GNG Electronics, refurbisher of laptops and desktops, on Friday set a price band of Rs 225 to Rs 237 per share for its upcoming Rs 460-crore initial public offering (IPO).

The IPO is scheduled to open for public subscription on July 23 and conclude on July 25. The bidding for anchor investors will open for a day on July 22, the company announced.

At the upper-end of the price band, the company's market valuation is over Rs 2,700 crore.

The IPO is a combination of a fresh issue of equity shares aggregating to 400 core and an offer-for-sale (OFS) of 25.5 lakh equity shares by promoters worth Rs 60.43 crore at the upper-end of the price band. This takes the total issue size to Rs 460.43 crore.

Proceeds of the fresh issue will be utilised for the debt payment, funding working capital requirements and for general corporate purposes.

GNG Electronics is one of the leading refurbisher of laptops and desktops with significant presence across India, the US, Europe, Africa, and the UAE.

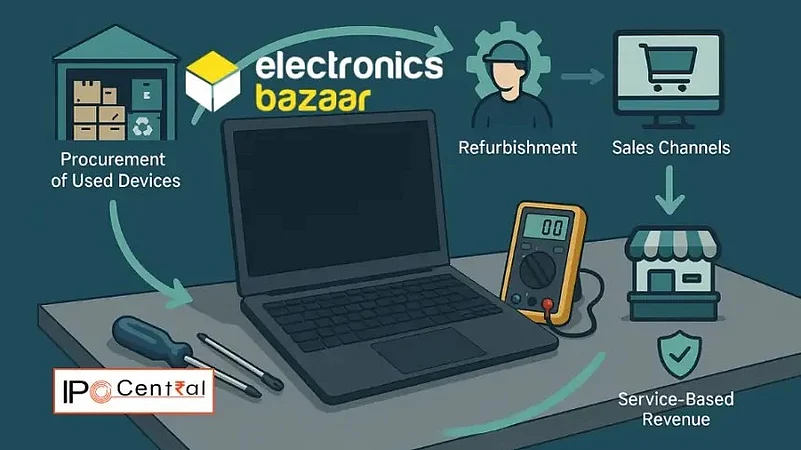

The company operates under the brand "Electronics Bazaar", with presence across the full refurbishment value chain from sourcing to refurbishment to sales, to after-sale services and providing warranty.

The company's comprehensive process of refurbishment of ICT devices such as laptops, desktops, tablets, servers, premium smartphones, mobile workstations, and accessories ensures that such devices are similar to new in terms of both performance and aesthetics.

Besides, the company is able to offer laptops at one-third price of new devices and other devices like desktops, tablets, servers, premium smart phones, mobile workstations and accessories at 35-50 per cent price of new devices.

Half of the issue size has been reserved for qualified institutional buyers, 35 per cent for retail investors and the remaining 15 per cent for non-institutional investors.

Motilal Oswal Investment Advisors, IIFL Capital Services, and JM Financial are the book-running lead managers to the issue. The company is expected to list on the bourses on July 30