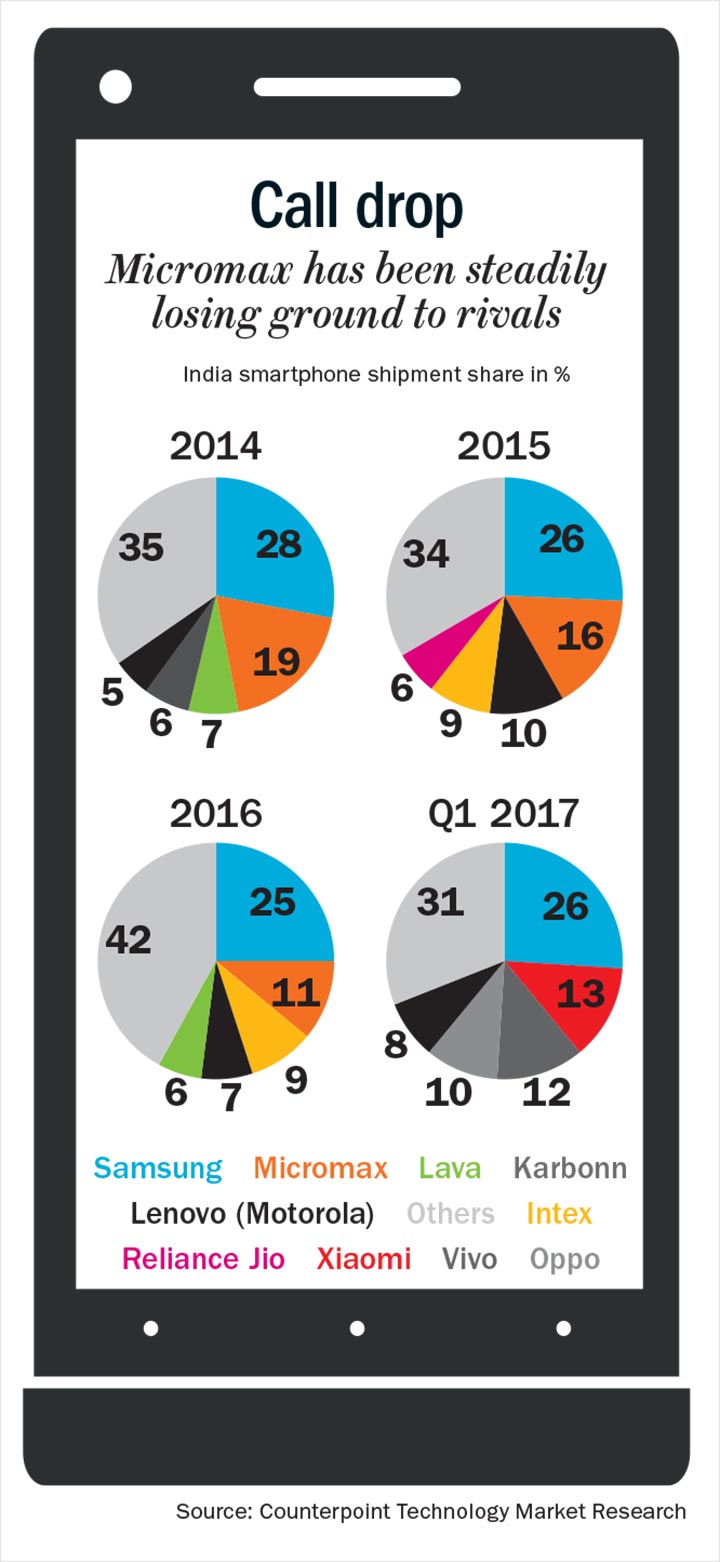

A silent revamp has been in the works at Micromax over the past few months. Its market share had eroded significantly from 19.1% in 2014 to 5.3% in March 2017, pulling down the company from its erstwhile number two spot and out of the top five selling smartphones brands in the country. On the other hand, Chinese players who were nowhere in the picture in 2014-15, today make up for around 43% of the smartphone market according to research by Counterpoint Technology Market Research. A strategy overhaul was definitely overdue.

Micromax, currently in sixth position in list of smartphone manufacturers by market share, is now looking to reclaim some of its lost glory through new product launches and a dual brand strategy that helps them address all segments in the smartphone category.

Brand makeover

During its initial years, Micromax had been on a dream ride. Kicking off in 2000 as distributors of leading mobile phone brands, the company reinvented itself as a mobile phone manufacturer in 2010. In just a matter of four years, it saw itself taking on giants such as Samsung. In Q2 2014, the homegrown brand overtook Samsung in becoming India’s leading mobile phone maker with a market share of 16.6% as against Samsung’s 14.4%. In the smartphone segment, the company was in the second position, right after Samsung.

However, the infiltration of multiple Chinese players like Vivo, Xiaomi, Lenovo and Oppo in the market has tipped the balance against Micromax. This has been largely enabled by the data overhaul spearheaded by Reliance Jio and the exponential adoption of 4G across the country. While the Chinese had their 4G handsets ready, Micromax still had its 3G and 2G stocks to be sold. And by the time Micromax emerged with its 4G range of phones, its competitors had already race ahead capturing a large chunk of the market.

Currently, Micromax has around 15 to 20 models of feature phones bringing in around 20-25% of the revenue. The remaining revenue is contributed in the ratio 50:30 by budget smartphones and premium ones respectively. The former segment has around 25 models while the latter, five. All new models are 4G compatible with downward compatibility to 3G and are equipped with VoLTE technology. (VoLTE stands for Voice over LTE, the technology that is required to support voice calls over a LTE network).

Micromax also merged its subsidiary Yu Televentures with itself in a bid to have a dual brand strategy in the smartphone segment. Micromax phones, which would hereafter be available only on offline channels for sale, will be producing phones in the budget and premium segments. Yu, on the other hand, would be available in Rs.5,000-15,000 range, but exclusively online. As part of Micromax’s foray into premium segment the company launched Dual 5, priced around Rs.25,000, in March 2017. Bharat 2 which retails at Rs.3,499 is its latest offering in the budget segment and one of the cheapest smartphones in the country.

Explaining their strategy, Shubhodip Pal, CMO at Micromax says, “Consumers who shop online are different from consumers who buy offline. Online consumers often know exactly what they want. Offline consumers need a bit more education about the phone, or they might not know what they want exactly. So, they often need a recommendation from family and friends and advice from retailers or need to touch and feel the product. So, these consumers are often reluctant to purchase a smartphone online priced above Rs.15,000. We have our dual strategy based on that.”

The fall from glory

Not too long ago, Micromax took pride in staying ahead of the curve. When it launched its Canvas series in 2013, it was a rage. Phones flew off the shelves and distributors sold it at a premium price, earning margins as high as 15-20% out of it. The Canvas series had a starting price of around Rs.3,000 and went up to Rs.13,000. Its success, suggests Agarwal, was largely due to continuous launch of new models with features like dual SIM, 5-inch screens, camera innovations, etc. It seemed like the company not go wrong.

So what tripped up the company when the going was good? Agarwal admits that the adoption of 4G happened faster than what the company had anticipated, and that it was caught on the wrong foot.

But not everyone thinks that the 4G rage and the subsequent takeover of the market by Chinese phones, were the only factors responsible for the fall of Micromax. Jayanth Kolla, founder and partner at the telecom industry consultant Convergence Catalyst feels the writing was on the wall. According to him, although the current numbers are in tune with the company’s version, the decline started much before. “Back in 2008-09, when there was an inflection point in the mobile phones market, they picked up a couple of features such as dual SIM and long battery life and focused their energies on grabbing the market share in tier-III and tier-IV cities and the rural markets. Only then did they turn their attention to the metros and the tier-I markets. Their strength has always been the distribution of devices, but what they always lacked was a well thought out, long-term product road map, which would have benefitted them in the long term,” Kolla opines.

He observes that Micromax’s initial customers were mostly first time smartphone users. However, the market soon reached a level of maturity and saturation, but the rate of innovation between models started decreasing, while the customers had evolved enough to think beyond mere hardware features. The Chinese, on the other hand, kept improvising on their product specs and the models kept coming one after the other.

Meanwhile, according to Kolla, Micromax continued to have Chinese ODM (Original Design Manufacturer) partners at the back end, who put devices together at substantially lower costs than the then big global companies. To an extent, the company leveraged on the price sensitive character of the Indian mass market, launching devices at a lower price with seemingly better features. But that was not enough for them to stay ahead in the game. “They started it (R&D facility) very late in the game, (in late 2014) post Xiaomi’s entry into India. They missed the boat during the peak of transition from feature phone to smartphones, which was the time when they should have evolved as a product company,” he says.

Agarwal however refutes the arguments that imply that the company has refrained from evolving into a real product company. “We are investing in building the ecosystem around our devices and this has been the key strength of our company for the past 3-4 years,” he says.

Apart from the R&D team in Bengaluru they also have an extended team in China. Pal explains how both teams function in tandem: “China understands the newest technologies whereas the Indian R&D team understands the Indian consumer.” The concerted efforts reflect in the company’s latest models. The dual camera with a steady shot feature in Dual 5, the display of Canvas 2 made of Corning Gorilla glass that can resist cracks from of a drop of a height of 5.24 feet, etc are some of the features introduced by the team, keeping the Indian customer in mind.

The Chinese invasion

While Micromax was busy displacing the leading brands, it missed foreseeing the competition closing in on it. Before the company knew it, Chinese brands were everywhere — on IPL stages, printed on the Indian cricket team jerseys — and they even lined up Bollywood celebrities to endorse them. Vivek Zhang, CMO, Vivo India, feels that bagging the title sponsorship for IPL 2016 and 2017 was the first step of their journey towards growth in the Indian market, helping them to garner brand recall across the masses. Operating in the price range of Rs.8,000-29,800, Vivo positioned itself as a premium smartphone brand and by the first quarter of 2017, it was in the third position with a 12% market share. “What we see in the present times is highly matured customers demanding a premium and innovative product with high-end technology at a reasonable price. The earlier perception about Chinese smartphone makers as producing a low-quality product has been rightfully altered. We have broken down this negative perception by positively offering cutting-edge technology and competence in the market,” says Zhang.

According to Shobhit Srivastava, research analyst at Counterpoint Research, the brands from China conduct ground-level research before introducing products. For instance, he notes how selfies have become a rage and how the Chinese companies are cashing in on it. Take the case of Oppo, which was in the fifth position last year, but climbed up to the fourth with 10% market share in Q1 FY17. The company has been investing in research to understand the consumers’ demands. According to Will Yang, brand director, Oppo, the company launched its Selfie Expert F1 series in 2016 following a survey in 2015, which revealed that although people loved taking selfies, the satisfaction of front camera was only 59% among Indians.

It is also notable that Oppo and Vivo, the sister brands from the parent company BBK Electronics which has a history of overtaking Apple in China, have gone after a strong offline distribution model, something that has been considered one of Micromax’s USPs. Vivo has a presence across 400 cities in 22 states with 30,000 retail outlets. In the last one year, the company added 20,000 retail outlets and expanded across 100 cities. Micromax, on the other hand, has a presence in over 500 districts through around 100,000 retailers. It has a three-tier distribution network, which spans across 65 super distributors, 1,500 micro distributors and its retailers. The competition, as can be inferred, is neck-to-neck.

The Chinese are not leaving any segment unattended. For instance, Micromax’s very own bastion of budget phones faces the risk of being hijacked by Xiaomi’s affordable RedMi series that ranges from Rs.5,998-18,000. Xiaomi, with the Internet being its primary medium of sales, announced its offline distribution plans in India in 2015 and presently has more than 10,000 offline stores, apart from five online partners and its own e-commerce store. Manu Jain, vice president and managing director, Xiaomi India categorises the smartphone features which are most in demand in India into five — dual SIM, a good battery life, powerful performance with an efficient processor as well as an optimum RAM/ROM, a good quality camera and VoLTE. After entering India in 2014, Xiaomi jumped to the number two spot with a 13% market share in March 2017 and clocked revenues of US $1 billion in 2016.

Quite a stretch

If the competition in the smartphone business wasn’t keeping them busy enough, in June 2016, Micromax launched its brand of air conditioners with a plan of investing around Rs.200 crore in that category. In March 2017, Micromax introduced a newer range of air conditioners. This came out after the launch of LED TVs in 2012 and laptops in 2015 under the brand. Is the company spreading itself too thin? Agarwal doesn’t think so and in fact, emphasises that it is part of the company’s strategy to become a complete electronics company. He feels there is tremendous opportunity in a country like India, where, according to him, only 4% of the population uses air conditioners. The huge market, Agarwal believes, is an opportunity to grow beyond just phones. Pal seconds it. “We are more than phones. There is a portfolio of products, again designed by understanding what the consumer’s needs are.”

Micromax was able to garner a market share of 10-12% in the LED business, which fetched Rs.1,000-1,500 crore last year for the company.

The company is expecting 4-5% of market share within the first two years of its foray into air conditioners and is planning to slowly launch other product segments as well.

The comeback strategy

If Micromax wants to get back in form with its smartphones segment, Srivastava hints at the challenge it has to overcome: a set of players who are much more agile than the earlier competitors and who have managed to replicate their success with China, in India. “Micromax must act like a startup now, because the challenges they were facing earlier have changed. The Chinese players have a different strategy altogether,” he notes. Opening up a design centre in India, manufacturing components locally, advertising it in an effective manner and targeting people who aspire to upgrade from their existing phones could be effective ways to go about it, according to Srivastava.

He doesn’t rule out the chances of a comeback for Micromax. After all, the Indian customer looks out for a phone with the best specifications and value for money. The company is revamping some of its earlier launches with additional features. In May this year, Micromax introduced its latest from the Canvas series, Canvas 2. The phone came with an Airtel SIM that offers 1 GB daily data and free calls for a year for Rs.11,999.

Micromax presently has distributors across the country with almost every distributor covering a diameter of around 100 km. The company still holds fort over tier-II and tier-III cities. While the Chinese brands are closing in on these regions, Micromax being a portfolio player can use its existing clout there to drive sales.

The go-to-market strategy of the company has identified three channels which Agarwal categorises as general distribution market or normal retail stores, organised retail stores and online. “There are certain segments in the market in which one particular channel will be strong. We launch our products based on that,” he says.

Srivastava feels that cutting down the number of models in the same price band might help the company further in forecasting the demand for a particular model. However to Agarwal, it is more about maintaining the right balance between not leaving the competitor the space for a new product, and not confusing the customer with too many products. He is hopeful that the company will be back on track in the next few quarters. Srivastava opines that Micromax’s foray in to premium segment might help the company regain some market share by Q2 2017, although not very significantly. “We plan to spend about 3% of our Rs.8000 crore top-line on marketing activities which should be sufficient to garner the momentum we need and we should be back on track,” says Agarwal.

Nevertheless, it’s not all that bad for the homegrown brand. While it might have lost steam for a while in the domestic smartphone market, in a recent study by Counterpoint, Micromax has emerged as the second largest handset maker in Russia with a 10% market share, behind Samsung and ahead of Apple Inc. That ought to be a breather. “We expect to sell a minimum 24-25 million phones there,” asserts a confident Agarwal, pinning the last year number somewhere around 20 million units.

The biggest challenge for the company is not to regain the market share, but to sustain it. Agarwal says the company will now keep a close eye on the developments in the telecom industry. “We have learnt our lesson the hard way from our past mistakes,” he says, but corrects it quickly. “It’s not a mistake actually. I would call it a fundamental disconnect. I think we have realised what we did wrong and we will be more careful in defining our portfolios in the future.”