Dave Thomas first set foot in India in 2001, wandering the lanes of Varanasi and Haridwar. It wasn’t until he came back a decade later that he was smitten with the hills of Uttarakhand. That’s when the thought of living and working in India crossed his mind.

An Adidas veteran for over 20 years, Thomas worked in markets as diverse as Germany, Japan and Dubai before being appointed the managing director of Adidas India in October 2015. It wasn’t a great time for the burly Australian to take charge. Financial irregularities at Reebok India had been plaguing the brand for over three years.

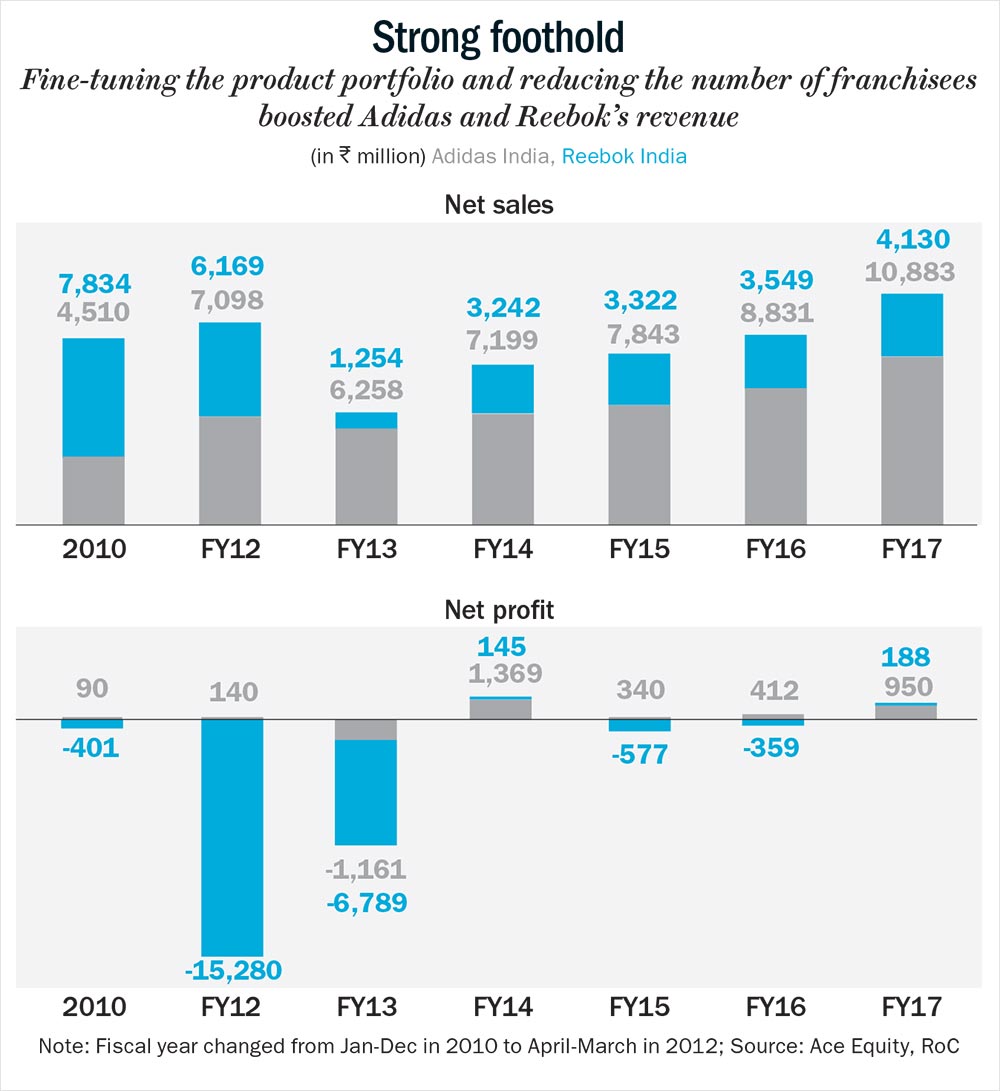

Adidas had acquired Reebok for $3.8 billion in 2005, but the India operations of the two brands were kept separate till 2011. The latter had accumulated losses of over Rs.20 billion. Adidas, meanwhile, had just started making a profit, albeit a small one, of Rs.90 million in 2010. The headquarters still believed in the Indian market, but the company was unable to make a serious headway despite being operational since 1995. “We were trying to do everything, measuring ourselves on points of distribution, regardless of whether it was helping build the brand or not,” says Thomas. “My mandate was to reset, clean up and stabilise the organisation. It was time to shake things up.”

Fresh stocks

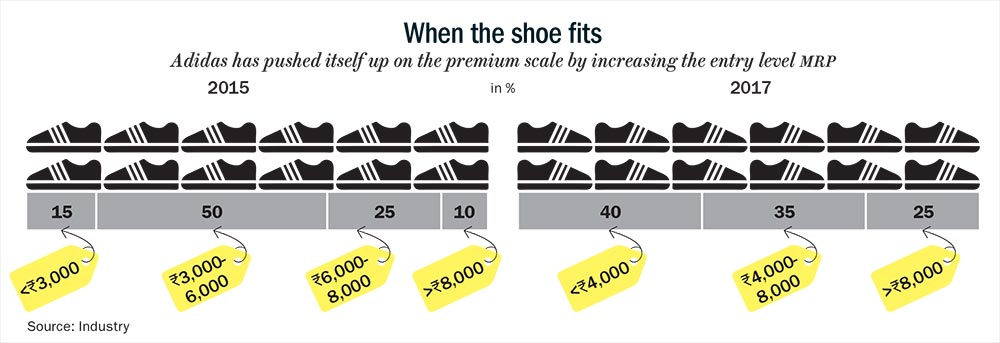

Adidas decided to position itself higher up on the premium scale. Till then, the brand was selling cheaper than Nike but more expensive than Reebok. The decision meant raising the entry level price from Rs.2,000 to upwards of Rs.3,500. It also meant bringing in more products from its global portfolio such as UltraBoost and Originals, and launching stores of their own. The shift helped Adidas clock Rs.11 billion in revenue, making it the largest sportswear company in India, with a profit of Rs.950 million in FY17. Reebok, after a tumultuous ride, too, turned the corner, with a profit of nearly Rs.190 million in FY17 even though its revenue has almost halved to Rs.4 billion now compared with Rs.7.8 billion in 2010.

In his Gurugram office, Thomas opens up about his early days in India. For one, when he asked his colleagues why Adidas Originals — the company’s casual sportswear line (driven primarily by its white sneakers range) — was doing well only in the North East, the replies ranged from “the region is different” to “their preferences and tastes are closer to China than India”. Not buying the flimsy reasons, Thomas made his way to Shillong in 2016. Over lunch with a friend, Thomas stopped to watch television for a while. That, he says, was the moment of truth. “It was all about Hollywood, MTV and football. It was so different from what I had seen in Delhi or Mumbai.” Originals had quietly found a market with the youngsters, thanks to the Hollywood appeal. “Customers there knew more about Originals than people who worked in this [Gurugram] building,” he says.

As a brand, Originals had been in India for at least five years but was neglected. “It was obviously underplayed. Originals (priced at Rs.5,000 then) was marketed no differently from another Rs.3,000 shoe brand in our portfolio,” says Thomas. Globally, Originals had concept stores of its own as well as Originals’ Stan Smith range, named after the retired American tennis player.

So, Thomas decided to push the Originals story in India by setting up standalone stores (800-1,000 sq ft) in metros. In late 2015, the company also brought in Ranveer Singh as the brand ambassador to target the youth.

The moves paid off. Originals’ contribution to overall revenue climbed to 10% from less than 1% earlier. Rishab Soni, managing director, SSIPL, one of the largest footwear retailers in the country, says that Originals’ success came on the back of the sneaker culture taking off globally. “Adidas was smart to grab the first mover advantage in this segment. To the user, it mirrored what was trending in other parts of the world and that worked well.”

Last November, Adidas opened its first Originals Fashion Destination Door (OFDD) store in Mumbai’s Linking Road, spread over 1,500 sq ft. There are only 100 such concept stores across the globe. Larger than the standalone Originals stores, these outlets stock limited editions of Originals ranging from Rs.5,000 to Rs.15,000.

Going premium

Back in 2015, the issue for the company was to figure out what it stood for. While it did have a larger portfolio compared with Nike’s, it still seemed lost. “It was about going wider and deeper with more affordable offerings,” admits Thomas. “The thinking was to first get bigger, then better. Now, it is about getting better first before getting bigger.” One of the ways Adidas set out to do this was by simultaneously launching brands in India and the rest of the world. “Earlier, there was a lag of one or two months, which was unacceptable. The trigger was the well-travelled consumer who wanted models they had seen elsewhere.”

Around the same time the company was pushing Originals, it also brought in UltraBoost, its high-performance shoe range, priced between Rs.15,000 and Rs.18,000. Although expensive, Soni says UltraBoost helped Adidas reach out to a distinct audience — marathoners and fitness-conscious folks. Today, it accounts for 25% of Adidas’ overall business, up from 10-15% in 2014.

Rajiv Mehta, founder director, KAN DFY Sports and former head of Puma India, believes Adidas has a huge advantage in having two distinct brands — one in the performance segment (UltraBoost) and second in the lifestyle one (Originals). “The whole strategy will play out well as long as it focuses on the product. Originals has a separate distribution strategy, which helps position it strongly as a lifestyle brand,” he says. Trying to sell both lifestyle and performance brands under the same roof made it difficult for Puma to show serious growth in either, reveals Mehta.

Thomas admits that the Rs.2,000-4,000 range was the sweet spot for the company earlier, bringing in about half of the business. While the mass range, now upwards of Rs.3,500, still brings in 40% of revenue, the premium range is a close second. The Rs.4,000-8,000 category, which includes some of Originals, account for 30-35% of revenue today. Soni concurs with Mehta. “Getting the [Originals and UltraBoost] range right helped to strengthen Adidas’ image and importantly gave it pricing power at the entry level,” he says.

Much of Adidas’ progress comes at a time when its direct competitor, Nike India, has been in the red since 2006. According to media reports, it has shut down 35% of its stores, leaving the count at 200.

Ankur Bisen, senior vice-president (retail & consumer products), Technopak Advisors thinks Adidas has also been smart in looking beyond cricket when reaching out to consumers. In the past, they had signed Sachin Tendulkar to endorse Originals. “Today, they have moved on to a larger sports platform, which encompasses football and running. It is clearly in line with its global strategy of being a sportswear brand,” he says.

Reaching out

A key component of Adidas’ revamped strategy includes distribution. Thomas says the approach earlier was to have one store that sold everything from cricket gear to basketball. “It was very difficult for the brand to differentiate itself.” The answer was clear — to open company-owned stores and trim the number of franchises to exercise greater control, as with any other international brand.

Bisen, however, says a part of the rethink was the result of the bitter experience it had with Reebok. Issues had erupted over franchisees appointed by Reebok, whose count has now been brought down to 50 from 500. “I would still say 35 is a good number for 450 Adidas stores and another 250 for Reebok. The objective being one franchisee will run multiple stores with enough skin in the game,” he adds.

At the peak (2012-13), both the brands together had over 850 outlets. The government’s decision to liberalise FDI rules also helped Adidas, enabling it to set up company-owned stores. So far, Adidas has opened 10-15 large-format stores with an area of 4,000-7,000 sq ft. In addition to this, the retail presence spans across 670 franchised outlets selling Adidas and Reebok products, 2,000 multi-brand outlets, 20 Originals and the lone OFDD store in Mumbai. “We are strategic about where our brands are available. For example, OFDD will have product offerings that no other format will get,” says Thomas.

With the ability to control its own retail operations now, Bisen thinks Adidas will shift gears. “This will give them the freedom to launch futuristic stores with modern technology and aesthetics. These stores will help in building equity and make it more premium.”

When it comes to e-commerce though, Adidas has been slow to get on the wagon. Players such as Puma had been more aggressive, with half their revenue coming from this stream. But that comes at a price as a high proportion of online means the brand gets discounted, severely affecting its image. Puma fell into this trap and Adidas wants to stay away. “For us, online is 20% of our business. We want to do it the right way and not be a discounted brand,” says Thomas. Adidas primarily sells mass models online, keeping the premium ones at bay.

Reebok overhang

Even as Adidas coasts along, Reebok is still trying to find its feet in India. According to Thomas, its revenue has remained flat since stores have been shut down.

When Thomas took over, the mess at Reebok was still acute. Embroiled in a Rs.8.7 billion scam, which saw the exit of top management, it was already struggling to get back on track. From a revenue of Rs.7.7 billion in 2009 and net profit of around Rs.130 million, Reebok rapidly slid to a loss of over Rs.15 billion in 2012, with revenue dropping to Rs.6 billion.

To deal with a crisis of this magnitude at Reebok and simultaneously get Adidas going was anything but easy.

In FY17, Reebok registered a revenue of Rs.4 billion and was finally in the black. Thomas says, “We have a strong distribution system now and need to establish fitness as a concept for Reebok.” However, he does not elaborate on whether the parent will be infusing funds into Reebok India.

Twin play

Mehta thinks Reebok still has some equity in the Indian market. “It is smart for the company to have both brands in order to preserve its consumer base rather than give it away to others such as Skechers and Puma.”

The trick, though, lies in carrying both the brands together. “Both Adidas and Reebok will have a Rs.3,000 shoe but their positioning will be different. One could focus on running while the other will be positioned for walking,” says Thomas. He narrates an incident during the launch of Adidas Yeezy Boost in collaboration with rapper Kanye West. With a price tag of Rs.24,000 and unsure of the response, he ordered only eight pairs. “But those flew off the shelves. We also had an edition of Reebok shoes, called Floatride Run, priced at Rs.16,000, which did very well.”

Thomas is clear that the advertising spend will steer towards premium offerings. “Adidas’ mass segment will have to find its own feet,” he says while reasserting “fitness” as the peg to push Reebok.

Meanwhile, other international brands are making their presence felt. Skechers is already a Rs.4billion brand in India. “At our pricing, in the Rs.4,000-6,500 bracket, there were very limited performance brands. So, we were able to carve out a niche. Women who wanted performance shoes for casual use did not have an offering. That’s where Skechers came in,” says Rahul Vira, CEO, Skechers South Asia.

Besides its core walking range across age groups, the brand sells running shoes and will be launching football and basketball shoes soon. “There is a huge opportunity in sports-specific performance shoes. There could also be opportunities in a sport such as badminton in India.” Today, Skechers has 158 stores (51 company-owned) and is available at 1,200 multi-brand outlets. While e-commerce is a small part of revenue for Skechers so far, the brand is launching its online store next month.

Asics India, meanwhile, positioned to tap runners, has 28 stores across 16 cities and will add another six to seven stores this year. Rajat Khurana, managing director, Asics India, says running is now perceived as a serious fitness activity in India. “This is marked in the 25-30 age group. Within the fitness regime, running is the fastest growing segment.”

Both these brands are more affordable than Adidas. While that could portend a challenge, Mehta points out that Asics still has limited distribution and products. “Skechers is a great brand but is viewed as an entry brand for most walkers. Serious runners or sports connoisseurs would not buy Skechers,” he adds.

Thomas, too, is not concerned about competition. He says more players will just expand the market, with consumers swaying towards sports brands and not just footwear. “Each of them has a good proposition. It just means we will have a lot more to do in the Rs.4,000-8,000 band.”

It is obvious Thomas loves a slugfest, which is a hangover from his days as a rugby player. “In rugby, you try a lot harder when you are up against good competition. If the new brands do well, they could make us look better,” he smiles.