When it comes to mosquito repellents, India has a pretty wide variety to offer — vaporisers, mats, coils, aerosols, gels and creams. And given the country’s tropical, bug-friendly climate, they’re all used well and frequently, right? Wrong. About 56% Indians don’t use any mosquito repellent at all, a number that climbs to an alarming 72% when it comes to rural households. Those are uncomfortable numbers for Godrej Consumer Products (GCPL). The market leader in the Indian household insecticides market, like its peers, has been unable to exploit the full potential for its products in rural India.

The gap can be attributed to unfavourable price points and lack of electrification in villages, believe analysts. That automatically rules out vaporisers and mats, leaving the old-fashioned mosquito coil as perhaps the only option. But not only does it emit smoke, it isn’t exactly cheap, either.

Which is where GCPL’s new product comes in. Good Knight Fast Card, which will be formally launched in early October, is a strip of paper that burns for three minutes and claims to keep mosquitoes away for four hours. Jointly developed by GCPL’s research teams in India and Indonesia, the product is sold in Indonesia under the Hit Magic Paper brand name. The new repellent ticks all the important boxes — doesn’t emit smoke, doesn’t require electricity and is cheaper than coils. “Mosquito repellent coils cost close to ₹2.5 per night. But the new repellent will cost ₹1 per strip. GCPL has broken a price barrier. This will help the company increase penetration,” says Harsh Mehta, analyst, HDFC Securities.

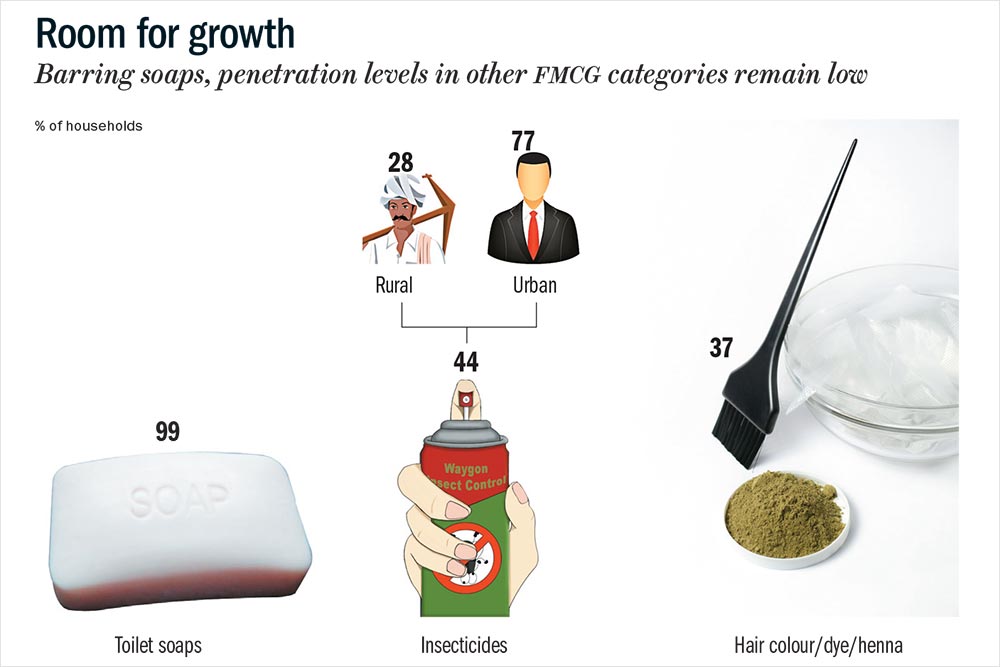

The ₹3,200-crore household insecticides market in India has been growing at 10-15% during the past three to four years and GCPL, for the most part, has been twice as fast. Currently, 44% of the company’s revenues come from this category, of which a third is from rural markets. Will the Fast Card help GCPL pick up even more speed? There’s the threat of cannibalisation, after all, since the company sells coils under the Good Knight and Jet brands. While that’s a risk, Mehta remains positive. “Competitor coil users might switch, too. Also, while margins are not known, they will certainly be higher than coils,” he points out.

The timing is off, says Anand Ramanathan, associate director, KPMG Advisory. “This is a seasonal product. The monsoons, when mosquitoes thrive, would have been a better time for such a launch,” he explains. Moreover, a product like this, while it has the potential to disrupt the market, also requires more marketing effort. Customers will have to be educated on how to use the product, Ramanathan adds. But if GCPL gets the pricing right, that may be enough to get the job done.