1. Mosaic Wellness

Boutique platform for holistic health

Boutique platform for holistic health

100 of 100

Founding year: 2019 | HQ: Mumbai

Founders: Revant Bhate, Dhyanesh Shah

Key Investors: Elevation Capital, Peak XV Partners, TKN Advisors

After co-founding a food-sector start-up and backing early-stage technology ventures, Revant Bhate, then in his late 30s, began to see that health often took a back seat for many Indians. Motivated to address this gap, he teamed up with Dhyanesh Shah in 2019 to launch Mosaic Wellness, a digital health-care platform, built to meet diverse consumer needs. Today, the company has established itself as a significant player in India’s digital health landscape, with a multi-brand portfolio tailored to different demographic groups.

"If we can make someone feel less awkward asking for help, and give them something that really works over time, we’ve done our job" Revant Bhate Co-founder and CEO

The company operates three primary digital clinics: Man Matters for men’s health and wellness, Be Bodywise for women’s health concerns and Little Joys targeting parental and children’s well-being. Its brands collectively offer telehealth consultations, diagnostic services, supplements, wellness products and tailored care plans, blending technology with consumer healthcare offerings.

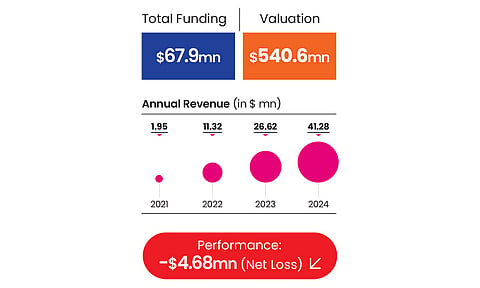

Over its lifecycle, Mosaic Wellness has accumulated around $68mn, positioning it among the better‑funded health‑tech ventures in India.

Skin care at scale

72.5 of 100

Founding year: 2017 | HQ: Bengaluru

Founders: Charu Sharma, Guna Kakulapati and Ramakrishna Rajana

Key Investors: JSW Ventures, Khosla Ventures, Stride Ventures

Cureskin is an AI-driven dermatology platform. The company’s core product is an app that leverages AI to analyse photos of users’ skin and hair for conditions such as acne, pigmentation, scars and hair loss, using more than 10mn skin pixels to derive over 2,000 facial attributes. The underlying algorithm was trained on a database of tens of millions of images, enabling bespoke care recommendations that can be followed with remote dermatologist supervision.

"Our focus has been on using data and protocols to make skin treatment more personalised" Charu Sharma Co-founder

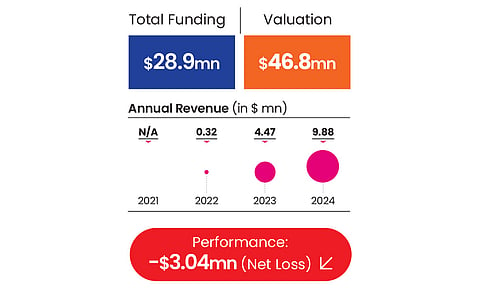

Cureskin’s technology has been deployed by an estimated 1.5mn users, with roughly 80% of its clientele in India’s Tier –II and –III cities. The latest capital infusion is earmarked for improving its AI capabilities, broadening its suite of solution offerings and scaling operations.

The business sits at the intersection of technology and personal care in India.

Wearable health and metabolic tracking

56.7 of 100

Founding year: 2019 | HQ: Bengaluru

Founders: Mohit Kumar, Vatsal Singhal

Key Investors: Blume Ventures, Steadview, Nexus Venture

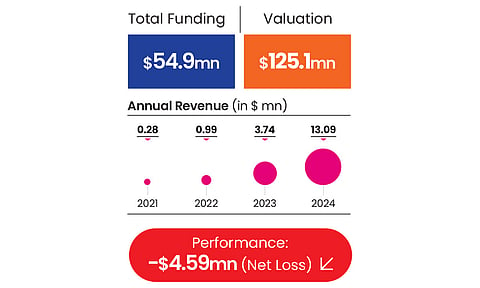

Ultrahuman has marked a noteworthy inflection point in its financial trajectory with reporting profitability for the fiscal year ending March 2025.

The start-up operates a self‑quantification platform anchored by wearable products and digital health services. Smart rings accounted for the majority of this growth, contributing over 90% of operating revenue. Subscription services and other operating lines also showed gains, contributing to a more diversified income mix.

"We wanted signals that are uncomfortable...users could not ignore patterns" Mohit Kumar Co-founder and CEO

Ultrahuman reported a net profit of $8.8mn in FY25, reflecting not just top‑line expansion but improved unit economics and cost management. Investors and industry watchers have noted that this shift underscores the company’s evolving business model from primarily hardware sales toward a hybrid of hardware and recurring software engagements.

Accelerating pathology through AI

15.6 of 100

Founding year: 2015 | HQ: Bengaluru

Founders: Tathagato Rai Dastidar, Rohit Kumar Pandey and Apurva Anand

Key Investors: Endiya Partners, Trusted Insight, Accel India

SigTuple was founded to apply AI to medical diagnostics. The company develops AI-powered systems that assist clinicians in analysing medical images, aiming to improve accuracy, speed and consistency in diagnosis.

"AI can improve diagnostic outcomes only when it earns the trust of doctors" Tathagato Rai Dastidar Co-founder and CEO

The company’s core products focus on computer vision-driven analysis of pathology slides, blood smears and radiology scans. SigTuple combines proprietary algorithms with clinician-in-the-loop workflows, positioning its tools as decision-support systems rather than fully autonomous diagnostics. This approach allows hospitals and laboratories to augment specialist capacity while retaining clinical oversight, a model that has shaped its regulatory and deployment strategy.

SigTuple has worked with diagnostic labs, hospitals and research institutions.

Keeping diabetes in check

10.1 of 100

Founding year: 2015 | HQ: New Delhi

Founder(s): Kunal Kinalekar, Gautam Chopra, Yash Sehgal

Key Investors: Blume Ventures, Leo Capital and Orios Venture

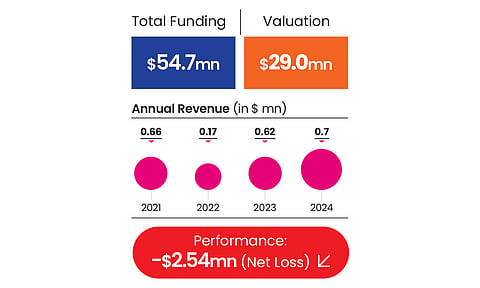

BeatO is a diabetes-management and digital-health platform for people living with diabetes through a combination of smartphone‑connected glucometers, app‑based tracking and remote consultations.

"People don’t need lectures. They need someone help them make small changes. We fill that gap" Kunal Kinalekar Co-founder and CTO

The company’s core proposition has been to integrate remote monitoring with lifestyle and clinical support to help users manage exercise, diet, medication schedules and diagnostics within a unified digital ecosystem.

The platform claims a user base exceeding 2mn people with diabetes, with significant adoption beyond major urban centres, and data reports indicate rapid year‑on‑year growth from Tier‑IV cities.

Additionally, BeatO has been recognised with a National Start-up Award in the health and wellness category.

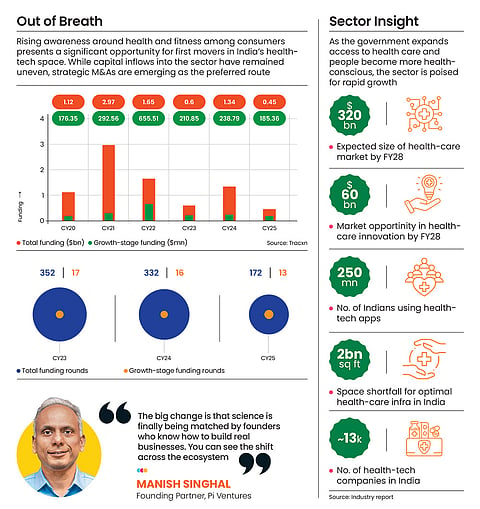

Owing to stringent regulations, global compliance standards and long R&D cycles, India’s health-tech sector has remained under close investor scrutiny. While AI has given a fillip to innovation across start-ups, the lack of patient capital continues to shackle the sector

Research and data partner: Ayvole