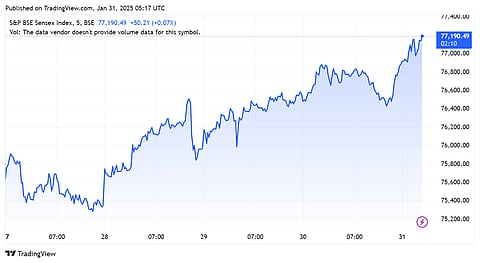

Sensex, Nifty Today: Just one day left for the budget to be presented in the parliament by Finance Minister Nirmala Sitharaman for the eighth consecutive time. For D-street investors, hopes remain high with benchmark indices— Sensex and Nifty— climbing for the fourth consecutive trading session.

Is the Budget Rally Finally Here? Sensex, Nifty Climb for the 4th Straight Session

Markets Today: Sensex and Nifty surged for the fourth consecutive session ahead of budget as market sentiment remains hopeful for favourable announcements

Nifty Auto came out on top as the best-performing sector on Friday morning, with the index surging by over 250 points. L&T, Titan, Mahindra and Mahindra, Nestle and Adani Ports were among the top-performing stocks in the Sensex pack.

At 10:30 am, BSE Sensex was trading at 77,135.58 level, up by 375 points, whereas NSE Nifty climbed by 140 points and was trading at 23,389.50 level.

The Finance Minister will be presenting the Economic Survey in the parliament today.

While market mood remains on robust ground despite subdued macros and not-so-great corporate earnings season, D-street analysts warn that this euphoria might be temporary.

"Since we are going into the Budget without a pre-budget rally, the probability of a rally, post-budget, will be high if the Budget delivers on growth-stimulating initiatives like cuts in personal income tax. But it is important to understand that the impact of the Budget will last only for a few days, at best," V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services said.

Volatility also remains a major concern for investors as the Vix has surged by over 16% since the start of 2025, touching a 6-month-high.

Market performance during last budget

Over the last five years, Nifty has plummeted four times ahead of the Union Budget. But last year was different as the market surged over 4.2% before the big day.

Overall, markets have largely remained under pressure over the past few months. The downtrend was largely owing to Trump's re-entry creating uncertainty in the geopolitical space, subdued macros, not-so-impressive corporate earnings and a declining rupee.

The medium to long-term trend of the market will be dictated by GDP and earnings growth. Therefore, investors should look for cues on these crucial macro trends," said Vijayakumar.