LG Electronics India debuted on Indian stock exchanges on October 14 with a premium of over 50%.

Listing at ₹1,715 on the BSE gave LG India a market capitalisation of ₹1.15 lakh crore, surpassing its South Korean parent.

In the IPO, LG Electronics Inc sold 15% of its stake through an offer for sale (OFS) worth ₹11,607 crore.

LG India Outshines South Korean Parent on Market Debut: Why Investors Are Bullish | Explained

The stock opened at ₹1,715 on the BSE and ₹1,710.10 on the NSE, giving the Indian subsidiary of the South Korean consumer appliance giant a market capitalisation of over ₹1.15 lakh crore. This made the company more valuable than its Seoul-listed parent, LG Electronics Inc, which has a market capitalisation of ₹91,391.4 crore (14.43 trillion KRW)

LG Electronics India on Tuesday debuted on Indian stock exchanges with over a 50% premium over its issue price. The stock opened at ₹1,715 on the BSE and ₹1,710.10 on the NSE, giving the Indian subsidiary of the South Korean consumer appliance giant a market capitalisation of over ₹1.15 lakh crore. This made the company more valuable than its Seoul-listed parent, LG Electronics Inc, which has a market capitalisation of ₹91,391.4 crore (14.43 trillion KRW).

A day after the listing, shares of LG Electronics India closed just 0.08% lower at ₹1,688.

Notably, in LG Electronics India’s IPO, the parent company sold 15% of its shareholding through an offer for sale (OFS) worth ₹11,607 crore.

With its market debut, LG set a new record for the highest-ever listing premium among IPOs exceeding ₹10,000 crore, closing 50.4% above its issue price. Before listing, the IPO had a grey market premium of around 31%. The strong debut underscored robust investor demand, driven by LG’s strong brand reputation and financial performance. Exchange data showed the IPO was oversubscribed more than 54 times, with institutional investors bidding 166 times their quota and retail participation at 3.5 times.

This listing gain puts LG just behind food aggregator Eternal (formerly Zomato), which listed at a 52% premium in 2021. However, Indian investors have learned that large IPOs do not necessarily ensure lasting success in the secondary market. Several major listings have faltered post-debut, Hyundai’s market entry in 2024 was lacklustre, opening 17% lower; Paytm’s ₹18,300-crore issue in 2021 crashed 27% on listing day; and even state-backed giant LIC’s ₹20,557-crore IPO in 2022 was only twice subscribed and listed 7.8% down.

However, brokerages' views are different in LG Electronics India’s case. At least four firms have initiated coverage with a ‘buy’ rating. Motilal Oswal Financial Services, Emkay Global, and Antique Stock Broking project over 50% upside in the stock price, while ICICI Securities sees a 35% upside.

Why Brokerages Are Bullish on LG India

LG Electronics India (LGEIL) is the clear market leader in India’s home appliance and consumer electronics sector (excluding mobile phones), said Antique in a note. The company has a strong presence across refrigerators, washing machines, televisions, inverter air conditioners, and microwaves. Its dominance spans both premium and mass-market segments, supported by continuous innovation, a trusted brand image, robust manufacturing, a vast sales and service network, and access to advanced global technology from its parent.

Motilal Oswal notes that LG holds strong market shares in premium segments, around 63% in OLED TVs, 37% in front-load washing machines, and 43% in side-by-side refrigerators.

“The company’s focus on premiumisation has led to several innovative launches, including OLED TVs, inverter ACs, and smart home appliances… It has also increased the share of locally sourced raw materials to 54% in FY25, with plans to raise this to 63% over the next four years, which should help improve profit margins,” the brokerage said.

India’s home appliances and consumer electronics market (excluding mobile phones) is projected to grow by around 14% annually between 2024 and 2029, and LG Electronics India “is well placed to benefit from this expansion.”

A wide distribution network remains one of LGEIL’s biggest strengths. The company has over 35,000 consumer touchpoints, 777 exclusive brand shops, and 463 B2B partners as of Q1 FY26. Its after-sales service network includes more than 1,000 service centres across India.

Strong Financials

LGEIL continues to deliver impressive financial results, with revenue growing at a compound annual rate of 13.1% and profit after tax (PAT) rising 22.3% between FY22 and FY25. Going forward, revenue, EBITDA, and PAT are expected to grow around 11–12% annually between FY25 and FY28, supported by steady operating margins, according to Antique.

LGEIL is also looking to increase its export contribution to about 10% by FY28 from 6% in FY25. The company expects its B2B segment to account for 14–15% of revenue over the next few years, up from 10% in FY25, as B2B margins are typically higher than in the consumer segment, said Motilal Oswal.

Adding that the company is targeting more than 25% annual growth in revenue from annual maintenance contracts (AMCs).

Indian Tailwinds

According to ICICI Securities, the company stands to benefit from favourable macro factors such as stricter BEE efficiency norms, lower GST rates, and state-level incentives like tax cuts and electricity subsidies, all expected to boost demand and strengthen its market position. Recently, the central government reduced sales tax on more than 400 items, including consumer appliances, which is expected to stimulate consumption demand.

“Lower GST rates simultaneously enhance affordability and demand across B2B and B2C segments. Reduction in interest costs, income tax rates, and electricity subsidies by some states also augur well. Together, these macro tailwinds will likely support market penetration, volume growth, and reinforce the company’s competitive positioning,” ICICI Securities noted.

Parent’s Growing Dependence

India’s growing importance to LG’s global business is evident, with its share of the parent company’s revenue rising from 3.5% in 2021 to 4.3% in 2024, with further growth potential ahead.

“We believe there is potential to steadily increase the range of products in India from the parent’s portfolio,” ICICI Securities said.

LG India has steadily increased its domestic sourcing of raw materials, with local procurement rising from 45.1% in FY22 to 53.8% in FY25, noted the brokerage.

The South Korean giant is also strengthening its manufacturing presence in India by setting up a ₹5,000-crore manufacturing facility at Sri City, Andhra Pradesh, funded through LG India’s internal reserves. The plant aims to double the company’s production capacity within five years, boosting supply chain efficiency and product availability. Production will begin with room air conditioners in FY27, followed by washing machines, refrigerators, and compressors by FY29.

Once operational, the facility will produce 1.5 million air conditioners, 8 lakh refrigerators, 8.5 lakh washing machines, and 2 million compressors annually. By locally manufacturing key components like compressors and heat exchangers, LG India plans to cut import dependence and lower costs. This will be the company’s third factory in India and a key driver of its export strategy, expanding its reach beyond the current 47 countries to new markets across Europe, the Middle East, Africa, Asia-Pacific, and the US.

Competitive Risks

However, all the brokerages mentioned above highlighted competition as a key risk for the company. Data compiled by Emkay Research show that LG India has maintained a strong market share across major consumer durable categories, refrigerators (30–33%), washing machines (32–34%), inverter air conditioners (16–23%), and panel TVs (27–30%) between CY22 and H1 CY25. As of Q1 FY26, LG continues to lead by a wide margin, holding 28% in panel TVs, 30% in refrigerators, 24% in washing machines, and 21% in inverter ACs, well ahead of its closest competitors.

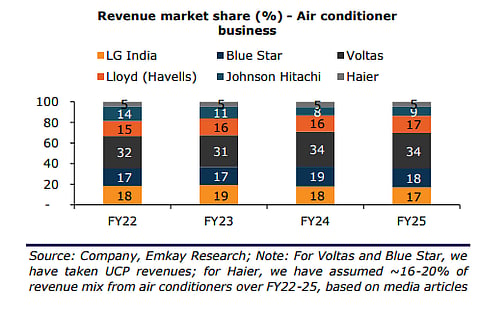

However, the company has lost some ground in the air conditioner segment, where its revenue share declined from 18% in FY22 to 17% in FY25 due to rising competition from Indian and Chinese brands such as Blue Star, Voltas, and Lloyd.

“Players in this sector face competition from existing and new entrants, ranging from large multinational companies to highly specialised entities focusing on a limited number of products and services,” said the brokerage, adding that the sector is witnessing heightened competition from Chinese brands, which have been gaining ground in high-growth categories.

“The rise of emerging business models and private labels introduced by consumer electronics retail chains is further exerting pressure on margins and challenging established players,” Emkay analysts noted.

Motilal Oswal added that higher domestic manufacturing costs further constrain pricing flexibility, affecting competitiveness against imports from low-cost regions such as China and Vietnam.