Beyond the top five cities in Outlook Start-Up Outperformers 2023, the lure of the emerging cities is clear. Here, the competitive landscape is less saturated, allowing for easier market entry. Moreover, government initiatives and infrastructure development in emerging cities are attracting businesses.

“A thriving start-up ecosystem should focus on nurturing start-ups that can make a lasting impact on the economy, create jobs and drive innovation,” says Mahankali Srinivas Rao, CEO of T-Hub, an innovation hub in Hyderabad backed by the Telangana government. “Hyderabad has emerged as a powerhouse in the Indian start-up landscape because of factors like government support, a focus on emerging technologies, foreign investment, top-notch infrastructure, sector diversification and innovation-driven organisations,” he adds.

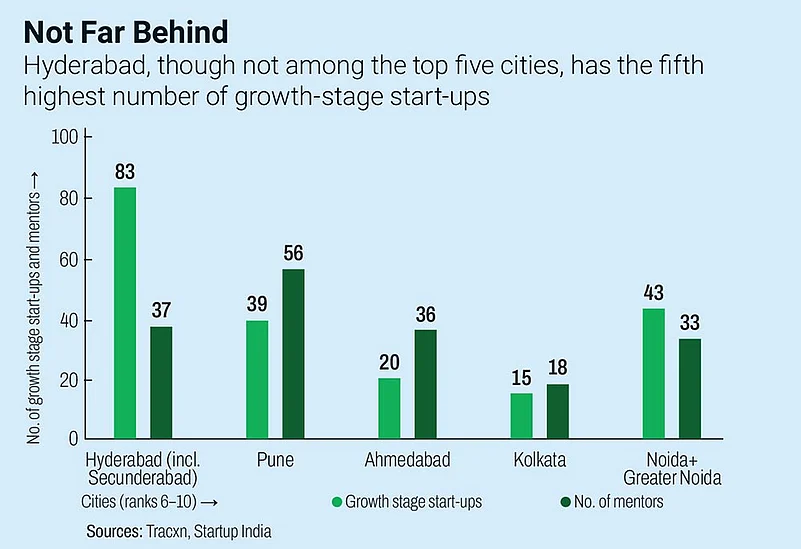

It is because of these reasons that a growing number of venture capital (VC) funds are based in the city, believes Srikanth Tanikella, managing partner of Pavestone Capital in Hyderabad. There are 10-odd such funds currently in the city, he points out. Hyderabad is fifth in funding and investment and human capital and seventh in knowledge edge. Also, it has the fifth highest number of growth stage start-ups and mentor institutions, right after Gurgaon.

Cites like Ahmedabad, Kolkata, Noida/Greater Noida, Jaipur, Coimbatore and Kochi have performed well on significant parameters in The Outlook Start-Up Outperformers 2023. “Over a billion Indians reside outside metro cities, comprising about 70% of the total market size in the country. Setting up operations closer to these markets gives start-ups a better understanding of local consumer behaviours and preferences, facilitating a more tailored approach to market strategies,” says Anirudh A. Damani, managing partner at Artha Venture Fund.

According to Navajith Karkera, who founded Rapture Innovation Labs with Jagath Biddappa in Hubbali, lower operating costs, access to skilled talent and the potential for growth outweigh the challenges involved in shifting out of metros, making it an attractive proposition for the growing number of founders who are willing to bridge the geographical gap through communication and occasional travel. Moreover, digital transformation has made virtual interactions and remote collaborations increasingly feasible and acceptable.

Shashank Randev, founder of venture capital firm 100X.VC, says, “With 50% to 60% of work being done online currently and easy coordination with Tier I professionals when needed, the appeal is clear. Within our own portfolio, which now encompasses over 140 companies, a substantial 35% to 40% are based in the Tier II cities,” he adds.

Shriram Subramanian, founder and MD of InGovern Research Services, draws attention to the Electronics Manufacturing Clusters (EMC) that the government is setting across the country, including in cities like Noida, Tirupati and Pune. “Similarly, the chemicals industry cluster has developed around Surat, Vapi and Ankleshwar in Gujarat and the pharma cluster is present in Hyderabad. These clusters matter to founders and investors because they will attract a talent pool. This is the most crucial ask for any start-up since it cannot always attract people from outside and pay for relocation,” he remarks.

The Sunshine to Make Hay

State governments are prioritising the creation of an enabling environment that fosters a conducive atmosphere for start-ups to thrive. For instance, the Karnataka Digital Economy Mission has collaborated with stakeholders, comprising financial institutions, venture capitalists and angel investors, to set up a Rs 75 crore seed fund as part of its Beyond Bengaluru initiative. This will promote budding entrepreneurs across three regional clusters—Mysuru, Hubballi-Dharwad-Belagavi and Mangalore.

The Maharashtra government has launched the Rs 200-crore Maharashtra Innovation and Technological Development Fund that will invest in deeptech start-ups, especially focusing on women-led entities. The state also has the Rs 120-crore Maharashtra Social Venture Fund, which the Small Industries Development Bank of India manages, and Rs 330-crore Maharashtra State Defence and Aerospace Fund, which leans towards spacetech start-ups specialising in satellite mapping, unmanned vehicles and drones.

Similarly, the Union government’s Chunauti initiative, a next-generation start-up challenge contest which is now in its fifth year, selects tech start-ups from non-metro cities, like Bhopal, Bhubaneswar, Bhilai, Dehradun, Guwahati, Jaipur, Patna, Mohali and Vijaywada, for incubation. Telangana too has come out with initiatives, such as TS-iPASS, a self-certification-based system for approvals and clearances, which exemplifies a business-friendly approach that reduces bureaucratic hurdles and expedites processes.

The establishment of Indian Institutes of Management and Indian Institutes of Technology in cities like Raipur, Rohtak, Udaipur, Kashipur, Tiruchirappalli, Ranchi, Shillong, Visakhapatnam, Jammu, Nagpur, Amritsar, Bodh Gaya, Sambalpur and Sirmaur is expected to produce a steady stream of skilled graduates, besides fostering a culture of entrepreneurship in these regions, with many start-ups being founded by their alumni.

Online education has further eased talent and skill acquisition, making geographical location less constrained. “This digital accessibility, combined with the physical presence of reputable institutions, is significantly contributing to making emerging cities viable options for start-up founders to set up operations,” Damani says.

A Hybrid Ecosystem

Over time, as emerging cities continue to develop their start-up ecosystems, it is plausible that they will establish more localised networks of investors and government stakeholders, reducing the need for frequent travel to metro cities. It is quite likely that start-ups here will grow to adopt a hybrid model with headquarters in metros and outposts in emerging cities. This approach allows them to tap into the talent and resources of both environments.

For instance, Noida-based Leverage Edu, which facilitates overseas education, plans to open offices in Thiruvananthapuram and Kozhikode in Kerala. Similarly, bike taxi service provider Rapido has extended its services to several emerging cities like Jodhpur, Udaipur and Varanasi.

“Adopting a multi-faceted approach that includes regulatory simplification, incentives, public-private collaboration and infrastructure development can help states in developing vibrant start-up ecosystem,” says Rao of T-Hub in Hyderabad.

Having their headquarters in metropolitan cities offers founders access to investors and large markets, while a foothold in emerging cities presents lower operational costs, access to talent and potential growth markets.