Despite the lifting of a cap on WhatsApp Pay’s user base in December 2024, allowing Meta-owned messaging platform to offer unified payments interface (UPI) services across its entire India user base, transaction volumes on the platform rose by only about 17% over the next six months.

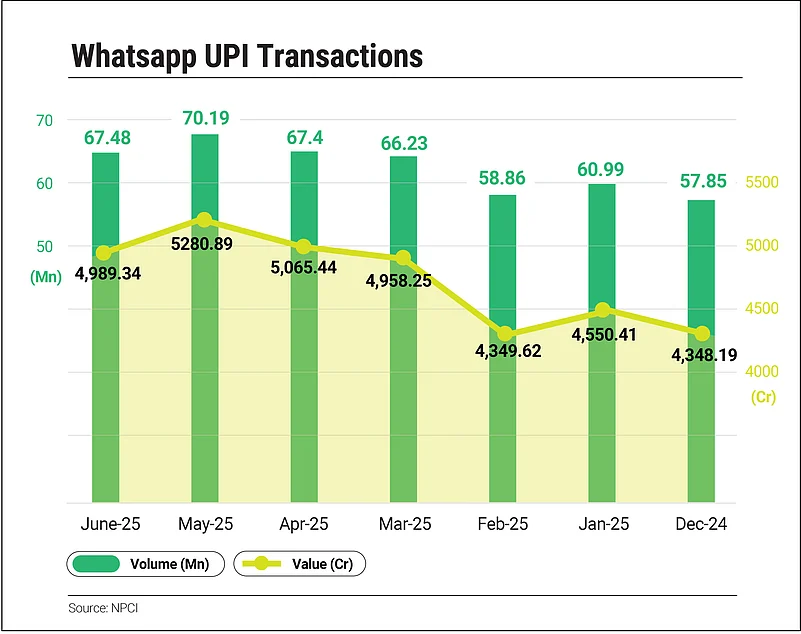

While the monthly transaction volume on WhatsApp grew around 17% from 57.85 million in December to 67.48 million in June, the transaction value grew around 15% from ₹4,348.19 crore to ₹4,989.34 crore during the same period.

WhatsApp Pay was initially limited to 1 million users in 2020 by a directive of the National Payments Corporation of India (NPCI), which was then increased to 100 million in 2022. This cap had been put on the Meta-owned messaging platform's payments feature as the domestic fintech ecosystem raised a hue and cry over the possibility that WhatsApp's large user base could lead to a concentration risk in the payments sector.

“We're committed to making payments on WhatsApp simple, reliable, and secure,” Meta said in an emailed response to Outlook Business. “Our goal is to add value and convenience to users' lives through various use-cases like bill payments, ticket booking, and shopping. We aim to accelerate digital payments and UPI adoption and continue contributing to India's digital and financial inclusion agenda.”

India has the highest number of WhatsApp users globally, with around 853.8 million active users in 2024, according to World Population Review data compiled in 2025.

UPI transaction volume in India stood at 18.1 billion in June 2025, with a value of around ₹24.04 trillion. WhatsApp’s share of that volume was under 0.4%, pointing to limited traction in a digital payments market dominated by PhonePe and Google Pay.

“WhatsApp was a little late in their move (to tap the payment market),” said Mihir Gandhi, Partner, Payment Transformation and Fintech at PwC India. “Two main issues restricted the expansion — first, the number of users on WhatsApp was limited. So, if I want to send money to any person, then that was not possible because I don't have him or her registered on WhatsApp UPI. Secondly, WhatsApp platform saw a higher number of technical declines at that point of time”

These failed transactions led users to switch to competing apps mid-process, Gandhi said, which created a mental barrier against using WhatsApp for future payments.

Crowded market, late entry

By the time Meta received approval for a full rollout in December 2024, Google Pay, PhonePe, and Paytm already held more than 90% of the UPI market. Of the 16.5 billion total transactions that month, the three players accounted for 15.27 billion.

WhatsApp Pay had shown early momentum in March 2022, when it saw 8–10 million daily transactions and signed up over 1.6 million users per day, despite no marketing spend. But growth tapered off.

“There are already strong players that already exist in the market,” said Gandhi. “So, the basic day-to-day transactions of P2P and P2M... people are already comfortable, and people are habituated to using those.”

Meta has not disclosed its India-specific investment in WhatsApp Pay. But media reports suggest that product design, banking partnerships, and marketing decisions remained centralized at Meta’s Menlo Park headquarters, frustrating the India team. Top executives Abhijit Bose, Manesh Mahatme, and Vinay Choletti left the company amid these constraints. The division lacked a dedicated country head until Ravi Garg, Country Head – WhatsApp for Business, took on the additional role.

Fintech analysts and users cited the lack of local marketing as a major reason for poor adoption. User Dipankar said cashback and coupon offers on rival apps influenced his payment choices. “That was never the case for WA Pay,” he said, adding that many users are still unaware the service exists.

Scaling efforts continue

Meta is now trying to expand WhatsApp Pay through new partnerships. The company had tied up with Razorpay and PayU in 2020 for in-app shopping and is now working with metro ticketing services in major cities.

In 2025, WhatsApp Pay won the “Emerging Fintech” award at the Digital Payments Awards hosted by the Department of Financial Services, Ministry of Finance.

“This is a proud moment for us... a testament to the transformative journey we have taken to scale Payments in India,” Garg wrote on social media. “We're excited to continue pushing boundaries and scaling Payments on WhatsApp in India, leveraging our platform's massive reach and ease of use to drive financial accessibility for over 1 billion Indians.”