Amid growing chatter around increasing smartphone production and sales in India, Apple is rapidly expanding its footprint in the personal computer and tablet segments, as Indian consumers increasingly shift towards premium devices.

Apple Chips Away at HP, Samsung's Share in India's PC and Tablet Market

According to a report by market analyst firm Canalys, Apple shipped approximately 236,000 units of its personal computer range in India in Q1 2025—a 73% jump in volume compared to 137,000 units sold in the same quarter last year

According to a report by market analyst firm Canalys, Apple shipped approximately 236,000 units of its personal computer range in India in Q1 2025—a 73% jump in volume compared to 137,000 units sold in the same quarter last year.

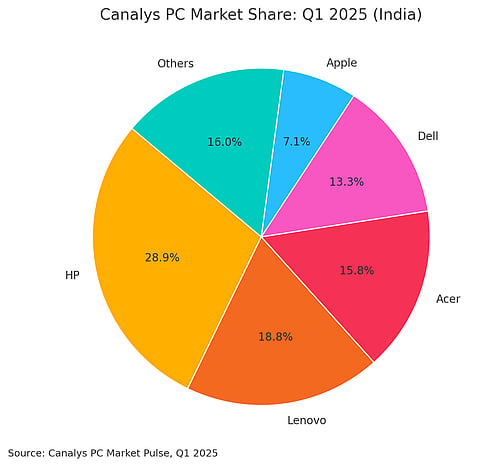

Apple posted the highest growth during the period, outpacing rivals such as HP, Lenovo, Acer, and Dell. After Apple, Lenovo registered the next highest annual shipment growth at 34.8%, followed by Acer at 11.5% and segment leader HP at just 4.6%. In volume terms, HP still commands the largest share of the market, shipping 966,000 units in the first three months of 2025.

Overall, India’s desktop and notebook shipments grew 13% year-on-year in Q1 2025, rising from 2.95 million units in Q1 2024 to 3.34 million units, according to Canalys.

While Apple still ranks fifth in terms of market share, it is growing rapidly as HP and Acer lose ground. The company—whose lineup includes MacBook Air and MacBook Pro laptops, and iMac, Mac Mini, Mac Studio, and Mac Pro desktops—saw its market share increase from 4.6% to 7.1% over the same period.

Meanwhile, HP's market share shrank from 31.3% to 28.9%, and Acer lost 0.3 percentage points year-on-year in Q1 2025.

Canalys attributed the overall growth in PC sales to a 21% increase in notebook shipments, which reached 2.4 million units, even as desktop shipments declined by 3% to 906,000 units. Within the notebook segment, premium models (costing over US$1,000) saw a 49% rise in shipments, while AI-capable notebooks witnessed a staggering 253% year-on-year growth.

“Enterprises increasingly view AI as a core feature, while consumers are turning to premium PCs for their multi-use value,” said Ashweej Aithal, Senior Analyst at Canalys.

He added that commercial PC shipments grew 11%, driven by strong enterprise demand despite weak government procurement. Consumer shipments rose even more—by 16%—boosted by Republic Day promotions and robust March-end sales. Offline retail also gained traction due to increased vendor investments in brand stores and large-format outlets.

Tim Cook 'Keen' on India Market

During Apple’s quarterly conference call on January 30, CEO Tim Cook emphasised his focus on India.

“India set a December quarter record during the quarter. We’re opening more stores there—we’ve announced four new stores. The iPhone was the top-selling model in India for the quarter. It’s the second-largest smartphone market in the world and the third-largest for PCs and tablets. We have very modest share in these markets, so I think there’s lots of upside there,” he told analysts.

Apple currently operates two official retail stores in India—Apple BKC in Mumbai and Apple Saket in New Delhi—both inaugurated by Cook in April 2023. The company has announced plans to launch four additional stores across key urban centres, including Delhi-NCR, Bengaluru, Pune, and the Borivali suburb of Mumbai.

According to Kantar, the iPhone was the top-selling model in India during the December quarter.

Apple Eats into Samsung’s Market Share in Tablet Segment

The Canalys report, released on June 23, also highlighted Apple’s growing presence in India’s tablet market. Apple’s market share rose to 16%, reflecting a 27% year-on-year increase and making it the second-largest tablet brand in India in Q1 2025. Samsung retained the top spot with a 29.9% share, though it experienced a steep 33.4% drop in shipments.

Chinese brands Lenovo and Xiaomi gained momentum with shipment increases of 16.1% and 12.6%, respectively. In contrast, Acer suffered a sharp 67.2% decline, likely due to its heavy dependence on the budget tablet segment amid a broader consumer shift toward premium offerings.

Commenting on the tablet market landscape, Ashweej Aithal noted that the consumer segment grew 21% year-on-year, supported by back-to-school promotions and enhanced offline retail presence. However, commercial tablet shipments fell by 54%, largely due to delays in government and education-related procurement.

Looking ahead, Canalys forecasts an 8% decline in overall tablet shipments for 2025, mainly due to sluggish institutional demand. That said, the education sector could still play a key role in driving demand later in the year. The report also highlighted the rising importance of Tier 2 and Tier 3 cities in India’s PC market, where consumers are increasingly value-conscious, prioritising performance, reliability, and after-sales service, helped by improved broadband access, digital tools, and online education.