India’s gems and jewellery (G&J) industry is likely to be one of the worst-hit sectors if US President Donald Trump imposes a tariff hike. The high export dependence on the US and labour-intensive nature of the sector have made it one of the most vulnerable industries to be possibly hit by Trump’s tariff as the April 2 deadline inches closer.

Will Trump’s Tariffs Hike Take Away India’s Labour-Intensive Gem & Jewel Industry’s Shine

As gems and jewellery is a labour intensive sector, a significant dip in exports would severely impact employment. Reportedly, around 1 lakh to 1.5 lakh workers will be impacted in the gold jewellery segment alone

A report by a financial services research firm Emkay Global highlighted that Trump’s tariffs hike would impact sectors like auto, pharma, electronics, but these industries are comparatively safer than G&J.

“We establish that the key susceptible sectors (auto, pharma, electronics) are far better placed than feared, whereas apparel and G&J are the most exposed,” said Emkay Global.

According to the Gem and Jewellery Export Promotion Council (GJEPC), nearly 50% of exports are likely to be gradually wiped out. Consequently, it will result in direct job losses of around 1 lakh to 1.5 lakh workers in the gold jewellery segment alone. Besides gold, India’s exports of G&J products include natural and lab-grown polished diamonds, and platinum jewellery.

“...But if they (tariff) do come, it is going to significantly impact the industry; nearly half of our business in the US, our largest export market, will be lost,” GJEPC’s chairman Kirit Bhansali told the Economic Times.

The Emkay report also highlighted that due to the labour-intensive nature of the sector, a significant dip in exports would severely impact employment.

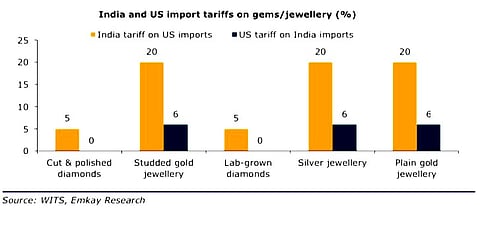

A trade research think tank GTRI report titled "Reciprocal Tariffs and India" mentioned that on a sectoral-level the potential tariff gap between India and the US is the second highest in the G&J sector at 13.3% after 23.1% in automobiles and auto components. The study highlighted that the higher the tariff gap, the worse affected a sector will be.

“Diamonds, gold, and silver, with $11.88 billion in exports, will see a 13.32% tariff hike, raising jewelry prices and reducing competitiveness,” GTRI’s report said.

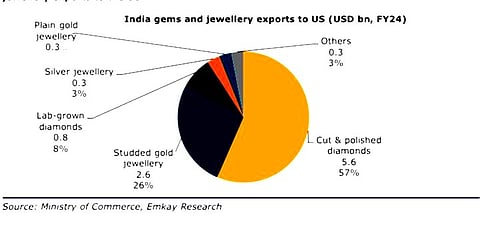

US-India G&J Trade

When it comes to India’s G&J exports, the US stands on top with the value of exports at $8,351 million FY25 (April-January), according to the ministry of commerce and industry trade data. It has remained the top export partner for India’s jewellery industry in the last five financial years, as exports to the US stood at $8,689 mn in FY21, $14,614 mn in FY22, $12,540 mn in FY23, and $9,907 mn in FY24.

While the value of India’s imports from the US stood at $5,068 mn in FY21, $6,842 mn in FY22, $7,672 mn in FY23, $5,160 mn in FY24 and $4,721 mn in FY25 (till Jan).

Average tariffs levied by India on exports to the US are more than double at 8.63% whereas the US imposed 3.17% on exports to India.

How G&J Exporters Are Navigating Challenges

As fear of the tariffs looms over the industry, G&J exporters are exploring other markets to mitigate the impact. Exporters of gold jewellery are shifting to countries like France, Italy, Switzerland, Jordan and South Korea, the GJEPC note stated. India has a free trade agreement (FTA) with Jordan and South Korea only. Apart from shifting exports, manufacturers are also moving their units to countries like Oman, Singapore and UAE to mitigate impact on production.

The study by Emkay suggested that increasing imports from the US can also help in easing the consequences.

“Given the highly commoditised nature of these goods, it should be relatively easy to shift some imports to the US to reduce the deficit for this sector,” the study stated.