“I made my first investment at the age of eleven. I was wasting my life until then,” was once quoted by the investment wizard Warren Buffet. This quote is enough to explain the benefits of early investment.

Importance of Early Investing

A sapling grows to a plant and ultimately becomes a tree, which gives us shelter and fruits that can be enjoyed in the latter years. Wealth cannot be accumulated overnight; it requires nurturing like a tree. Similarly, money saved and invested in initial years will reap benefits in the latter years for sustaining a comfortable lifestyle.

Benefits of early investing

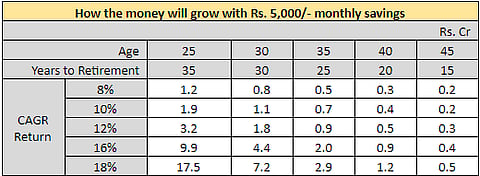

Magic of multiplier: Known as the eighth wonder of the world, which even amazed Albert Einstein is the power of compounding. A known fact is money saved is money earned and it gives astonishing return with the power of compounding. The earlier and the more you save; the exponential effect will further multiply your income. Let’s illustrate it with an example.

Jim and William started working at the age of 25 years and both want to retire at 60. As observed from the table, with a monthly investment of Rs. 5,000, from the age of 25, Jim will end up with a corpus of Rs 3.2 crore at CAGR return of 12 per cent p.a. when he retires. With the same amount of investment and return assumption, William who starts investment at the age of 35, will accumulate only Rs 0.9 crore. Now, to retire with the same amount of Rs 3.2 crore, William needs to invest approximately Rs 17,000. This itself demonstrates the importance of early investing as it encompasses the power of compounding.

Wider and better choice of investment alternatives: If you start investing early, you will have various choices of investment alternatives to choose from. This also benefits as one can allocate more funds to riskier assets like equity and related products. As an asset class, to fetch full benefit, equity requires both reasonable time and adequate risk appetite. Therefore, a person starting with early investment, will have both this factor working for him/her. This advantage erodes as you age which will restrict your choice of investment resulting in moderate return with less risk appetite.

Better alignment towards goal-based planning: Early investing also helps in better aligning various financial goals. Theses financial goals include planning for marriage to house purchase, children’s education to planning a foreign tour, saving for medical expenses to retirement etc. Depending on its importance, each goal requires a dedicated investment that comprises of various assets classes with different holding period and risk composition. Of course, an early investment will help in better meeting these goals and weathering any downfall cycle in the chosen asset classes. This might not be possible if you start investing late with your goal being important.

Full benefit of rupee cost averaging: Taking forward the discussed benefits of early investing, the rupee cost averaging (RCA) works best when you have a longer time horizon for investment. The RCA is the strategy when more shares/mutual units are purchased when share price/net asset value (NAV) is down and less shares/units when the price/NAV is high. This helps in curbing the volatility and reduce the average cost of shares/units. The Systematic Investment Plan (SIP) is a classic example of this. The longer the time of investment, better would be the effect of RCA/SIP with relatively higher and less volatile returns. And the longer time is only possible if you start investing early.

Know the difference between saving after spending and spending after saving: We can end the discussion with one more advice from the Investment Guru, Warren Buffet - “Do not save what is left after spending; instead spend what is left after saving.” A great advice is hidden for all of us within this simple sentence. It is a common tendency for the youngsters to spend lavishly when they are in their early earning period; maybe they deserved it, after the years of education, hard-work and struggle they put in. However, if a little caution is applied here, they can be made aware of the difference between need, want and desire. This will help them to start investing early and by now, we all know, the benefit of the same. So, have you started investing? If no better start now.

The authors are CFA, Head of the Department– Financial Markets & Assistant Professor, Department of FinTech & Financial Markets at ITM B-School