A New Hope

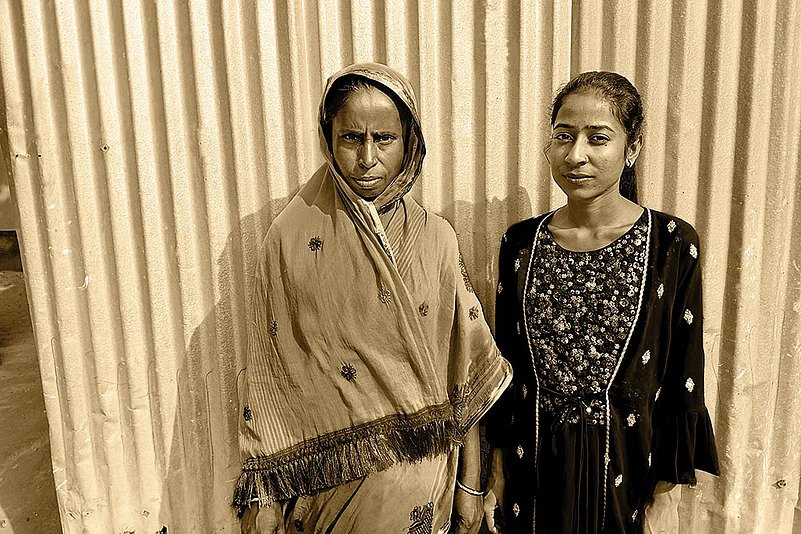

Abeda Khatun

Age: 35, Kamalpur, Assam

Took a loan to expand her fishery business

Abeda Khatun, 35, from Assam’s Barpeta district, is one of two women selected for the Lakhpati Didi scheme in her gram panchayat. The central government-backed rural livelihood scheme will help Abeda expand her fishery business.

A mother of two, Abeda runs an integrated fishery as well as a cattle and poultry farm with her husband Waris Ali, 46, in Kamalpur, a village located nearly 110 kilometres west of Assam capital Guwahati.

She has applied for Rs 10 lakh under the Lakhpati Didi scheme. A final disbursement is being considered and Abeda hopes her request will be granted.

If she gets the money, she will invest a large sum in her fisheries, a venture that is proving more lucrative than her poultry and cattle ventures.

Abeda’s entrepreneurial journey began in 2008, shortly after her marriage when she joined a 15-member self-help group called Rhino SHG.

There she met Momtaz Begum, a ‘jeevika sakhi’. Jeevika sakhis or livelihood friends are volunteers assigned to gram panchayats to promote livelihood schemes under the Assam State Rural Livelihood Mission (ASRLM).

With Momtaz Begum’s help, Abeda obtained Rs 15,000 from the SHG and raised chickens and ducks in her backyard. As years passed, her business grew.

In 2014, Abeda applied for a loan of Rs 50,000 to start rearing cattle. The venture did well, and she used the money to reinvest and pay off the loan.

Abeda’s family had a pond in which they would rear fish for household use. With money flowing in, she decided to turn the family pond into a commercial venture.

In early 2019, with jeevika sakhi’s help, Abeda obtained a subsidised bank loan of Rs 1 lakh to build two fisheries on her farmland.

She already had a pond and built a new one. The fishery venture was an instant success.

But Abeda’s life is not easy. She says, “My work starts at daybreak, usually at 5 am I do a round of the fisheries first, and then the ducks, hens and cows.” She then makes food for her family, sends her son to school and daughter to college and does other household chores.

The Assam floods of 2022 hit Abeda’s family hard. Floodwater inundated her fishponds and she lost most of her farm animals.

“We thought we would not be able to restart, but luckily, some of our relatives came to our rescue,” she recalls.

Abeda and her family have since rebuilt most of the farm. If she receives the money she has applied for, Abeda wants to scale up her fishery project.

Sanjeeb Baruah

An Inspiring Journey

Rashmi Singh

Age: 25, Manethu, Uttar Pradesh

Works as a BC Sakhi

Rshmi Singh, 25, from Uttar Pradesh’s Kanpur Dehat district, started a self-help group (SHG) in her village in 2020. Now, there are 14 members in her SHG, based in Manethu. She has also inspired 45 more SHGs in the village.

Since 2022, Rashmi has been working as a Business Correspondent Sakhi (BC Sakhi). She helps people in her village do banking transactions with ease. She visits the homes of the elderly and sick to help with their banking needs like cash deposits, withdrawals and account openings.

In October 2023, she was enlisted under the Lakhpati Didi scheme.

Rashmi passed Class XII when Covid-19 struck in 2020, forcing her to halt her studies. One day, she came across an advertisement for the recruitment of BC Sakhi in a newspaper, which required the applicant to be a member of an SHG.

Already affiliated with an SHG, she filled in the application. Later, she attended a one-week training and began working as a BC Sakhi in her village.

At first, she earned just around Rs 250–500 a month. Everyone in her family discouraged her.

“You do not earn much from it, why are you troubling yourself in the scorching sun. It is better to give tuition to children,” they used to say, Rashmi said.

Despite their scepticism, Rashmi persisted. Her diligence paid off. Now, she earns around Rs 15,000–17,000 a month and needs to go out only if there is a sick or elderly customer. Other villagers come to her for their banking needs.

Reflecting on her journey, Rashmi says, “I had to work very hard. Sometimes, I thought of giving up and everybody said the same. But I kept going. I just felt that I had to do this.”

Her achievements have inspired others, leading to more women joining SHGs in her village.

She started with just 50–60 bank accounts, and now manages around 800–900.

She handles her finances independently and invests in a recurring deposit and a systematic investment plan. Her next goal is to earn at least Rs 30,000 per month.

Versha Jain

Seizing Opportunities

Kiran Devi

Age: 34, Narauli, Bihar

Took a loan to start a tiffin service

Where there is a will, there is a way. This proverb aptly describes the journey of Kiran Devi, a 34-year-old resident of Narauli village in Muzaffarpur district, approximately 75 kilometres from Bihar’s capital, Patna.

Kiran had to discontinue her studies while she was in class IX due to financial challenges. As the eldest sibling, who has three younger sisters, she took on the responsibility of supporting her parents, who were engaged in strenuous field work. Life was far from easy for Kiran, but she held on to the dream of improving her circumstances.

When she got married to Ranjeet Kumar, who was employed in a factory in Delhi, she was hopeful of a better life. However, fate took an unexpected turn when, after marriage, her husband sought employment in his hometown to care for his elderly parents.

Kiran supported the decision but managing the family with her husband’s income of Rs 7,000 proved challenging.

Life took a harsher turn when the Covid-19 pandemic hit, and her husband lost his job. Kiran recalls, “It was a difficult time for us, we could not even manage to have two meals. But I did not lose my hope for better days.”

In February 2022, a friend suggested she join a self-help group (SHG). Initially unfamiliar with SHGs, Kiran learned about them from friends. On March 10, 2022, she joined the Jyoti SHG in her village, committing to a monthly contribution of Rs 100 and attending meetings twice a month.

She seized an opportunity when a new power grid was being set up in her village, and its officials needed food services. Kiran decided to take a Rs 10,000 loan from the SHG to start her tiffin service.

Currently, she earns Rs 6,000–7,000 from this venture. Her SHG informed her about the Lakhpati Didi scheme, and she plans to apply for it. If selected, Kiran aims to start a small beauty parlour in her village.

Kundan Kishore

Gateway to Financial Independence

Lalita Naag

Age: 40, Gongla, Chhattisgarh

Started a clothing store

Anita Dugge

Age: 47, Korra, Chhattisgarh

Bought an auto-rickshaw

In Chhattisgarh’s remotest district, where extremist activities have long plagued development, there is a quiet tale of empowerment.

Sukma district has been marred by insurgency for years. It is among the least developed districts in India. Over 83% of the district’s population belongs to tribal communities. Agriculture has traditionally been the prime source of income in the hinterland, including in Sukma.

Against this backdrop, SHGs are working for change and the Lakhpati Didi scheme is aiding their efforts. The scheme, launched last year, provides financial support to rural women to start their own ventures.

Lalita Naag, from Gongla village in Sukma district, joined a self-help group in 2016. She is now covered under the Lakhpati Didi scheme.

With the loan, she ventured into the entrepreneurial realm, establishing a clothing store. Her monthly earnings now range between Rs 10,000 and Rs 15,000.

Lalita is now thinking beyond immediate gains. She has invested in her daughter’s future by opening accounts with the Sukanya Samriddhi Yojana and the Jan Dhan Yojana. “Since joining the Lakhpati Didi scheme, my financial condition has improved significantly,” Lalita says.

Lalita sees the growing trend of online shopping as an emerging challenge. Online shopping is yet to reach rural Chhattisgarh. Lalita says the connection she has with her customers cannot be replaced by an app.

Anita Dugge, from Korra village, another beneficiary of the programme, bought an autorickshaw with the money. She has hired a driver and manages the finances and maintenance herself.

Anita says she and her family make sure they prioritise loan repayments, and then use the remaining income for household needs.

Anita too is facing a challenge. The number of personal vehicles is increasing in Sukma. The competition has dented her earnings a bit, she says.

The Lakhpati Didi scheme has emerged as a force for change in rural Chhattisgarh. It is breaking the shackles of financial dependency and fostering self-reliance.

Tarun Bharadwaj