Laxmii was jinxed from the start. This Akshay Kumar-starrer was one of the most anticipated movies in 2020 and it was scheduled to hit the theatres in May. But, the pandemic descended and the movie release kept getting postponed. Finally, it was scheduled to be screened in early November for Diwali, on streaming platforms. Just when everyone thought the worst was over, several Hindu groups raised objections to the movie’s original title Laxmmi Bomb. So, the makers changed the title to Laxmii.

Meanwhile, Fox Star had paid a hefty price for the movie rights, including digital, satellite and music, at Rs.1.6 billion. When the theatrical release became impossible, they had to sell it to Hotstar for Rs.1.2 billion. It was a marked down price, even then, Laxmmi Bomb was the most expensive digital or OTT (over the top) deal ever. Hotstar seemed confident that they would make good the investment since the movie was a remake of the superhit Tamil movie Kanchana and had a popular star leading it. Their promotions projected confidence. Sadly, the movie turned out to be one of the biggest disasters of 2020. A poor storyline was panned by critics and the wicked joke in the industry was that Laxmii had truly bombed.

This is a perfect illustration of the gamble that OTT players are taking, as they push ahead with their content acquisition spree. This shot-in-the-dark, it seems, is every big player’s strategy. All of them seem to be splurging on content, and throwing it at the audience to see what sticks. Hotstar has invested over Rs.35 billion to date, while Amazon Prime Video has spent upwards of Rs.20 billion on original content since its India entry in 2016. While there is no word on how much more Hotstar will spend in the immediate future, reports say that Amazon Prime and Netflix will together burn as much as Rs.75 billion over the next two to three years.

OTT players are splurging on content. What’s their game?

The platforms are driving themselves into a corner, and they may need a smarter strategy soon

Can the content splurge really continue?

Tipping point

In India, FY20 revenue from digital video stood at Rs.85 billion, with YouTube taking away Rs.15 billion. That spared Rs.70 billion for over 30 OTT service providers. Of this, Netflix made Rs.9.24 billion last year, while Hotstar made Rs.11.12 billion. Amazon Prime Video does not disclose its India numbers, but they should be somewhere in that range.

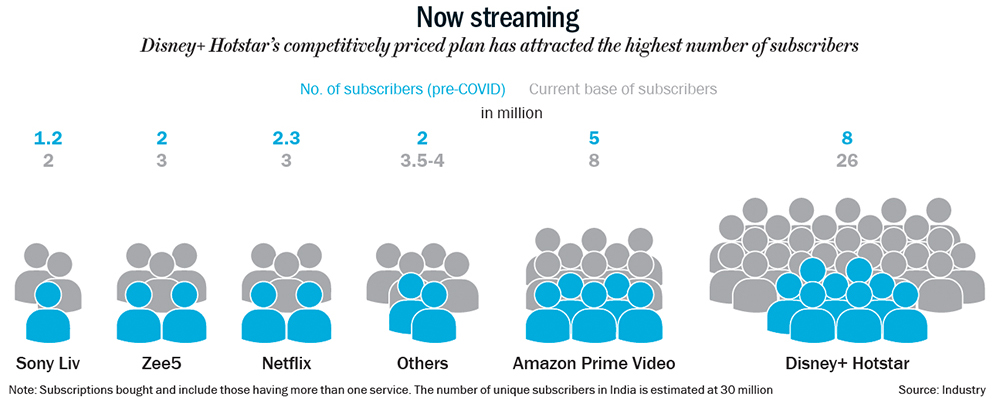

While OTT subscriptions have grown steadily driven by strong content over the past three years, it got a leg up after the lockdown as people were confined to their homes. In terms of subscribers, two to three years ago, only five million were willing to pay for streamed content. Today, 30 million Indians are willing to pay for it. That is an increase of 6x. In fact, the total number of subscriptions currently stand at around 46 million, meaning there are quite a few who have subscribed to more than one platform. During the pandemic, subscriptions’ share in revenue rose to 60%, when earlier, the reliance was largely on advertising. “It is a trend that is likely to accelerate,” says Gaurav Gandhi, director and country general manager, Amazon Prime Video, striking an optimistic note.

But, the pace of growth in subscription from hereon is debatable — more on that in a bit.

To squeeze every drop out of this highly competitive, digital-video market, the three biggies in the OTT business — Netflix, Amazon Prime Video and Hotstar — are raining money on movies and to create original content. This may be a tough market, but it is witnessing a boom and no one wants to be left out. “The boom in consumption comes down to a combination of factors such as focus on high quality, cinematic value, local original content (his company does it in ten languages including English), increasing disposable incomes and a growing base of discerning customers,” says Gandhi.

Since users seem happy to spend on content, OTT players are happy to cut big cheques to acquire it. According to Uday Sodhi, senior partner at Kurate Digital Consulting, a strategic advisor to OTT players, a platform builds a library in the first two to three years and that is the right way to do it. As he sees it, high-quality content is a necessary long-term investment. He says, “A series like Sacred Games will cost you money but brings you viewership over the next decade if not more. Profit will not come in the first few years, and that has been borne out.” In FY20, Netflix posted meagre profit of Rs.90 million. Data for Amazon Prime is unavailable and Hotstar lost Rs.5.54 billion in FY19. This fiscal, the numbers might look better considering the jump in subscriptions across platforms; that said, the profit numbers may still not be pretty enough, with the heightened content cost this year.

The Big Three are adopting different strategies, in terms of content and pricing, to make the best out of this difficult-yet-tantalising situation. Before we delve into their individual dynamics, the more important question is how much room there is for subscriber growth.

While the players are bullish, there is reason to believe subscriber growth may plateau or even drop a bit next year. Just for some perspective, India boasts of 85 million cable homes and about 70 million homes with DTH (direct to home) connections. The average monthly bill for cable roughly comes to Rs.170, while for DTH, it is around Rs.320. Unlike in the US, where Netflix could easily disrupt the space because cable television was expensive, here in India, the value proposition cable television offers is strong, which limits the need for an alternative. “It’s mainly a question of how much the audience you are catering to values the quality of content,” says Sodhi.

Besides, there is a real danger of interest waning. “Thanks to the lockdown, there was huge demand for content and people binged on OTT subscription. Given the dramatic surge in subscription, growth has got front-ended dramatically. So everyone who wants an OTT subscription has already bought one in all likelihood. As we get back to ‘normal’ work, some subscriptions may not be renewed so growth from hereon will be subdued,” says a senior OTT official, whose earlier stint was in broadcasting.

Among the Big Three, Netflix saw the least addition and Hotstar saw the most thanks to its free content that brings in money through advertising. Currently, Amazon commands close to eight million subscribers while Hotstar commands 26 million subscribers (See: Now streaming).

Among the Big Three, Netflix saw the least addition and Hotstar saw the most thanks to its free content that brings in money through advertising. Currently, Amazon commands close to eight million subscribers while Hotstar commands 26 million subscribers (See: Now streaming).

Irrespective of the pecking order, the recent surge puts all players in the same boat: to keep the current subscribers on board, they have to keep the platform exciting with new content even if the prospects for new subscriptions looks rather slim. Growth from hereon will have to come from new subscribers buying for short periods, to binge on that exciting new content. This is where both their content and pricing strategies become critical.

Different strokes

Let’s take Netflix first, the global pioneer that built its fortune in the US and is now applying the same formula across the rest of the world. Globally, Netflix has focused on premium content, and has adopted the same strategy in India, by making and airing shows with high production value, appealing to a discerning audience. Srishti Arya, director-international original film, Netflix India says, “We want to be the home for the most diverse and entertaining stories in India. We understand that not everything will appeal to everyone, which is why we invest in a variety of stories so that you always have something you will love on Netflix.”

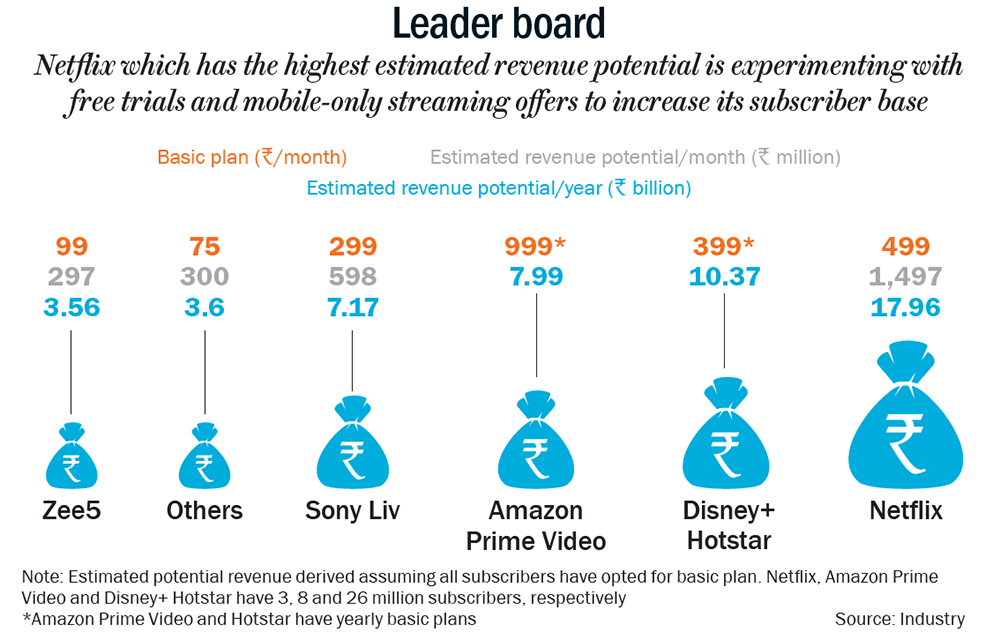

The pricing of its core plan at Rs.499 per month (which totals to Rs.5,988 per annum) is way pricier than its nearest competitor Amazon Prime, priced at Rs.999 per annum, and Hotstar, which offers a blend of free and paid content. The platform has garnered three million paying subscribers, which is the smallest subscriber base among the Big Three, but Nikhil Dalal, senior consultant at RedSeer does not see the OTT player changing its global strategy in India. He says, “Wherever they operate, their content is viewed as premium and their target segment pays for that proposition. That will not change for the Indian market.”

Here, Netflix’s content acquisition has been on the mark, too, going after local content that suits its overall strategy of premium positioning. Its originals with high production value such as Sacred Games, Delhi Crime, and Jamtara – Sabka Number Aayega have been hugely popular. And, then there are shows such as Masaba, Masaba, a comedy drama riding on the popularity of designer Masaba Gupta; Indian Matchmaking and Fabulous Lives of Bollywood Wives, which target an elite audience with money to spend. This, along with its international content, makes for a formidable offering. “At Netflix, we believe that great stories can come from anywhere and be loved everywhere. Therefore, we subtitle and dub our series and films in more than 30 languages. They enable more people to have access to great stories and to discover new stories from other parts of the world,” adds Arya.

But, even with its rock-solid positioning and enviable content selection, the platform may soon hit a roadblock in subscriber growth. Should it then expand its market, by including content that appeals to the masses? The earlier mentioned senior OTT official draws a comparison to what Star TV did in the 1990s with its India programming. “There was only so much Star TV could do with American television shows such as The Bold and the Beautiful or Santa Barbara. Realising the big revenue was in Hindi mass entertainment, they changed their strategy to successfully take on Zee,” he says.

However, for Netflix, diluting the content focus might be a colossal strategic mistake. At least that is what the facts bear out: Amazon with one-sixth the pricing has been able to garner only 2.6x the subscribers. Another layer of go-between pricing that offers only local content may be a plausible strategy, but this could mean it will have to invest a lot more on local content acquisition. It will also be a bigger headache as they will have to develop a local content strategy that distinctly appeals to existing customers, as also to the next band of lower price subscribers. Straddling a wider spectrum may end up diminishing their content novelty and edge, and mess with its positioning, too. That means revenue for Netflix India may now hit a plateau at roughly Rs.17 billion, with three million subscribers at Rs.499 per month (See: Leader board).

However, for Netflix, diluting the content focus might be a colossal strategic mistake. At least that is what the facts bear out: Amazon with one-sixth the pricing has been able to garner only 2.6x the subscribers. Another layer of go-between pricing that offers only local content may be a plausible strategy, but this could mean it will have to invest a lot more on local content acquisition. It will also be a bigger headache as they will have to develop a local content strategy that distinctly appeals to existing customers, as also to the next band of lower price subscribers. Straddling a wider spectrum may end up diminishing their content novelty and edge, and mess with its positioning, too. That means revenue for Netflix India may now hit a plateau at roughly Rs.17 billion, with three million subscribers at Rs.499 per month (See: Leader board).

Recently, the platform did introduce the Rs.199 offer, which is mobile-only streaming. Dalal says this was a smart strategy to increase trials. The same tack was used in the platform’s recent offer of free viewing for two days. But, a big spurt is unlikely.

Local flavour

In sharp contrast, Netflix’s nearest global competitor Disney is a mass player in India thanks to Hotstar. Disney+ Hotstar offers a mix of local and global content including long and short films, and web series. It has created plans to suit two distinct segments — the local and regional content along with cricket priced at Rs.399 per annum under its VIP pack, and the premium pack that offers ad-free, international content priced at Rs.1,499 per annum or Rs.299 per month.

One unique element that sets Hotstar apart is cricket. In 2017, it got the digital-streaming rights for IPL for the next five years when Star India won the bid, and a year later, it won the rights for all domestic and international cricket for the next five years when Star India won that bid, too. Currently, 20% of its viewership comes from sports and, more specifically, from cricket. “Cricket has a huge addressable market and that makes it a very big differentiator for Hotstar in appealing to the mass market,” explains Dalal. Considering Star paid Rs.163.50 billion for the consolidated IPL rights for five years, the payoff has been hardly flattering. In FY19, IPL is said to have contributed about 60% to Hotstar’s total revenue of Rs.11.13 billion. If one takes the closest digital benchmark available of Facebook, which paid Rs.39 billion for five years or roughly about Rs.8 billion/year, Hotstar’s revenue from IPL barely seems to be breaking even.

Although advertising is said to constitute nearly half its revenue, the streaming service is in the red and its new owner Disney is widely known as a conservative spender. There is a good chance that the management won’t be splurging on content and will instead push the Disney brand with a lot of global content. Disney did not respond to a questionnaire from Outlook Business on its OTT strategy.

Then, there is Amazon Prime Video. This one is playing a different game altogether. It is aggressive in acquiring customers, but it is acquiring customers for the entire Amazon ecosystem that offers shopping, movies and music. The initial approach was to get the user first to e-commerce before selling music and video to him/her. Now, it works the other way too. Sodhi explains, “The video service feeds their highly strategic e-commerce business and the e-commerce business’ success feeds the video service. This is a unique service and not comparable with others in the market. The objective is simple and that is to increase the user base.” That is indeed true. There can be no better evidence for the strategic value the video business holds than its e-commerce rival Flipkart now showing Hindi films.

Amazon offers nothing for free. A Prime membership costs Rs.999/year or Rs.129/month. It also sells originals and movies separately. Gandhi says their pricing is based on their value proposition. He says, “It is a common misconception that Indians are price-conscious. They are value-conscious and have always paid for good content.” Dalal believes that Amazon has nailed the value-proposition by offering a lot of variety. And with a bigger customer base, it may continue to build on its content strength even further.

With Amazon’s willingness to stay the course and its bundling of varied products, it is likely to remain a formidable player who will keep the focus on content, compelling others to keep pace, whether they can afford to or not. Both Netflix and Hotstar may find the game exacting.

Meanwhile, smaller players beyond the Big Three are dreaming of riding the big boom in content, too. Hiren Gada, CEO, Shemaroo Entertainment, a company that launched the ShemarooMe OTT platform in 2019, says India presents a diverse set of viewer preferences. He says, “Creativity cannot be someone’s monopoly. It will be no different from television as more genres emerge, leaving room for many players. The task on hand is to build the pay market and that is a long-term game.”

Dalal believes that winning will not be determined by a fat wallet but by clever identification of content that appeals to an audience. “Content will always be king,” he says. So, expect the spending spree to continue for some more time, even if it means more pain for the producers.