It has been over two decades since McDonald’s, Pizza Hut and Domino’s entered the Indian market and since then international QSRs have played a huge role in building the food services market. However, the last couple of years have been quite a challenge for them. New stores failing to yield the desired numbers and dwindling footfalls in older stores, has been leading to unimpressive single-digit or in some cases, negative same store growth (SSG) numbers. As a result, their profitability has taken a hit. Jubilant Foodworks saw its profit after tax decline by 34% from Rs.91.7 crore in nine months of FY16 to Rs.60.5 crore in nine months of FY17.

As they continue to chase growth, all players have taken a hard look at their overall strategy. Be it store expansion, location, operating costs, or even store ownership. And instead of pursuing mindless growth, the focus is back on reining in costs and expanding judiciously. But can the international food chains sustain their first-mover advantage and re-invent themselves, yet again to cater to the changing Indian market?

Comeback strategy

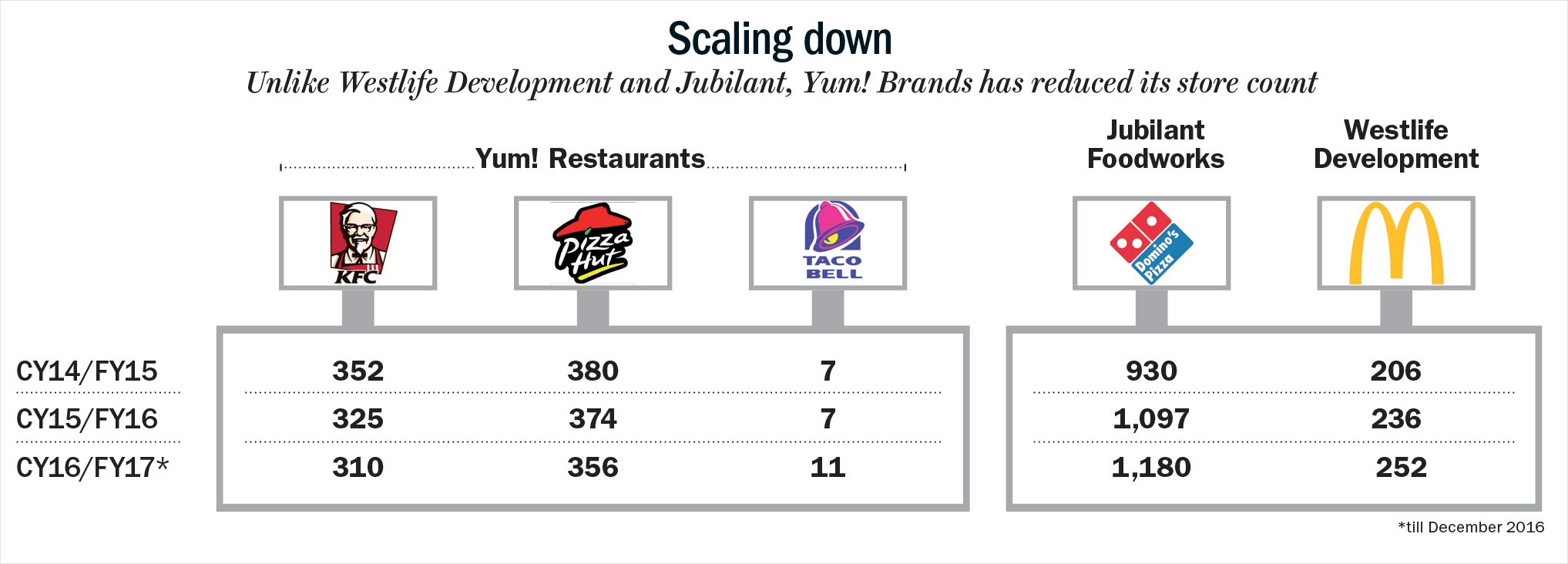

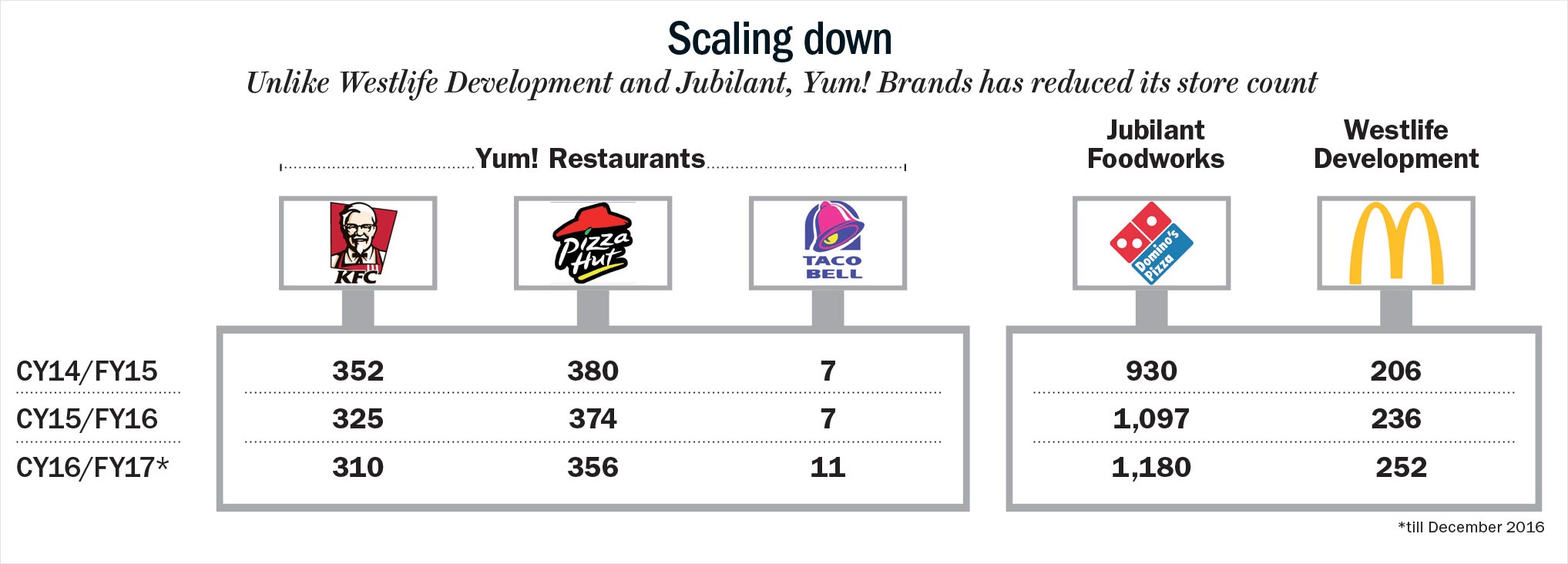

It has been tough for the QSRs in the past couple of years and the numbers show it (See: Hunger Pangs). Ajay Kaul, outgoing CEO, Jubilant Foodworks believes that it is not just QSRs that are struggling with growth. “For the past 2-3 years, it’s not just the food service category, these are also the worst years for the FMCG industry,” he points out. Jubilant Foodworks — the master franchisee for Domino’s and Dunkin Donuts shut down some of its stores for the first time in 11 years. The Virat Kohli of QSRs in India, which has been adding over 150 restaurants every year since 2013, had to shut 7 stores in the third quarter of FY17. KFC, which had 352 restaurants at the end of 2014 shut some of its stores bringing the count to 310 restaurants at the end of 2016. Pizza Hut (both KFC and Pizza Hut are owned by the Indian arm of Yum! Brands) has brought down its restaurants from 380 to 356 in the same two year period.

But each of them has a strategy up their sleeves to get back on the growth track. Amit Jatia, vice chairman of Westlife Development, the master franchise for McDonald’s in West and South India, says he saw the signs early. “By 2013, we realised inflation was playing havoc with our unit economics and for a retail brand to grow and win, not only do you need to change the look of your restaurants but you also have to get the cost structure right,” he says. Jatia had designed the restaurant operating platform (ROP 1.0) in 2002 and brought down store opening costs by 40% and operating costs by 30% by localising the supply chain and equipment procurement. Now it was time again for his team to go back to the drawing board.

In 2013, Jatia launched ROP 2.0 and claims to have brought down the cost of opening a restaurant by another 20-30% by adopting greener technologies like using solar panels to heat water and cutting AC tonnage by using the latest technology at the store level. “So all restaurants opened from January 2016 are on the new platform and the basket together is giving us positive cash flows. We are spending Rs.2.5 crore to open a restaurant unlike earlier which costed Rs.2.8 crore. The operating cost has been brought down by 300 basis points for a new restaurant,” he says.

Some of the QSRs have moved out of the costly mall spaces in big cities to other areas with heavy footfalls such as airports, hospitals, railway stations, and metro stations. Devyani International, which is also one of the two master franchisees for Yum! Brands, also handles Costa Coffee. The coffee chain went into a phase of consolidation last year — closing unprofitable stores and opening new ones in locations with higher footfalls. Almost half of its 100 outlets are now in office complexes, airports and hospitals. The QSR players are also looking at new avenues of reaching consumers. For instance, Domino’s entered into an agreement with IRCTC in 2015 to deliver pizzas to passengers in trains. It is now available at 130 stations across the country.

Unlike McDonald’s, KFC or Pizza Hut, Domino’s expanded in India with a small size no-frills store format. This model has helped the pizza chain rein in real estate costs at the outset and add stores across the country very quickly. The others have followed the hub and spoke model with large dine-in stores. No wonder then that Domino’s has a staggering 1,179 stores in India covering 259 cities, as against 356 for Pizza Hut, 310 for KFC, and 250 for McDonald’s in West and South India.

But even the no-frill-low-on-rentals model of Domino’s has come under pressure. Jubilant Foodworks was recording a same store growth of above 15% SSG till third quarter of FY13 but has registered single digit growth rates or even negative SSG in some quarters thereafter. This meant that they had to take some tough decisions.

Apart from closing down stores in the December 2016 quarter, Domino’s also cut its expansion target to 110-115 stores as against 130 planned earlier for FY17. Hari Bhartia, chairman, Jubilant Foodworks, in an analyst call post-results said, “We have reinforced our focus on profitable growth, and to this effect we have closed those restaurants which were not meeting return norms under both Domino’s and Dunkin’ Donuts and this principle will continue to drive our future network expansion plans also.”

The focus has clearly shifted to unit economics at the store level. “From a margin expansion perspective, we are looking to identify opportunities of cost rationalisation and improvement in operating leverage. We do expect to see gains from this in the coming years. We also believe that introduction of GST will have significant positive impact on our margins,” says Bhartia.

Kaul, who is being replaced by former PepsiCo executive Pratik Pota from April 1, 2017, too, indicates Domino’s will not be as aggressive as earlier when it comes to store openings. “For 3 years, we opened around 150 stores but we added only about 115 stores last year. The idea is to focus on profitable stores and looking at locations that will provide us that. We only plan to enter new cities when we are confident that consumer sentiment is improving,” he says. QSR chains depend heavily on the top 40 cities in the country to sustain their business. For instance, even as Domino’s has entered many tier II and III cities in the past couple of years, the top 10 cities still contribute 60% of its revenue.

The company hired AT Kearney to help them improve their cost efficiency and look at investing in areas which would bring them the much-needed cost savings. In a bid to reduce input costs, Jubilant invested Rs.100 crore in building a commissary in Greater Noida. “It is going to be operational by the end of this fiscal. It has the capacity to service more than 600 restaurants in the North. This commissary would also be producing some raw materials that are now being sourced from external vendors and hence will bring in cost efficiencies,” says Kaul.

Right sizing and shutting down unprofitable stores is a strategy being followed by almost all chains. Yum! Brands India shuttered 42 KFCs and 24 Pizza Huts between CY14 and CY16. But it didn’t stop there. It also went on to re-organise its franchising structure. “The challenge for us was to get the consumer to come back for more visits. So it was important for us to go back to the drawing board and course-correct. And, that’s exactly what we did,” says Rahul Shinde, managing director, Yum! Brands India. For most of 2015, the company focused its energies on re-organising its business and decoding its consumer. Yum! Brands concluded its year-and-a-half-long exercise to re-organise its business under larger, well-capitalised franchisees towards the end of 2015. More than 300 outlets, operated by several of its franchisees, were sold to a newly formed entity — Sapphire Foods India. The new entity is owned by a consortium of four private equity funds led by Samara Capital. Now the Indian business of Yum! Brands is split its two master franchisees — Sapphire Foods India and Devyani International.

New Format, newer menus

While Kaul and Jatia feel that the industry is facing a consumption slowdown and not really a consumption pattern change, Gaurav Marya, president, Franchise India, which facilitates franchising of businesses/brands (including restaurant chains), thinks otherwise. He feels while people are eating out more, there are more claimants to the pie and changing tastes of consumers is bringing new players to the fore. “I think QSR products like burgers and pizzas have been in Indian market for more than 15 years and are witnessing some fatigue,” he says. Marya believes that food habits of youth in big cities have undergone a drastic change. “The variety of food offerings is growing exponentially in big cities. QSR formats were not ready to cope with this shift. Millennials have both disposable time and income and they are increasingly spending them in other cooler hangout places (like pubs, cafes, bars and lounges),” he adds.

For instance, Social, a café-bar, is a great hit with the millennials in Delhi, Bombay and Hyderabad. “We are not only a café for the millennials, but we are also a form of co-working space for them. We have customers coming for breakfast, lunch, and dinner. So we have been able to maximise our tables. Since we are relevant at different times of the day, it has worked for us,” says Riyaaz Amlani, founder of Social and the president of National Restaurant Association of India. The typical investment for opening a Social café is around Rs.3 crore and Amlani claims to get his money back in 12 to 18 months with the average order size being Rs.800. Helping him crack the market, despite being a small player, is the fact that the casual dining and PBCL (pubs, bars, cafes, and lounges) segment is growing at over 24% annually.

The emergence of new options and formats has forced the international QSRs to spruce up their offerings. While McDonald’s responded to the shifting trend by starting McCafes in 2013, which offers a larger variety of brews and beverages and comes with a more chic ambience, KFC launched its KFC Hangouts in January 2017. “We have recently introduced our new look stores — KFC Hangouts. The new format is intimate and informal, making it the perfect hangout zone for every mood and occasion. It has a rustic feel, with an interesting mix of wooden and metal furniture, brick walls and earthy lamps,” explains Shinde.

While the McDonald’s and Domino’s of the world may not match the eclectic menus of pubs and cafes, they have constantly tried to innovate around their menu offerings while trying to stick to their core strengths. For instance, India is considered a vegetarian’s market and to be a fit here, KFC had expanded its vegetarian offerings. While catering to the local market was definitely a good way to go, KFC soon realised it had to play to its strengths as well. “The one big change we made last year was to bring the chicken back to the forefront. In hindsight, this may seem like an obvious thing to do, but that fact is that nobody makes chicken the way we do. So, if you look at 2016, our innovations, formats and flavours, big ticket launches, Chizza, 5-in-1 Meal Box, Smoky Grilled, Friendship bucket and Nashville — they are all about chicken,” says Shinde. He feels that their reoriented stores, franchisee, and menu strategies are now bearing fruit. “2016 has been a transformational year for KFC and we have seen positive sales momentum with two consecutive quarters of double-digit same sales growth of 13% for the quarter ending September 2016 and 16% for the quarter ending December 2016,” he elaborates. It is a trend he hopes will sustain in the coming quarters as well.

After spending its initial years on getting the supply chain right, McDonald’s first revamped its menu in the late ’90s which brought to market some of its iconic products such as McAloo Tikki and ChickenMcGrill. They introduced their breakfast menu in 2010. They recently launched Dosa burger and Jatia thinks they might just have the next Aloo Tikki on their hands. “New products continue to drive sales and create differentiation. We have constantly increased our addressable market through brand extensions, including opening of 104 McCafé’s within a short period of 30 months,” points out Jatia. The company hopes to add around 300-350 cafes in the next five years apart from doubling the number of McDonald’s outlets from the existing 252 stores during the same period.

Deliver more, discount right

While Domino’s business model was built for delivery from the beginning, they have increased their focus on online orders and delivery. Today, home delivery contributes 50% to its total revenue, while it brings in one-third of the revenue for McDonald’s which started McDelivery in 2005. About 49% of its home deliveries comes through online orders (both web and app). “We believe that in a couple of years almost 60-70% of our total delivery business will come through online orders,” says Kaul.

Speaking of food delivery, the dynamics of the business has undergone a change in the last two-three years, thanks to the mushrooming of food delivery start-ups across the country. It has been a boon and a bane for the established QSR players. A boon because the QSRs leverage the network of these start-ups to cater to customers, and a bane because they have added to the existing competitive pressure. Marya of Franchise India joins the dots here. “Delivery players like Swiggy and Zomato have brought your neighbourhood restaurants and chains into contention,” he says. The food pie which was earlier dominated by QSRs is now divided between a larger number of players. Take the case of Swiggy which has added 3,000 additional restaurant partners in 2016 and now supplies from 12,000 restaurants in eight locations. “Earlier, order volume would be skewed toward weekends which accounted for two-thirds of our volume. However, with more customers ordering food online, we see an increase in orders even during weekdays,” says TS Srivats, VP-marketing, Swiggy. “Our data reveals that Indian items like vada pav, momos and rolls are as popular as burgers and wraps in some locations,” says Srivats. According to him, customers are ordering 4-5 times a week in these locations and some loyal customers have even ordered 30 times a month.

No free lunch

The QSRs are also now doing away with random discounting. They have realised it only burns a hole in their pockets and rarely helps in retaining customers. “In times when consumer sentiment is not too upbeat, the natural tendency is to probably rely on discounts for growth. But from now, we will make only targeted offers, not the usual buy 1 get 1 offer,” says Kaul. “Discounts for online orders would be higher because we want to bring in more customers there,” he adds.

Jatia, too, has a different philosophy on discounting. “When business and footfalls get challenging, typically you start price pointing and discounting because you don’t want to lose customers. That’s exactly what everybody is doing. But we chose to do ad campaigns around building connections,” he says. According to him, only 10% of McDonald’s marketing spend goes towards price discounting and the focus in advertisements is more on building connections and highlighting menu additions.

These strategies seem to be working for some of them. KFC and Pizza Hut found their way out of the negative SSG in the past quarters. For Westlife, the December quarter was the sixth quarter it managed to stay in the positive territory. For Jubilant, it is still a mixed bag with SSG turning negative in the December 2016 quarter. The company is not giving up just yet. Jubilant says while store additions in FY18 may be slightly lower than the 115 in FY17, it will still be a significant number as they remain bullish on India.

But the good old days of double-digit growth appear a far cry at this point of time. Are Indians bored with burgers and pizzas? “Not really,” says Kaul. “Even after 60 years, Americans are still not bored of burgers and pizzas. In India, the number of times people eat out is still far lower than in China, Malaysia, and Thailand. So there is still a lot of steam left,” he says. The QSRs are looking at the slowdown as a phase to re-strategise and refocus. “We are building for the long term,” says Kaul. This time around though, the focus is on profitable growth.