In April this year, the Ministry of Electronics and Information Technology (MeitY) notified the latest rules for online gaming, putting in place a regulatory framework for an industry that has often complained of unfair treatment due to a lack of clarity over what can be interpreted as legal. Coming amid increasing instances of edgy state governments rushing to either ban online gaming or penalise companies, this clarity can also be the much-needed shot in the arm for the industry and coax hitherto wary investors to shed some of their inhibitions.

Last month, the Karnataka High Court quashed a show cause notice issued to online gaming company Gameskraft Technologies by the Directorate General of GST Intelligence (DGGI) after the tax body found users placing bets on the company’s gaming platforms like Rummy Culture, Rummy Platform and Rummy Partner. The DGGI estimated the total value of bets on these “games of chance” between 2017 and 2022 at Rs 77,000 crore, and levied a 28% tax on the company. The penalty charges ballooned to a whopping Rs 21,000 crore. The start-up contested this levy, claiming that it went against the legally accepted distinction between “games of skill” and “games of chance”. Games of chance attract 18% GST.

Diving into Definitions

In the past, the country’s courts held that a game of skill could be differentiated from a game of chance based on the predominance of skill or chance in the activity involved.

According to their interpretation, games of skill are those where the outcome predominantly depends on the player’s physical or mental skill, strategy, knowledge, technical expertise and experience. Skill-based games like online rummy, fantasy sports, poker and e-sports are legitimate business activities protected under Article 19(1)(g) of the Constitution. Games of chance are determined by luck. Here, players neither participate in achieving the outcome, nor have control over it. These include games like roulette or rolling dice, considered gambling and deemed illicit in India.

India’s online skill gaming industry often suffers from inherent perception challenges. Malay Kumar Shukla, secretary of the E-Gaming Federation, points out that the latest rules prohibit online games that have wagering on an outcome. However, online real-money gaming (RMG) is confused with gambling.

Vishal Mehta, partner of Vertices Partners law firm, notes that the regulations in place until now have been inconsistent across states, with some allowing certain types of games that others prohibit. “This created a lot of ambiguity for operators and challenges for law enforcement agencies. The Central government’s involvement could provide a more consistent regulatory framework for the industry,” he says.

Wary States

In recent times, the governments of Tamil Nadu, Karnataka, Andhra Pradesh and Telangana moved to ban all RMG activity, including games of skill, citing addiction, suicide and financial losses as the effects of online gaming. The Chhattisgarh Gambling Prohibition Act of 2022, notified in March 2023, also prohibits online gambling and betting, though it excludes skill-based games.

However, their high courts struck down these regulations, observing that they could not justify the total ban on all forms on online gaming, including the games of skill.

“While state governments have the right to regulate games of chance, they cannot infringe on the fundamental right of people to carry on a trade or profession, which is why gaming companies have challenged state laws that are prohibiting valid, pay-to-play skill games,” Surbhi Kejriwal, a partner at law firm Khaitan & Co, says.

Industry Prospects

A 2021 report by the Boston Consulting Group and venture capital firm Sequoia on the country’s mobile gaming sector showed that it grew at a 38% compound annual growth rate (CAGR) in 2017–2020. It estimated that it can become a $5 billion market opportunity by 2025, backed by a rapidly increasing user base of over 300 million, growing with ease of access, a spike in new adoption and leading companies actively shaping market evolution with increased marketing spend. By regulating and taxing the industry, the central government can tap into an additional source of revenue.

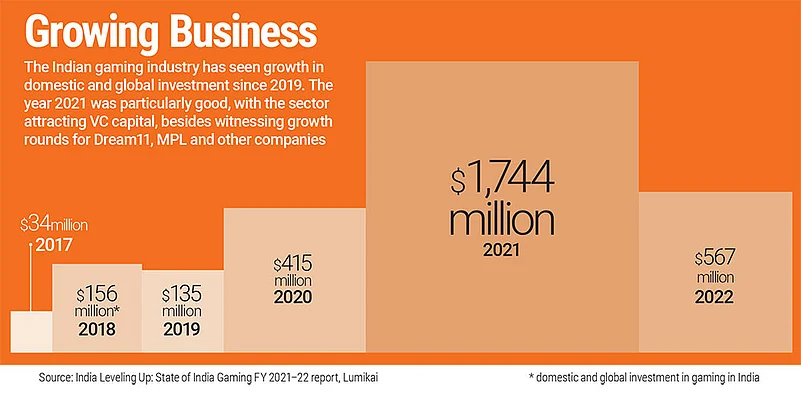

The India Leveling Up: State of India Gaming FY 2021-2022 report by Lumikai Fund, an early-stage venture capital fund backing gaming start-ups, estimates that the country’s gaming market will grow at a 27% CAGR to reach $8.6 billion in FY27. Indian gaming companies raised $3.01 billion from domestic and global investors between 2018 and 2022. According to the report, they raised $567 million by the end of CY’22, which is a 320% increase from $135 million in 2019. Since 2021, the country has seen the emergence of three gaming unicorns—Dream11, Game24x7 and MPL—besides more than six strategic exits and one successful IPO—Nazara Technologies.

Justin Shriram Keeling, a founding general partner at Lumikai Fund, notes that India’s RMG market stood at around $1.5 billion as of FY22. “A Central framework reduces regulatory lacunae and bureaucratic burden for new companies and entrepreneurs, which will help foster innovation,” he adds.

Optimism Over New Rules

Under the new gaming rules, the government will appoint multiple self-regulatory organisations (SROs). Comprising industry representatives, educationists and other experts like psychology experts, etc., the SRO will be responsible for declaring which online games are permissible after determining whether or not they offer wagering.

Online gaming operators have reacted positively to these rules, hoping that they will provide better guidance and structure to the industry. Sai Srinivas, co-founder and CEO of mobile esports and digital gaming platform Mobile Premier League (MPL), says, “This is the first and important step in providing legal recognition for the online gaming sector and will bring much-needed regulatory certainty by reducing fragmented state-wise laws.”

Aparajita Chandra, partner at India Law Offices, adds, “Now these operators cannot be belligerent and do anything that suits th eir business. Moreover, it might impact those who operate in a grey space in terms of wagering. In the long run, it will benefit youngsters who are addicted to these platforms.”

The broad guidelines of the new rules attempt to safeguard industry players by distinguishing legitimate skill gaming operators from unauthorised gambling and betting operators. Furthermore, to weed out illicit operations and benefit legitimate registered operators, the entire ecosystem, including the IT infrastructure, banking services and advertising, is expected only to support legally permissible games.

According to Shukla, this move will positively impact gamers as the operators that serve them will prefer to be within the government and the SRO’s regulatory framework. “We also expect this to plug tax leakages from illegal gaming operations,” he emphasises.

Will the ambiguity around the definition of games of skill and games of chance and the new MeitY rules spook investors from backing start-ups in this domain? Unlikely, says MPL’s Srinivas, who believes that regulations bring stability, boosting growth and driving investments.

“A uniform framework such as this will immensely increase investor confidence. While there has already been a steady inflow of investments within the gaming sector, we expect this to grow manifold in the coming years,” he asserts.

Sumit Agrawal, founder of Regstreet Law Advisors and former SEBI officer, notes that till now, online gaming companies were functioning in regulatory limbo with a threat of overarching government interference at any time. The new rules show the government’s intent to regulate rather than restrict and will make the sector more attractive to investors. All stakeholders, including investors, have welcomed this regulatory clarity. With SROs, the government has opted for a light-touch regulatory approach as opposed to extreme measures such as imposing centralised licensing requirements, as seen in China, they feel. Investors are reassured that the government is providing legitimacy to the industry.

Some Concerns

Asish Philip Abraham, partner at Lakshmikumaran & Sridharan Attorneys, notes that industry players are warily looking at certain provisions of the MeitY rules, like the full KYC requirement.

This is because of customer experience concerns, as many might not be comfortable sharing these details and the onus of compliance that rests on the company while onboarding users. These could raise compliance costs for online gaming platforms, especially for smaller players.

However, according to Roland Landers, CEO of All India Gaming Federation, the burden of compliance will only be felt by those gaming companies that do not yet follow such self-regulatory frameworks. “Even in these cases, the IT minister has been clear about the intention to support and help the gaming industry’s growth. We are confident that gaming companies will be well supported in meeting compliance obligations,” he says.

Soham Thacker, founder and CEO of e-sports gaming platform Gamerji, finds it unfortunate that the MeitY rules bucket all gaming intermediaries into a broad category requiring similar compliance. “It has failed to provide the much-needed clarity sought by the industry, as there is no distinction between RMG and non-real-money games,” he says.

“This affects us directly as a young start-up, because Gamerji is a non-real money gaming platform. We are yet to evaluate the percentage of costs, but the regulation should have the provision only for RMG platforms,” he rues. As per the newly defined IT Rules, 2023, RMG is a game where players deposit “cash or kind with the expectation of earning winnings on that deposit”.

Confusion Reigns

While many high courts have already identified a few games that do not fall under the ambit of gambling, an element of confusion remains because games of skill dominate those of chance. Hence, the new rules have a “permissible online RMG”, verified by an SRO. This move was necessitated since RMG revenues contribute to 57% of the Indian online gaming market, as per Lumikai’s report.

Mehta is also concerned that the new MeitY rules might limit innovation by imposing restrictions on certain specific types of games and payment methods, stifling the industry’s growth and limiting its potential. Moreover, it does not include offline or brick-and-mortar gaming activities, which could create an uneven playing field and could lead to ambiguity. This also does not address the real challenge of gaming addiction among players, financial loss and suicides.

Envisioned as a regulatory body, SRO will comprise a diverse group of experts to ensure that the industry meets the standards set by the government and is permissible under law and not harmful for society. SROs are intended to be advisory in nature and will not have enforcement powers since they are not statutory institutions. Agrawal points out that the rules themselves provide that the government shall have the ultimate say. “Thus, its success will depend on whether the members want these SROs to act as regulatory or only as a rubber stamp,” he says.

With the implementation of multiple SROs, there might be forum shopping to get registration with SROs and commensurate risk of litigation, though there is provision for a grievance redress mechanism.

Mehta notes that industry participants might object to the rules, guidelines or directions given by an SRO and may challenge steps taken or rules prescribed by it. This could result in litigation and uncertainty for the industry. Abraham believes that the power clash will potentially happen in the SRO decision against state gaming laws.

He cites the example of the Tamil Nadu Prohibition of Online Gambling and Regulation of Online Games Act, 2022, which has banned games like rummy. However, the Supreme Court has held these as games of skill. “Thus, when a rummy online game intermediary approaches SROs and gains a membership, there will be a question on whether the said membership is valid and applicable in Tamil Nadu,” he elaborates.

Cautious Optimism

Industry players hope that this self-regulation can safeguard them from sporadic bans from state governments, which hurt their business. A comprehensive framework for online gaming will end the state-wise regulatory fragmentation.

Some, like Nitish Mittersain, joint MD of Nazara Technologies, prefer having an optimistic outlook. “SROs intend to work with payment gateways to only authorise licensed games to accept payments,” he says, adding, “To that extent, they will be empowered to not just work as an advisory body, but actually certify and authorise games of skill.”

The other big puzzle for the sector is the goods and services tax (GST). While operators have suggested that the tax be levied only on gross gaming revenue (GGR), the government has been considering levying GST on the entire prize pool. This is driven by the perception that gaming is similar to betting, wagering and gambling and, hence, should be subject to similar taxation of 28%.

Sensing that the online gaming industry might come under this ambit, industry stakeholders have already made recommendations to government bodies to reconsider the taxability of game of skills and game of luck separately or at least keep game of skill outside the 28% slab. Ankur Gupta, practice leader, indirect tax, at tax advisory firm SW India, says that the industry is taking a beating with authorities getting aggressive and demanding a tax of 28% “without any basis”.

“India is already at the second position in terms of the number of online gamers with more than 425 million gamers. The market has huge growth potential and is attracting many global gaming platforms to enter the country,” he says. “However, the GST authorities’ approach, coupled with their unrealistic demands, will surely be detrimental and might create a roadblock for the entire industry,” he adds.

Ball in Government’s Court

The Madras High Court, while striking down the ban on skilled gaming, observed that skilled players had the right to make a living off their skills. With the recent investment figures, the online gaming industry has shown that it has the potential to grow, but what it needs is legitimacy, besides standardised regulation that is backed by reason and clarity.

The operators hope that the new MeitY rules will reduce regulatory fragmentation at the state level and foster a more stable business environment. Will the government live up to their expectations?