of anaemic near-term growth, especially if near-term historical growth rates were to persist in the medium term as well,” KIE flagged in a note.

The Time That Was

Multiples for consumer stocks have remained anchored around pre-pandemic levels, even as growth collapsed across categories and companies. This disconnect suggests that both market expectations and stock multiples may be due for a reset, aligning more realistically with a new environment marked by slower growth, likely margin pressures, and rising competitive risks.

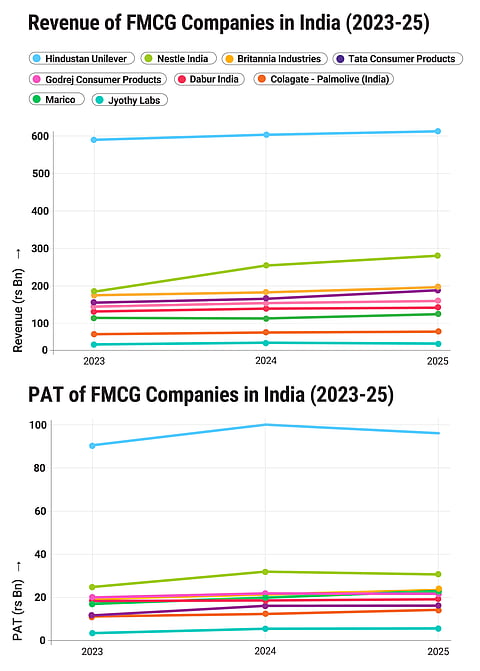

Most consumer companies have delivered mediocre growth compared to the past, while facing heightened risks to both profitability and volumes due to increasing competitive intensity across categories.

Despite long-standing narratives around India’s favourable demographics and low product penetration, actual earnings growth among Indian consumer firms has lagged behind global peers across several categories in recent years.

As per KIE, this underperformance is expected to persist. Near-term volume growth is likely to remain in the low single digits, with revenue growth hovering around mid-single-digit levels amid subdued demand and limited visibility on recovery. Medium-term prospects don’t look much better either, as growth rates may continue to struggle beyond mid-single digits.

Looking further ahead, competitive pressures across categories are expected to remain elevated. Once penetration and usage levels rise in line with India’s growing per capita income, long-term and terminal growth rates for the sector may taper off to low single digits, analysts at KIE forecasted. In short, the once-high-growth consumer story now appears to be losing its shine, putting the defensive sector on the back foot.

Heat of Competition Punching Hard

With increased mobile penetration and an influx of a new generation of consumers, long-standing consumer companies are increasingly struggling with the heat of intensifying competition.

According to Prasad, several consumer-facing categories are likely to face different degrees of disruption: from growing competition and the diminishing impact of traditional distribution networks to increasing standardisation across products.

At the same time, shifting consumer preferences and evolving regulatory landscapes could pose additional medium-term challenges for certain categories. On this basis, Prasad cautions that heightened competitive pressures are likely to weigh on both growth and profitability for incumbent players in the years ahead.

All said and done, the consumer sector, once celebrated for being the defensive fortress holding the ground steady in times of turbulence, has lost its charm. The culmination of muted growth, eroding pricing power, overstretched valuations, and intensifying competition has brought the consumer space out of favour, at least at its current valuations. As fundamentals take centre stage once again, the days of paying a premium simply for brand strength or historical dominance may well be behind us.