Kraków, Poland’s second largest city has a history that goes back to the 10th century. With time, it has become a key business and economic centre, with a fairly large start-up community. At least once a year, Abhijit Roy makes that mandatory work trip to the city.

As MD & CEO of Berger Paints India, his company acquired Bolix, a local firm in 2008, where he sits on the supervisory board. His visits have always remained somewhat unremarkable since it’s all about work, leaving little time for anything else. A moment of serendipity during an unplanned morning walk remains etched in his mind and Roy gleefully narrates it.

The story goes back to 2014, when he saw six men with tools perching on a makeshift platform, before fastening a harness to ensure they did not fall. A few cans of paint were placed on the platform and with a spray and tools, they quietly got to work. By dusk, the entire three-storied building had a new coat. “They were regular workers doing their job. Just the speed at which work was done stunned me,” says Roy. The same job in India would have taken the same number of people but four to five days of work.

More importantly, there was no inconvenience at all to people who walked past or other residents of the building. In Roy’s mind, what stayed was how the “pain was taken out of the painting”. Back in India, he decided it was time to figure out how a home could be painted, without its occupants being isolated into a single room, in dread of the resultant dust.

The Polish experience made him believe that a well-trained painter, equipped with the right tools could quietly go about his work sans the choking dust. Barely six months later, Berger was ready with Express Painting — it marked the company’s entry into the service side of the business, having sold only paints earlier. Besides, this opened up a window to the premium segment for Berger, which had earlier been associated with economy offerings. Asian Paints, the market leader, had offered a similar service in home solutions at the turn of the century. But, Berger improvised with a sanding machine that vacuumed out 90% of the dust, and positioned itself as “faster, cleaner, better“.

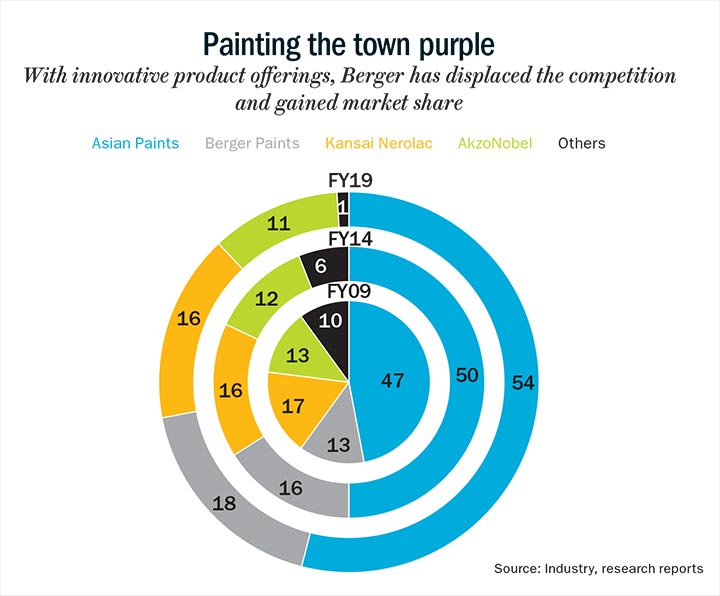

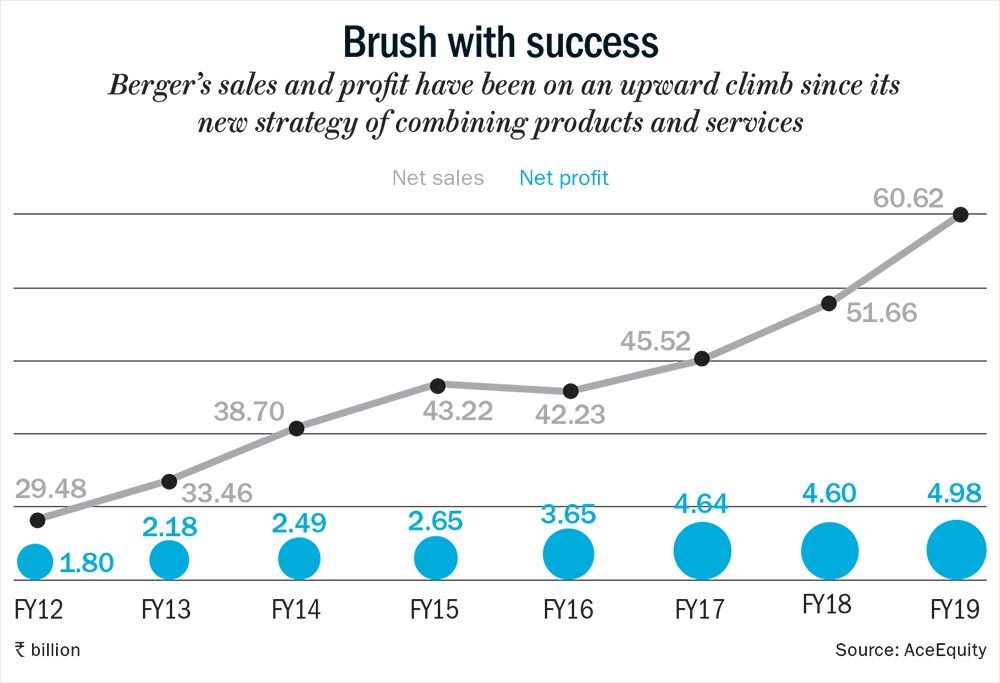

Berger’s success, from being the fourth largest, to now the second after Asian Paints, is the result of spotting an opportunity fast, responding to it just as quickly by tweaking existing solutions and marketing this new product smartly. It has been rewarded for its agility and adaptability with an 18% market share, which may be way smaller than the leader’s 54%, but higher than the 16%, that it had in 2014.

Quick off the ground

Roy’s impromptu walk in that central European country, which led to Express Painting, was a tipping point for the company in many ways. It upped its marketing game and increased its advertising spend. Through Express Painting, Berger also took over the process completely — from procuring the painting equipment from China and Germany to training the worker and selling the service to the customer. The promise was that the 20-day ordeal would now be down to eight to nine days with an army of automated tools such as sanding machines, mixers, sprays and automatic rollers. Depending on what was needed, the outgo for a painter would be Rs.15,000-25,000.

The painter is incentivised to buy the company’s products, for which he gets a credit period or business through Berger’s advertising. “While they invest in the equipment, the return is in the form of more business,” says Roy. With less time taken, the painter could also take on more jobs each month. It seems to have worked. The number of painters who partner with Berger has tripled — from 4,000 at the start of the service in 2015 to over 12,000 now.

Many a time during our conversation at Berger House in Kolkata’s iconic Park Street, Roy uses the phrase “plain observation”, as a euphemism for common sense. By his own admission it is a far cry, for a company which till 2005 just copied the market leader. Since 2012, when Roy occupied the corner office, the need to think out of the box has gained urgency. Time has been of essence and, in each case, the ideation and development of a new product has never taken more than four to six months.

Waterproof putty was a result of this charged atmosphere, and the final idea had come from a somewhat unlikely source. The existing product was the old-fashioned putty or skim coat, as it was called, in more developed markets — basically a texturing technique used to smoothen walls. Everyone in paints and cement existed in this commodity business, where the putty was sold at Rs.22 per kg, with no product differentiation to speak of.

Three times a year, Berger holds its regional managers conference in its Kolkata office. This freewheeling session is held in a conference room on the fifth floor. It was here, in 2015 that inspiration struck. By that time, the product had already been shown to some of the key team members to basically decide how it had to be pushed with the trade.

Berger’s regional manager from Lucknow, at that meeting, may have raised a few eyebrows when he picked up two glasses and put the regular putty in one and Berger’s new waterproof version in the other. He then poured water in both glasses and let it stand for a full five minutes, before draining out the liquid. He put a spoon in both samples and presented starkly contrasting results to an audience comprising Berger staff, who were left spellbound. Regular putty was muddy while Berger’s to-be-launched product fell like powder. “I still have no idea how the guy thought of the glass test,” Roy says. But it was undoubtedly convincing.

Berger pushed its luck to price the new product at Rs.44 per kg, while the regular variety costs Rs.22 per kg, in the belief that the proposition was strong and would justify the premium. It was a move that worked and competition quickly followed suit, though 65% of the market still remains with Berger.

“Though Berger was a late entrant in the putty market, their unique waterproof positioning upset the status quo,” says DK Guha, executive director of Lowe Lintas Group, the agency handling the advertising for Berger. The company’s communication has worked because of its simplicity, precision and relevance. For Express Painting, the ads revolved around “Painting ka T20”.

The putty was obviously a game changer and the team could have rested on its laurels for a few years, but Roy kept his eyes and ears open. A few months after, he struck gold again in Bangladesh, where Berger has a fairly large operation. It translates to 58% market share, with Asian Paints in second position with 14%. It is a happy reversal of roles for Berger.

The company’s brand WeatherCoat Antidirt Longlife had been around for a while in the neighbouring country, and its advertisement was on television when Roy was in his hotel room. The theme was simple with a cartoon character throwing dirt and the other emerging to wipe it off.

In Bangladesh, dirt is a large concern from the frequent rains. In India, Roy knew, this product could be altered and repositioned as anti-dust. He sounded off his team. “Our job is to identify a need that the market is not fulfilling and just go for it,” adds Roy. As is the norm now, the product was ready in less than five months. Called Berger WeatherCoat Anti Dustt, the communication focused on India, where construction activity is always in progress. “That always meant having a dusty environment. Dhool aaye, par ghar par na tik paye was the line used where consumers were asked not to worry about the dusty environment. The paint would take care of the exterior of their house as dust would not settle,” explains Lowe Lintas’ Guha. Soon after, Asian Paints launched Apex Shyne, meaning the challenger was unsettling the leader.

Roy knows that a good product and a strong message won’t get you very far, if the trade is not convinced. So, he makes sure dealers and consumers are always involved. It only makes pushing a new product easier. This was evident in the launch of WeatherCoat Kool & Seal in 2017, which was initially met with a level of cynicism. The story goes back to when Roy travelled to Nagpur in peak summer for a market visit. Over a meal, he was asked if there was a product to fight the oppressive heat. The complaint was simple – “Hamari tanki se garam paani aata hai”. When the product was ready to be rolled out, he took it to a few retail outlets first in Nagpur and then Pune. The Berger team painted one stretch outside the outlet with the new product and other with the rival’s. “We got them to step on both with their bare feet to feel the difference in temperature. Doing it in the hot sun was deliberate,” he says. The story was lapped up by the trade.

Trade and beyond

Many dealers now fanatically push the company’s brands. Among them is Praveen Kumar. Early this year, the 44-year-old was in Monaco for the Berger dealers meet and received a ‘super gold medal’ for selling the highest volume in South 1– this region encompasses Andhra Pradesh, Telangana and Tamil Nadu.

Based in Vijayawada, Kumar is the city’s largest paint dealer and the biggest in the South 1 region. His family has been in the business since 1986. His card proudly bears names of all the top paint brands, though he has an obvious soft corner for Berger. For seven years in a row, his outlet, Sri Vijayalakshmi Enterprises, has been the recipient of the ‘super gold medal’ (gold and silver being the next best), which requires a dealer to up their sales by 10% each year. For FY19, his turnover from Berger was Rs.90 million. He says a lot has changed at Berger over the past eight to 10 years but points out three in particular. “They have launched many new products, increased our margin and come a long way in recognising dealer contribution,” he explains. From just 10-15 dealers in Vijayawada around 2011-12, Berger today has close to 100, with Asian Paints at over 200. As for margin, Asian Paints offers dealers around 5% and Berger over time, now offers twice as much, with the larger dealers such as Kumar touching 15% on the back of volume incentives. He has just returned from a trip to Pattaya in Thailand, where Berger has unveiled PU RoofKoat, its latest waterproofing paint.

Roy points out that of the total universe of 90,000-100,000 outlets, Berger retails at 28,000, with around 2,500 outlets added each year. A former Berger Paints official says the company has strengthened its relationship with the trade by not resorting to price undercutting. While it does increase sales volume, it directly affects margins that distributors and retailers make. This is said to be one of the key reasons for AkzoNobel to have ceded ground to Berger, resulting in dealers not always willing to stock its products. “Berger also has a very efficient supply chain management system ensuring its key outlets are never out of stock,” he adds.

Asian Paints, which claims to reach over 52,000 outlets, has the advantage of a larger brand portfolio, which comes from its presence across segments. Piyush Pandey, chairman, Ogilvy India, who has worked on the market leader’s advertising for over 35 years, says that the company’s product range comes from its sound understanding of the Indian market. “Three decades ago, they saw a market for smaller cans since there were people who wanted to paint just the window grills,” he explains. “You have to know when to accelerate and when to cruise, and they did that very well here,” adds Pandey.

The leader’s inherent strengths remain indisputable, though Berger Paints has not really let an opportunity pass. Rakshit Ranjan, founder, Marcellus Investment Managers, is clear that Asian Paints’ strength has been its supply chain efficiency. “This helped in higher inventory turns to the dealers. The painter would push what the dealer stocks and the customer would buy what the painter recommends. Therefore, the dealers were more empowered than the painters,” he explains. In this extremely challenging situation, Berger decided to take a different route. “They reached out to the painter six to seven years ago, which was a very smart thing to do,” says Ranjan. The company provided a token number inside the paint bucket. “Only a painter could access that and it gets recorded in the firm’s incentive programme. It created a strong rapport with the painter and gave Berger a lot of traction.”

Travel seems to bring out the best ideas for Roy. A few weeks ago, he was in Pune and Nashik and noticed something, which he quietly passed on to his team. Nothing much is shared since it is under wraps, but if things go as per plan, it could well be the launch of a new product. It’s an interesting phase for the company, which is constantly on the lookout for small ideas that can grow very big. Abneesh Roy, executive vice president, Edelweiss Securities, spells out the company’s transformation over the past decade. “It has managed to move from being at the lower end to becoming a very aggressive player at the mid-end,” he thinks. While the marketing savvy is well appreciated, the task on hand, according to him, “will be to sustain the product pipeline and simultaneously strengthen distribution.” From a laggard at fourth in 2004 to a serious number two now, it has been a difficult journey made easy with many little ideas. Berger will need plenty of these to coat more walls.