I think building a strong equities portfolio is like building a winning cricket team. You want to create a team with a diverse set of players who will win in all types of conditions and pitches. More importantly, you want players who thrive in adverse conditions and stressful situations when many, who may be comparable in favourable conditions, are not able to survive for long in such an environment.

Samit Vartak

SageOne Investment’s CIO and founding partner on what makes Balkrishna Industries an irresistible find

How I found my player

I have been closely following Balkrishna Industries (BKT) since 2012, when I first met the management, but ended up investing in the company only after four years, at the start of 2017, when they had completely proven me wrong.

In 2012, I had concluded that the company was going in for a huge capital expenditure (almost doubling its capacity) at the wrong time when the commodities cycle had peaked. But, more importantly, the incremental return on capital was sub-par. From 2011 to 2016, owing to a slowdown in commodities, mining, construction and agriculture, the global off-highway tyre (OHT) market had contracted by 30%. Though my thesis for the industry turned out to be accurate, BKT made a mockery of it by increasing its sales by 50% with improving operating margin and working capital days. At a time when global competitor, Titan International, almost went bankrupt, BKT increased its operating margin from less than 18% to over 35%. I had now found the key player in my team.

In a league of its own

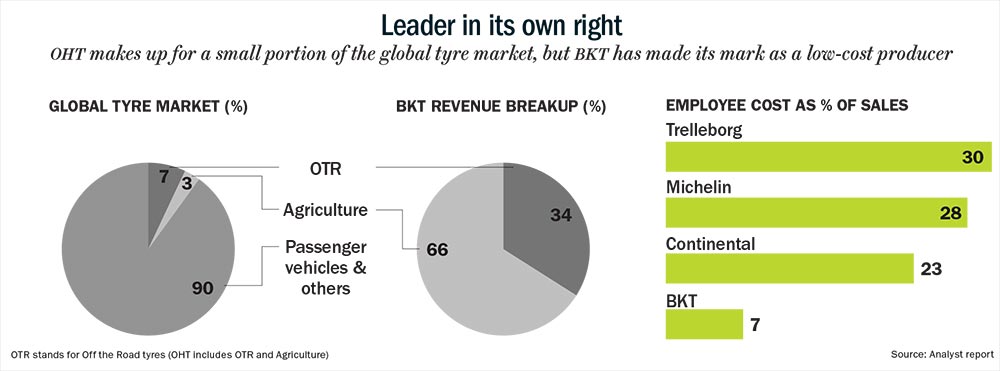

Founded in 1987, Balkrishna Industries is a leading global manufacturer in the OHT segment with 5% market share. It focuses on specialist verticals such as agriculture, construction and mining, and offers a product range of over 2,400 SKUs. The company sells its products in 130 countries through a network of 300 distributors. While its major market is Europe, BKT is underpenetrated in India and the US, contributing 15% of sales each. The company owns five state-of-the-art production sites in India with a capacity of 300,000 MTPA and employs more than 7,000 people. Yet, its employee cost at 7% of sales compared with over 25% for global competitors, makes BKT the lowest cost producer that generates the highest margin. BKT entered the OHT business in mid-1990s, mainly targeting the replacement market. It offered its tyres at 50% discount to global branded players. After 20 years, the company generates 25% of its sales from OEMs and the discount has narrowed to 15%-20%. In addition, BKT has to face trade barriers in terms of countervailing duty in the US. This is exact opposite of the protection that domestic passenger or commercial vehicle (PV/CV) players get. Because its cost of manufacturing is 40%-45% lower compared with tier I competitors, even after such steep discounts and trade barriers, BKT is significantly profitable compared with competitors.

Different dynamics

The global annual tyre market is worth more than $160 billion. OHT makes up for just 10% of the overall market and also the business dynamics are very different compared with the PV/CV tyre business. OHT tyres are made-to-order and in very small batches. Compare this with PV tyre companies, which carry a few SKUs and can produce million units. Mass production in the OHT business is extremely difficult and, hence, automation and China are not a threat.

Many competitors have tried to enter this segment, but haven’t been able to gain much traction owing to significantly higher complexity of this business. Capital expenditure requirement is twice that of PV/CV tyres. With extremely high labour involved, global players find managing labour issues in India complex. The non-OHT market is more than 10x the size of OHT. Also manufacturing is highly automated. Therefore, it’s a preferable area for global as well as domestic players to outsource manufacturing from India. But, getting on an OEM’s approved vendor list though takes four to five years. Building a distribution network across multiple geographies is also an extremely difficult and time consuming process. Not surprising that BKT took 20 years to build its network.

Big growth opportunity

With a market share of less than 2% in the mining/construction (OTR) segment and less than 8% in the agriculture segment, the growth opportunity for BKT is humongous. OTR is a high-margin business and the market is more than 2x of the agriculture segment. BKT has only 1/3rd sales in this category. The company is now taking steps to target the mining sector: (1) launch of higher-sized mining tyres through internal R&D efforts (the company has launched 39-inch plus tyres; earlier it was manufacturing up to 25 inch tyres) and (2) network expansion though tie-ups with mining service providers.

BKT significantly underpenetrated in India as well as the US, and the company is expanding its distribution network in these two geographies. Contribution from OEM sales for BKT is currently less than 25% though it has doubled in the past seven years. The company is now an approved vendor with all global OEMs and as discounts get lower, this segment will be a big growth driver. Given that it has one of the widest product offerings, BKT will also be able to increase its market share in the replacement market.

Cycle upturn

In FY17, the company utilised just 55% of its total capacity. Yet, it managed to generate operating margin of over 35% and ROE-ROCE of above 20%. Even after more than Rs.2,700 crore investment, the company is now net cash positive in terms of debt. Of late, thanks to the commodity cycle, global demand for OHT has picked up, input costs are down and the company is well poised to benefit from operating leverage as its capacity utilisation rises. Historically, over the past 5 and 10 years, the company has been able to grow its earnings by almost 25%. With a more favourable economic environment, BKT is well on its way to repeat its historical trend.

The company, traditionally, hasn’t commanded high valuation because it gets clubbed with PV and CV tyre players whose businesses are not comparable since their customers, distribution network, manufacturing process and competitive intensity are very different. There are large-scale expansion plans being announced globally in PV/CV tyres, but that is not the case in the OHT segment.

BKT’s stock trades at a one-year forward P/E of 23x, which is similar to what top tier domestic PV/CV players are trading at. Given the high entry barriers, growth potential, and increasing operating leverage, Balkrishna’s valuation appears fair if not exactly cheap.

The writer holds the stock in his personal capacity and has recommended the stock to his clients