At half-past three on a Thursday afternoon, we are ushered into a lounge on the 6th floor of Bajaj Finserv’s Pune headquarters. We’re here to meet Sanjiv Bajaj, vice-chairman of the holding company which owns, in terms of market cap, the country’s second-largest non-banking finance company (NBFC); the most-profitable private general insurance company and the biggest private life insurer in terms of lives covered. Bajaj steps out of a marathon executive meeting to speak with us but appears relaxed and unhurried as he settles down to talk about his company’s metamorphosis over the past decade.

Creating a Legacy of His Own

After building Bajaj Finserv into a finance powerhouse, what's next on Sanjiv Bajaj's mind?

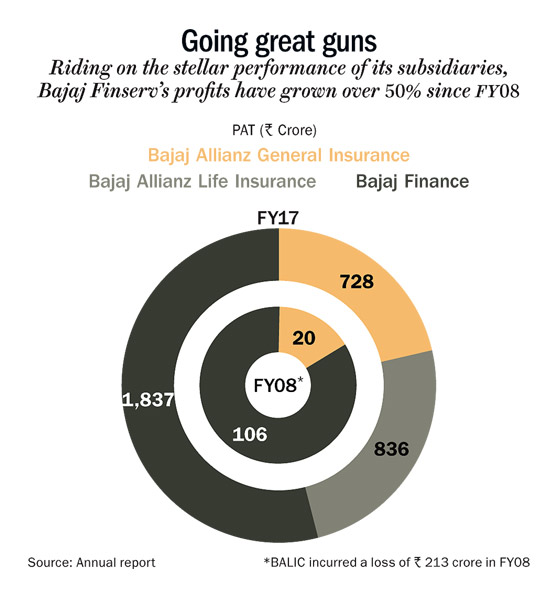

An engineer from Britain’s University of Warwick and with an MBA from Harvard Business School, the 47-year-old Bajaj took over the financial services business in 2008 in a division of the family business that saw elder brother Rajiv taking charge of the automobile business. It may not have seemed like the best deal at that point in time: the business that Sanjiv got was a far cry from the financial powerhouse it is today; Finserv was a loss-making entity while Rajiv throttled away on a more profitable group flagship. But that was then. From a loss of Rs.32 crore in FY08, Finserv has grown exponentially to close FY17 with Rs.2,261 crore profit. It is now the country’s third-largest financial services company with a market-cap of over Rs.69,400 crore, while its revenue has been growing at a CAGR of 34% over the past eight years, profitability has galloped even faster, at 54% CAGR (see: Going great guns).

That performance has largely been driven by Bajaj Finance (BFL), which today runs the biggest book in the consumer finance business in the country with assets of nearly Rs.65,121 crore (as on Q1FY18). It’s not surprising, then, that investors, including the country’s biggest foreign institutional investor Capital International and GIC, Singapore’s sovereign wealth fund, have lapped up BFL’s story enthusiastically. And they got more than their money’s worth. The BFL stock has dished out a phenomenal 56x return against the benchmark return of 95% since FY08 (calculated since May 26, 2008, when Finserv was listed). The unlisted insurance ventures with Allianz, too, have made their mark with robust profitability. Finserv owns 74% stake each in the general and life insurance ventures and over 57% stake in BFL.

So, what is Finserv’s secret sauce? The simple answer: seizing opportunities at the right time — but never blindly. “We always asked questions: how sustainable is the business model we are building? Does it give us adequate profit? Does it keep us ahead of the pack? Financial services are a commoditised business: is your business model a me-too model that somebody else can copy? Do you always have to be the cheapest or is there a superiority aspect that you can bring to it? More importantly, will it be profitable in the long run?” explains Bajaj. In hindsight, he adds, the demerger was the best thing that could have happened to the business. “The decision to carve out Finserv as a separately listed company brought in the much-needed focus,” says Bajaj. He found a mentor and guide in Nanoo Pamnani, the then-director of Citibank’s Asia Pacific business based out of Singapore, who is now vice-chairman and independent director of Bajaj Finserv. “From Pamnani as a mentor, to Rajeev Jain [managing director, BFL], we got the right people that helped us in building the company. It is a people business after all,” opines Bajaj.

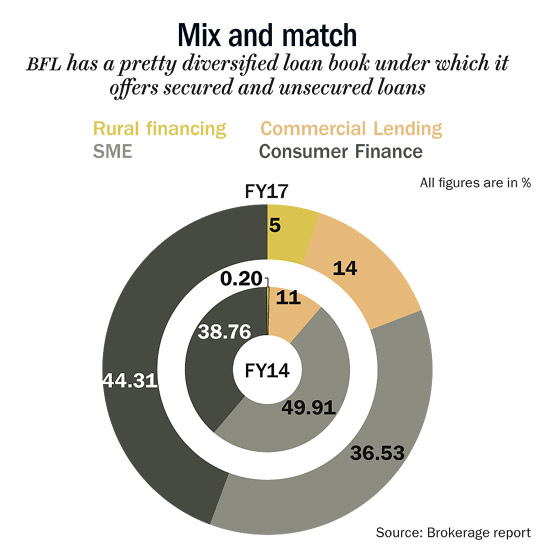

In the decade since he took over, what had been Bajaj Auto’s captive auto finance arm changed its contours as Bajaj and his team connected the dots on the consumer lending landscape. “The overarching theme when we moved into the financial services space was that if India is going to grow over 6-7%, there will be humongous opportunity in the financial services space. So we created a much larger canvas and that is how we transformed the finance company from a captive unit into a full-fledged lending institution,” points out Bajaj. Every fiscal, beginning FY09, the NBFC ventured into at least three new segments of lending. As a result, its portfolio now has over 20 lending categories spread over a judicious mix of consumer, small and medium enterprises or SME, commercial, and rural (see: Mix and match).

Unsurprisingly, the resounding performance of its subsidiaries has left an indelible mark on Finserv’s books. Today, the NBFC, Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance account for 47%, 24% and 27%, respectively, of the holding company’s profit. But the jewel in the crown is clearly BFL, which has seen its profitability soar an impressive 92 times, from Rs.20 crore in FY08 to Rs.1,836 crore in FY17.

The performance has also got its peers gushing. Rashesh Shah, chairman and CEO, Edelweiss Group, is impressed by the way Bajaj has built his business. “His achievement is already reflected in the performance of not only Bajaj Finance, but also the general and life insurance ventures. His methodological approach to building scale, constant focus on achieving inclusive growth and profitability are what separates him from the others.”

Jewel in the crown

When Jain was roped in from AIG to spearhead BFL’s business in August 2007, he inherited a business that was deriving close to 90% of its revenue from auto financing, with consumer durables and personal computer financing making up for the rest. Even though the NBFC continues to be the largest financier of Bajaj Auto, accounting for 36% of motorcycles sales and 23% of three-wheelers, Jain has reduced its contribution to overall revenue by widening the portfolio across retail, SME and commercial lending. The result: assets under management (AUM) have shown a CAGR of 36% over the past five years, while revenue and profit have clocked a CAGR of 36% and 35%, respectively.

Within consumer finance, BFL continues to be the largest consumer durables lender in India with a presence in 318 cities and approximately 14,100 dealer counters across the country financing close to 6 million purchases in FY17. “Consumer finance has always been a strong point for us and we have seen an average annual growth of 20% in the segment. Constant innovation and a sound cross-sell strategy have translated into higher returns,” says Jain, adding that BFL has successfully leveraged its 20.13 million-strong customer franchise to cross-sell other products. He explains why cross-selling is important – it lowers the cost of acquisition, as selling to existing clients is cheaper than selling to a new client. The target for cross-selling is to have two products per customer in the consumer business and five products per customer in the SME business.

Importantly, Jain has been instrumental in adopting technology very early in the game. “Our focus on technology has offered customers the convenience to buy any product without having to wait long for a loan approval,” mentions Jain, who in 2015 launched India’s first EMI finance app that gave out loan approvals in 60 seconds. The average loan tenure in this category is about five to six months. Bajaj is pretty kicked about using technology for creative disruption. “Earlier, it used to take three days to clear a consumer durable loan. We said, ‘Why can’t we make it three hours?’ It came down to three minutes and now it’s down to 30 seconds. Next is a pre-approved loan for a set of products based on what you are looking for on social media. It’s not even 30 seconds… it is already approved. That’s the advantage with tech and analytics, you can just leapfrog,” explains Bajaj. BFL has also created a unique Existing Member Identification (EMI) card, distributed to over 6.9 million customers, which enables them to avail instant credit after the first purchase. Last year, the company expanded its EMI card proposition, with offerings in retail categories such as fashion, travel, insurance and daily spends including groceries, small appliances and the likes. The business is operational in top 35 cities with a footprint of approximately 10,000 partner stores across India.

Shah of Edelweiss believes BFL is the perfect example of how technology can be a big game changer. “The company is in product segments wherein you have no option but to manage your risk and cost efficiency, and technology plays a critical part here. The turnaround time, NPLs (credit cost) and cross-sell opportunities that Bajaj is able to generate itself speaks of the technological brilliance that they have developed,” he says.

Over the years, BFL has expanded its EMI financing business to digital and lifestyle products. In FY17, it financed approximately 167,000 purchases on e-commerce platforms. And, as a category extension of its lifestyle financing business, the company is also offering life care financing, which allows funding of elective surgery. Drawing parallels with Synchrony in the US, which has a healthcare financing portfolio of close to $1 billion, Jain says, “We now have close to 2,500 hospitals and clinics across the country in the top 30 cities that accept our EMI card for elective surgeries. It is now contributing to 6,000-7,000 accounts per month. So, we are quite excited that this itself could become an independent line of business over a period of time.”

SME lending is another big business segment under which BFL offers secured and unsecured loans. Secured lending is done through three product offerings: loan against property, lease rental discounting and home loans, while unsecured lending is done through two product offerings: business loans and professional loans. The business as on FY17, had an AUM of Rs.21,993 crore and has been growing at 37% over the past six years. Within commercial lending, the AUM stands at Rs.8,452 crore as on March 2017, representing a CAGR of 45% over the past six years. In FY16, three new industry verticals — corporate finance, financial institutions group lending business and light engineering — were launched and have garnered AUM of Rs.1,639 crore as of March 2017.

Pointing out the difference that BFL has brought in the SME business, Jain mentions that much of it has to do with the digitisation drive of the government. “The amount of digital information [tax returns, Aadhaar and so forth] in the public domain is humongous, be it a consumer or a small business,” he says. Using its digital infrastructure, BFL has been able to effectively segregate its SME borrowers into different buckets. “Today, even a good or an average borrower has to furnish the same set of papers to a bank or financial institution to raise even a Rs.20 -lakh working capital loan. If you are a very good customer, I will ask for only 13 pages of paper for a working capital loan. If you are an average customer but still qualify for a loan, I would ask you for 100 pages of paper. Now, one can’t expect the same differentiation from other financial institutions,” he adds.

Meanwhile, in rural lending, BFL has expanded its footprint by setting up branches in two new states — Rajasthan and Tamil Nadu — and penetrating deeper into existing seven states. The rural MSME business offers unsecured and secured loans to self-employed clients; unsecured loans are offered through business loans and doctor loans, while secured loans are offered primarily through lower-ticket loans against property as well as secured enterprise loans. As on FY17, the company had a presence in 560 locations. “You will see us cross 1,000 towns, cities and villages in India by March 2018,” said Jain in a recent concall with analysts. The rural business AUM stands at Rs.3,072 crore, representing a growth of 129% over FY16.

The reasoning behind BFL ramping up its lending offerings in just every possible category is simple: it eliminates the possibility of hitting saturation in any particular category. More importantly, Jain mentioned in the concall that as competition increases, it’s imperative that BFL diversifies. “There are lots of non-banks wanting to emulate our model. So, we will see some degree of irrational exuberance, irrational behaviour on pricing, on risk management. We have strategically identified how to go about it… to go deeper and deeper into and make our portfolio more granular,” he stated.

Jain believes as competitive intensity increases, BFL will grow in segments such as lifestyle financing and life care financing where competitive intensity will be lesser and bring greater granularity to the portfolio. “It is difficult for any new competitor to achieve that. It can only be done by, say, the top two or three private banks in India. The rest cannot do this overnight because it is a multi-year effort,” he explains.

Rivals are certainly impressed. Rajashree Nambiar, CEO, IIFL Finance, says, “Bajaj Finance has grown very fast. They have been constantly innovating and adopting new technologies to stay ahead of the curve. Analytics has helped them to use their consumer finance base to cross-sell various products.”

Insuring growth

Even as BFL continues to gain traction, Finserv’s insurance ventures, too, have achieved critical mass. Bajaj Allianz General Insurance (BAGIC) is now the second-largest private sector general insurer in terms of premium collected. With a major focus on the retail business, motor insurance leads the business mix. Emphasis on profitability through superior underwriting, and strong cash flow generation has resulted in higher return on equity of 23%. Similarly, the life insurance venture has about 40% share of lives covered in group schemes. It has a higher mix of ULIP in top-tier markets and a higher mix of traditional plans in lower-tier markets.

Tarun Chugh, the newly-appointed MD of Bajaj Allianz Life Insurance (BALIC), points out that from a tier II- and tier III-focused franchise, the company is now increasingly focusing on metro cities. “We have increased our distribution channels in terms of agents. We are now looking at bancassurance tie-ups,” he says. The focus has also shifted slightly in terms of customers: the company is adding mass affluent clients to its customer base as this segment is prepared to invest in regular premium insurance products to avail more protection and benefits from their coverage. The share of mass affluent clients in the customer mix has gone up to 36% in FY17 from 23% in the previous year. The strategy could help the company in increasing premium collections. In FY17, the company had gross written premium of Rs.6,183 crore, 5% higher than the previous year.

Training of agents is serious business in an industry where mis-selling of products has led to a cap on commissions and brought about other regulatory changes. As things stand, BALIC has 75,000 agents and 130 trainers — 18,000 agents were added in FY17 alone. “To make sure that this large group of agents is prepared to answer customers’ queries, trainers train the 700 branch managers, who, in turn, train the agents working under them,” says Manish Sangal, president, agency and direct channel, BALIC.

Meanwhile, BAGIC, which accounts for 24% of profit at Bajaj Finserv, has remained more focused on retail customers and been more prudent than peers. This has stood the company in good stead. “Prudent underwriting and a focus on the retail segment (motor and health insurance) has been a key driver for its sustained profit and net worth growth. It is one of the few players in the industry to make underwriting profit,” mentions Kajal Gandhi, analyst at ICICI Securities.

According to Tapan Singhel, MD, BAGIC, the idea has always been to be a customer-focused player, offering value-for-money solutions. “We have a clear focus on efficient claims management and growth with profitability. The company follows a risk-based pricing model where the price is commensurate with the risks being undertaken. We have never succumbed to the ongoing price war in the industry where companies are only focused on gaining short-term market share through discounting,” he says.

BAGIC has also undertaken several initiatives in a bid to simplify processes and become more customer-friendly. Recently, it launched a service on its app where, in case of a car accident, policyholders can settle their own claims by uploading pictures of the damaged vehicle. The loss would be assessed by the company and the claim amount would be conveyed to the customer. If he agrees, the company will transfer the money to him. Another initiative is Travel Ezee for travel insurance. In case of a flight delay, the app will automatically process the data pertaining to the delay and also start the process of claim settlement. It will notify the policyholder about the claim amount he is entitled to because of the delay, and transfer the money once he agrees. Pointing out how technology has yet again played its part in the insurance business, Bajaj says, “This is building efficiency for me and for the traveller, it’s a huge value proposition.”

Apart from technology, Bajaj believes “accountable empowerment” has also played a significant role in Finserv’s growth.

Real staff “strength”

At Finserv, business ideas are not just the prerogative of the head office; employees play an equally important role in coming up with business ideas and implementing them. That’s where the annual offsite at each of the subsidiary companies comes into play. Three months before the off-site, each subsidiary is expected to start gathering ideas from its teams; the 70-80 ideas that each company collects is whittled down to 30-40 that are converted into five or six major themes. These ideas are presented as business models at the off-site by cross-functional teams. Of these, 20-25 ideas get the go-ahead for pilots of three months, although some go up to eight months or even a year. Target outcomes are clearly defined and later, assessed.

“The teams come up with ideas that thrills them. We don’t want employees to be in a boring 9 to 5 job environment, but we want them to be accountable. When they put out a plan, we support it, capitalise it and provide them with all tools. We’d be open to altering the course of the plan if there are hurdles, but they can’t give it up in three months. We expect them to give the project three years at least,” says Bajaj. Over the past decade, several such pilots have gone on to form new business ventures for Finserv. For instance, in 2012, the consumer durable finance team of Bajaj Finance came up with the idea of rural lending, based on the insight that aspirations of younger customers would be similar in urban and rural India – and BFL could serve both with quick and easy EMIs.

The idea was first tested in 10 rural locations in Gujarat and Maharashtra, with encouraging results. “We found the ticket size was same and credit performance was better,” recalls Bajaj. The business was then expanded across Gujarat and Maharashtra and subsequently in neighbouring states. A hub-and-spoke model was adopted where, initially, a centre would cater to five areas and when these areas gained a certain size, each would play hub to the next set of spokes.

What started as a small idea is now a separate business line. Today, BFL is present in over 550 rural locations. And it is not just consumer durable lending; the idea was also adopted by the SME business and gold loan team as well, both of which have started operating in rural areas.

Empowering employees is working wonders at BAGIC, too. Singhel points to how front-end employees came up with the idea of simplifying the insurance renewal process when there is a renewal gap in the insurance of a vehicle. “Typically you would appoint an agency that would photograph the vehicle and send photos to underwriters with their recommendation. It would then take them a couple of days to decide whether or not to renew the policy. In 2015, our team said, ‘Why can’t we do this on the spot, since we have high-speed connectivity now?’,” he explains. That idea was implemented immediately and the process shortened from two days to under 10 minutes. “We encourage people to speak out about what they think can be done better,” says Singhel. To make sure that the employees are recognised for their good work, they are felicitated at various forums and rewarded depending upon the impact that their ideas make on the business. As it happens, Singhel is a classic example of the benefits of encouraging and empowering employees: he has risen through the ranks at BAGIC, having started off as a branch manager.

As expected, though, the experience is not uniformly positive. Bajaj admits that latitude can come with its share of mistakes.

Trial and error

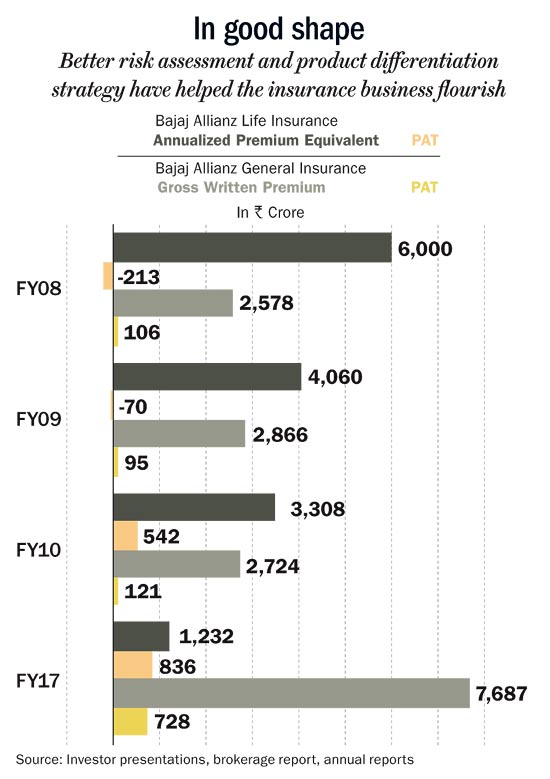

A golden rule at Finserv is to move quickly and make amends if a strategic move or a business plan starts to unravel at the seams. A prime example of that is when the company took a conscious decision of slowing down its insurance business from 2008 because of regulatory headwinds. Bajaj explains that when the first major set of guidelines for Ulips came in September 2010, he understood that the change in guidelines would require a significant change in strategy in a regulated business. “We realised that we needed to build a nimble organisation that can change fast. To align with the change, we let the business consolidate rather than grow,” he adds. The result: BALIC’s gross premium fell from Rs.11,420 crore in FY10 to Rs.7,484 crore in FY12. But the strategy paid off. Despite slowing down, the 16-year-old BALIC remained profitable (see: In good shape). “Fortunately, we operate in an industry that is not saturated. Consumer credit to GDP is 11%, and insurance penetration — both life and non-life — is low compared with many similar countries. So, the focus has been on profitability and sustainability of the businesses even if it means having to close down a business,” says Bajaj.

That’s exactly what BFL did with its construction equipment business, whose peak exposure stood at 14% of the loan book. In 2011, the group entered infrastructure finance with much optimism, at a time when big investments were being made in the sector. “The big projects — roads, power plants, ports —were going to big banks. The very small ones — like a Rs.50-crore project — were at a higher risk level than we were willing to take. But there was opportunity in the mid-sized projects,” Bajaj recalls. These were projects to the tune of Rs.500 crore that needed four or five lenders who would each take Rs.100-200 crore exposure. These were “far more manageable projects”, says Bajaj, with none of the “noise of the big projects, which entailed extraneous factors such as re-settling of villages”. There was also the possibility that these mid-sized developers would grow and the existing relationship would help Finserv graduate to larger projects.

In about 18 months, Finserv processed about 15 loans, building a Rs.2,000-crore infrastructure book. But there were just too many roadblocks. “Projects were getting delayed because permissions were not coming through, environmental issues were cropping up, or land was not available. While there were some shady developers, a majority of them were victims of external circumstances going against them. So, we took a hard look at the business and felt that these issues would stay for too long. It was best to cut our losses and exit the business,” Bajaj says. The other problem in the infrastructure space was that the large number of lenders present in the space was keeping margins low even in good times. “If margins are low in good times, you are going to get totally squeezed in bad times. We had obviously not thought hard enough on that aspect before we started out on the infrastructure business,” admits Bajaj.

It was a short-lived episode but brought in some key learnings. “We realised that we need to keep away from businesses where external risks are so large that they can potentially hurt the viability of the project, since we are not in a position to mitigate that risk,” he says.

Well-cushioned

Today, BFL has a loan book of Rs.65,121 crore, which has been growing at 36% CAGR for the past five years. But risk factors abound. According to Credit Suisse, BFL’s strong growth is being accompanied by rising risk portfolio without commensurate margin cushions being built. “Risk is also rising within secured products — share of commercial loan against property (LAP) is rising (now 70%) vs residential while spreads fall,” the global research firm stated in its report.

Jain, however, plays down the concerns. “Over the past two years, we have reduced our momentum in LAP,” he says. In Q4FY17, the LAP business grew by just 2.3% YoY. “It’s our view that the luxury end of the real estate business market will see significant slowdown in velocity and, therefore, we have cut maximum exposure by cities in our portfolios to go more retail, more distributive rather than concentrated,” says Jain. Instead of focusing on super affluent and HNI clients in the LAP business, BFL has now gone retail, averaging down to Rs.1 crore per customer. “We are now in 80 cities and we only do direct-to-customer transactions without intermediaries; we have reengineered our processes,” adds Jain.

Shah of Edelweiss points out that while LAP is a relatively cleaner business, the biggest challenge is the valuation of the collateral itself. “This [valuation] is what defines your loans, yields etc. There are instances of people being lax on these and these pose a big threat, especially given that competition has been very high in this segment,” he says. Nambiar of IIFL Finance, too, believes the challenge in LAP is competitive intensity. “As it is an easy product, there is always a fear of overleveraging. Earlier, there were concerns that players were using surrogate data such as value of the collateralised property. However, post-demonetisation, players are sticking to the intrinsic value of the business and cash flows,” she explains.

Though BFL had to grapple with the fallout of demonetisation when net NPA for Q4FY17 moved 5 basis points from 0.39% to 0.44%, Jain believes the pain is over. He points out that BFL has already accelerated its provisioning on lending to two-wheelers to 40% and some personal loans to 75% from January-March, as it readies to declare its asset quality ratios to 90-day overdue basis against the current 120-day basis, in line with the transition set out by the Reserve Bank of India. This effectively means that even if the non-performing asset ratios rise in Q1FY18, it will not have any impact on the profit, points out Jain. As on March 2017, the company’s gross non-performing asset ratio based on 120-day overdue basis was 1.7% (Rs.955 crore). In fact, BFL’s asset quality has only improved sharply. In FY09 and FY10, the GNPA ratio was at 16.6% and 7.6%, respectively, owing to stress in the two-wheeler and computer financing businesses. Post the setback in asset quality, BFL focused on improving its risk management process and framework. “This included product rationalisation like exiting the computer financing business, focusing on safer products such as LAP and mortgages during a turbulent FY11-14, increased use of Cibil scores, focusing on repeat customers with good repayment pattern and on affluent & mass affluent customers,” mentions Gandhi of ICICI Securities in her report.

Today, with a stable tier-I capital of 14.56%, Jain is confident that Bajaj Finance would have no problem in achieving 25% balance sheet growth and 20% net interest income growth in FY18. Not surprising that a strong performance in a weak economic scenario (healthy return ratios — RoA at around 3%, RoE over 20% GNPA less than 2%) has led to higher investor interest in the stock. This is reflected in the way BFL’s price-to-book multiple has expanded from 1x in 2013 to over 4x currently. Vinay Khattar, head of research, Edelweiss Securities, believes there’s a reason for the premium valuations. “Consumer finance is a model that not many players have been able to crack. Companies that tried ended up with a lot of NPAs. Bajaj Finance has done well to control that and has put in place a massive distribution network to capitalise on India’s rising consumer discretionary spending.”

Given its strong risk management capability, is BFL nurturing plans of applying for a bank licence? Jain cautiously says the option is always open and will be considered at a relevant point in time. “When we first started off, it was about borrowing wholesale and lending retail. After achieving a certain size, we said we need to borrow retail and lend more wholesale, and that is how the commercial lending business began,” he points out. For now, BFL’s retail deposits constitute around 10% of overall borrowings and in the coming years, this number is expected to rise significantly. At the end of FY17, the NBFC had a deposit book of Rs.4,128 crore, representing a growth of 84% over FY16.

One big reason that BFL is also eyeing retail deposits lies in the learning from the spectacular unwinding of GE Capital post the 2008 credit crisis. GE Capital, which had an asset size of over $200 billion globally, was caught in the credit squeeze as its entire borrowings had come from corporate deposits. “They were strong on risk management but what hurt them was the liquidity risk. They had to knock on the doors of Berkshire Hathway [which did the deal at 10% coupon on preferred stock worth $3 billion] because they were running out of money. So, we are very cognizant about the liquidity risk,” points out Jain. Over a five-year horizon, 20-25% of BFL’s borrowing is expected to come from retail deposits. “This means at a fundamental level whether we choose to become a bank or not is not relevant. But yes, the option [of becoming a bank] does exist,” adds Jain.

On the insurance front, Bajaj believes there is enough potential to grow organically with Allianz as its partner. That sense of optimism stems from the fact that both the businesses are profitable and have enough capital to grow in the coming years. “As a group, we have always believed that profit is capital. Since our growth strategies are built on carefully calibrated risk parameters, we have been able to deliver higher returns on capital,” he says. In fact, of the 31 non-life insurers operating in the country, BAGIC is among the few to post an underwriting profit of Rs.62 crore in FY17 and a 29% jump in profit to Rs.728 crore. Importantly, its solvency ratio stands at 2.61, significantly higher than the regulatory requirement of 1.50.

The picture is similar in life insurance, which enjoys a high level of capitalisation. BALIC’s net worth stands over Rs.8,400 crore, over seven times the capital infused. Since FY08, the venture hasn’t seen any capital infusion as profits of over Rs.4,900 crore, generated over the past five years, have only been ploughed back. With an AUM of over Rs.a50,000 crore, the life venture is comfortably placed on a growth trajectory. Chugh is also quick to point out that the life insurance venture has seen its individual rated business grow by 41% this fiscal as against the industry growth of 21%. “This has been the company’s highest growth rate on individual rated new business since FY08,” says Chugh.

It’s not surprising that against such a backdrop, Bajaj is least concerned about where the growth is going to come from or what grand form Finserv will eventually take. Instead, he is more focused on the people quotient. “As we grow and bring on more people, the concern is, how do we keep the entrepreneurial culture consistent? Though we are not a start-up, we have been working like one and that is the mentality we want to protect and propagate. We want to be the disruptor and don’t want anyone catching us by surprise. Even as I speak there are a bunch of ideas being discussed [at the ongoing meeting]… so I really have to run…,” says Bajaj as he heads back to the meeting. Looks like it’s business as usual at Finserv.