India Inc. Q3: Glass half-full, half-empty, the origin of this widely used metaphor remains quite unclear even today. From literature novels to English economist Josiah Stamp, the credit for its initial emergence remains imprecise.

Can the Upcoming Earnings Season Bring Cheer for India Inc?

Q3 Preview: As 2024 comes to an end with a not-so-cheerful second half for India Inc., all hopes are now tied to the upcoming quarter results. Will Q3 be able to clear the cautionary clouds of the previous quarter?

However, today, it is gaining attention for a different reason- the performance of India’s corporate sector.

This is somewhat similar to the term 'resilience,' which has been frequently used to describe India's stock market performance this year as compared to its global peers. But markets are just the followers of the corporate sphere's course, in the longer run at least.

Undoubtedly, Q2 was a major dampener not just for the corporate space but on the macro-front as well. GDP plummeted to 5.4 per cent during the second quarter. October's inflation print touched a 14-month high of 6.21 per cent before easing to 5.49 per cent the month after. Urban demand dwindled and industrial growth took a hit. Clearly, not a euphoric picture.

The subdued performance was even visible during corporate commentaries, which eventually sent share prices on a downtrend.

Not a Total Loss, But Still Struggling

While many were already expecting a weak quarter as potential headwinds became quite evident before the earnings season started, some sectors witnessed an even sharper blow.

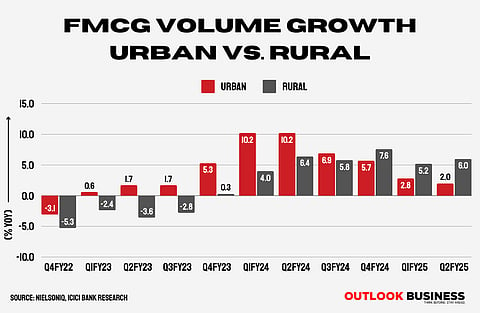

For instance, the FMCG sector struggled to perform well, owing to muted demand, above-than-normal monsoon and higher food inflation. On year-to-date basis, the Nifty FMCG index has struggled to stay in positive territory. Major industry giants like HUL (Hindustan Unilever), Britannia and Dabur mentioned urban demand woes as major challenges during corporate commentary.

But what worked out well for the sector was the premiumisation bet and the strong rural demand trend.

Similarly, the oil and gas sector was also stuck in a low-lane as weak GRM (gross refining margins) weighed heavily on the profit levels of oil firms. Major domestic oil companies reported a double-digit fall in profit levels. IOC (Indian Oil Corp.) was the hardest hit as the profit figure declined by nearly 99 per cent.

As for city gas distributors like Indraprastha Gas and Mahangar Gas, things are even worse. The government slashed APM (administered price mechanism), which is one of the cheapest sources of gas for city gas distributors. This will eventually take a toll on the margin levels of these companies as per analysts.

Meanwhile, the threat to the auto sector was already visible when inventory levels reached an all-time high just a few months back. While the festive season did bring in some hope, passenger vehicles again witnessed a drop of nearly 14 per cent last month. And as the next year kicks in, many auto giants like Tata Motors, Hyundai and Maruti Suzuki have announced price hikes starting in January, which might further put pressure on retail sales.

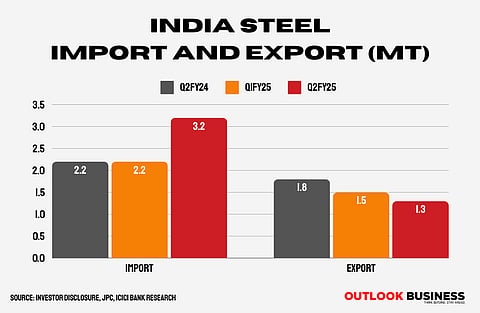

As for metals and mining, the sector continues to witness heightened pressure, primarily owing to the pricing stress on the domestic front. Steel sector has been the worst hit, which has even led to a decline in export levels of the commodity.

However, sectors like IT (information technology) and BFSI managed to perform well. While the increase in discretionary spending led by the Federal Reserve's rate-cut decision managed to lift investor sentiment, a hiring uptick also added to the optimism.

The quarter was pretty weak on an overall basis, but investors were more focused on the cautionary flags Q2 raised for the December quarter.

"The key sectors still seem to be holding up well but the overall demand trends appear to be soft, especially discretionary spending. Input cost pressures and volatile commodity prices may also affect margins, making Q3 a cautious period for businesses. The outlook is bullish on the banking and IT sectors, but auto companies like Tata Motors and Bajaj Auto face headwinds as they continue to lose market share," said Jathin Kaithavalappil, assistant vice president at Choice Broking.

While the quarter remained weak, some analysts believe that the term 'disappointing' is too far-fetched as the downplay was already well-anticipated before.

"Overall, while H1 FY25 earnings growth has moderated compared to H1 FY24, this slowdown was anticipated and already reflected in analysts' earnings previews. Moreover, many high-frequency indicators point to a much-improved performance in H2," said Sujan Hajra, Chief Economist and Executive Director, Anand Rathi Shares and Stock Brokers.

Momentum steadily picking-up

While the outlook remained dim, macro indicators are steadily indicating towards a brighter picture. India's private sector growth touched a 4-month-hight as the PMI (purchasing managers' index) stood at 60.7 this month, up from 58.6 recorded in November. The industrial output index, IIP also surged by 3.5 per cent in October month.

As for inflation, the CPI figure moderated to 5.48 per cent in November, within RBI's tolerance range.

According to rating agency, Ind-Ra, corporate India is expected to see a rebound in revenue growth during the H2FY25, driven by higher volumes and an improved ability to pass on rising raw material costs.

"The confidence stems from the expectation of a continued recovery in the rural markets, led by agriculture (benefiting mass products), and plateauing of urban consumption after a decline in the first half (providing support to discretionary products)," the rating agency said in a release.

While the broader sentiment was for sure subdued, it is worth noting that 2024 was quite an eventful year. Multiple factors, including the election season and high household leverage, weighed heavily on the consumption levels.

But as the geopolitical tensions ease with a potential rise in government spending on the domestic front, things are expected to improve.

As per a report by ICICI, Q3 has started off to a good start with goods exports rising by 17 per cent year-on-year and festive demand holding up.

"Many high-frequency indicators point to a much-improved performance in H2. We maintain our projection of an 11 per cent earnings growth for the Nifty50 in FY25, with midcap earnings likely to outpace the Nifty 50. Adjusted for one-offs, even small-cap indices are expected to show healthy earnings growth for the full year, signaling a recovery in the second half," Hajra added.

As for now, the metaphor of glass half-full, half-empty will play out much better as the earning season starts, waving goodbye to a quiet second quarter.