For decades, imported Scotch and London gin ruled India’s premium shelves. But what was once the preserve of foreign brands is now contested ground as Indian labels narrow the distance on imports in the premium race. In the most expensive bars in Delhi and Mumbai, it’s no longer unusual to see a Rampur single malt or Jaisalmer gin commanding the same attention as their Scottish or British counterparts.

How Radico Khaitan Is Transforming India’s Premium Spirits Market with Rampur Malt & Jaisalmer Gin

Imported labels no longer have India’s premium shelves to themselves as homegrown spirits gain recognition and push for global market share

Consumers are moving beyond everyday blends, willing to pay more for distinctive and upscale experiences. That shift has cracked open a space long guarded by international heavyweights like Pernod Ricard and Diageo.

Into this crowded, fast-moving arena steps Radico Khaitan, best known for labels like 8PM whisky and Magic Moments vodka. With Rampur single malt and Jaisalmer gin, the company has broadened its portfolio to increase visibility in the premium spirits segment, both at home and overseas.

But competition from multinational heavyweights and ambitious Indian players is intense. Hurdles in the alcohol industry in the shape of heavy regulations, frequent changes in excise policies, state-level pricing controls and occasional state bans remain. Input costs for grain, extra neutral alcohol (ENA), glass and packaging are also volatile. Global trade friction is the new variable in this equation.

In this landscape, Radico Khaitan’s bet on premiumisation is both a growth opportunity and a test of whether an Indian company can build a true luxury spirits brand in a market where price still weighs heavily on consumer choice.

“Our focus is on the luxury and semi-luxury space, creating products the world desires, like The Spirit of Kashmyr vodka…Our target is that our P&A [prestige and above] category should grow by 15% annually over the next three years. The numbers will follow. Once volumes grow, operating leverage kicks in,” says Abhishek Khaitan, the company’s managing director.

The P&A category, which starts at around ₹700, contributes nearly half the company’s revenue. Of its record net revenue of ₹4,851.2 crore in 2024–25, ₹2,340 crore came from this segment. The semi-luxury (₹1,200– 4,000) and luxury (₹4,000 and above) segments contributed ₹350 crore and the company expects it to cross ₹500 crore this fiscal.

Brokerage firm Ventura expects the P&A segment to grow at a compound annual growth rate (CAGR) of 29% to ₹5,027 crore by financial year 2028.

The Crowded Top Shelf

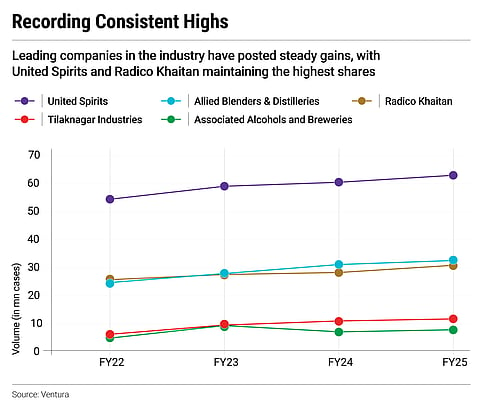

Radico is hardly alone in chasing India’s top shelf. Premiumisation is now the industry’s defining theme, with both global and domestic players expanding aggressively. Whisky remains king with a two-thirds market share, but gin and vodka are growing fast, driven by younger drinkers and cocktail culture.

With Rampur single malt and Jaisalmer gin, Radico is staking its claim alongside global icons while using these brands to anchor its export push. “Increased competition from domestic and international players are some of the headwinds for Radico,” says Sunny Agrawal, head of fundamental research at SBI Securities, a brokerage.

According to industry body Confederation of Indian Alcoholic Beverage Companies, Indian-made foreign liquor (IMFL) brands accounted for 32% of the premium segment (₹1,000) in 2019. By 2024, the share had risen to 40%, eating into the share of foreign brands, whether bottled in India or at origin.

Pernod Ricard and Diageo still dominate the whisky segment, where Chivas, Glenlivet and Johnnie Walker enjoy deep brand equity and distribution networks. But Indian single malts are emerging as strong challengers.

The fight is no longer confined to whisky. The craft gin boom has brought a flood of boutique players, (see Raising the Bar, pg 66) yet Radico’s Jaisalmer still commands more than half the luxury gin market, holding its own against imported labels such as Hendrick’s and Roku. Vodka remains another fortress: Magic Moments controls around 60% of the domestic market despite a host of new entrants.

Agrawal notes that Radico’s premium brands have outpaced its regular spirits portfolio, and new launches like Morpheus Super Premium whisky and The Spirit of Kashmyr vodka are expected to further accelerate growth. While rivals such as Indri and Amrut overlap on price, Radico’s whiskies are pitched slightly higher, giving it a chance to carve out a differentiated niche.

“Competition is the best thing that happens. When there is noise, larger players benefit. For example, in vodka, there were so many brands which entered the market. But we still hold 60% of the market,” says Khaitan.

From Bulk to Brands

If the battle for premium shelf space looks crowded today, Radico Khaitan has weathered tougher tests before. In the late 1990s, soon after a family split, Khaitan, then in his early 20s, stepped into what was then Rampur Distillery and Chemical Company.

The firm was mainly a bulk supplier, bottling for liquor manufacturer Shaw Wallace and supplying Contessa rum to the defence sector. When that contract ended, the business was left adrift. “That’s when my dad and I decided to get into branded liquor. We had the experience of producing the best liquor. The only thing we lacked was sales and distribution, which I had always been fond of. I was 24 at the time, with zero money and we recruited about 100 people, mostly in their 20s,” he says.

The craft gin boom has brought a flood of boutique players, yet Jaisalmer commands over half the luxury gin market, holding its own against imported labels

The gamble paid off. In 1998, Radico’s first label, 8PM whisky, sold over a million cases in its debut year. Premiumisation began in 2006 with the launch of Magic Moments vodka, whose packaging and positioning helped Radico crack an underdeveloped category.

If vodka opened the door, Rampur single malt changed the mindset. “It was difficult to convince the team to sell bottles priced at ₹8,000, ₹15,000, ₹35,000…But once they did it, they believed they could sell anything. That has been transformative. Rampur changed the mindset,” says Khaitan.

Since its 2016 launch, the company has tripled production capacity for Rampur and last year a bottle of Rampur Signature Reserve fetched ₹5 lakh at the Hyderabad duty-free.

Prestige in spirits, however, is slow to build. Sometimes it takes years just to perfect the blend. Khaitan points to Kohinoor, Radico’s soon-to-launch luxury rum. “The blend took us five years to crack. It’s like art. Sometimes you can’t force it,” he says.

Barriers Beyond the Bar

For all the buzz around premiumisation, Indian spirits companies face plenty of headwinds. The biggest is regulatory. Alcobev contributes nearly a quarter to most states’ GDP, yet each state sets its own rules, taxes and distribution model. For Radico, it means navigating what Khaitan terms “28 different countries”.

In an August 2025 report, brokerage firm Ventura warned that shifts in regulations can disrupt operations and sales. However, it also noted state governments’ growing dependence on liquor taxes may ultimately push towards more stable regulation in favour of alcobev producers. Execution risks, meanwhile, remain, especially for companies investing heavily in new launches and capacity.

Costs are another drag. Prices of grain, ENA, glass and packaging have swung wildly in recent years. “State-specific challenges, elevated inflation reducing disposable incomes in the hands of end-consumers and increases in key raw material prices are some of the main risks that can hamper brand growth. Mitigating them through improved product mix and effective cost control could help offset these challenges to some extent,” says Agrawal of SBI Securities.

Ventura added that Radico’s premiumisation strategy itself is a cushion, as high-end brands enjoy stronger pricing power. With input prices stable, it expects Radico’s margins to expand in 2025–26.

Exports present both opportunities and peril. “The US has implemented a 50% tariff on Indian goods, impacting brands like Rampur Jugalbandi. This could increase retail prices by $5–10 per bottle, potentially reducing competitiveness against Scotch and local American spirits in the US market,” said Ventura’s report.

This could erode competitiveness, even though for now, exports remain a small slice of the company’s revenue.

The India–UK Free Trade Agreement (FTA), on the other hand, is likely to be a tailwind. “The company’s estimated bulk Scotch requirement for 2025–26 is ₹250 crore and in three years, bulk Scotch imports are expected to cross ₹400 crore. The FTA is expected to lead to significant cost advantages,” Agrawal says.

Consumer behaviour is another wild card. India’s middle class is embracing cocktails, gin and craft spirits, but younger cohorts are also more health-conscious, with teetotalism on the rise in some circles.

Finally, there’s branding. With alcohol ads banned in India, companies must rely on surrogates, lifestyle extensions and word of mouth. For challengers in the premium segment, this makes building visibility harder.

Radico’s next big test lies overseas. “We have always said we are a proud Indian company, with the aspiration of making global brands,” says Khaitan. “If the Japanese could do it with Yamazaki, why can’t Indian malts?”

Premiumisation is a long-haul strategy. Asked about challenges, Khaitan says, “Honestly, earlier I could have listed 100 challenges. Now, I don’t see major challenges. The only question is: how big can our premium brands like The Spirit of Kashmyr become? It is a degree of success.”

As he looks ahead, his refrain is clear. “We have just scratched the surface.”