When a storm strikes, brittle ships batten down their hatches and wait for the winds to die. But sturdier vessels, with power in their belly, cut through the frothing waters.

COVID-19 is a viral storm — literally, now that the virus is air-borne — which has gripped all countries and companies by surprise. At the centre of the resultant chaos and unease, ironically, is the one industry that keeps the world footloose and fancy-free — of travel. Over the past four months, this industry has come to a grinding halt; planes have been grounded and hotels have folded.

The airline and the hospitality companies had anyway been struggling, facing the brunt of an economy that has been slowing down since 2019. In the travel industry, the one segment that was doing well was that of the online travel-aggregators (OTA). “They have been one of the main driving factors behind growth in revenue and investment in the travel and hospitality space bringing in much needed innovation catering to the new-age traveller,” says Ankur Pahwa, partner and national leader – e-commerce and consumer internet, EY India. Therefore, the new-age traveller can hope to track a tiger in Ranthambore, to converse with a Rinpoche on the mysteries of Buddhism in Ladakh or go snorkeling in the deep blue of the Andaman. “OTAs democratised travel,” says Pahwa.

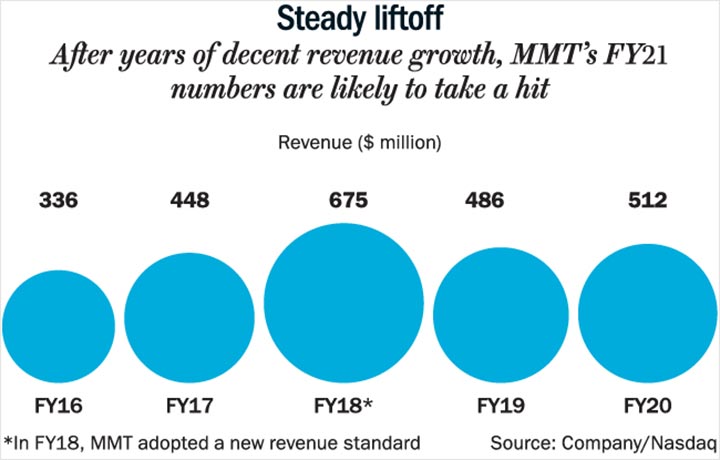

With these strong tailwinds, MakeMyTrip (MMT), India’s first OTA built a fortune and emerged as the biggest company in the segment with more than 40% market share. What started off as a garage start-up is today a $723-million company with a market cap of $1.93 billion (See: Steady liftoff). Sure, it faced strong competition from the likes of Yatra and Cleartrip, but there was plenty for everyone with the OTA market growing at a healthy pace.

Then, early this year, the respected medical journal Lancet observed a curious phenomenon in China’s Wuhan. An increasing number of people were being diagnosed with pneumonia, and the illness seemed to have come from a novel virus. No one could have guessed the impact of this viral outbreak then, but a few months from then, the world and its running have been turned on their heads. All previous calculations and estimates have come to naught, particularly in the travel industry.

What are MMT’s chances now? Will it even survive?

Earning its stripes

When MMT’s founder Deep Kalra gave an interview to Outlook Business in 2018, for the Secret Diary series, he recalled the struggles of keeping the business going in its early years. If you remember, the company has already lived through two slumps, between 2001 and 2003, before the current one. The first was from the dotcom bust and the second, after the 9/11 attack. During these years, Kalra says, they were always short of cash. When their phone lines were chewed out by rats, they would go hunting for an electrician in the middle of chilly winter nights. Without money to pay, they offered rum and advice on getting the best travel deals as compensation!

Needless to say, the company has developed a tough, unbreakable spirit over the years. It did see the initial spurt of success, but soon faced the challenge of getting Indians to pay for services online. MMT adapted. It smartly shifted its focus to NRIs. When one of their earlier investors, eVentures, wanted an exit after the dotcom debacle, the founders stepped in and took over that stake. And, when it was looking to list, Kalra and Rajesh Magow (co-founder and group CEO) met investors across the US, at ten meetings a day, to gauge their sentiment. The two barely slept a few hours those days, and finally MMT managed to raise $70 million through an IPO and was listed on the US-based NASDAQ in 2010.

In 2005, MMT had moved its operations to India. It has since grown its presence here organically, and through partnerships and acquisitions. Its biggest acquisition was of Naspers-owned OTA Goibibo for $1.8 billion in 2016, which also brought the bus-ticketing platform redBus under its wing. In 2018, it tied up with Flipkart to sell tickets for domestic flights through the e-commerce platform and then with Oyo Rooms, to have the budget stays listed on the OTA platform.

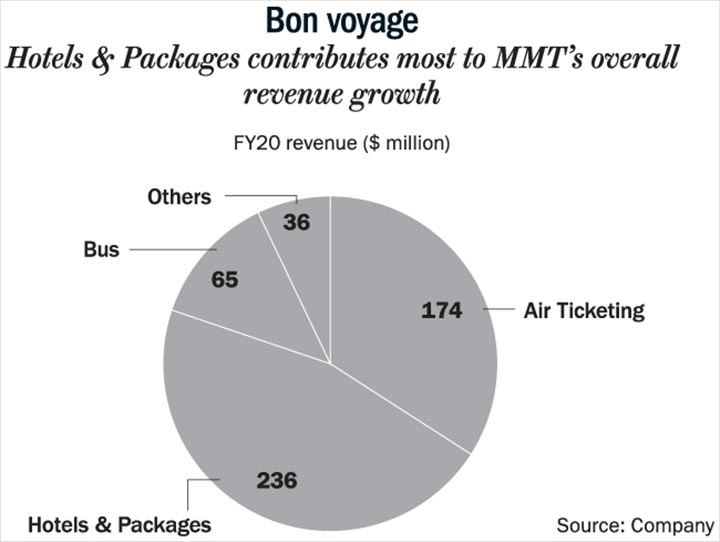

With such aggression in expanding volumes, MMT has seen a steady increase in revenue over the past five years — from Rs.299.66 million in FY15 to Rs.511.52 million in FY20 — 70% increase, and it has diversified across segments from flights to holidays and even homes and villas (See: Bon voyage).

Till Q3FY20, things were going well, according to the plan. That quarter, the company had generated adjusted revenue to the tune of $208 million, the most it has made in any quarter. The company entered the fourth quarter with the same operating momentum, said Mohit Kabra, CFO of MakeMyTrip, in the Q4FY20 earning call. But, they had to “change gears halfway through the quarter due to the unexpected and unprecedented impact of COVID-19 on travel demand,” he said. Midnight March 24, the central government announced suspension of all flights (domestic and international) to contain the spread of the virus. Travellers frantically began to cancel their tickets and OTAs had to tackle the sudden surge in customer queries.

MMT’s gross bookings fell by 12% that quarter year-on-year to $120.66 million and adjusted revenue fell by 16%. Its adjusted net loss after one-time exceptional charges stood at $18.34 million in Q4FY20, nearly the same as in the year-ago quarter.

Fast and furious

The aggregator was quick to recognise the danger and acted. In the earnings call, founder and group executive chairman Kalra explained how they prioritised. After putting in place safety protocols for employees, it turned its attention to customer experience. It allowed people to do free cancellations, upgraded its pay-later options, and helped hotel partners sell vouchers that could get people interested in planning a future trip. It also gave customers regular updates through social media and popular messaging systems. “During this lockdown period, we also began to focus on automating as many potential post sales queries as possible, so we can reduce reliance on call center support in the future,” he said.

The other important measure was reducing fixed expenses, including personnel and administrative expenses. It laid off 350 employees, cut salaries by 10-100% for the management ranks and upwards, and began outsourcing support services to third parties. Even before COVID-19, there was a definite effort to move towards converting fixed costs to variable costs, such as reducing its fixed-cost-driven offline channel (company-owned travel agencies) and increasing variable-cost-driven offline channels (franchisee-owned travel agencies). In fact, it shut down all of its company-owned outlets and signed up 150 franchise-owned ones. Post Covid-19, this effort to lighten its load has gained momentum. For example, MMT has “dismantled” its offline team managing corporate events, because those are going to be far and few between. “Collectively, our cost actions will help us reduce fixed costs as we begin to rebuild our business post-lockdown and make us a leaner and more efficient organisation going forward,” said Magow.

It did sound a bit alarming but Kalra said during the call that the lockdown and “zero travel” situation could extend for months and possibly quarters. “We, therefore, acted swiftly and sharply, reducing our fixed costs to give us a runway of about two years even in such unforeseen lockdown,” he said. The quarterly run rate of fixed cost had been brought down from $45-50 million to $30 million, and the company expects a cash burn of around $20 million in Q1FY21. The burn is expected to fall to $10 million in the next few quarters and eventually lead to the target breakeven.

Even before the pandemic struck and lockdown was announced, the aggregator had been cutting back on expenses. Magow said during the call that, for the quarter, the company narrowed adjusted operating losses down to $10.3 million or $5.5 million adjusted operating cash loss, if you add back depreciation expenses. That said, MMT is a head above its peers in managing its cash flow. In their report, Morgan Stanley analysts observed that MakeMyTrip has an advantage over its competitors in the availability of $168 million in free cash flow as of March 2020. Very few OTAs can boast of such a cash chest at this point in time.

Morgan Stanley notes that even if the trends remain challenging, MakeMyTrip has enough liquidity to see it through six to eight quarters. Besides, it has a strong supporter in the Chinese travel company Ctrip, which had raised its stake in MMT from 10% to 49%, and had said that it would be interested in future fundraising efforts of the aggregator. “It's always comforting to have their continued support as our key shareholder in such exceptional circumstances,” said Kalra, in the earnings call.

One risk though is a possible cash drain because of a potential adverse ruling on an ongoing litigation. MMT set aside a non-cash provision of $31 million last quarter for the case relating to the acquisition of the South East Asian booking platform, HotelTravel.com in 2012. The management said the company could have a cash outflow to the tune of $35-40 million in the event of an adverse ruling but it expressed confidence that the judgement will be in its favour.

Flight to safety

Besides managing those immediate priorities, the company has worked on various product innovations to improve the services of hotel and airline partners. As Magow said in the call, “Clearly, the primary concern for all future travellers will be that of hygiene and safety.”

For example, who would want to holiday in a resort, even if offered the steepest discount and sheets of Egyptian cotton, if the property was used to house a party of ‘Covidiots’? So the aggregator has introduced safety initiatives called MySafety and GoSafe, through which hotel owners can self-certify their properties for cleanliness. In future, through MMT, the property owners will be able to get an independent audit done by a reputable firm. For airline partners, MMT has an option for contactless check-ins and luggage tag printing.

These may seem like tweaks made to existing products, but even these can help partner companies survive, according to Apurva Chamaria, CRO of RateGain, a SaaS service provider to many OTAs including MakeMyTrip. The aggregators have a great vantage point, being an intermediary between companies and clients, so they offer invaluable insights. “OTAs will be the enabler and play a vital role in ensuring that supply partners deliver a safe and stress-free experience,” says Chamaria.

All of this only means MMT could emerge stronger, post Covid. The aggregator already has a dominant market position — commanding nearly half the market — and weaker players, even horizontal players such as Expedia, Travelguru and others (which together make up about 10% of the total market), may have to step out of the game as pandemic casualties. Pahwa believes, only those with the capacity to scale up and deepen services will be able to survive the game.

It’s likely to become a duopoly or at worst case a three-player market with MMT and two other rivals – Yatra and Cleartrip (18% market-share in ticketing). MMT’s nearest rival Yatra, which has a market share of 24% also has strong liquidity with cash of $32.5 million as of June 2020 and fixed costs at approximately $1.2 million/month, which can easily take care of its cash needs for two years.

As Kalra said in the call, MMT “entered this crisis in a far stronger competitive and financial positioning than our peers and (we) believe that gap will only widen as we begin our recovery.” The Morgan Stanley report supports this sentiment and says, “This could help solidify MakeMyTrip's position and significantly improve marketing efficiencies (for the company).” The report added that the company has been expanding into other customer segments such as corporate, by buying a majority stake in Quest2Travel, which has helped strengthen the brand. MMT is now present across three segments: leisure, small and medium businesses, and large corporates. During the lockdown, it has deepened its presence in corporate segment by letting companies use idle buses (through redBus partners) to transport their employees.

MMT’s dominant position is enviable, and an inevitable consolidation could very well draw the attention of the Competition Commission of India. But that’s a happy problem to have when companies are losing sleep over survival.

As for the hotels segment, despite financial disruption for smaller hotel players, there may be no problem with respect to supply of inventory, the management asserts. “There could be a small fraction, percentage of supply that might not be available. The overall supply is huge,” said Magow. The focus for MMT will be “more and more on bringing the business back”. Magow also added that MMT is open to restructuring the take rate, currently at 22%. Take rate is the percentage of the value of the transaction that the company facilitates that it gets to keep as revenue. But any change in rate will be based on volumes, to help partners manage costs.

The aggregator holds the aces, but is careful not to squander it. Magow struck a chord of cautious optimism when he said that they have been seeing “green shoots of recovery” ever since travel opened up in a calibrated manner. The company says that they have been seeing a day-on-day growth in booking volumes across flights, bus and hotel segments.

“Travel will not disappear, let me make that clear, it will bounce back,” says Arjun Sharma, chairman of New Delhi-based Select Group, which owns a travel agency and hotel properties across the country. “Look at China, as soon as the flights resumed, around 50 million trips were booked in the first two days… It may take some time, but it will bounce back,” he adds. Maybe international flights and travel will take a while longer to take off, and maybe people will prefer isolated modes of holidays such as using self-drive options and secluded resorts, but travel we will.

Kalra agrees. With the many restrictions different governments have put in place, international trips will definitely not be planned anytime soon and he sees “travel bubbles with certain countries that would allow access to India and vice versa”. “We have no doubt, in the long run, the travel business will rebound. As humans, we are naturally wired to travel and seek person connections and new travel experiences, whether it's to visit family, friends or loved ones, to establish new business relationships or to seek adventure and experiences, it will inevitably happen,” he said, in the earnings call. “But we have a long climb ahead.”

He, too, sees people choosing options that would make social distancing easier. “The days of carefree, leisure, discretionary travel will gradually return once the virus is adequately controlled or an effective treatment of vaccine gets developed,” said Kalra. Otherwise, MMT expects demand to first come from business, family and medical travel.

Magow hopes that the jumpstart given by essential travel will be carried forward by short-term leisure holidays to destinations that are safe as per health standards and allow social distancing. This, he says, would lead to a significant spurt in domestic tourism for the coming quarters. “One of the biggest contributors in reviving the tourism industry will be the 50 million outbound travellers, who will now purposefully restrict international travel and shift their priorities to domestic travel,” he adds. It is the proverbial silver lining, according to him. It would be, at least for MMT, which gets 80% of its bookings from domestic segments.

MMT has played its hand well so far, by capturing a significant share of the market, by building alliances across industries, and by building a cash chest and preserving it. It has earned its formidable position. So, it is only fair that it gains further lead over its peers, even in the midst of this storm.