Xerox has many admirers. The American company transformed the computer industry with its Palo Alto Research Centre, better known as PARC. But, few want to be its photocopy. The multinational, bogged down by its daily operations, failed to see the potential of the first personal computer with a graphical user interface and mouse, connected to the Ethernet. It had dibs on the personal computing space and internet boom, basically on El Dorado, and blew it. Clearly, no company wants that to be part of their history.

However, big companies still find it difficult to keep up, even in India. “None of the IT companies have been innovating internally in India. They continue to be masters of legacy technologies, which are becoming less relevant,” says V Balakrishnan, who has worked at Infosys as a board member and CFO for a decade, before founding Exfinity Venture Partners. He is talking about the likes of Infosys, Wipro, TCS, HCL Tech and Tech Mahindra, the software behemoths that have risen in the country over the past three decades. Their clients now want more, like robotic process automation, machine learning, Internet of Things or blockchain, but sadly, the Indian IT leaders haven’t always been up to the task.

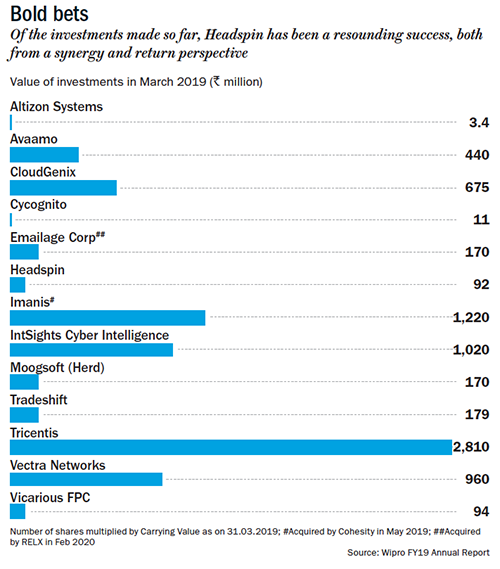

One of the country’s biggest IT firms is trying another tack. It created Wipro Ventures in 2015, to race into the future. After all, the parent caters to the top 1,000 global corporations in enterprise IT. Since it was setup, the $100 million-fund has bet on 16 start-ups over the past four years (11 in US, four in Israel, and one in India) across sectors such as aerospace, automotive, education, communications, healthcare and retail. These include Altizon Systems ($1.3 million), Vectra AI ($8.7 million), Sealights ($8.6 million) and Tricentis (See: Bold bets).

Wipro is not alone. Infosys raised $500 million for the Infosys Innovation Fund in 2015, and has done eight deals so far. Global biggies are on this path, too. Cognizant has Cognizant Accelerator Ventures, which buys minority stake at an early stage. Similarly, IBM Ventures which was founded in 2000 has made 28 investments till date. The Wipro fund, created at the instance of scion Rishad Premji, is now looked after by managing partners Biplab Adhya and Venu Pemmaraju. Wipro Ventures’ aim is to influence solutions (being built by start-ups) before they mature, and this helps Wipro build strong relationships with companies that are strategically important, according to Pemmaraju.

Wipro is not alone. Infosys raised $500 million for the Infosys Innovation Fund in 2015, and has done eight deals so far. Global biggies are on this path, too. Cognizant has Cognizant Accelerator Ventures, which buys minority stake at an early stage. Similarly, IBM Ventures which was founded in 2000 has made 28 investments till date. The Wipro fund, created at the instance of scion Rishad Premji, is now looked after by managing partners Biplab Adhya and Venu Pemmaraju. Wipro Ventures’ aim is to influence solutions (being built by start-ups) before they mature, and this helps Wipro build strong relationships with companies that are strategically important, according to Pemmaraju.

Calculated risk

Analysts say that the parent has smartly moved the risk to Wipro Ventures, and the reason is their size. “Large companies, especially publicly listed ones, don’t have much leeway in terms of making very risky moves internally. So they hive off the risk to an external third party, where the pace of innovation is going to be faster,” says Sanchit Vir Gogia, founder, Greyhound Research.

The portfolio companies are therefore chosen with extra care. Unlike the usual VCs, Wipro Ventures is chasing both strategic and financial goals. Adhya says they have a set checklist in place. First, they invest (between $1 million to $10 million) only in enterprise software, fintech and healthcare IT start-ups, as dictated by the emerging needs of the existing customers of Wipro. Two, they only pick early to mid-stage companies with generally available products and paying customers. They typically participate in start-ups that are in rounds A and B of funding. Balakrishnan says that investing early is important if you are in this game with strategic objectives. “Early and strategic stakes guarantee better access to the start-up’s technology and relatively higher influence,” he says. Three, the fund bets alongside other institutional investors who have the ability to lead a round, whenever it is appropriate.

Pemmaraju explains the process with the example of Headspin. Wipro Ventures took a minority stake in the San Francisco-based start-up in 2017. Founded in 2015, it is a mobile app testing company, backed by Google Ventures. Its platform allows an application developer to test an app and fix bugs, without writing any code, before releasing it. Meanwhile, Wipro runs a quality engineering and testing business, which counts British American Tobacco, Vodafone Qatar and CLK Enerji as its clients and contributes 12% to the revenue. Headspin’s solution was found to be a perfect fit, since it helps the client manage the performance of their mobile platform.

Headspin was reported to be seeking a unicorn valuation of $1.2 billion in its latest fundraising round, in December 2019. But, this is not just a one-way street. Wipro’s collaboration also helps the start-ups, like it did with the go-to-market (GTM) campaign for each industry vertical such as retail, telecom and banking. “Through a successful joint GTM campaign, we were able to deploy the Headspin solution in several Fortune 1000 corporations, globally,” says Pemmaraju. Such a campaign would require a lot of money, which young companies are likely to be short of. Balakrishnan says the biggest problem for start-ups is sales and marketing. “They may have a good product backed by good technology, but they don’t know how to approach global enterprises. That is a totally different ballgame, and it also costs a lot,” he adds.

The partnerships help Wipro meet evolving needs of its enterprise clients and, at the same time, improve the valuation of a start-up by adding more customers. A shining example is that of Demisto, which was acquired by Palo Alto Networks for $560 million in 2019. Demisto focuses on security orchestration, automation and response (SOAR) tools, which are hot in the cybersecurity space. Wipro was looking to partner with a next-generation SOAR platform, when it ran into Demisto. The start-up had automated playbooks designed to reduce human review on security alerts. Wipro Ventures’ cybersecurity and risk service (CRS) team started working with Demisto from early 2017, and over two years, both the companies jointly won over several Fortune 1000 customers. It gave Wipro a reputation of being at the cutting edge and, Demisto, substantial revenue and customers. “Given that we were an early investor in the company, this transaction helped realise a healthy return on investment,” says Pemmaraju.

Rishi Bhargava, the co-founder of Demisto, recalls pitching their then small cyber security start-up to Wipro Ventures in 2016. The fund was evaluating next-gen platforms to power Wipro’s global Security Operations Centers (SOCs). Bhargava says those early discussions convinced them of the start-up’s fit, and Wipro Ventures invested $20 million in Series B equity financing.

It is not easy for a global technology services company to work with a small company, but Bhargava says the fund’s managing partners were a fantastic go-between. “They ensured that the relationship was prioritised, brought relevant domain expertise and also helped us build a close working relationship with the sales team of Wipro’s cyber security enterprise,” he says.

Another investment, Imanis Data (in which Wipro invested $4.5 million) was acquired by San-Francisco-based unicorn Cohesity for an undisclosed amount. Wipro’s latest exit is going to be Emailage Corp, acquired by RELX for $480 million in February 2020.

Computing Challenges

The fund run by Wipro’s bigger peer, Infosys, hasn’t been as successful, according to analysts. It offloaded its minor stake in artificial intelligence firm UNSILO for $800,000, which is far lower than the $2 million it had invested in the Danish company in November 2016. Its second known exit was from ANSR Consulting Holdings, which helps multinational companies bring global captive units to India. It sold its stake for $1 million, lower than the $1.4 million it had invested. Infosys’ fund has also seen departure of several heads and has also remained headless for almost a year.

Balakrishnan says that there has to be clear thinking, effective integration and it should be pushed from the top to make it work. “The biggest challenge may be to find a person of authority within the company, who can be a chain manager and make the investment connect with different verticals, in order to see what is relevant and take it to the market,” he says. Wipro’s fund has done better also because it is an initiative of Premji, driven by two fund managers who enjoy the confidence of the Wipro chairman.

The managing partners have also had their share of learning. Adhya says that they understand the importance of ‘right integration’. “For a small start-up, working effectively with a large organisation such as Wipro can be challenging,” he says. The two managers of the fund believe that they have to invest in the right founding team, with the right expertise and team chemistry. While picking co-investors, they choose people who are committed for the long run and have relevant domain expertise. And, as the young company grows, they hire the next level of leadership. “Eventually, the right sales team makes all the difference,” adds Adhya.

Pemmaraju backs this. “In almost all cases, a start-up that is not doing well has challenges in sales, specifically related to issues such as ineffective lead generation, friction in the sales process and not being able to do a proof-of-concept quickly. This leads to the value of the product not being clearly demonstrated in a short period of time,” he explains.

These collaborations sound like a great strategy, but there are fault lines. As per analysts, in the venture investing game, four or five out of 10 completely fail, two or three return what was invested, and the remaining one or two are likely to give a blockbuster return. Pemmaraju admits that there can be challenges, such as a start-up not doing well or the developing of friction between the two organisations. But, they try to get a handle over the problem and work with the start-up to solve that. The duo says, once they identify the issues that are limiting the growth of the company, they work with other co-investors and the management team to affect a change.

Despite their progress, Balakrishnan says Indian players including Wipro are a bit late in the game. “IBM, Accenture and some other large service providers have been doing it for some time now, and they have put a lot of money in the start-up ecosystem. That is where all the innovation is happening,” he says. And, analysts add that Indian IT players are also losing their biggest advantage — labour arbitrage. Automation (or bots) is taking away a lot of processes. “The writing on the wall is that labour arbitrage alone will not get you dollars anymore. When you go in and have a conversation, it is expected that you already have competencies in blockchain, IoT and automation,” says Gogia. Indian IT companies have had to lay off close to 20,000 workers in just one year, and industry body Nasscom fears one-third of all tech jobs (or one million people) in India could be at risk in the next five years, for want of the right skills.

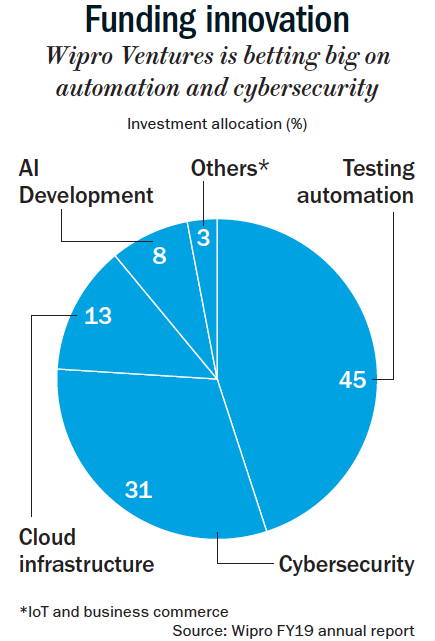

The investments made by Wipro Ventures (15 out of 16) reflect this scarcity (See: Funding innovation). They are in companies founded either in USA or Israel, which are advanced markets, and only one is in India. “The evolution of B2B SaaS companies in India has been slower. Typically, a lot of start-ups happen around the B2C arena. India continues to do that but over the past couple of years the focus on enterprise SaaS has been very, very high,” says Gogia.

The investments made by Wipro Ventures (15 out of 16) reflect this scarcity (See: Funding innovation). They are in companies founded either in USA or Israel, which are advanced markets, and only one is in India. “The evolution of B2B SaaS companies in India has been slower. Typically, a lot of start-ups happen around the B2C arena. India continues to do that but over the past couple of years the focus on enterprise SaaS has been very, very high,” says Gogia.

Another go

Whatever the drawbacks, Wipro Ventures is happy with what they have achieved so far. To their credit, they have managed to co-invest with the giants, including Cisco, Google, Facebook, Amazon and Tesla, across portfolios. They have stayed put in 13 out of 16 investments from the first fund, with three exits so far.

Enthused, the team has raised a second fund of $150 million in January this year. Wipro will use this to invest in early and mid-stage start-ups worldwide, which are building enterprise solutions in cyber security, analytics, cloud infrastructure, test automation and AI. If the boom in B2B business and the drive shown by the fund’s leadership team remain, Wipro can do a Rajinikanth. “Late-ah vandalum, latest-ah varuven.” (Baasha, 1995) Late maybe, but ‘latest’ always.