Angrez toh chale gaye par apni aulaad yahaan chhod gaye was never supposed to be a compliment but there is one angrezi thing that this country’s riders can’t seem to get enough of. No, weed apart, it is the Royal Enfield (RE) Bullet. In fact, the Bullet sends its owners into a deeper trance than weed. So strong has been the addiction that the market cap of Eicher Motors, which owns RE, is now more than that of marquee bike-maker Harley Davidson (HD). Bulls 1, Hogs 0. Almost everybody rides the RE it seems. So much so that a startup in Bengaluru called BBQ India offers barbeques on a Classic 500.

As a country, we have always been loud to the point of being garish, but the Bullet’s distinct thump matched its stately built. The Bullet also had machismo thrust on it as in its early days it was used by the army and the police. Due to their cantonment roots, Bengaluru and Chennai (manufacturing base) have historically had a high RE ownership. What added to the mystique was all these goras coming down to the north, hiring it and riding to Rishikesh or through the Delhi-Agra-Jaipur golden triangle. The mystique kept building until the rest of the country said in 2010, ‘I will have what she’s having’. Well, not exactly, but you get the drift.

The 2009 tweaks made the bike rider friendly. There was nostalgia, and born-again bikers waiting to take over. Mass players like Hero and Bajaj Auto were focused on the commuter segment because that’s where the money was. So when people wanted to move from the commuter segment to something bigger, there was no other bike in that segment, and RE was the natural option. Critical mass came to RE because it was already an aspirational brand. The numbers came in and they capitalised as the commuter segment was continuously growing.

Over the past eight years, RE has sold over two million bikes and now almost everybody seems to have one. There is no longer that exclusive machismo; it used to be a head-turner when the thump passed by. Even now, it is a head-turner. Now, you turn your head away as there happens to be one passing by every minute if you are in any high per capita income state like Delhi, Punjab, Haryana, Maharashtra, Kerala, Tamil Nadu, Karnataka or Goa. In that sense, it no longer has that novelty.

A cult in itself reeks of exclusivity; when everyone does or has the same thing, it is no longer a cult. At best, it is a smug mutual admiration club; at worst, it is a faceless mob at a peak hour railway station. People can sense your presence but nobody gives a shit. A Bullet is no longer niche and therein lies the positioning problem. For the buyer, it is initiation into a cult; for the company, the cult has been left way behind. Bullet is now a high-powered affordable commuter bike for those looking to replace their 100-150cc.

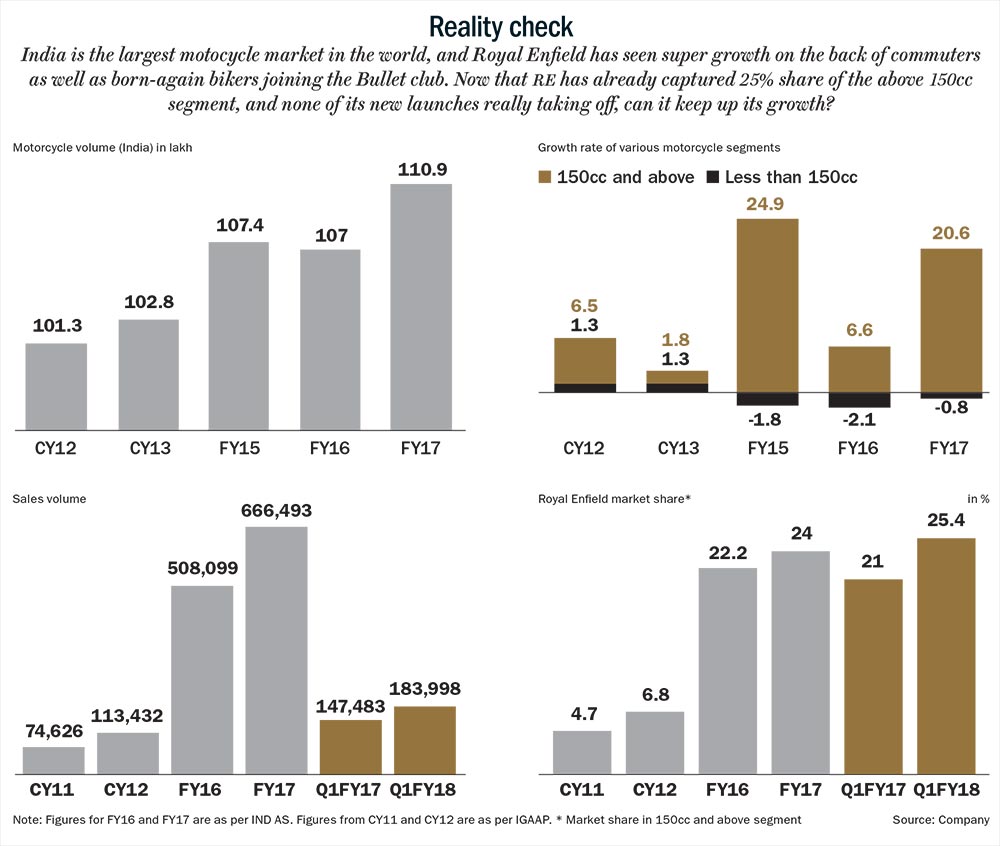

RE has been a remarkable financial success for a company which was almost sold for having a leaky bottomline and hardly any topline (see: Reality check). In the earlier days and even now, the build quality of RE is the subject of heated debate. Its perennially oil-leaking engine gave birth to lines like, “If it does not leak, it is not an Enfield,” which was then countered by aficionados with bluster like, “A Bullet never leaks; it just marks its territory.” Word-of-mouth counts for a lot in the biking community and riders still complain about build quality, service issues, the lack of a fuel indicator and so on, and yet the RE sells like hot cakes in a brutal two-wheeler market. Ask Mahindra & Mahindra, they worked at it for nearly a decade before giving up on the mass market having entered the business after acquiring Kinetic Motor Company. Commuter bikes get replaced in about five to seven years, and its vintage aside what has really worked for RE is the lack of a competitively-priced substitute in the 350-500cc segment. Mahindra Mojo did enter the segment but didn’t make much headway. Hormazd Sorabjee, editor, Autocar India says, “RE buyers are not buying a bike, they are buying into a community. It is very hard to beat RE in the 350-500cc space. If it could get any competition at all, it would be if HD came down into their segment, but that is a long shot.”

HD has its own issues growing in India but it did make considerable progress after launching the Street 750 and closed 2016 selling 4,241 cruisers. While its biggest markets continue to be Delhi, Mumbai, Bengaluru, Hyderabad and Chandigarh, even HD could not have thought that Kolhapur would turn out to be a big market, and that is where it recently opened its first concept store. HD pioneered community biking in the US and launched the Harley Owners Group in India in 2010.

In India, the caste system prevails everywhere. Even with bikers. The 100-150cc is entry-level commuter while the 350-500cc Bullet is for experienced riders with tashan. Every Bullet rider aspires for a Harley though. Show me a hot-blooded Bullet rider who does not lust for a Harley and I will show you Indian men who don’t have the hots for Sunny Leone but nevertheless express their affection in private. Mumbai-based Hariharan Venkataraman is an ardent biker and takes his Harley Street Bob for a spin unfailingly every weekend. He says, “Bullet is aspirational for a lot of people. But every Bullet-owner aspires for a Harley. If you ride a Harley, it means you have arrived!” Sorabjee smiles in agreement, “After riding a Bullet, most RE owners graduate to HD or Triumph. RE’s price is an easy access point into a certain biking lifestyle. It is the poor man’s Harley in a way.” Bulls 1, Hogs 1.

Even if its share is about 6% of the overall bike market, its own pervasiveness could prove to be a headache for RE. The incentive to own vintage significantly reduces when everybody has one or if there is a superior offering which overwhelms your need to belong. Bajaj Auto, which does know a thing or two about bikes, is doing precisely that by going for the jugular with its Dominar 400. In its latest commercial Haathi mat paalo that mocks the Bullet as an unreliable white elephant, it is targeting buyers who are migrating from the 100-150cc commuter segment. That very segment has been the source of RE’s stupendous growth over the past eight years. Anoop Bhaskar, CIO, IDFC MF says, “As income levels went up people wanted to upgrade from a 100cc bike and RE happened to be at the right time at the right place and benefited from it. Nobody could foresee it, not the company, not the analysts. Who would have visualised that the 120,000 volume would become 700,000 in five years time and that too at a price 4x Hero’s entry level?”

Dominar’s latest commercial did touch a raw nerve. Butt-hurt RE owners were soon ranting online about how the Bullet separates the men from the boys and how it is customary for dogs to bark as an elephant makes its way through. Yes, we do have our own online version of Hell’s Angels! A righteous Bull would also point out that not every RE bike is a Bullet and one cannot use those terms interchangeably like in this story. For all the talk of brotherhood, RE’s latest Himalayan Odyssey, the 14th edition had just 61 participants including six women. In comparison, Rider Mania held in Goa last year saw a bigger turnout. Guess the new crop of RE-owners fancy flat terrain and cheap beer more than the arduous Himalayas.

The fact of the matter is long before RE started branding itself using the HD community copybook, Bullet clubs like Inddie Thumpers and Rolling Thunder Motorcycle Club had already done the groundwork. That bonding helped sustain the mystique and machismo which pulled in a new breed of buyers when they were looking for a higher powered, affordable offering. All said and done, the RE is still your father’s bike. It more or less does look, sound, ride and occasionally breaks down like it did then. Been there, seen that, and if you are someone in 2017 who is still undecided on what next after your 100cc, there is a good chance that you may opt for something really sexy and powerful, not stodgy and steady.

That’s the reason the new-age Dominar 400 poses a real challenge to RE’s hegemony in the mid-market category and it could well do what Pulsar did for Bajaj Auto, i.e. give it a new lease of life in its segment. Bajaj Auto’s attack is two-pronged as it has tied-up with Triumph. About 4,000 Triumphs have been sold since launch in November 2013 and the above 500cc market is growing at 25% each year on a low base. Triumph wants to increase its assembly in India and the tie-up with Bajaj aims at that and more.

RE never had any competition in the cruiser space and other similar powered offerings like Mojo, Duke 390 and Honda CBR250R were not even seen as competition, given that they lacked vintage and killer pricing. The entry of the Dominar 400 seems to have changed that. Bajaj Auto has also put a cap on any RE price increase by pricing the Dominar 400 aggressively. “It was very difficult for KTM and others to attract Bullet buyers as the machismo associated with Bullet is absent in others. Hence Bajaj Auto had to design a completely new high capacity sports cruiser,” says Harley-buff Venkataraman. To build equity among riders for the Dominar 400, Bajaj is also borrowing from the HD copybook and engaging riders through weekend group rides called Hyper Rides and longer 10-day trips called Hyper Tours. Dominar 400 did get off to a lukewarm start but has since averaged 2,000 units a month. In contrast, RE sells 50,000 units a month.

What’s crazy is that for RE diehards, the Bullet’s flaws are a significant part of its appeal. “The Dominar might be technically a very good bike but you are buying a Bullet for its personality and character. The Dominar does not tug at the heartstrings like a Bullet does,” says Sorabjee. He feels the big bike culture is growing and something like Dominar 400 may actually grow the overall mid-market than take away market share from RE.

The classic problem

Along with sustaining growth after the capacity increase to 825,000, the bigger challenge for Eicher Motors CEO Siddhartha Lal is to prove that RE is more than just a one-trick pony. About 80% of RE sales come from the Classic 350 and Bullet 350 and waiting period for the best-seller is now down to two months. Joseph George, analyst, IIFL in his report states that the falling order book poses risk to FY19 growth. “Our dealer checks put the waiting for the Classic 350 at 15-60 days and that for Bullet 350 from 0-30 days. This implies that the total order book has come off to 80-90k vs. ~150k at FY16-end. As the company commences production at its third plant, we expect this order book to deplete largely by FY18-end. To achieve 15% growth in deliveries in FY19, new orders (which is < deliveries) would need to grow 30% YoY in FY19. This looks difficult, in our view.” RE therefore needs to desperately crack a new market or launch a new model to re-energise the cult and keep its growth engine revving. The new models launched in the past three years, Continental GT and Himalayan, haven’t taken off. In fact, the Himalayan continues to be dissed for its poor build.

But in the last analyst concall, Lal said that the Classic 350 concentration is not something to worry about. “We are delighted that we have such a strong franchise and people are so interested in buying the Classic. We will continue to do a lot of work on other models and build them up as well but as long as people are buying Royal Enfield, we do not mind which one it is that much,” Lal remarked. Despite repeated follow-up, the company did not respond to questions addressed to CEO Siddhartha Lal. Former CEOs RL Ravichandran and Venky Padmanabhan also declined to participate in the story.

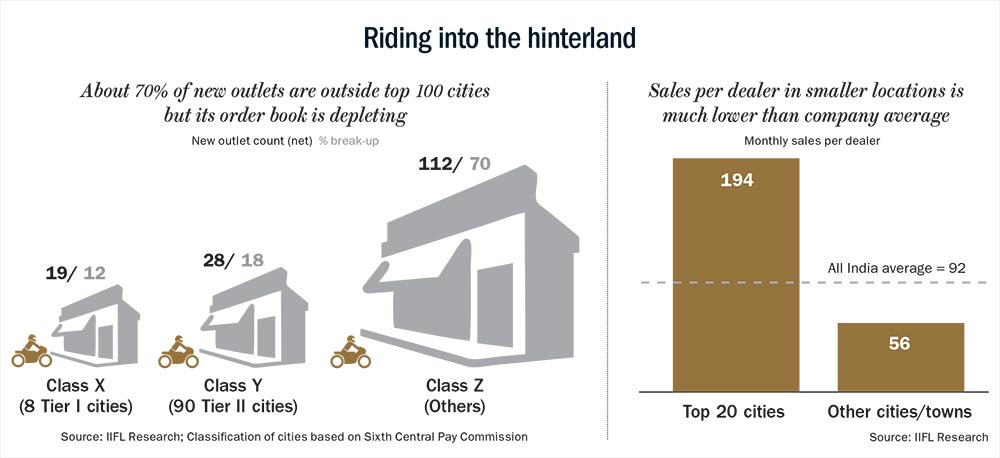

Lal’s remarks grossly underplay the concerns brought forth by George. RE’s growth strategy has so far been a mix of deepening distribution in the Indian market and focusing on exports. It is targeting a dealer network of 825 by FY18 but George feels the strategy of going deeper might not pay off. He points out, “RE’s dealer network expansion over the past 15 months reveals that 70% of the new dealerships are outside the top 100 cities (classified Tier I/II). Outside these cities, volume per dealer is much lower than the company average. As the company expands into smaller towns/villages, dividend from network expansion will reduce materially [see: Riding into the hinterland].” This concern over distribution is also something that does not bother Lal as he believes India has a big enough market. “Any market that sells Maruti or Hyundai should be able to take Royal Enfield dealership. It is a better proxy than some of our two-wheeler compatriots who actually may have 30,000-40,000 motorcycles or mopeds or something which really is not relevant for our audience,” he said, replying to an analyst’s query.

IIFL’s George has a ‘reduce’ rating on the stock with a 12-month price target of Rs.24,700, but Edelweiss’ Chirag Shah has a price target of Rs.34,891 citing, ‘Management is confident of strong domestic demand. It believes, more number of players will expand the market. Also, management has been sharpening focus on states where its presence is low. This is likely to add new catchment areas. Operating leverage from higher scale is yet to reflect as Eicher Motors is in investment mode in export markets.’

Around the world

Lal is cognisant that investors expect him to pull out growth from his custom-built RE helmet. That growth could either come from selling more by penetrating deeper into the market or tapping other two-wheeler markets which have the same characteristics as India. That is why he has narrowed down on Thailand, Indonesia, Colombia and Brazil where there is a very large commuter motorcycle market. The gameplan is to repeat the same success it has achieved in the Indian market by positioning itself as an affordable cruiser for those graduating up from commuter bikes. The only hitch is that RE does not have the same name recognition or heritage that it enjoys in India and hence the brand building has to be ground up.

Even with developed markets, Lal knows that breaking in those markets would require higher-powered bikes. In an earlier analyst concall, he reiterated, “The big five — UK, Germany, France, Italy and Spain — each has about 50 dealers, most of them are multi-brand. We are selling well in some of these markets but the size of the market is low. The market is normally slightly higher powered motorcycles which we do not have in our portfolio as yet. So that means we are still a niche player here rather than a mainstream player, which we plan to be in developing markets.” In the 750cc and above, RE is the outsider with unproven credentials and hence Lal is clear that he wants to rule the 250-750cc segment worldwide.

Staying with exports, the US is also a market that RE wants to crack, given its affinity for biking. The US is also a quaint market in the sense that it is heavyweight motorcycles that dominate there. No self-respecting American rides a bike less than 750cc as he does not want to go through the trauma of being overtaken by a truck. Not that it has stopped RE from upping the ante. In November 2016, it opened its first retail outlet in Milwaukee, Wisconsin, which also happens to be where Harley Davidson is headquartered.

It may have set up base in Hog territory but RE has a long ride ahead of it. As Ryan Farrick, who bought a 2014-built RE 500 (in early 2016), writes on Quora, “At least in the United States, Royal Enfield is regarded as something of a niche bike. They have a reputation for being unreliable, prone to breakdowns, and good for little else than casual jaunts around town.” In the US, RE sells Classic, Bullet and Continental GT priced between $5,000-$6,000 and will soon add Himalayan to the range. Rod Copes, a Harley Davidson veteran who heads RE North America had in an earlier interview with Forbes dismissed similar comments saying, “There’s a lot of banter out on the internet, a lot of old wives’ tales about Royal Enfield over the past 15 years, in the United States. But in the last three to five years, Royal Enfield has really taken their quality and process control and manufacturing to a whole new level.”

Buyers in India still rant on RE’s Twitter handle about service centre issues and defects that they face, but the Bullet continues to trudge on. Farrick, who has spent considerable time in India, adds, “I don’t regret buying my Royal Enfield, but I will never, ever buy another. If my experience is any indication (or the many horror stories posted online), Royal Enfield is still building a beautiful vintage bike with outdated, vintage parts. If you live in India then you might not have as many issues. The RE really seems to struggle above 65mph/104kmph, which you’re unlikely to hit regularly in most Indian cities. But it’s completely outclassed by the Honda CBR250RR or just about any other mainstream Japanese bike, in regard to performance as well as reliability.”

Unlike India where the RE has become a cult despite its shortcomings, export markets like the US are unforgiving towards bad quality or defects. What has really worked for RE in India is its vintage appeal and pricing. That could work in other markets as well if its reliability improves. Even in the US, they are competitively priced compared with the cheapest Harley or the hot-selling Scout Sixty. Sorabjee concurs with Farrick but doesn’t dispute the potential overseas demand. “There is a huge appeal outside but they need to nail the quality. It is retro and has the cost advantage but it needs refinement as there is a big reliability gap between Enfield and the Japanese bikes. Right now the bike appeals to the heart, if they improve it to appeal to the head, it will be a powerful combination.”

Lal is aware that along with harvesting a new crop of buyers every year, RE also needs to upscale. That is what Harley Davidson did very well given its stupendous range until changing demographics and improved competition caught up with it. Assuming a replacement cycle of five-seven years, those who bought a RE in 2012 could soon be looking for a more powerful bike to ride on.

The Interceptor 750, an improvised version of the Continental GT, is reportedly RE’s next big launch that will catapult it into the league of Harley Davidson. It is critical for RE that its first 750cc offering pulls in decent volume as the Continental GT and the Himalayan have failed to click even with RE old-timers. Lal mentioned in the last analyst concall, “It will be absolutely highway worthy, and therefore it will bring us out of a niche segment in a lot of faster international markets. It has to be extremely relevant for the upgrading market in India… We have to have something substantially different from our existing offering to capture the imagination of existing customers.” It will also be a test of its UK technology centre that Lal has set up in his quest to become a prominent global player in the 250-750cc space. Along with Simon Warburton (ex-product planning head at Triumph) who now heads product development in the UK, Lal had also roped in Pierre Terblanche, Ducati’s former design head, but Terblanche left after working with RE for about two years in August 2016.

RE’s FY17 export volume was 15,383, 2.3% of the total volume of 666,493. Of the total revenue of Rs.7,038 crore, Rs.222 crore was from exports with spare parts and services contributing Rs.581 crore. The export market may be a priority for Lal but the beauty of a two-wheeler market like India is the huge replacement demand. Given that a million 100-150cc motorcycles come up for replacement every year, RE is ramping up production from 60,000 to 85,000 a month to capture as much of that demand as it can.

Asking for the moon

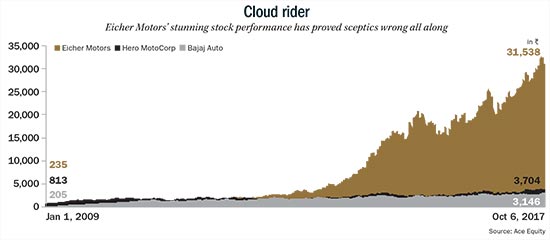

It is not kosher to cast aspersions on a market darling and Eicher Motors has been one for a while. But with great market cap comes great expectation and at the current lofty valuation there is not much room for error. RE has continually surprised investors with its growth and many an investor sold thinking that the growth was about to taper, only to regret in hindsight. From July 2015 to January 2016, the stock slumped from its all-time high of Rs.21,000 to Rs.15,000. Guess why? The same concern being aired now: a possible growth slowdown. Thereon the stock rose phoenix-like and doubled in eighteen months to hit a new all-time high of Rs.33,500 (see: Cloud rider).

Bhaskar was among those who sold out ‘early’ and then just watched the stock go stratospheric over the following years. “The feeling always was that the growth can’t sustain as there wasn’t much coming in from the heavy-duty trucks side. Nobody was sure and none of the analysts could convince you that this growth would last beyond three years as the truck business was going nowhere. And we were all fixated on the truck business,” he recalls.

That fixation has come full circle and now analysts and fund managers alike cannot have enough of RE. So much so, that some analysts devote barely a couple of lines to VECV in their research report. Even in the overall sum-of-the-parts valuation, VECV is only 10% of the overall price. VECV does not get much footage either in the annual report or on Lal’s Twitter handle. What the heck, we do not have a VECV chart in this story either. Bhaskar says VECV’s current market share is due to a market peculiarity which he sums up thus: “Once the Indian consumer labels a product to a certain brand, the brand becomes as much a prisoner as king of the category. Growth then is a function of whether the category will grow or not. People unblinkingly buy a Hero bike and a Honda scooter but they won’t as readily buy a Hero scooter or a Honda bike. Transporters buy a 12 tonne from Eicher but a 25 tonne from Ashok Leyland.”

When Lal partnered with Volvo for VECV, the intent was to use Volvo’s technology and make a dent in the heavyweight segment dominated by Tata Motors and Ashok Leyland. However, major success has continued to evade VECV and even today it has just 5% of the heavyweight market. Bhaskar says, “Eicher’s first heavy-duty truck called Jumbo failed and the company has since found it hard to shake that perception off. The Volvo tie-up hasn’t really helped as bulk of the sales still comes from 5-15 tonne. In Q1FY18 they sold 1,407 heavy-duty trucks, down from 3,205 in Q1FY17 quarter. The initial target was to sell 1,000 trucks a month.”

VECV revenue did move up from Rs.7,737 crore in FY16 to Rs.8,549 crore in FY17 but net profit barely moved from Rs.339 crore to Rs.343 crore with Ebitda margin at 8%. Given that VECV continues to be a laggard, does it make sense for Lal to hive it off and focus only on RE? Lal is no stranger to divestment. When he was handed over the reins at Eicher, he sold off all the businesses that were not doing well, including tractors, to focus on RE and the LCV arm, for which he partnered with Volvo for VECV. Making RE a world-leader in the 250-750cc segment is a professed obsession for Lal and his energies are better deployed tending to a 30% Ebidta business than one generating 8%. Besides, a pure-play growth machine could possibly sustain the premium multiple that Eicher currently enjoys.

Apart from VECV, Eicher Motors has another tie-up with Polaris Industries that doesn’t get talked about much. The joint venture produces Multix, which resembles a crossed-version of Mahindra Gio and Tata Magic Iris. Coincidentally, Polaris also owns Indian Motorcycle and its 900cc offerings complement RE which wants to rule the 250-750cc segment. Given that there is no great headway still with Multix, it is Indian Motorcycle that Lal could eventually find more interesting. In any case, there is too much attention on Ducati, forget the unions, there is real bidding competition from HD, private equity firms, you name it. And given Volkswagen’s disinterest, Ducati will change hands for sure, the union opposition notwithstanding.

What might make the Indian tie-up/acquisition easy is that motorcycles is not a core business for Polaris, it recently shut down its Victory range of motorcycles and Indian could be on the block soon. While it accounts for 10% of sales, its gross margin is the lowest at 11% compared to the other businesses. Polaris also has balance sheet issues and its stock tanked sharply after as many as 10 class action lawsuits that alleged that it misled investors over the financial impact of a series of recalls over its Sportsman ATVs. It also had to recall about 24,000 Indian motorcycles due to a potential fuel leak. Amidst its woes, Polaris would rather focus on its core business and get rid of motorcycles. The hard work for Lal lies in figuring out how to bump up the gross margin at Indian.

Eicher Motors’ current market cap of $13 billion is twice that of Polaris at $6.5 billion and whose revenue is $4 billion. Even Harley Davidson’s market cap now stands at $7.8 billion with a P/E of 13.5x, CY16 revenue of $6 billion and a 11.5% net margin. HD’s sales are taking a hit. The 999cc Scout Sixty from the Indian stable is doing much better, priced at $9,000 compared to the cheapest Harley Street Rod starting at $8,700. There is no rebranding headache either for RE; the brand is called Indian. It has heritage and history that matches that of Royal Enfield. Existing RE riders can graduate to the Indian brand with a sense of pride, never mind the Red Indian logo. Lal sure has global ambition and no global play is complete without a major deal that offers footprint or a new customer segment.

For now though, RE needs to get its 750cc play right or the Classic 350 concentration will come back to bite. In good times investors don’t complain about anything but in bad times everything gets run through a toothcomb. Bhaskar explains, “The past two years’ growth has come from distribution expansion. If you can only grow by expanding distribution it’s a dangerous territory to be in. If the waiting period for its best-seller comes down further from the current level, then the stock could see a de-rating.” At its current price of Rs.31,500, Eicher trades at 33x FY19 estimates. That multiple pencils in a 20% annual growth in sales volume. Over the years RE had the wind on its back but with increasing competition it can no longer afford to take its stupendous growth for granted. When you can no longer milk nostalgia, sheer performance is the only thing that can power you ahead.