1. Yubi

Credit made easy

Credit made easy

100 of 100

Founding year: 2020 | HQ: Chennai

Founders: Gaurav Kumar and Vineet Sukumar

Key Investors: TVS Capital Funds, CRED, Lightspeed India

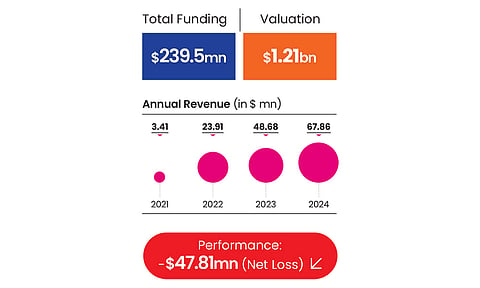

Yubi is a fintech unicorn that’s reshaping how corporate credit and debt markets function in India and beyond. Originally launched in 2020 as CredAvenue, the company rebranded as Yubi in 2022.

At its core, Yubi operates as a technology-driven marketplace and operating system connecting enterprises, banks, NBFCs and investors. Instead of traditional loan sourcing through relationship-based systems, businesses can access term loans, working capital, structured credit, co-lending arrangements and supply chain finance through a single digital interface.

"There’s a strong trend in India towards financialising savings, with increasing recognition of the value credit funds offer" Vineet Sukumar Founder and MD

The platform uses AI and machine learning for risk assessment, underwriting and fast decision-making, enabling turnaround times that are significantly faster than legacy credit channels.

One of Yubi’s differentiators is its AI-powered product suite under brands like YuVerse, Accumn and YuCollect which automates underwriting, risk modelling and collections workflows. It has helped the company facilitate over ₹3.2 lakh crore in debt transactions.

Adding speed to banking

92.7 of 100

Founding year: 2015 | HQ: Bengaluru

Founders: Akash Sinha, Reeju Datta

Key Investors: Musha Ventures, Y Combinator, Krafton

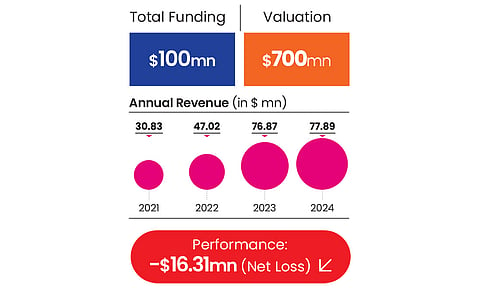

Cashfree Payments is a fintech platform that provides full-stack digital payment and payout solutions to businesses, enabling them to collect payments and disburse funds seamlessly. Since its inception in 2015, the company has grown to serve over 800,000 businesses, processing around $80bn in transactions annually and supports functions including payment collection, vendor payouts, wage payouts, marketplace settlements, refunds and application programming interface (API)-based banking services.

"At scale, payments stop being a feature and become a liability if they fail" Akash Sinha Co-founder and CEO

Cashfree’s platform emphasises easy integration and scalability, offering APIs for thousands of merchants and direct integrations with major e-commerce and service platforms. It has also expanded its regulatory footprint by securing key licences including payment aggregator and prepaid payment instrument authorisations from the RBI, enabling broader product capabilities.

Fintech for the grass roots

79.7 of 100

Founding year: 2017 | HQ: New Delhi

Founders: Himanshu Chandra, Pallavi Shrivastava

Key Investors: The World Bank, Tiger Global Management, Peak XV Partners

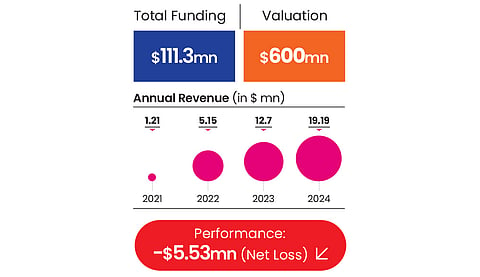

Progcap is a fintech company focused on bridging the credit gap for underserved MSMEs and last-mile retailers across India. The company combines software and financial services to deliver working capital and other fintech products to businesses often excluded from traditional banking systems. The platform uses proprietary technology and risk-scoring tools to assess creditworthiness and supply flexible, collateral-free loans.

"We realised lending to MSMEs only works when capital moves alongside goods and services" Pallavi Shrivastava Co-founder and MD

Since its inception, Progcap has scaled rapidly, serving hundreds of thousands of retail and MSME customers across 500-plus Tier–II, –III and –IV cities, and facilitating credit disbursements across diverse sectors.

The company obtained an NBFC licence and continues to expand its products and services with the aim of becoming a full-stack digital banking platform for small enterprises.

Decluttering financial management

72.3 of 100

Founding year: 2019 | HQ: Mumbai

Founder: Jitendra Gupta

Key Investors: Rainmatter, Bedrock, 3one4 Capital

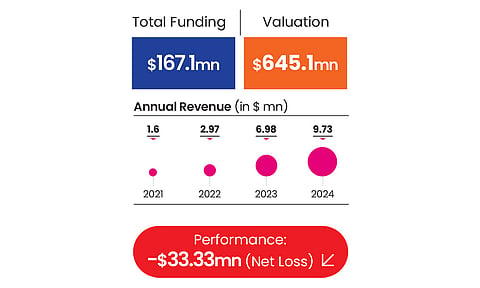

Jupiter offers a unified money management experience through a single app, combining savings accounts, credit cards, loans, investments, insurance products, UPI payments and other financial services.

"Jupiter was built so that people understand what’s happening to their finances" Jitendra Gupta Founder and CEO

Jupiter began by partnering with regulated banks to offer savings accounts and quickly expanded its product stack. The company has secured significant regulatory approvals including an NBFC licence and a prepaid payment instrument licence, enabling it to offer digital wallets and lending products. Its strategy has been to leverage partnerships with banks such as Federal Bank and CSB Bank to provide credit cards and savings accounts while focusing on customer engagement through product innovations like its account aggregator service.

To date, Jupiter counts over 3mn registered users with high engagement across multiple products and has issued more than 150,000 co-branded credit cards.

Fintech NBFC plugging infrastructure gaps

72.0 of 100

Founding year: 2016 | HQ: Gurgaon

Founders: Tushar Aggarwal, Shruti Aggarwal

Key Investors: Fullerton India, DMI Finance, Altara Ventures

Stashfin is focused on expanding access to credit through technology-enabled lending products tailored for the underbanked and middle-class consumers. The company uses advanced risk scoring, AI-driven underwriting and a digital platform to offer personal loans, flexible credit lines and credit products often to users with limited or no access to traditional banking credit. Over the years, the company has grown significantly, building a strong customer base across cities and expanding into related financial services including insurance offerings and payment solutions.

"We spent years refining models that respond to how people earn and repay in reality" Tushar Aggarwal Co-founder and CEO

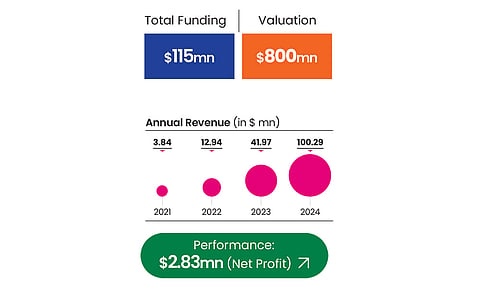

In 2023–24, the company posted reported a net profit of around $2.83mn, as it scales its lending operations and expands its ecosystem. Its assets under management also rose, reflecting growing loan disbursements and customer adoption.

While fintech start-ups have played a key role in advancing financial inclusion in India, the country’s regulatory environment has often been challenging to navigate. Also investors are increasingly focused on strong margins, making the growth journey more daunting. As a result, many start-ups are turning to wealth management and broking

Research and data partner: Ayvole