US President Donald Trump imposes 25% tariff on Indian exports amid ongoing trade talks.

MSMEs may face job losses as exports to the US come under pressure, experts said

IMF and RBI maintain India’s growth outlook at 6.4–6.5% despite headwinds

Elevated tariffs could shave 20–40 bps off India’s FY26 GDP growth

Trump’s 25% Tariff Poses Growth Risk—But India Is Far from a ‘Dead Economy’

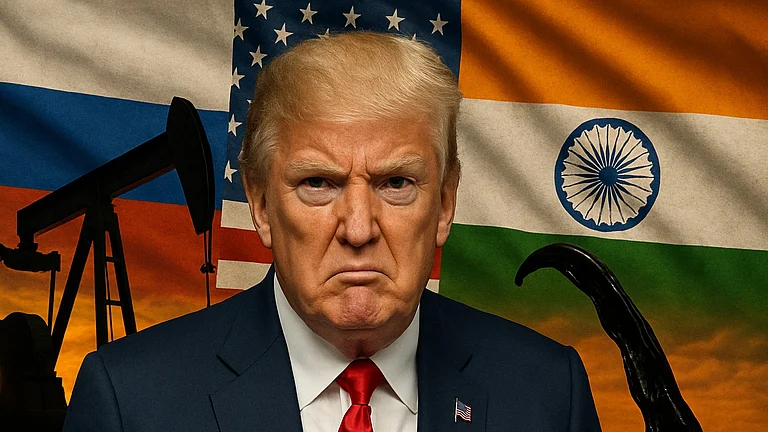

Hours after confirming a 25% tariff on all Indian exports from August 1, US President Trump called India a "dead economy" alongside Russia, casting a shadow over trade talks and heightening short-term risks for India's MSMEs and external sector

Hours after imposing a punitive 25% tariff on all Indian exports to the United States, effective from August 1, US President Donald Trump described India as a "dead economy" along with Russia. Additionally, he threatened an unspecified "penalty" for India's defence and energy ties with Moscow.

The surprising move has cast uncertainty over trade talks and also raised fresh concerns over the near-term impact on India's external sector and MSME exporters. While the new tariffs are expected to weigh on exports and short-term growth momentum, the broader outlook remains steady—for now.

A Tariff Shock No One Saw Coming

India is one of the first countries to engage with the US for trade deals, months before Trump even announced "reciprocal tariffs" on April 2. During his visit to Washington, DC in February, Prime Minister Narendra Modi and Trump decided to finalise the first tranche of a bilateral trade agreement (BTA) by September-October this year. However, it was largely anticipated that India and the US would seal an interim deal before the expiry of Trump's 90-day tariff pause deadline on July 8, which was later extended till August 1.

"All discussions we are holding are aimed at the BTA," said a government official last week familiar with the matter, suggesting that an interim deal is not India's priority. A team of the US delegation is scheduled to visit New Delhi this month to further the talks. Against this backdrop, a tariff announcement from Trump came as a surprise.

However, the commerce and industry ministry asserted that the government is studying "implications" of Trump's statement on the BTA and will take all steps necessary to secure India's interest.

Export Concerns

Even as a 25% tariff is similar to what Trump announced on April 2, Indian broking house Nuvama's head of research committee, Abneesh Roy, pointed out that it is somewhat higher than the overall weighted average tariff on all imports of 18%.

Furthermore, among emerging market peers, Bangladesh, Vietnam, Indonesia and the Philippines have lower tariffs than India at 20%. South Korea has tariffs similar to India at 25% while China received tariffs penalty of 55%.

With Vietnam’s tariffs set at 20%, India’s tariffs of 25% or even a 15% tariff (in the best-case scenario) may not lead to any major trade diversion opportunities in the near

term, said Japanese financial services firm Nomura. However, over the medium term, it still expects India to remain a beneficiary of the China plus one strategy, as diversification is a bigger driver of this trend.

Roy also suggested that India could partially offset export losses by redirecting shipments to other destinations. "Moreover, the recent INR underperformance, if it sustains, could further work to offset higher tariffs on India to some extent and also make Indian goods competitive in other markets," he added.

Still, with Indian exports facing steeper barriers, economists have flagged potential risks to investment sentiment and capital flows, particularly at a time when domestic demand remains subdued. The effectiveness of policy response will be critical in cushioning these shocks.

Growth Prospect

Despite Trump's rhetoric, India is expected to remain the fastest-growing major economy in the coming year as well. The International Monetary Fund (IMF) in its updated World Economic Outlook (WEO), released on Tuesday, revised its projection for India’s economic growth to 6.4% for the years 2025 and 2026, from its earlier estimations of 6.2% and 6.3%, respectively, published in April.

The Reserve Bank of India (RBI) has projected India’s growth for the year at 6.5%, though market consensus stands slightly lower at 6.3%. Economists warn that the 25% tariff, if sustained, could shave 20 to 40 basis points off gross domestic product (GDP) growth.

"The elevated tariffs can subtract as much as 40 bp directly from GDP growth and widen the current account deficit by a similar magnitude in FY26," said Dhiraj Nim, economist at ANZ Bank.

Japanese brokerage firm Nomura also flagged a downside risk of 20 bps to India's growth which it pegged at 6.2% year-on-year for FY26. "Exports to the US account for 2.2% of India’s GDP, and include pharma, smartphones, gems and jewellery, industrial machinery, auto components, textiles and iron and steel; most of which will likely face margin pressure," said Sonal Varma, chief India economist at the Japanese financial services firm.

She added that the elevated tariffs will adversely affect exports to the US, eroding any benefits due to trade diversion, hurting profit margins and reducing investments and leading to job losses for Micro, Small & Medium Enterprises (MSMEs).

While growth forecasts for India remain largely positive despite Trump’s remarks, the actual impact will hinge on how long the tariffs stay in place, how policymakers respond, and how the ongoing trade talks with the US unfold.