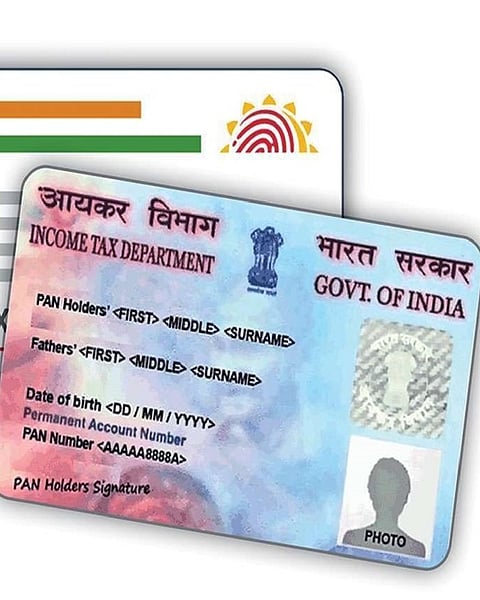

What is PAN 2.0?

The PAN 2.0 Project is an e-Governance initiative to re-engineer taxpayer registration services, consolidating PAN and TAN-related processes. It aims to enhance service quality, offering online validation, and reducing paperwork through technology