Apple CEO Tim Cook said that the majority of iPhones sold in the US will be from India.

It came just a day after the US announced a 25% reciprocal tariff on Indian goods.

Cook noted that most Apple products are temporarily exempt from tariffs since April.

Experts believe the tariff threat is largely a negotiation tactic and is unlikely to derail Apple’s plans in India.

Trump’s Trade Spat Fails to Deter Apple’s India iPhone Ambitions

Despite tariff threats, Apple remain committed to scaling up iPhone production in India. Experts believe the tariff threat is largely a negotiation tactic and is unlikely to derail Apple’s plans in India

A day after US President Donald Trump announced 25% reciprocal tariffs against India, Apple chief executive Tim Cook reiterated that, going forward, the majority of iPhones sold in the US will have India as their country of origin. He was speaking to analysts after Apple reported a 10% YoY growth in revenue, reaching $94bn—47% of which came from iPhone sales.

"In terms of country of origin, it is the same as I mentioned last quarter—there has not been any change. The majority of iPhones sold in the US now have India as their country of origin. As for our other major products—the Mac, iPad and Apple Watch—the vast majority sold in the US come from Vietnam. That said, for most international markets, the majority of our products are still manufactured in China," Cook said.

He also noted that the vast majority of Apple’s products are covered under the Section 232 investigation, which allows the US President to impose trade restrictions. Smartphones (including iPhones), computers and electronic parts have been temporarily exempted from the newly proposed tariffs since April this year. This comes as the US Commerce Department is investigating whether importing semiconductors and derivative electronics threatens national security. This probe is expected to conclude in a few weeks.

Earlier, some reports citing Indian government officials also referenced this investigation and expected exemptions for electronics exports to continue.

Experts Outlook Business spoke to believe smartphone exports are likely to remain exempt from tariffs—and even if they are eventually included, it is unlikely to alter Apple and other companies’ plans to scale up manufacturing in India.

"It is just a negotiation tactic," says Neil Shah, co-founder at Counterpoint Research, a market research and consulting firm. He also says even if India ends up paying 25% tariffs, it would still be far lower than what China is facing—so that would not make India any less attractive for companies. He further adds that shifting production to the US would take over a decade—especially for Apple, which uses hundreds of components sourced from across the globe.

Apple's India Push

Apple has scaled up its production in India over the last four years, says Runar Bjorhovde, London-based senior analyst at Canalys (part of Omdia, a global technology research and advisory firm).

“Apple’s build-up in India is not related to the tariffs specifically. It started in 2020 with two objectives. First, the Covid-19 pandemic became a very clear sign that Apple had an overdependence on China, so it launched the ‘China Plus One’ strategy to hedge the risk. Second, targeting the opportunity in India, as the market starts to lean more into premium and the middle class grows. As India is still highly price-competitive and offers great cost benefits for local production, Apple has rapidly scaled up its production in India,” he said.

This has helped India become the world’s third-largest exporter of mobile phones, clocking exports worth $20.5bn in calendar year 2024, according to a study by the Centre for Development Studies. The Economic Times reported that about $12.8bn worth of 2024 mobile phone exports were iPhones.

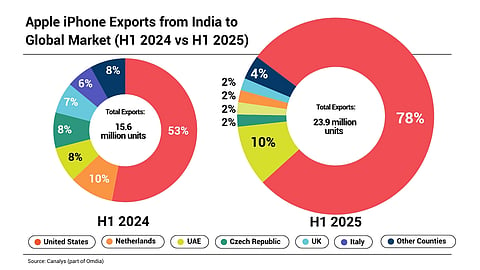

But these numbers shifted more dramatically in the first half of 2025, as Bjorhovde highlights.

“Apple went from around 20% ‘made-in-India’ share for its US supply in Q2 2024 to over 75% in Q1 2025,” he said. Not just Apple—Motorola also went from just over 1% to 35% in the same period, though the total volume is much smaller in comparison (around 1.1mn units in Q2). In the same period, Samsung went from 0% to 5%.

“Most of Apple’s frontloading happened in Q1 2025, which resulted in a massive 25% YoY shipment growth. Apple’s units ‘corrected’ in Q2 to decline 11%, where Apple has sought to maintain its inventory levels, which thus should quite closely reflect the end-user demand (or perhaps be slightly below if Apple reduced its inventory a little even though it still remained high),” Bjorhovde said.

Adding that Samsung was the vendor driving the frontloading in Q2 2025—as it is dependent mainly upon Vietnam for its US supply—there was a lot less urgency in Samsung’s case to frontload and it rather happened gradually in May and June, particularly for A-series models and the S25 Ultra.

Apple assembles its iPhones in Foxconn and Tata Electronics’ factories in India. Earlier, Canalys analyst Sanyam Chaurasia told Outlook Business that Foxconn supplies more than half of the 23.9mn iPhone units exported from India. He noted that Tata Group’s electronics unit now accounts for nearly four in ten iPhones exported from India.

Foxconn, operating under Bharat FIH in India, maintains manufacturing plants across at least three states—the oldest being in Sriperumbudur and Oragadam in Tamil Nadu. The company now plans to enter semiconductor manufacturing in partnership with HCLTech, with a proposed plant in Jewar, Uttar Pradesh.

Meanwhile, Tata Electronics also runs three iPhone assembly units. It launched a greenfield EMS facility in 2021, acquired Wistron’s operations in Karnataka in 2024 (now branded Tata Electronics Systems Solutions) and in January 2025 acquired a 60% stake in Pegatron’s India operations, including its Chennai-based iPhone assembly plant.

Production Stays Put

According to Mohammad Faisal Ali Kawoosa, chief analyst at market research firm Techarc, tariffs are now more or less similar across geographies.

“If we take China and India, there is a 5% difference now—and even India is advantageous because it is 25% only. It is not a very big delta now that brands will think, okay, let us set up somewhere else,” he said.

He added that this appears more like a pressure tactic, as the real trade deal conversation is still ongoing.

“Even if this 25% is the final number, the point is it is not going to impact us, because it is eventually being consumed in the US. Apple will either have to increase the cost of the phone there or see how they can absorb it. One of the good things for Apple is that in the US, most of it goes through operator-driven channels,” he said.

On July 31, Cook told analysts that the company expects a $1.1bn impact from tariffs this quarter—mainly due to those imposed on China under the International Emergency Economic Powers Act (IEEPA), which allows the US to levy tariffs citing extraordinary foreign threats.

“The Indian production is not going anywhere—it might just return to a more ‘split’ supply to different regions,” said Bjorhovde.

He added that the risk of a slowdown in Indian exports relates more to the overall health of the market—for example, if worldwide demand starts to contract.

“Apple is still scaling its production in India through Foxconn and Tata Group, so I do not expect this to slow down until Apple has reached the sweet spot balance it is aiming for between China and India. The greater risk for Indian production might actually be around making sure that there are sufficient engineers on-ground in India who can help support the production,” he said.

Apple’s supply partners still depend mainly on expertise flown in from China. It will take many years before this becomes resilient through the local workforce, as it is a question of experience, MScs and PhDs.