When I started following the market in 1965 I could look back at what we might call the Ben Graham training period of 1935-1965. He noticed financial relationships and came to the conclusion that for patient investors the important ratios always went back to their old trends. He unsurprisingly preferred larger safety margins to smaller ones and, most importantly, more assets per dollar of stock price to fewer because he believed margins would tend to mean revert and make underperforming assets more valuable.

This Time Seems Very, Very Different

Today's world underscores the axiom that the market can stay irrational longer than the investor can stay solvent

You do not have to be an especially frugal Yorkshireman to think, “What’s not to like about that?” So in my training period I adopted the same biases. And they worked! For the next 10 years, the out-of-favor cheap dogs beat the market as their low margins recovered. And the next 10 years, and the next!1 Not exactly shooting fish in a barrel, but close. Similarly, a group of stocks or even the whole market would shoot up from time to time, but eventually – inconveniently, sometimes a couple of painful years longer than expected – they would come down. Crushed margins would in general recover, and for value managers the world was, for the most part, convenient, and even easy for decades. And then it changed.

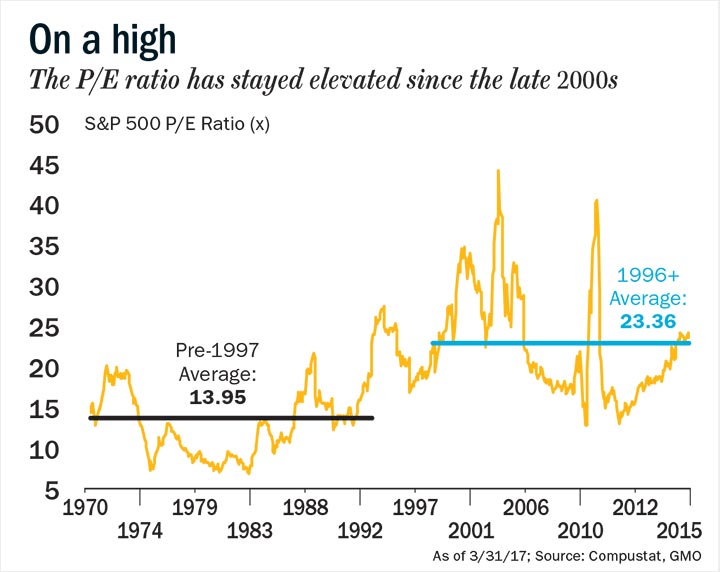

Exhibit 1 shows what happened to the average P/E ratio of the S&P 500 after 1996. For a long and painful 20 years – for someone betting on a steady, unchanging world order – the P/E ratio stayed high by 1935-1995 standards. It still oscillated the same as before, but was now around a much higher mean, 65% to 70% higher! This is not a trivial difference to investors, and 20 years is long enough to test the apocryphal but suitable Keynesian quote that the market can stay irrational longer than the investor can stay solvent.

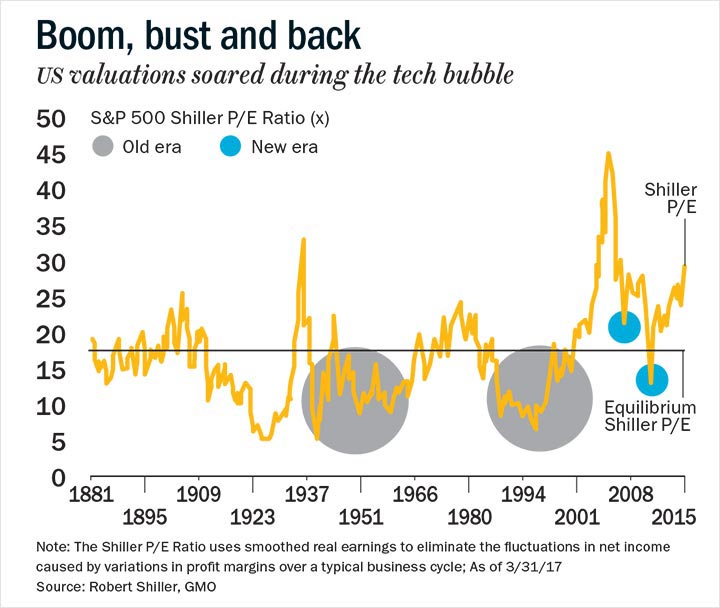

Along the way there were early signs that things had changed. First was the decline from the greatest bubble in US equity history, the 2000 tech bubble. Compared to the previous high of 21x earnings at the 1929 bubble high, this 2000 market shot up to 35x and when it finally broke, it fell only for a second to touch the old normal price trend. And then it quite quickly doubled. Compare that experience to the classic bubbles breaking in the US in 1929 and 1972 (Exhibit 2) or Japan in 1989. All three crashed through the existing trend and stayed below for an investment generation, waiting for a new crop of more hopeful investors. The market stayed below trend from 1930 to 1956 and again from 1973 to 1987. And in Japan, the market stayed below trend for… you tell me. It is 28 years and counting! Indeed, a trend is by definition a level below which half the time is spent. Almost all the time spent below trend in the US was following the breaking of the two previous bubbles of 1929 and 1972. After the bursting of the tech bubble, the failure of the market in 2002 to go below trend even for a minute should have whispered that something was different. Although I noted the point at the time, I missed the full significance. Even in 2009, with the whole commercial world wobbling, the market went below trend for only six months. So, we have actually spent all of six months cumulatively below trend in the last 25 years! The behavior of the S&P 500 in 2002 might have been whispering in my ear, but surely this is now a shout? The market has been acting as if it is oscillating normally enough but around a much higher average P/E.

How about profit margins, the other input into the market level? Exhibit 3 shows the return on sales of the S&P 500 and Exhibit 4 shows the share of GDP held by corporate profits. Compared to the pre- 1997 era, the margins have risen by about 30%. This is a large and sustained change. And remember, it is double counting: above-average profit margins times above-average multiples will give you very much above-average price to book ratios or price to replacement cost. Counterintuitively, if we need to sell at replacement cost (most people’s view of fair value), then above-normal margins must be multiplied by a below-average P/E ratio and vice versa.

To this point, we have looked at two of the three most important inputs in markets and they are very different in the same direction, upwards. A third one – interest rates – is also very different. As is well-known, short rates have never been at such low levels in history as they were last year. Come to think of it, the population growth rate is also very, very different. As is the aging profile of our population. And the degree of income inequality. So too the extent of globalization and indicators of monopoly in the US. Also the extended period of below-trend GDP growth and productivity almost everywhere 3 GMO_Template Proprietary information – not for distribution but particularly in the developed world. And serious climate change issues that may be understated in countries like the US, the UK, and Australia, where the fossil fuel industries are powerful and engage in effective obfuscation, but pre-1997 the topic was not broadly appreciated at all. The price of oil in 1997 was more or less on its 80-year trend in real terms of around $18 a barrel in today’s currency. The trend price today, based on the cost of finding new oil, is about $65 a barrel with today’s price only slightly lower despite an unexpected surge in supply from US tight oil, or fracking. Three and a half times the old price is not an insignificant change when you realize that almost all serious economic declines have been associated with price surges in oil. And, finally, my old bugbear – the modus operandi of the Federal Reserve and its allies is very different in its 22-year persistent effort to work the highs and lows of the rate cycle lower and lower. One might ask here: Is there anything that really matters in investing that is not different? (Actually, I have one, but will save it for another discussion: human behavior.)

We value investors have bored momentum investors for decades by trotting out the axiom that the four most dangerous words are, “This time is different.”2 For 2017 I would like, however, to add to this warning: Conversely, it can be very dangerous indeed to assume that things are never different.

The writer is co-founder and chief investment strategist, GMO. This is an excerpt from GMO's quarterly letter, you can read the full version here.

Copyright © 2017 by GMO LLC. All rights reserved