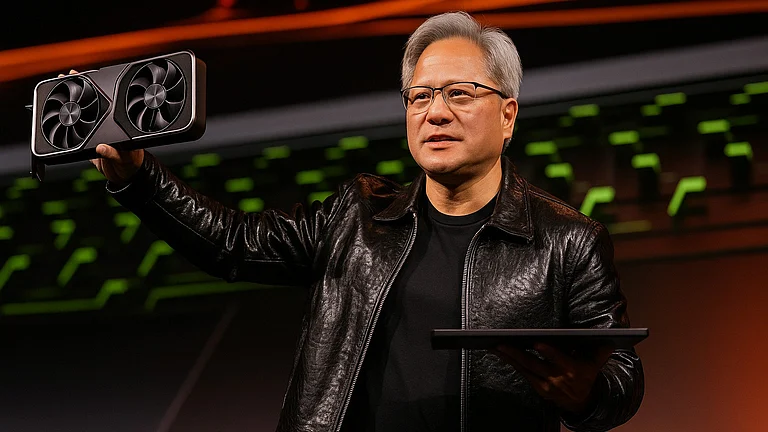

Jensen Huang, the CEO of Wall Street's darling AI firm Nvidia, has started to offload company stock as part of a plan that could see him sell up to $865 million worth by the end of the year. According to an SEC filing on Monday, Huang has already sold 1,00,000 shares for $14.4 million over two days (June 20 and June 23). According to a report by Bloomberg, the sales are part of a new 'Rule 10b5-1' plan, which was disclosed in Nvidia’s latest quarterly report.

Nvidia CEO Jensen Huang Offloads Company Shares Worth Over $800 Million

Nvidia CEO Jensen Huang has started offloading company shares worth up to $865 million and is expected to be completed by the end of this year

Huang, who is also the 12th richest person with a net worth of ₹126 billion, as per the Bloomberg Billionaires Index, has sold over $1.9 billion worth of Nvidia stock in the past. On Monday, Nvidia shares closed at a $144.17 price level, nearly flat with gains of around 0.22% on the Nasdaq.

Once the most beloved tech stock of D-street, Nvidia's share price trajectory has remained muted so far this year. Nvidia shares witnessed a single-digit surge of 4.24%, from $138.31 to $144 price level currently, on a year-to-date basis.

10b5-1 Trading Mechanism

Jensen Huang’s pre-arranged trading plan, which comes under SEC's Rule 10b5-1 trading mechanism, allows him to sell up to 6 million Nvidia shares by the end of the year.

The 10b5-1 rule allows corporate insiders to offload company stock via pre-arranged trading plans without attracting any allegations related to insider trading.

These shares are worth about $865 million based on Monday’s closing price of $144.17. Meanwhile, another filing shows that he plans to sell an additional 50,000 shares soon.

Huang is not the only C-suit executive to sell company shares. Nvidia board member and billionaire Mark Stevens has followed a similar action. On June 18, he sold over 6,00,000 shares for around $88 million, according to a separate filing.